An employment verification letter for a mortgage is a formal document that verifies the employment status and income of an individual applying for a mortgage loan. This letter serves as proof to the mortgage lender that the applicant has a stable source of income and is capable of repaying the loan. The employment verification letter usually includes significant details such as the borrower's job title, employment start date, current employment status (whether full-time, part-time, or self-employed), and the applicant's monthly or annual salary. Additionally, it may mention the company's name, address, and contact information, alongside the letter's date and the name and signature of the authorized company representative. Several types of employment verification letters for mortgage can be utilized depending on the borrower's circumstances: 1. Standard Employment Verification Letter: This letter confirms the applicant's employment, position, tenure (start and end dates if applicable), and income. It usually serves as a general letter of verification. 2. Income Verification Letter: Specifically focuses on the borrower's income, detailing the base salary, bonuses, or commissions they receive. Lenders may request this type of letter if the applicant's income fluctuates regularly. 3. Self-Employment Verification Letter: Required when the borrower is self-employed. This letter confirms the applicant's self-employment status, years of operation, and average income earned. It might also include the most recent tax returns or financial statements. 4. Part-Time Employment Verification Letter: If the borrower works part-time or has multiple part-time jobs, this letter confirms their part-time employment status, average hours worked per week or month, and income. 5. Verification of Employment and Leave Letter: This letter is applicable when the applicant is on leave or planning to take extended leave during the mortgage application process. It verifies the individual's employment status before their leave and confirms their intended return date. 6. Letter for Probationary Employees: For individuals still on probation or recently hired, this letter verifies employment status, probationary period duration, and income. Verifying employment is crucial for mortgage lenders as it helps them assess the borrower's ability to repay the loan. A well-drafted employment verification letter should be accurate, concise, and include all relevant details, ensuring a smooth mortgage application process for the borrower.

Employment Verification Letter For Mortgage

Description

How to fill out Employment Verification Letter For Mortgage?

Regardless of whether it's for business needs or personal matters, everyone must deal with legal issues at some point in their life.

Filling out legal documents requires meticulous care, starting with selecting the correct template.

Once it is saved, you can complete the form using editing software or print it out and fill it in manually. With a vast collection of US Legal Forms at your disposal, you won’t need to waste time searching for the suitable template online. Utilize the library’s straightforward navigation to find the right template for any circumstance.

- For instance, if you select the incorrect version of the Employment Verification Letter For Mortgage, it will be rejected once you submit it.

- Therefore, it is crucial to find a dependable source of legal documents like US Legal Forms.

- If you need to obtain an Employment Verification Letter For Mortgage template, follow these straightforward steps.

- Search for the template you require using the search bar or catalog navigation.

- Review the form’s details to ensure it is appropriate for your context, jurisdiction, and location.

