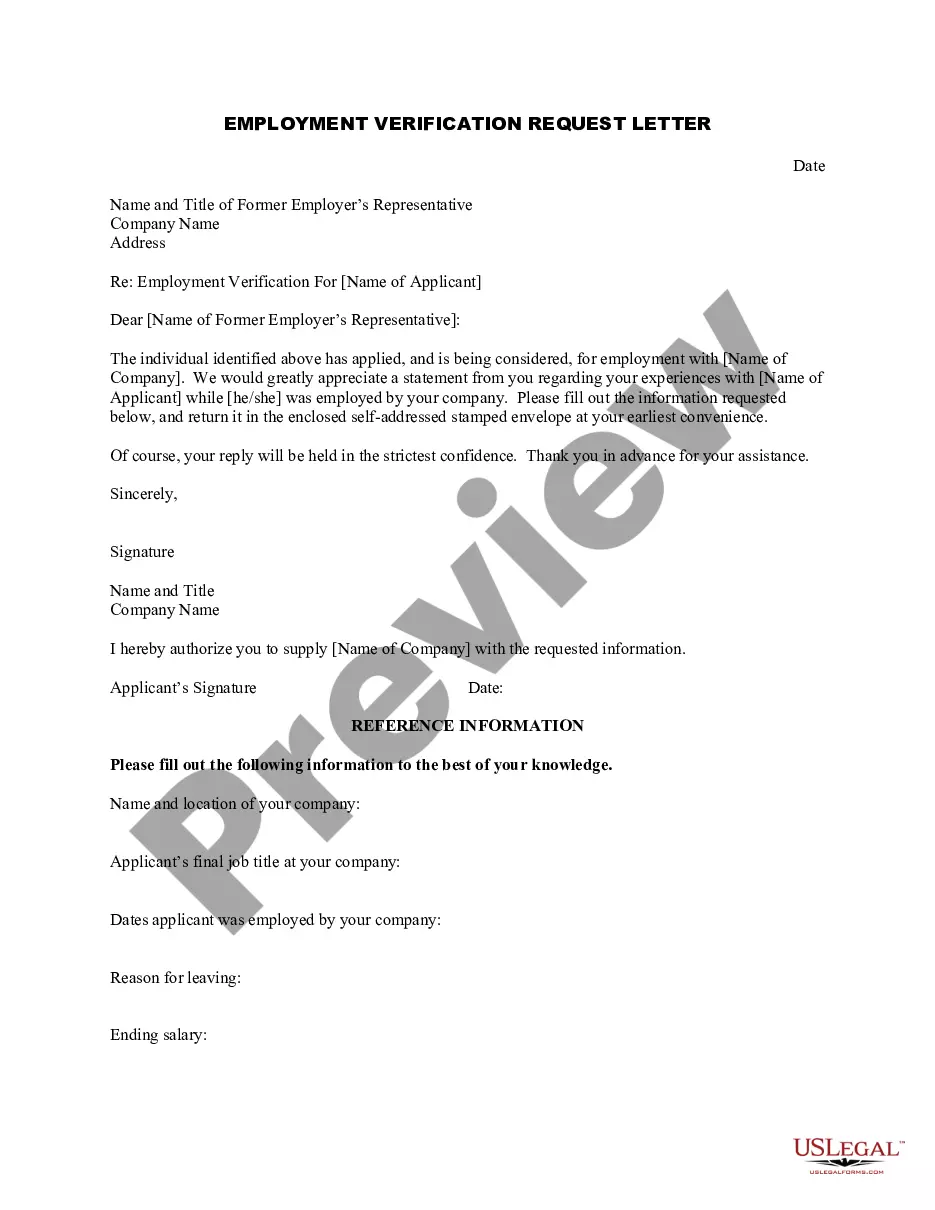

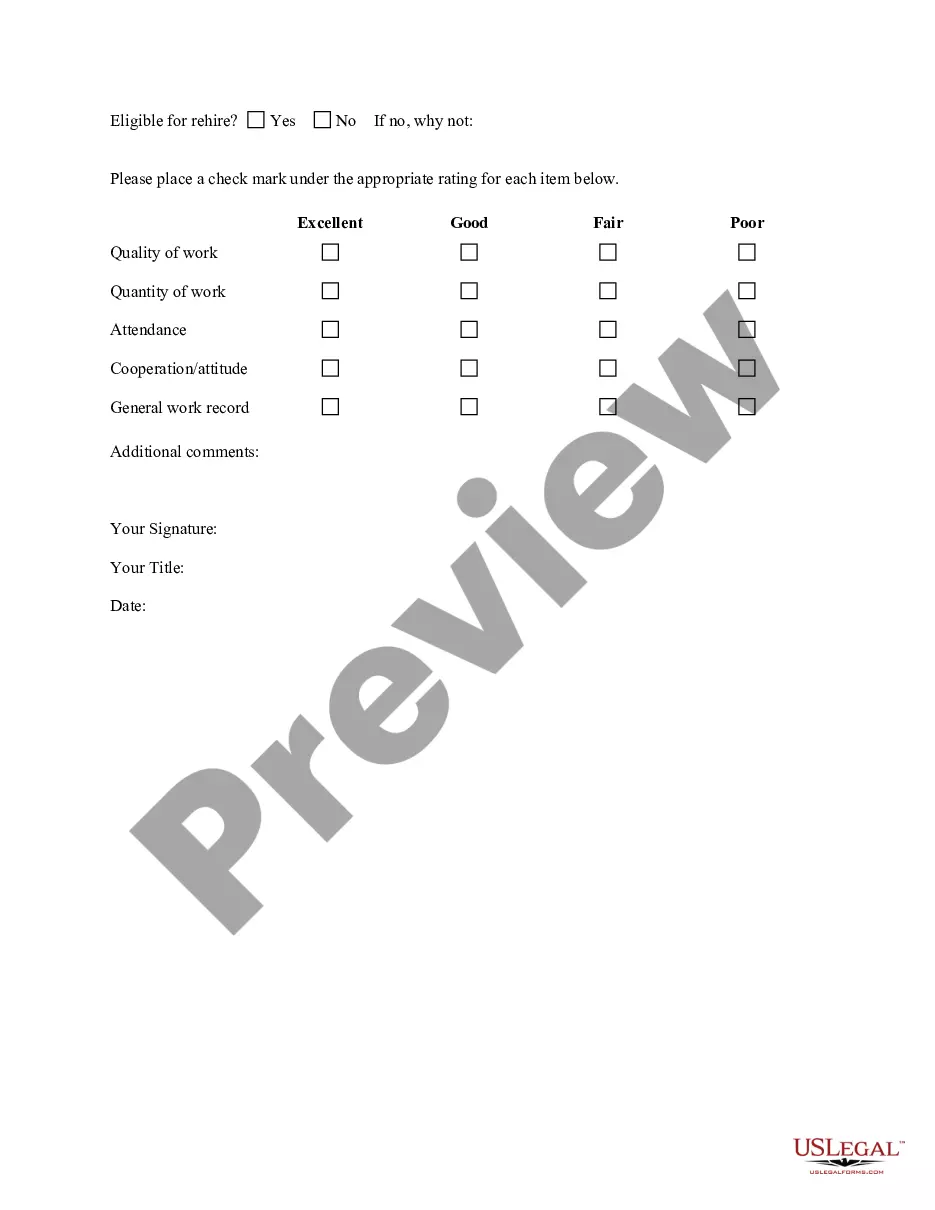

A verification of employment letter for mortgage is a document that confirms an individual's employment status and income, typically requested by mortgage lenders during the loan application process. This letter enables lenders to validate the borrower's ability to repay the mortgage loan and determine their level of financial stability. It serves as an essential part of the approval process by providing employers' and borrowers' information, including key employment details and income specifics. Keywords: verification of employment letter, mortgage, loan application process, employment status, income confirmation, mortgage lenders, repayment ability, financial stability, approval process, employers' information, borrowers' information, employment details, income specifics. There are two main types of verification of employment letters for mortgages: 1. Standard Verification of Employment Letter: This type of letter includes the borrower's general employment information, such as their job title, length of employment, and current income. It also verifies that the borrower is still employed at the company and provides contact details for the employer or human resources department. Additionally, it may mention the borrower's employment status (full-time, part-time) and whether any pending changes in employment are expected. 2. Verification of Employment and Income Letter: This letter is similar to the standard verification of employment letter but includes more comprehensive details regarding the borrower's income. In addition to the employment information, it specifies the borrower's salary or hourly rate, regular working hours, and any additional income sources, such as commissions, bonuses, or overtime. This type of letter aims to provide a thorough overview of the borrower's income stability and potential for future growth. Both types of verification of employment letters for mortgages are crucial for mortgage lenders to assess the borrower's financial standing and make informed decisions regarding loan approval. These letters are typically requested directly from the borrower's employer or HR department and should be on official company letterhead, signed by an authorized representative, and include accurate and up-to-date information.

