Sample Purchase Sale With Assumption Of Mortgage

Category:

State:

Multi-State

Control #:

US-CC-12-1730D

Format:

Word;

Rich Text

Instant download

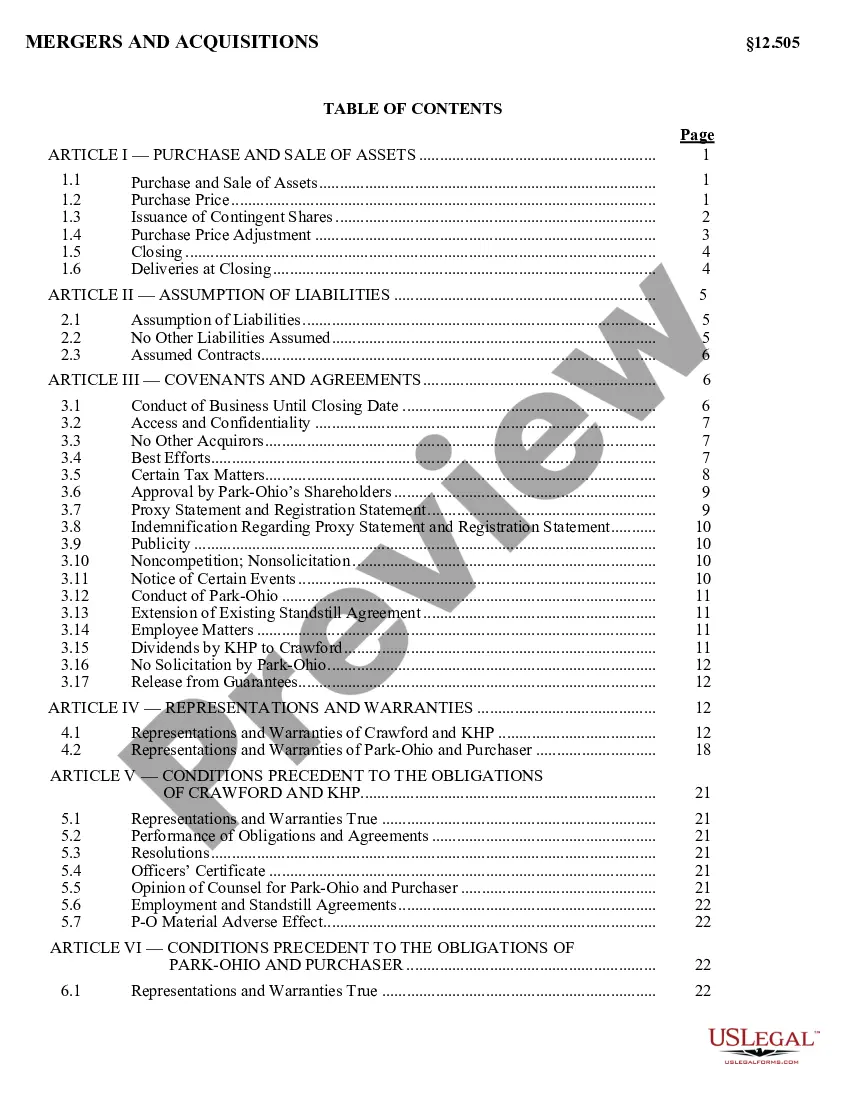

