Contractor IRS withdrawal refers to the process of withdrawing funds from an individual's contractor or freelance business account that has been subjected to Internal Revenue Service (IRS) regulations and tax obligations. Contractors are independent workers who provide services to clients without being directly employed by them, often working on a contractual basis. When it comes to IRS withdrawals for contractors, there are two main types to consider: estimated tax payments and retirement account withdrawals. 1. Estimated Tax Payments: Contractors are responsible for paying their own taxes since they are not subject to traditional employer withholding. Instead, they are required to make estimated tax payments throughout the year. These payments are made directly to the IRS on a quarterly basis. Contractors typically estimate their tax liability based on their income and calculate the amount they owe. The withdrawals are made from the contractor's business account and sent to the IRS. By making these estimated payments, contractors fulfill their tax obligations and avoid penalties or interest for underpayment. 2. Retirement Account Withdrawals: Contractors also have the option to contribute towards retirement accounts, such as Individual Retirement Accounts (IRAs) or Simplified Employee Pension (SEP) IRAs. These accounts allow contractors to save for retirement while receiving tax advantages. When it's time to withdraw funds from these retirement accounts, contractors can initiate an IRS withdrawal that follows specific rules and regulations. Depending on the type of IRA or retirement plan, penalties and taxes may be applicable if withdrawals are made before a certain age, typically 59 and a half. It's vital for contractors to plan their IRS withdrawals carefully, seeking advice from tax professionals or financial advisors to ensure compliance with IRS rules and regulations. Additionally, contractors must maintain accurate records of their income, expenses, and transactions related to IRS withdrawals, allowing for proper reporting and tax filing during tax season. By responsibly managing their IRS withdrawals, contractors can maintain their financial stability and meet their tax obligations efficiently.

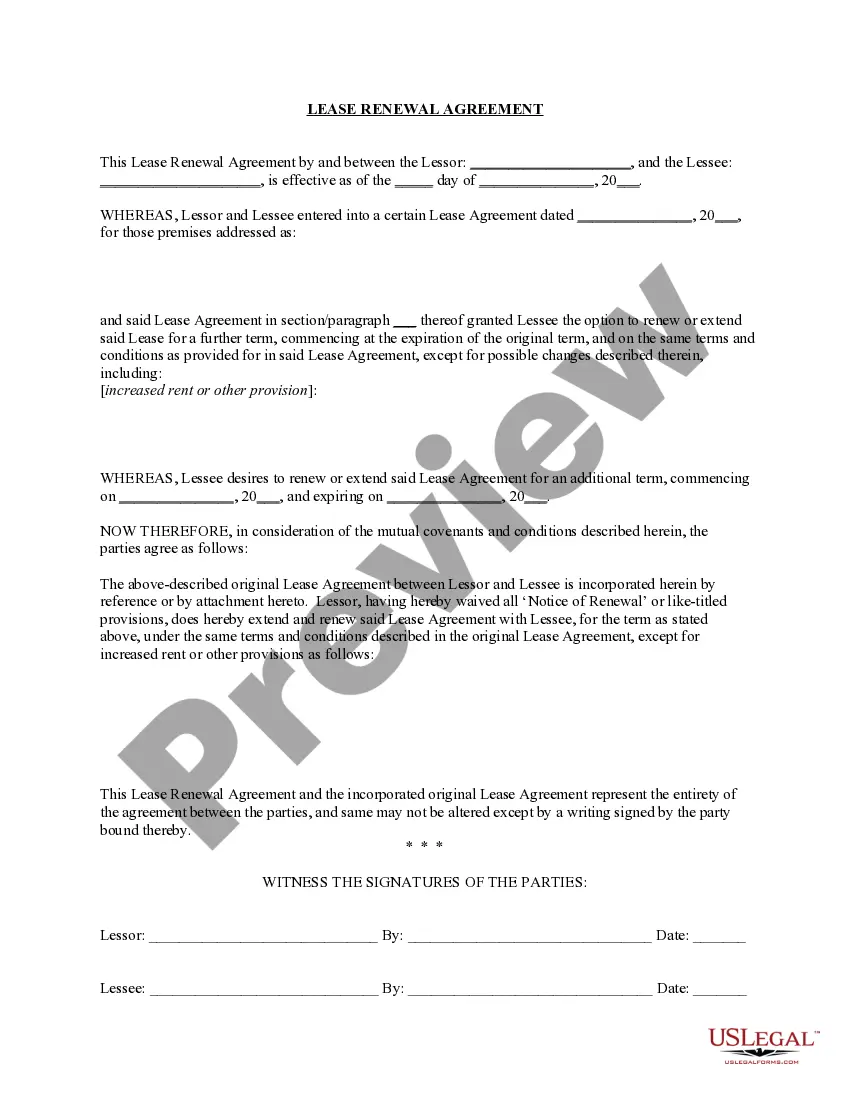

Criteria For Independent Contractor Status

Description Contractor Irs

How to fill out Ss 8?

Properly drafted official documentation is one of the fundamental guarantees for avoiding problems and litigations, but obtaining it without a lawyer's assistance may take time. Whether you need to quickly find an up-to-date Criteria For Independent Contractor Status or any other templates for employment, family, or business situations, US Legal Forms is always here to help. It's an easy-to-use platform comprising over 85k legal templates grouped by state and area of use verified by experts for compliance with regional laws and regulations.

If you want to know how to obtain the Criteria For Independent Contractor Status in a matter of clicks, adhere to the guideline below:

- Ensure that the form is suitable for your situation and region by checking the description and preview.

- Look for another sample (if needed) via the Search bar in the page header.

- Click Buy Now when you locate the corresponding template.

- Choose the pricing plan, log in to your account or create a new one.

- Pick the payment method you like to purchase the subscription plan (via a credit card or PayPal).

- Select PDF or DOCX file format for your Criteria For Independent Contractor Status.

- Click Download, then print the template to fill it out or upload it to an online editor.

The process is even simpler for current users of the US Legal Forms library. If you subscription active, you only need to log in to your account and click the Download button near the selected document. In addition, you can access the Criteria For Independent Contractor Status later at any moment, as all the documentation ever acquired on the platform remains available within the My Forms tab of your profile. Save time and money on preparing official documents. Try out US Legal Forms right now!