Verification Of Employment Letter For Mortgage

Description verification of employment form mortgage

How to fill out Verification Of Employment Letter For Mortgage?

Legal papers management may be overpowering, even for the most skilled specialists. When you are interested in a Verification Of Employment Letter For Mortgage and do not get the a chance to commit in search of the appropriate and updated version, the operations could be stressful. A strong web form library might be a gamechanger for everyone who wants to take care of these situations successfully. US Legal Forms is a industry leader in web legal forms, with over 85,000 state-specific legal forms available whenever you want.

With US Legal Forms, you may:

- Access state- or county-specific legal and organization forms. US Legal Forms covers any needs you might have, from individual to organization paperwork, in one location.

- Use advanced resources to complete and handle your Verification Of Employment Letter For Mortgage

- Access a useful resource base of articles, guides and handbooks and resources connected to your situation and needs

Save effort and time in search of the paperwork you need, and utilize US Legal Forms’ advanced search and Review tool to find Verification Of Employment Letter For Mortgage and download it. If you have a membership, log in to your US Legal Forms profile, search for the form, and download it. Review your My Forms tab to see the paperwork you previously saved and to handle your folders as you see fit.

If it is your first time with US Legal Forms, make an account and get unrestricted use of all advantages of the library. Listed below are the steps to consider after downloading the form you need:

