A Loan promissory note template for a personal loan agreement is a legal document that outlines the terms and conditions agreed upon by a lender and a borrower for the repayment of a loan. This template serves as a written evidence of the loan agreement, ensuring that both parties are aware of their obligations and responsibilities. The Loan promissory note template typically includes important details such as the names and contact information of the lender and borrower, the loan amount, the interest rate, the repayment schedule, and any late payment penalties or fees. It also specifies the collateral, if any, that is being used to secure the loan. Keywords: Loan promissory note template, personal loan agreement, legal document, terms and conditions, lender, borrower, repayment, loan amount, interest rate, repayment schedule, late payment penalties, collateral. There are different types of Loan promissory note templates for personal loan agreements, named as follows: 1. Simple Loan promissory note template: This template is suitable for straightforward personal loans that do not involve complex terms or collateral. It outlines the loan amount, the interest rate, and the repayment schedule. 2. Secured Loan promissory note template: This template is used when the borrower pledges collateral, such as a car or property, to secure the loan. It includes provisions regarding the use of collateral in case of default. 3. Variable Interest Rate Loan promissory note template: This template is designed for loans with variable interest rates. It includes provisions that specify how the interest rate will be determined and adjusted over time. 4. Balloon Payment Loan promissory note template: This template is used for loans where the borrower agrees to make smaller, regular payments for a specified period and a large final payment, known as the balloon payment, at the end of the loan term. 5. Installment Loan promissory note template: This template is suitable for loans that are repaid in equal installments over a fixed period. It outlines the repayment schedule and the total number of payments required. By utilizing these various Loan promissory note templates, individuals can tailor their personal loan agreements to suit their unique circumstances and requirements while ensuring compliance with legal regulations.

Loan Promissory Note Template For Personal Loan Agreement

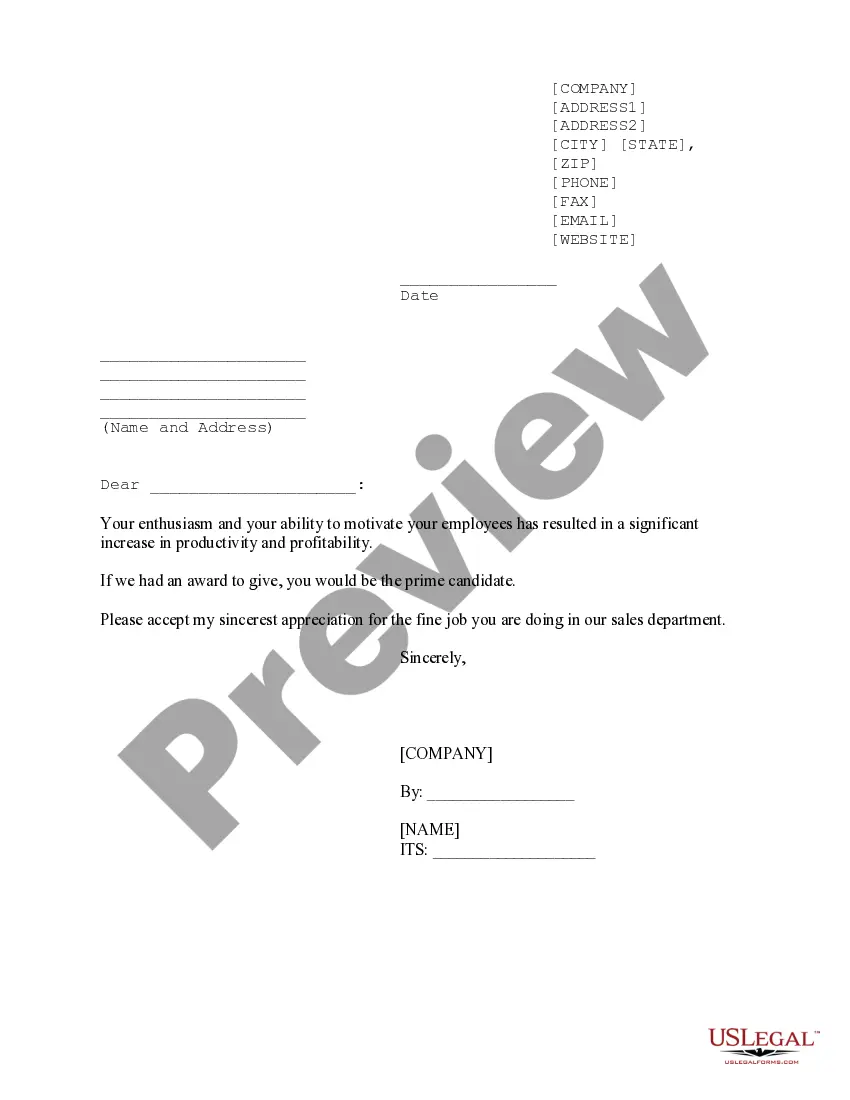

Description promissory note for a personal loan

How to fill out Loan Promissory Note Template For Personal Loan Agreement?

