An income verification letter for self-employed individuals is a written document that confirms the income status and financial stability of a self-employed person. This official letter is typically requested by financial institutions, landlords, or other organizations as proof of income when applying for loans, mortgages, rental agreements, or other financial transactions. Keywords: income verification letter, self-employed, income status, financial stability, written document, proof of income, financial institutions, landlords, loans, mortgages, rental agreements. Types of income verification letters for self-employed: 1. Business Income Verification Letter: This type of income verification letter specifically focuses on the income generated by a self-employed individual's business activities. It provides detailed information about the business's financial standing and verifies the income declared by the self-employed person. It includes details such as business name, type, registration number, income sources, and a confirmation statement from the self-employed individual. 2. Tax Return Income Verification Letter: This letter is prepared based on the individual's tax return or tax documents. It serves as proof of income for self-employed individuals who file their taxes and provides a summary of their income, deductions, and taxable amount. The letter may be issued by a certified public accountant (CPA) or tax preparer, and states the individual's average annual income, the number of years they have been self-employed, and their adherence to tax regulations. 3. Bank Statement Income Verification Letter: This type of income verification letter is issued by a bank or financial institution where the self-employed individual holds their business or personal accounts. The letter verifies the individual's income by providing bank statements for a specific duration, usually the past six months or a year. The bank statement letter includes details of deposits, withdrawals, and regular income sources, reaffirming the financial stability of the self-employed person. 4. Client/Customer Income Verification Letter: Self-employed individuals often work with clients or customers who can provide verification of income. In this case, a letter can be requested from the client(s) confirming the self-employed individual's regular income and ongoing business relationship. The client income verification letter includes details such as the client's name, contact information, duration of the business relationship, and the average monthly/annual income received from the client. These types of income verification letters for self-employed individuals provide official documentation and validation of their income, strengthening their credibility when engaging in various financial transactions.

Income Verification Letter For Self-employed

Description proof of self employment letter

How to fill out Self Employed Income Letter?

Dealing with legal documents and procedures might be a time-consuming addition to your day. Income Verification Letter For Self-employed and forms like it usually require you to look for them and understand the way to complete them effectively. As a result, if you are taking care of financial, legal, or personal matters, using a thorough and hassle-free online library of forms close at hand will help a lot.

US Legal Forms is the best online platform of legal templates, featuring over 85,000 state-specific forms and a variety of tools that will help you complete your documents quickly. Check out the library of appropriate papers accessible to you with just a single click.

US Legal Forms provides you with state- and county-specific forms available at any time for downloading. Shield your papers administration procedures having a top-notch services that lets you put together any form within a few minutes with no extra or hidden charges. Just log in in your account, locate Income Verification Letter For Self-employed and download it straight away within the My Forms tab. You can also access formerly saved forms.

Could it be your first time using US Legal Forms? Register and set up up an account in a few minutes and you’ll gain access to the form library and Income Verification Letter For Self-employed. Then, adhere to the steps below to complete your form:

- Be sure you have the right form by using the Preview feature and reading the form information.

- Choose Buy Now when ready, and select the monthly subscription plan that meets your needs.

- Select Download then complete, sign, and print out the form.

US Legal Forms has twenty five years of experience assisting users manage their legal documents. Find the form you need today and enhance any process without having to break a sweat.

income verification letter Form popularity

income verification letter for self employed Other Form Names

self employed proof of income form FAQ

Self-employed people or individuals who do not receive pay slips can provide bank statements (of the last 6 months or a year). It shows a clear record of the overall salary received and business transactions in a financial year. The Form 16 is issued by employers to the employees.

Provide details about your self-employment, such as the name of your business, the nature of your work, and the duration of your self-employment. Explain any relevant accomplishments or projects you have completed as a self-employed individual, highlighting your skills, experience, and expertise.

You sell your old stuff as a business. You take care of pets. You work in rideshare. You deliver the goods. Rent your room. Earned valuable goods. Kickstart with crowdfunding. IRS documentation.