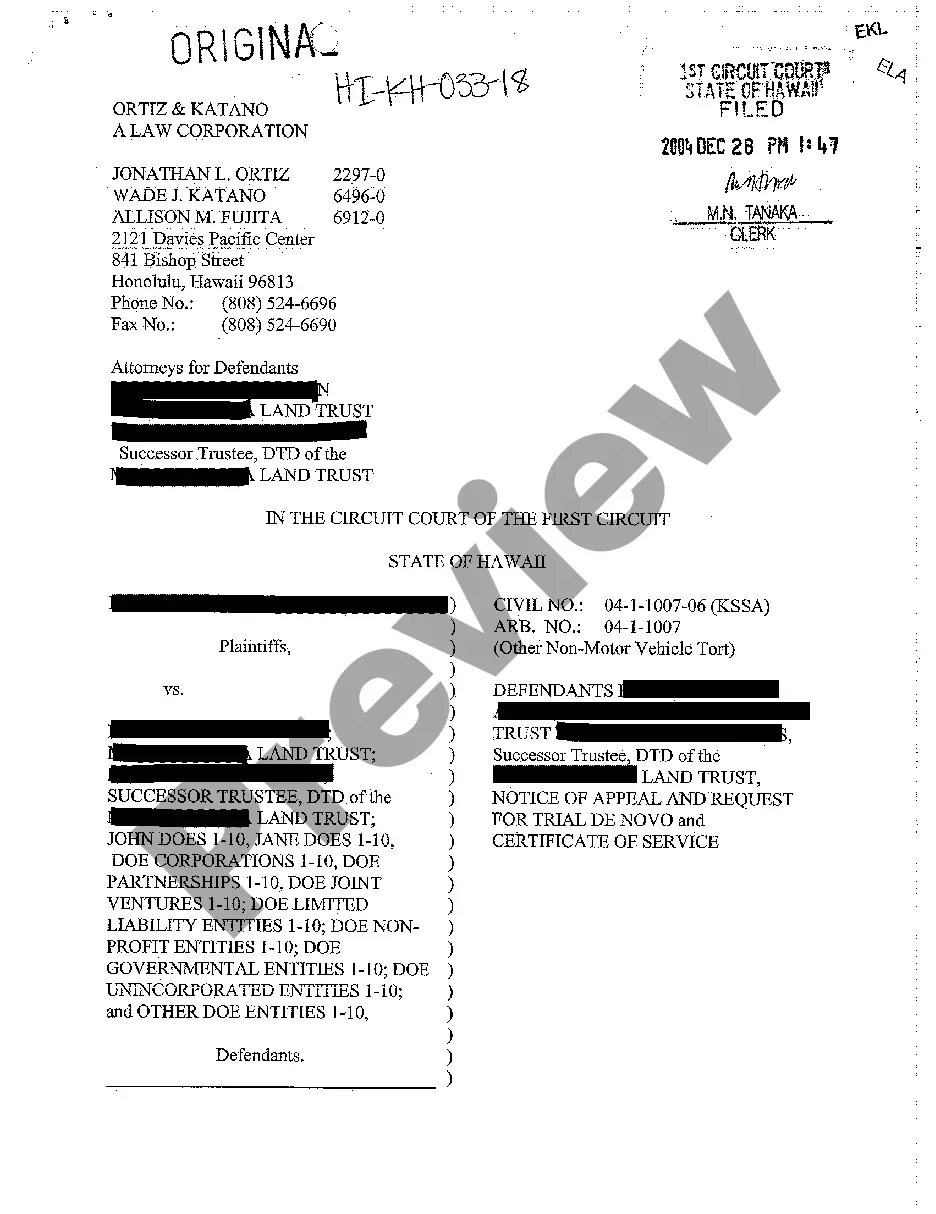

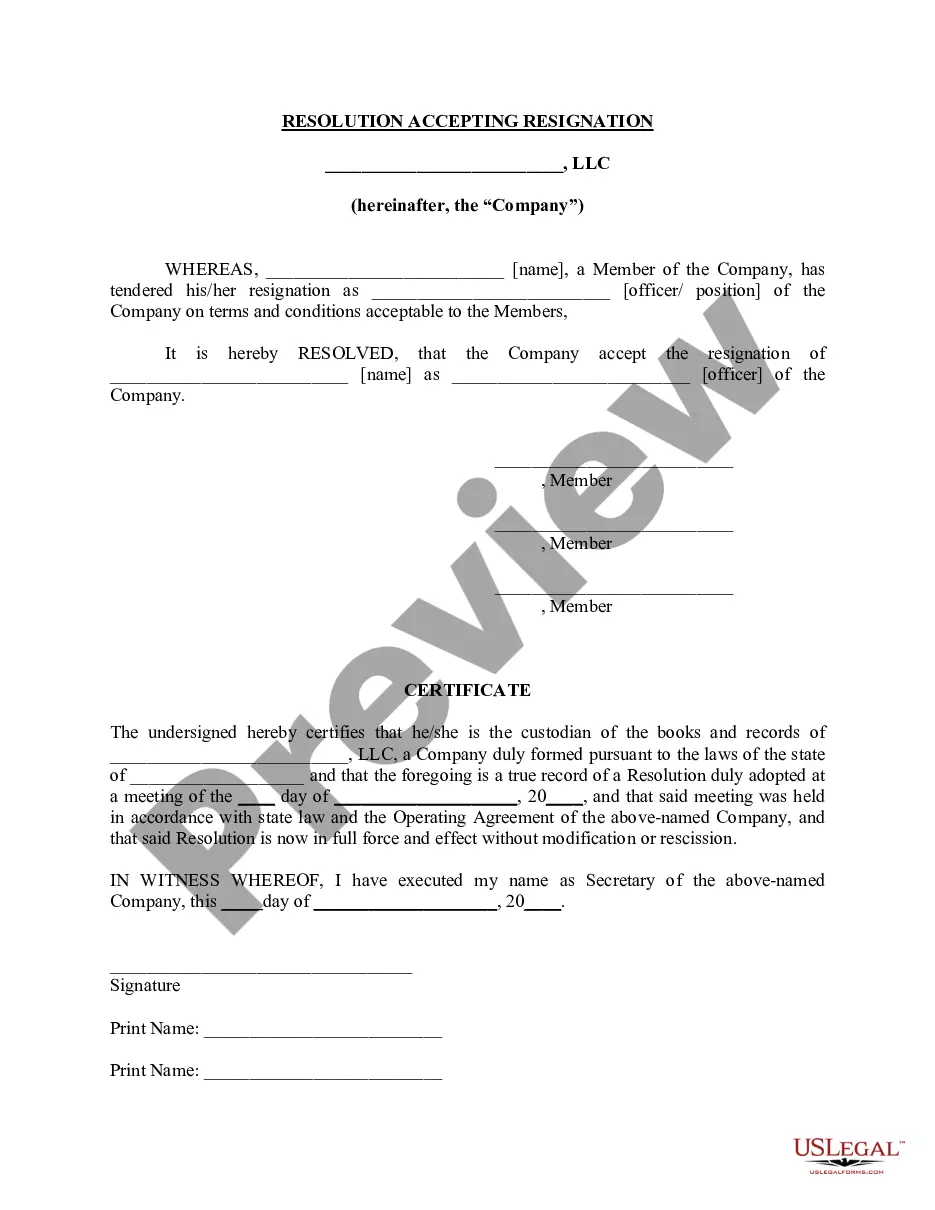

- Verify this is the correct form by previewing it and reading its information.

- Ensure that the sample is approved in your state or county.

- Select Buy Now once you are all set.

- Choose a monthly subscription plan.

- Pick the format you need, and Download, complete, sign, print out and send your document.

Benefit from the US Legal Forms web library, supported with 25 years of expertise and reliability. Change your daily document administration into a smooth and user-friendly process today.

Form popularity

FAQ

Writing a letter of confirmation for employment involves stating the employee’s name, date of hire, and position within your company. Clearly confirm that the employee is currently employed by your organization, and include any relevant details like hours or annual salary if requested. This letter serves as essential documentation for their mortgage application.

To write a verification of employment letter, you should start with your company’s letterhead and date. Include the employee’s name, position, and employment dates. Conclude with your signature and contact information, ensuring it's professionally formatted, to meet the lender's needs during the mortgage process.

When answering the probability of continued employment on a Verification of Employment letter for mortgage, be transparent. If the employee's position is stable and there are no anticipated changes, you can indicate a high probability of continued employment. Conversely, if there are any uncertainties, it’s better to communicate that to provide accurate information to the lender.

You could technically perform your own employment verification, but it’s often not advisable. Lenders typically require third-party verification to ensure credibility and impartiality. Using services or platforms like USLegalForms can streamline the process, providing you with templates and guidelines that meet specific lender requirements.