Drafting legal documents from scratch can sometimes be daunting. Some cases might involve hours of research and hundreds of dollars invested. If you’re searching for a more straightforward and more affordable way of preparing Loan Promissory Note Template For Personal Loan Agreement or any other documents without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online library of more than 85,000 up-to-date legal documents covers almost every aspect of your financial, legal, and personal matters. With just a few clicks, you can quickly access state- and county-specific forms carefully put together for you by our legal experts.

Use our website whenever you need a trusted and reliable services through which you can easily locate and download the Loan Promissory Note Template For Personal Loan Agreement. If you’re not new to our website and have previously set up an account with us, simply log in to your account, locate the template and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No worries. It takes minutes to register it and navigate the catalog. But before jumping straight to downloading Loan Promissory Note Template For Personal Loan Agreement, follow these recommendations:

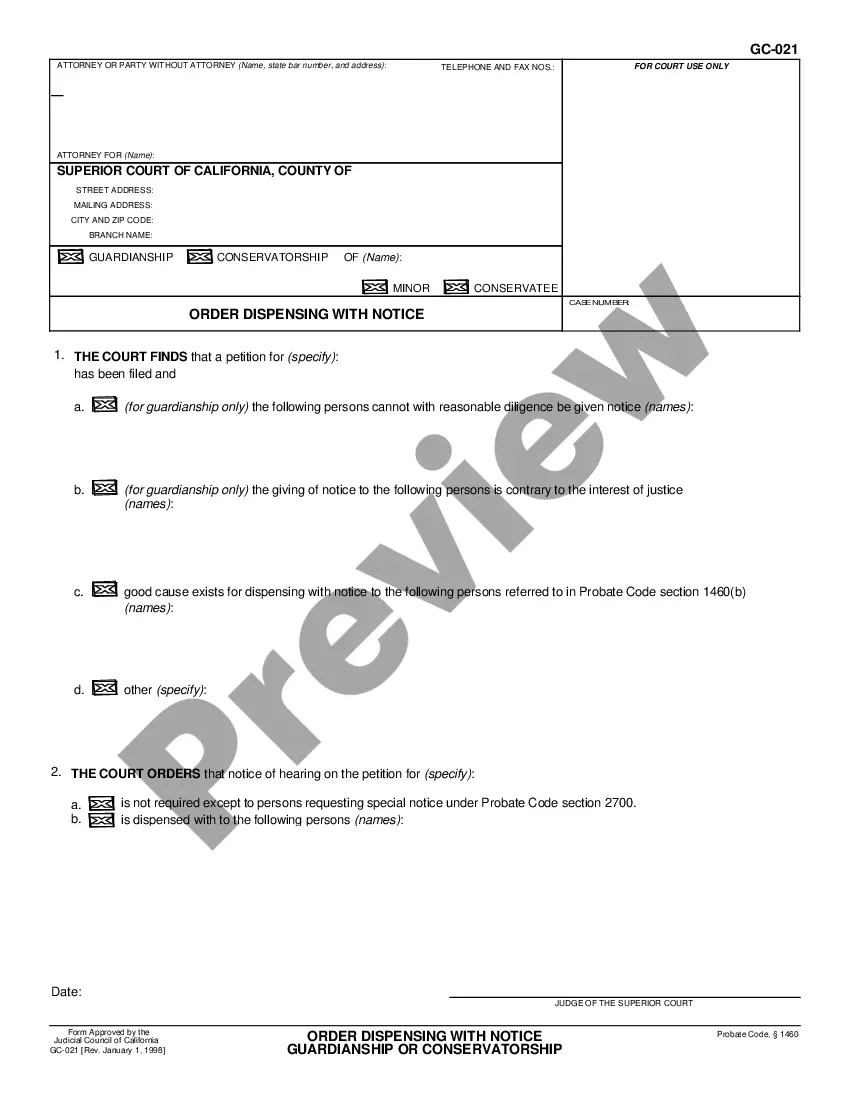

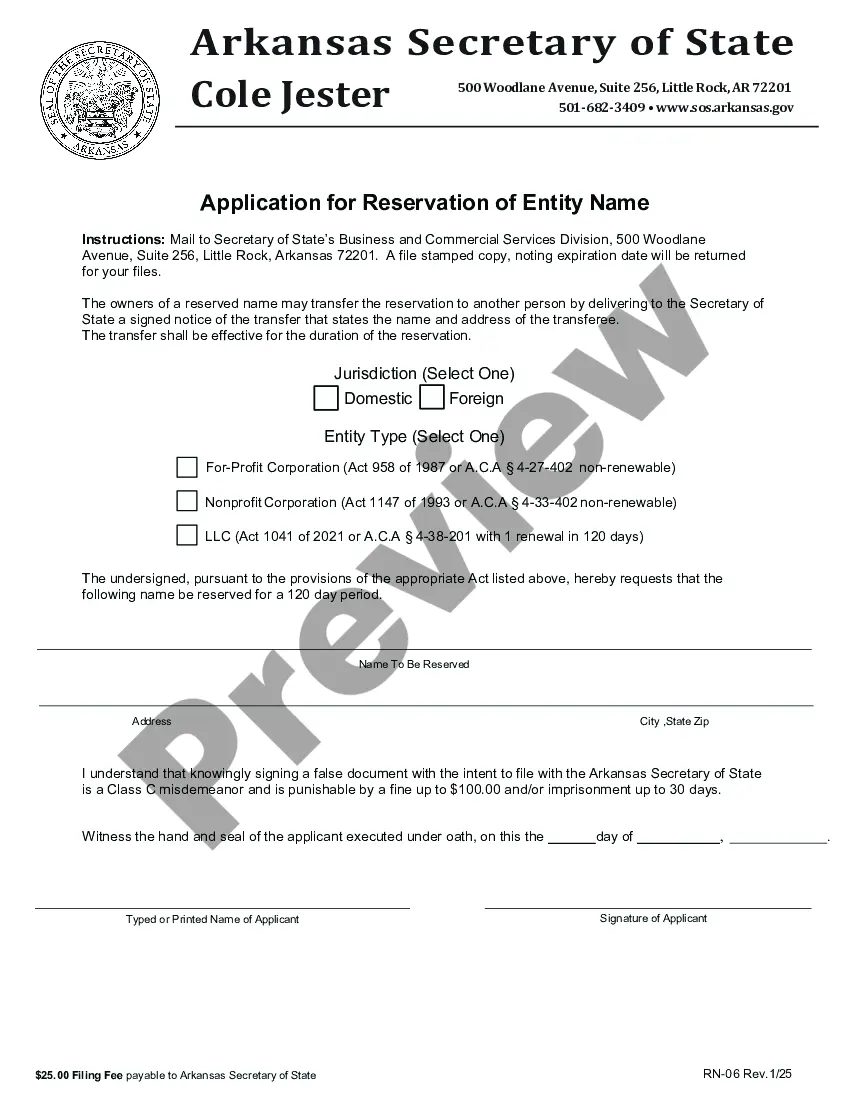

- Review the document preview and descriptions to ensure that you are on the the document you are looking for.

- Make sure the form you choose complies with the requirements of your state and county.

- Choose the right subscription option to get the Loan Promissory Note Template For Personal Loan Agreement.

- Download the form. Then complete, sign, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us today and transform document completion into something easy and streamlined!

Form popularity

FAQ