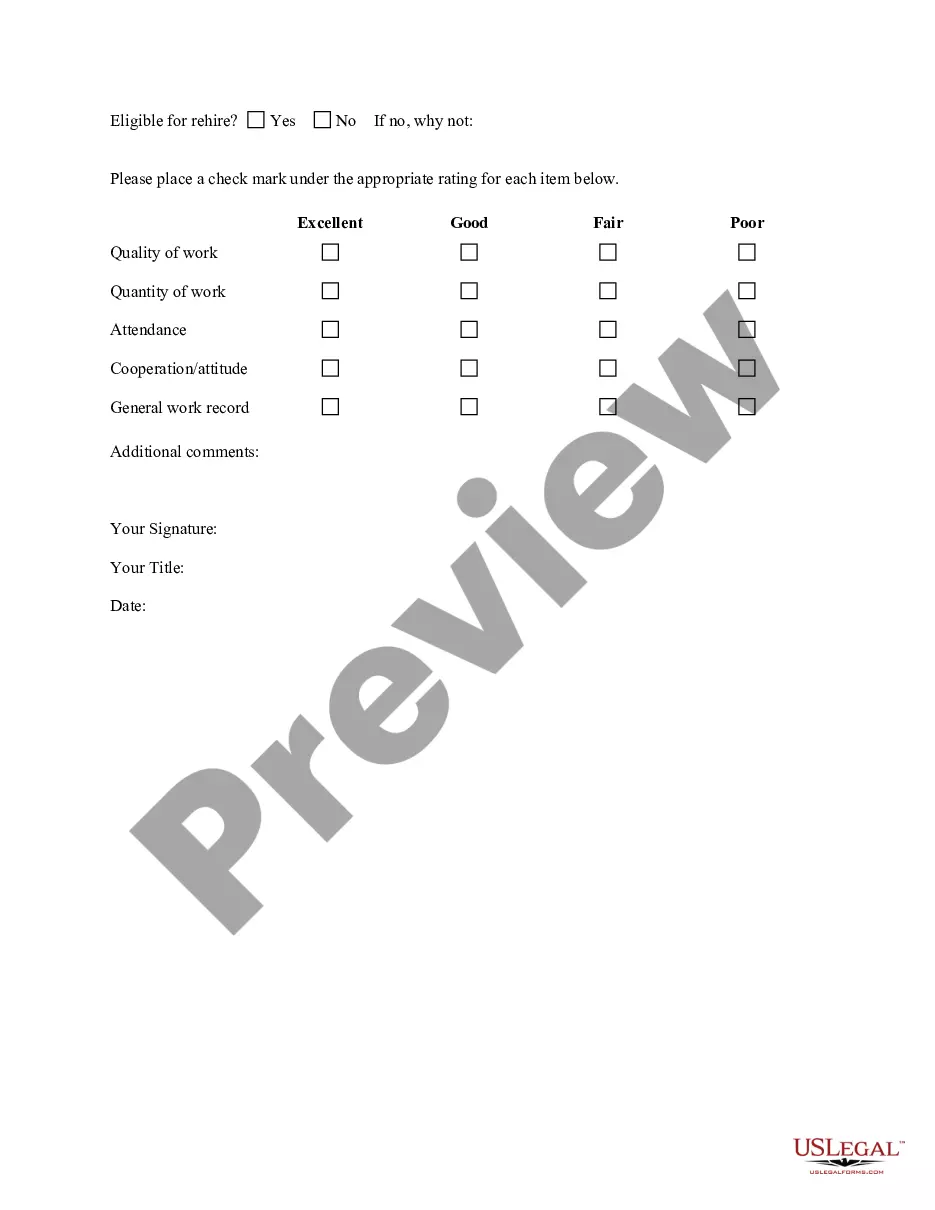

What should be included in employment verification letters? Employer address. Name and address of the company requesting verification. Employee name. Employment dates. Employee job title. Employee job description. Employee current salary. Reason for termination (If applicable)

The lender may verify a self-employed borrower's employment and income by obtaining from the borrower copies of their signed federal income tax returns (both individual returns and in some cases, business returns) that were filed with the IRS for the past two years (with all applicable schedules attached).