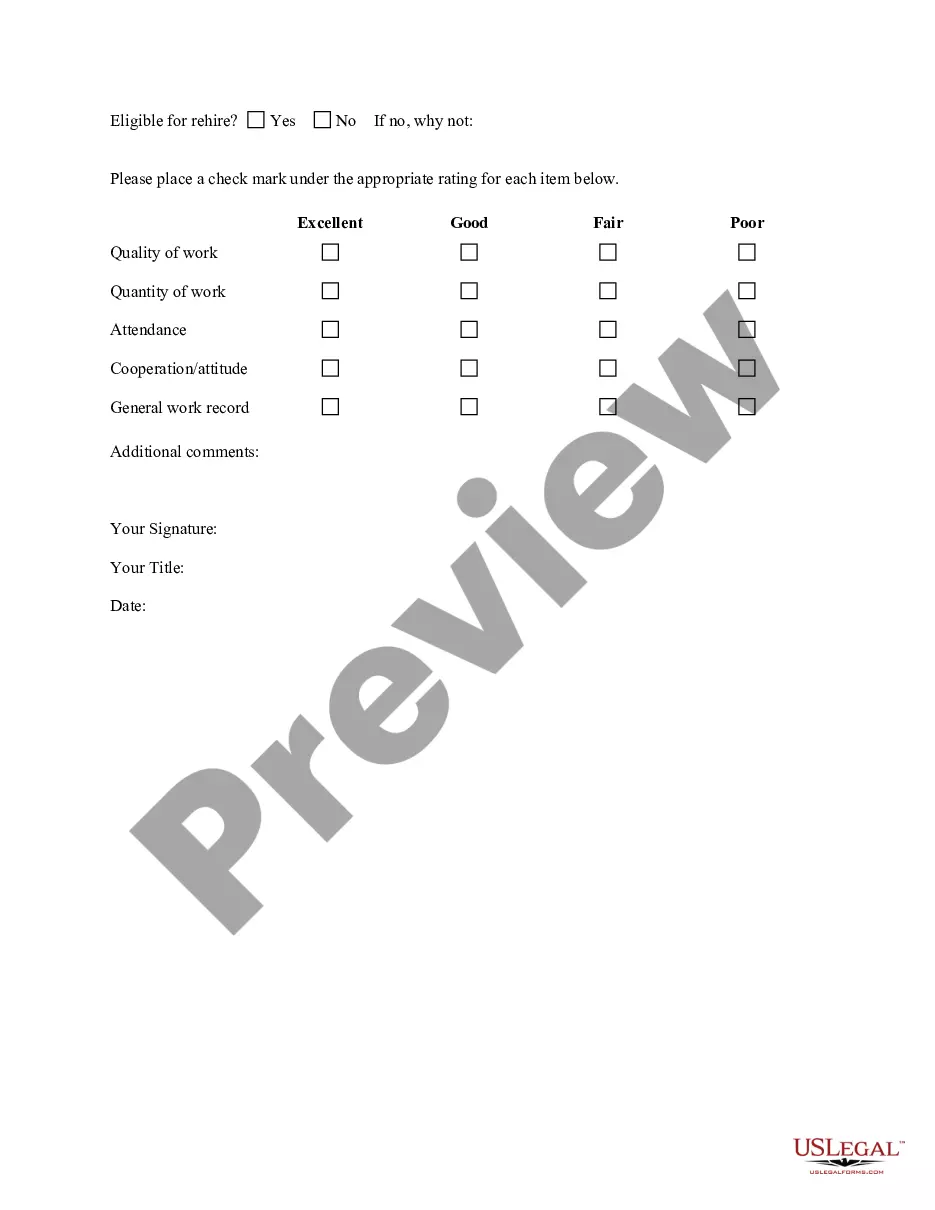

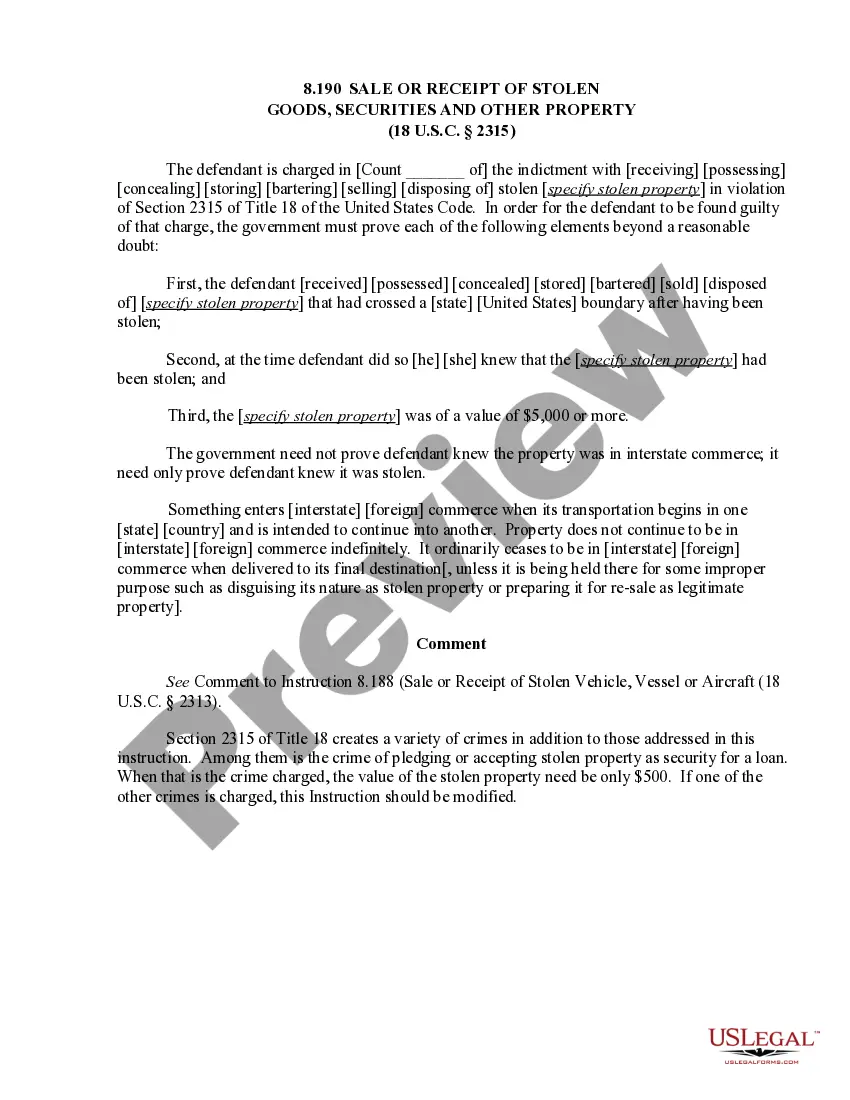

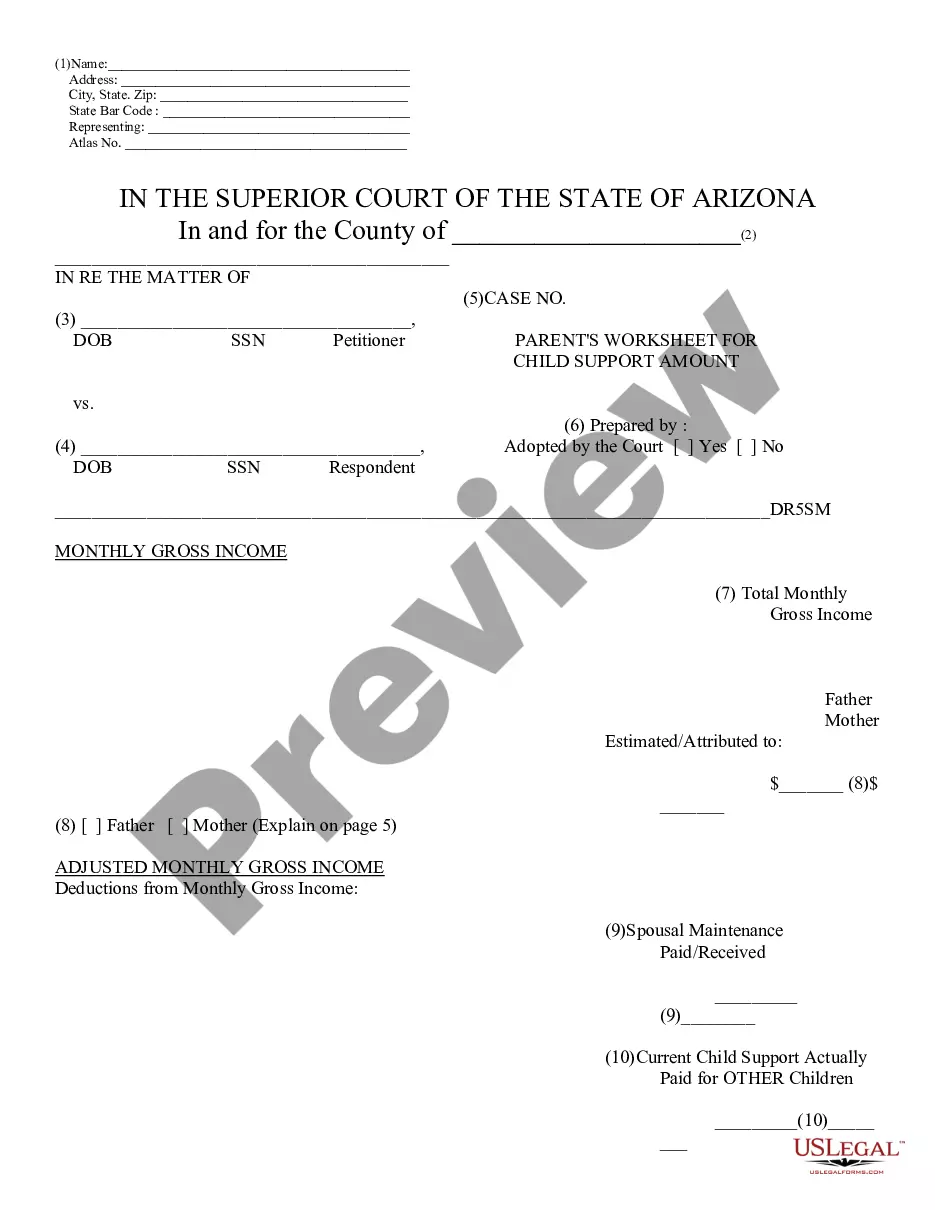

- Click on the form’s preview to inspect it.

- If it is not the correct form, return to the search function to locate the Employment Verification Letter For Mortgage template you need.

- Acquire the template if it aligns with your needs.

- If you possess a US Legal Forms account, simply click Log in to access previously stored templates in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the account registration form.

- Choose your payment method: either a credit card or PayPal account.

- Select the file format you prefer and download the Employment Verification Letter For Mortgage.

Form popularity

FAQ

You can request an employment verification letter by formally contacting your employer. Write a clear email or letter stating your need for an employment verification letter for mortgage purposes, specifying any details required by your lender. It's advisable to include your current job title and the timeframe for when you need the letter. If you use UsLegalForms, you can access templates that guide you in composing your request with ease.

To obtain your employment history for a mortgage, start by contacting your employer's HR department. They can provide the necessary documentation, including a detailed employment verification letter for mortgage purposes. If your company does not respond or you have been laid off, you can also check with previous employers. Additionally, using platforms like UsLegalForms can streamline this process by offering templates that help you draft your requests effectively.