When filling out the employment eligibility verification, you generally need to provide details such as the employee's full name, position, employment dates, and possibly the reason for verification. Additionally, you may need to include the company's name, address, contact information, and tax identification number. Providing clear information helps expedite the mortgage application process.

The employment verification letter should usually be addressed to the lender requesting it, such as a bank or mortgage company. If you do not have a specific name, addressing it to 'To Whom It May Concern' is an acceptable alternative. This ensures that the letter reaches the right hands and contains all the necessary information.

To write a verification of employment letter for mortgage, start by including your company’s letterhead. State the employee's name, job title, and the duration of employment clearly. You can also mention the employee's salary if required, and ensure that it is signed by someone in a management position to lend credibility to the document.

To create a verification of employment letter for mortgage, you should begin by gathering all necessary information, including your job title, salary, and employment dates. Clearly state these details in a formal letter format. It's also beneficial to include your employer's contact information for verification purposes. Alternatively, using a service like USLegalForms can simplify this process by providing templates that ensure you have all the required elements in your letter.

An employment verification letter for mortgage is usually written by a representative from your company, often someone from the HR department. This person is responsible for confirming your employment details and ensuring the letter meets the lender's requirements. If you're in a small business, your direct supervisor may draft this letter. It's essential to ensure that the writer has the authority to provide such confirmations.

To obtain a verification of employment letter for mortgage, you typically need to contact your employer's HR department. They will provide the necessary documentation that confirms your employment status, salary, and job title. You may need to submit a written request or fill out specific forms, depending on your company's policies. Companies often have templates they use to make this process smoother.