Agreement Investment Trust With Monthly Income

Description

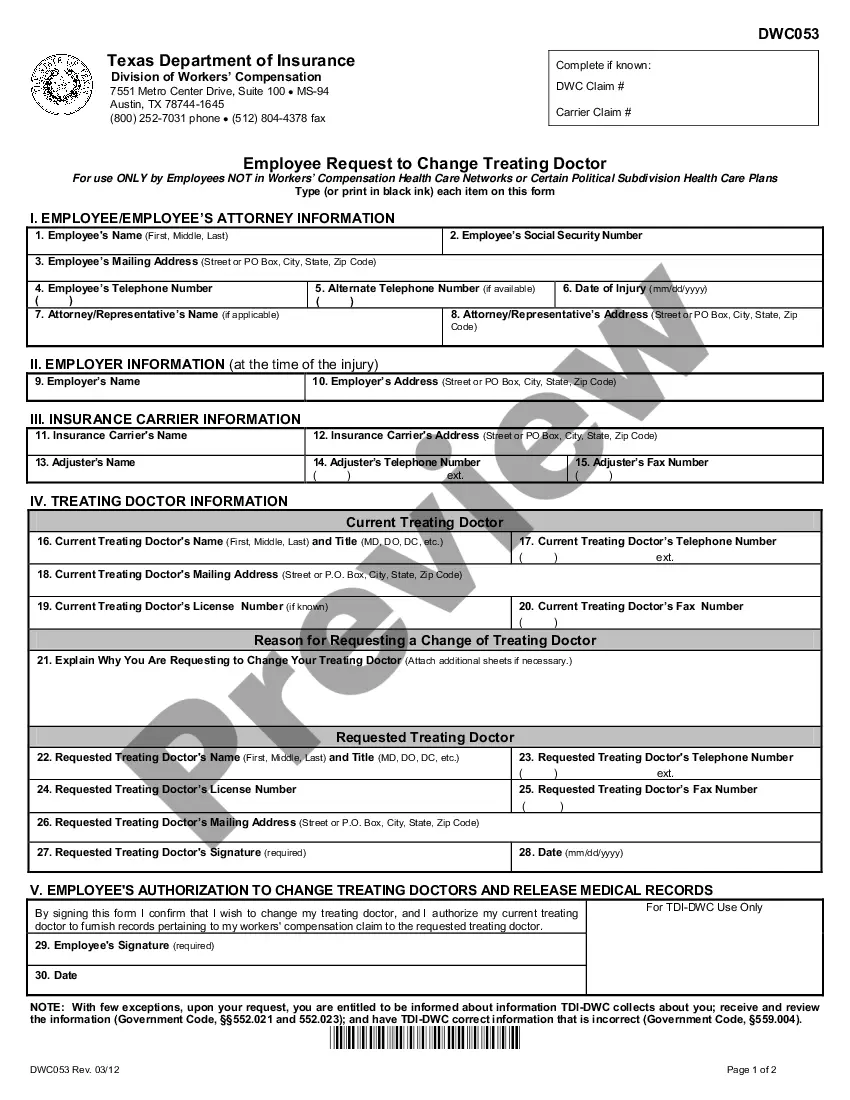

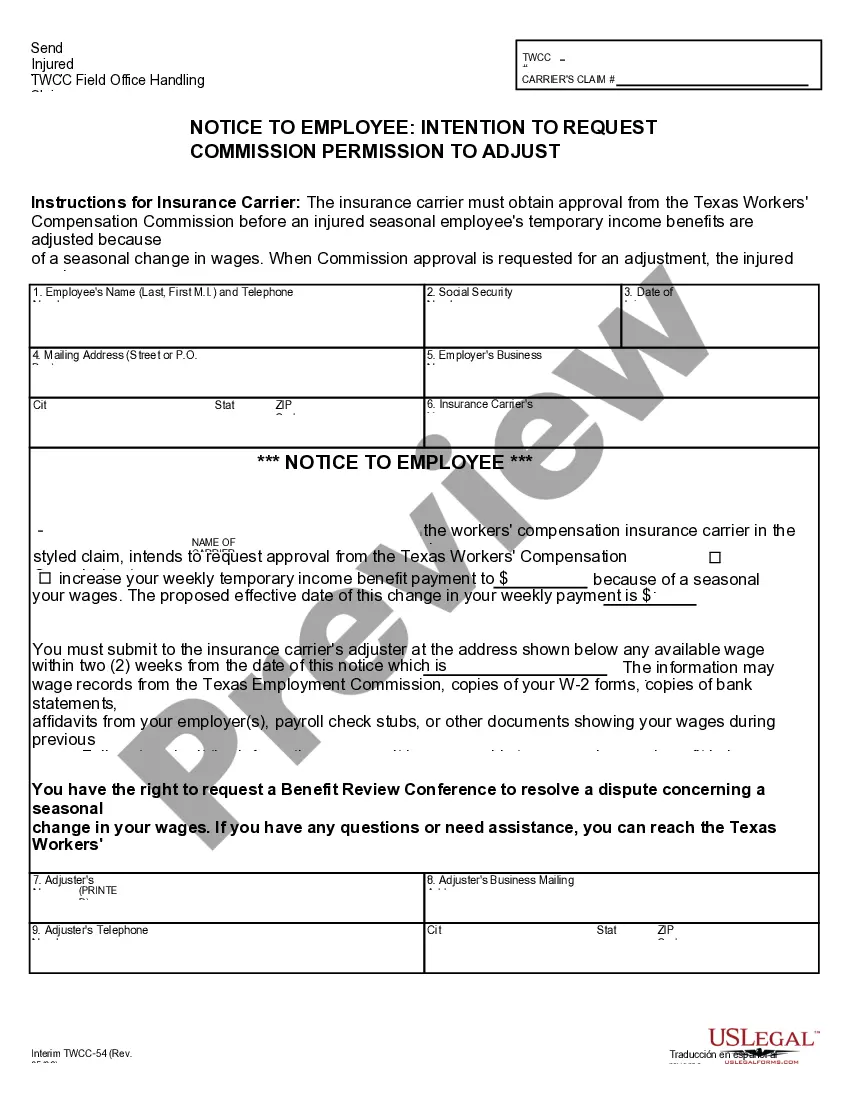

How to fill out Advisory Agreement Between Real Estate Investment Trust And Corporation?

Bureaucracy requires exactness and correctness.

If you do not engage in completing documents like the Agreement Investment Trust With Monthly Income on a daily basis, it may result in some misunderstandings.

Selecting the appropriate sample from the outset will ensure that your document submission will proceed smoothly and avert any hassles of re-submitting a document or repeating the same task from the beginning.

Obtaining the correct and current samples for your documentation takes just a few minutes with an account at US Legal Forms. Eliminate the bureaucracy worries and streamline your form processing.

- Locate the template using the search functionality.

- Ensure the Agreement Investment Trust With Monthly Income you’ve discovered is suitable for your state or county.

- Review the preview or examine the description that includes specifics on how to use the template.

- If the result aligns with your search, click the Buy Now button.

- Choose the appropriate option from the suggested pricing plans.

- Log In to your account or sign up for a new one.

- Complete the transaction using a credit card or PayPal payment method.

- Download the form in your preferred format.

Form popularity

FAQ

Trust beneficiaries must pay taxes on income and other distributions that they receive from the trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets. IRS forms K-1 and 1041 are required for filing tax returns that receive trust disbursements.

For trusts, distributions are taxable to the beneficiary, and the trust must file a Schedule K-1 for each beneficiary paid. The beneficiary will then report the income on their tax return. The trust must also generate a Form 1041 to report the total amount of income the trust earned from the grantor's date of death.

The short answer is 'Yes', income earned by a trust is taxable. Many trusts are Grantor Trusts which means the Grantor of the trust includes any income earned by the trust on their tax return. For non-Grantor Trusts, if $600 or more is earned, the trust must file a tax return using form 1041 to calculate the tax.

Beneficiaries receiving money from a trust fund account collect their funds as per the terms of the trust. For example, the beneficiary may receive all of the funds in a lump sum, or payments are sent on a monthly, quarterly or annual basis.

Business of a Trust Not Subject to Self-Employment Tax Reg. §1.1402(a)-2(b). As a result of this statutory and regulatory language, income derived from a business maintained by a trust (or an estate) is not included in determining net earnings from self-employment of the individual beneficiaries.