A letter of employment can be any official document that verifies your current job and income details. This includes letters from your employer outlining your position, salary, and length of employment. For mortgage purposes, an employment verification letter for mortgage should be formatted correctly and include specific details that lenders look for. Using a reliable platform like US Legal Forms can ensure your letter meets all necessary requirements.

A proof of employment letter is a document that confirms your employment status with a particular company. It typically includes details such as your job title, employment dates, and salary information. When applying for a mortgage, providing a well-structured employment verification letter for mortgage can strengthen your application and build trust with lenders. This letter serves as essential documentation for your financial stability.

Yes, lenders often verify your employment when you're applying for a mortgage. They may contact your employer directly to confirm your job status and income. This helps ensure that the information in your employment verification letter for mortgage is accurate and reliable. To streamline the process, consider using a formal employment verification letter that can facilitate communication between you and your lender.

If a lender cannot verify employment, they may delay the mortgage approval process or deny your application. It is crucial to provide an accurate employment verification letter for mortgage and any additional documentation to support your employment status. Be proactive and communicate with your lender, as they may suggest alternative solutions or documentation. Ensuring clear communication and proper documentation can help you navigate this challenge.

To prove self-employment for a mortgage, collect essential documents such as tax returns from the last two years, bank statements, and profit and loss accounts. Additionally, an employment verification letter for mortgage helps illustrate your earnings and job status. Providing a comprehensive package of your financial details enhances your case. Always keep your documents organized and accessible for lenders.

Mortgage lenders verify employment through contacting your employer directly to confirm your job title, salary, and duration of employment. They may also ask for an employment verification letter for mortgage, which details your employment information. In some cases, lenders further examine your financial records to ensure your income is stable. Accurate and precise documentation greatly streamlines this process.

Mortgage lenders verify self-employment through multiple methods, including reviewing your income tax returns and bank statements. They may require additional documentation, such as profit and loss statements, to confirm consistent earnings. A well-prepared employment verification letter for mortgage can further support your self-employment status. Always be prepared to provide additional proof of income.

A Verification of Employment (VOE) letter is typically valid for 30 days when applying for a mortgage. Lenders rely on recent employment details, so it is essential to submit an up-to-date employment verification letter for mortgage qualification. If your housing application spans a longer period, you may need to request a new letter. Always check with your lender for their specific requirements.