A will can be advantageous because it provides standardized procedures and court supervision. Also, the creditor claims limitation period is often shorter than for a living trust. Because probate is time-consuming, potentially expensive and public, avoiding probate is a common estate planning goal.

If you have a will, your assets will be administered through the probate process. Generally, if you have a trust, your assets will be transferred to your loved ones without probate.

DISADVANTAGES OF A TRUST Most importantly, a trust will cost more than a last will at the initial stage of planning and you have to provide more information up front.

Unfortunately, the remote online notarization law does not apply to estate planning documents, including wills. Under current law, the self-proving affidavit to your will must be notarized in person for it to be valid in Wisconsin.

You can pick yourself as trustee for now, but you'll need a successor trustee who will take over when you die or if you become incapacitated. Also take this time to decide what you want to pass on to which heirs. Draw up the trust document: You can use an online program to do it yourself or get the help of an attorney.

No, you do not need to notarize your will in Wisconsin to make it legal. You may, however, make your will "self-proving" in Wisconsin, but you'll need to go to a notary to do so. The court will consider a self-proving will without contacting the witnesses who signed it, which speeds up probate.

Benefits of a living trust Avoid probate. Probate is the court-supervised legal process in which your estate is distributed ing to your last will and testament. ... Protect your loved ones' privacy. ... Have greater control and flexibility. ... Protect your assets during your lifetime.

In addition to possibly avoiding probate, living trusts can be managed in private??unlike a will. Private estate processes often make it more difficult for others to challenge the details of the estate. Living trusts can also help you manage your finances if you become unable to do so for whatever reason.