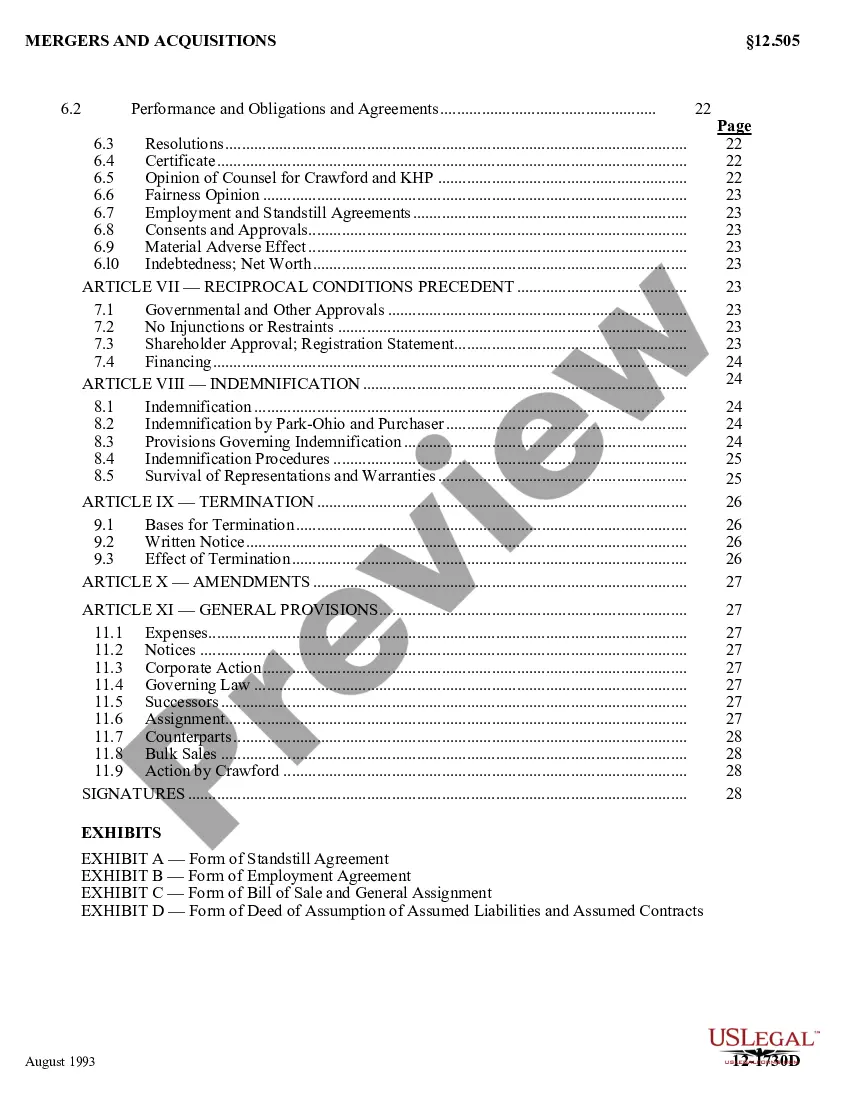

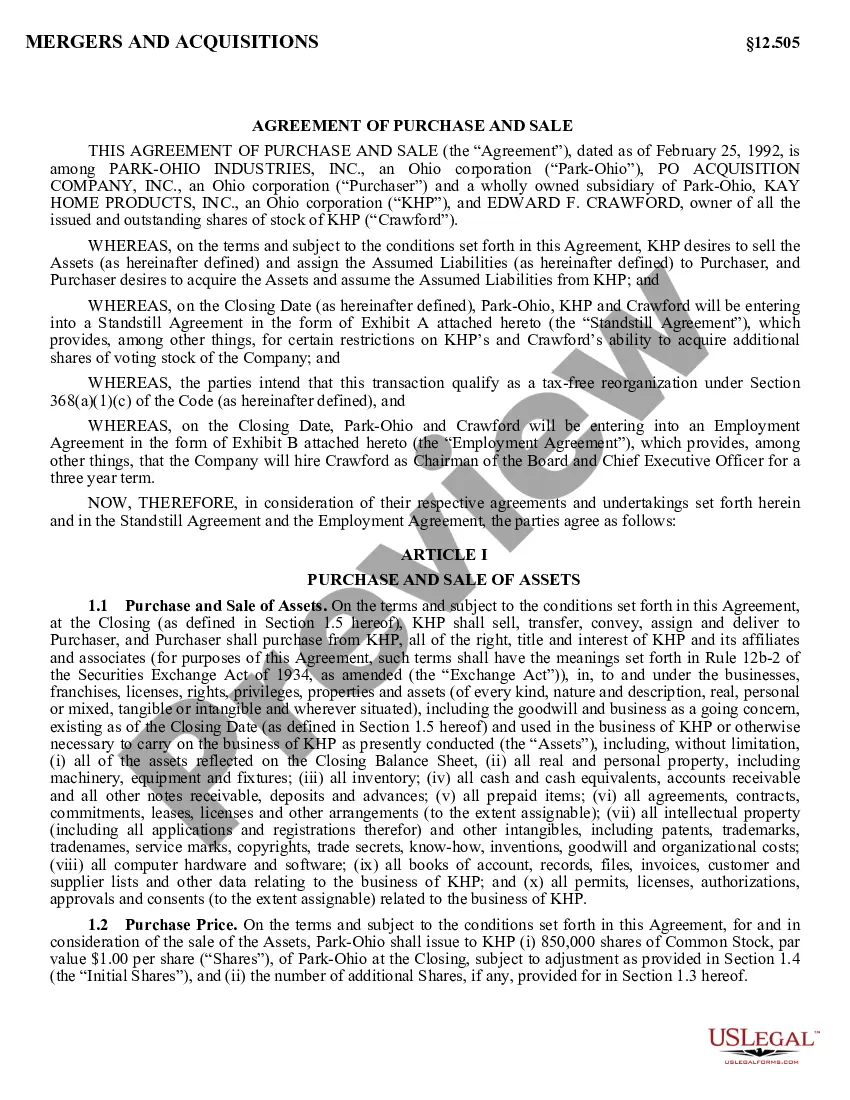

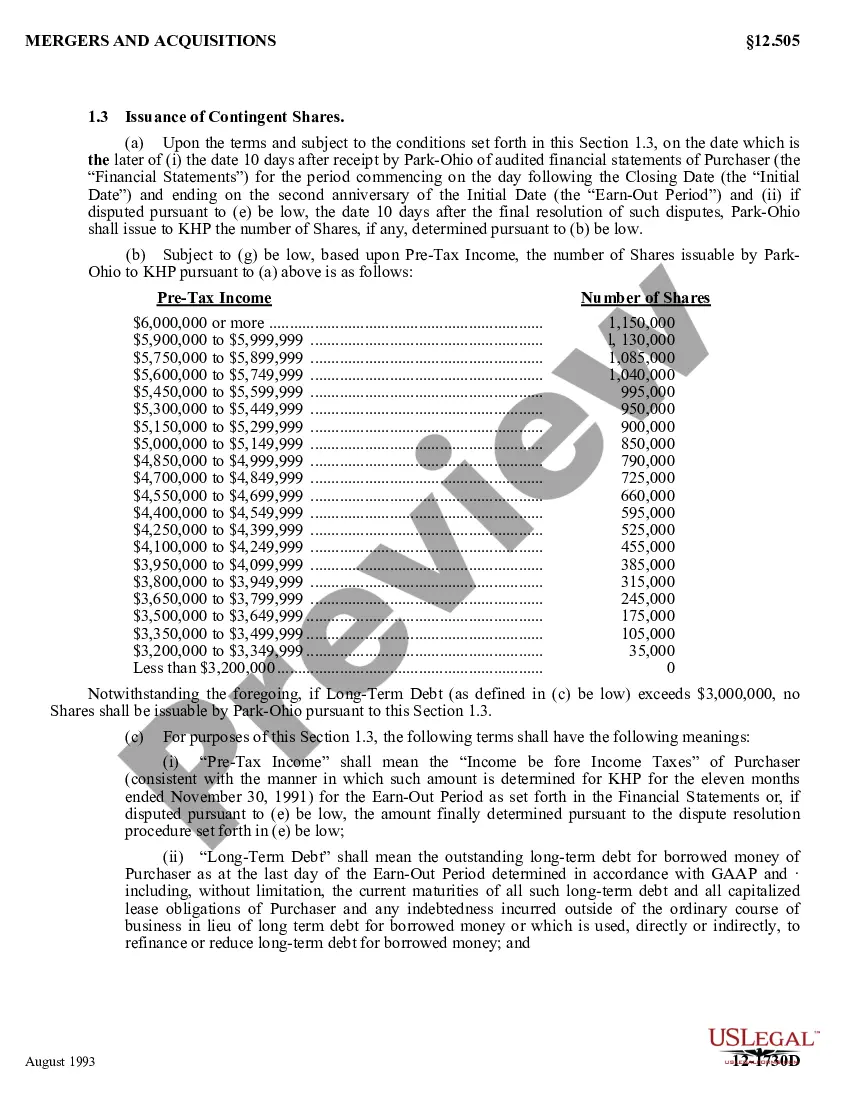

Description Purchase Home Form

This is an Agreement of Purchase and Sale, to be used across the United States. This Agreement is to be used by a corporation, when it wishes to purchase and/or sale certain property belonging to the company.

Free preview Agreement Sale Form