Distribution Agreement Services Withdrawal

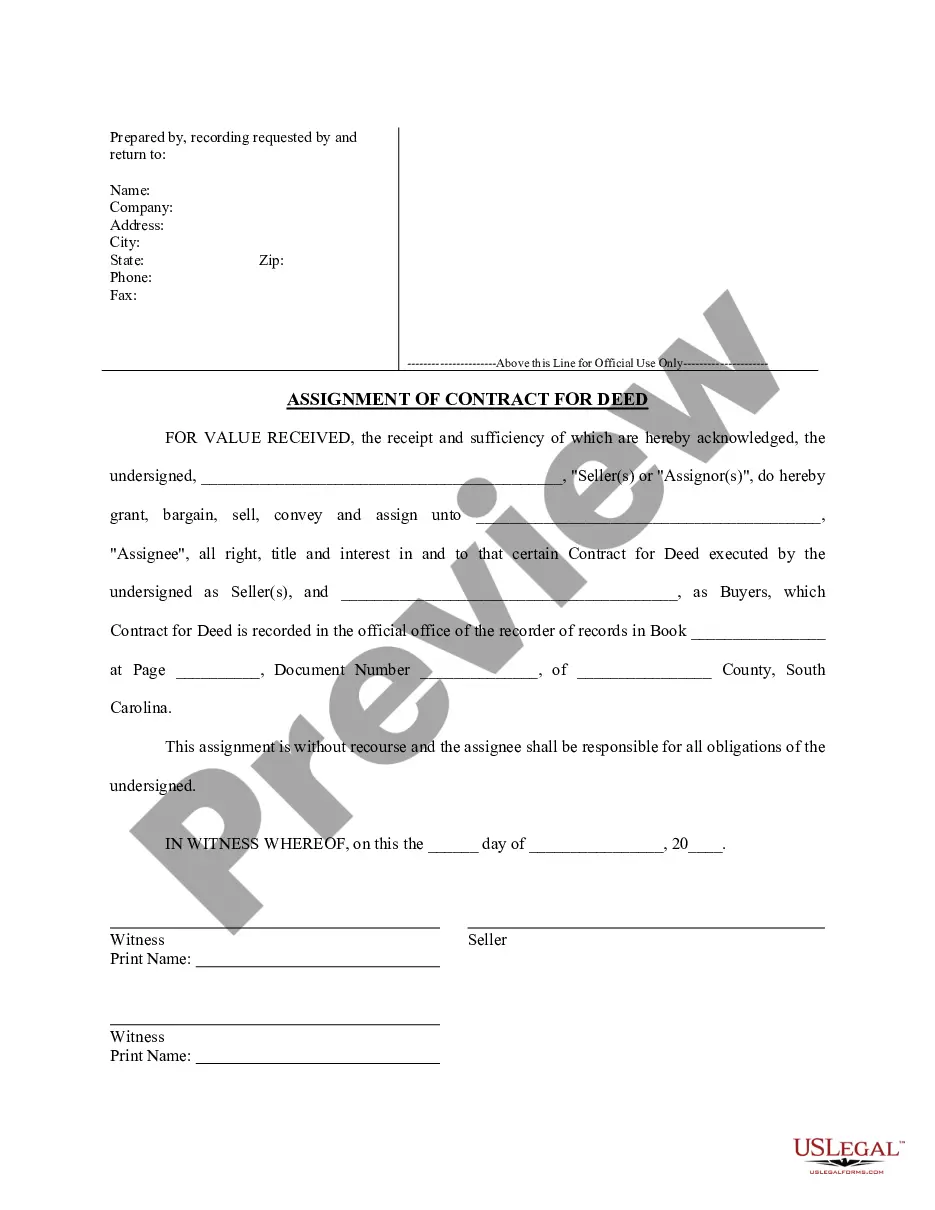

Description

How to fill out Distribution Agreement Services Withdrawal?

Steering through the red tape of standard documents and templates can be arduous, particularly if one does not engage in that professionally.

Even selecting the appropriate template for a Distribution Agreement Services Withdrawal can be labor-intensive, as it must be authentic and precise to the final detail.

Nonetheless, you will require significantly less time obtaining a suitable template from a trustworthy source.

Obtain the correct form in a few straightforward steps: Enter the name of the document in the search box. Choose the fitting Distribution Agreement Services Withdrawal from the list of results. Review the description of the sample or view its preview. If the template meets your needs, click Buy Now. Move forward to select your subscription plan. Use your email to create a password and register an account at US Legal Forms. Select a credit card or PayPal payment method. Download the template file to your device in your preferred format. US Legal Forms will save you considerable time determining whether the form you discovered online is appropriate for your requirements. Create an account and gain unlimited access to all the templates you seek.

- US Legal Forms is a platform that streamlines the process of finding the correct forms online.

- US Legal Forms serves as a single destination for obtaining the latest document samples, verifying their usage, and downloading them to complete.

- This collection consists of over 85K forms applicable in various professional fields.

- When searching for a Distribution Agreement Services Withdrawal, you need not question its relevance since all forms are authenticated.

- Having an account at US Legal Forms ensures you have all necessary samples readily available.

- You can save them in your history or add them to the My documents catalog.

- Access your saved forms from any device by clicking Log In at the library site.

- If you do not yet have an account, you can still search for the template you require.

Form popularity

FAQ

What Is an In-Service Withdrawal? An in-service withdrawal occurs when an employee takes a distribution from a qualified, employer-sponsored retirement plan, such as a 401(k) account, without leaving the employ of their company.

Key Takeaways. A qualified distribution is a tax- and penalty-free withdrawal from a qualified retirement plan such as a 401(k) or 403(b) plan. Qualified distributions come with conditions set by the IRS, so investors don't avoid paying taxes.

Key TakeawaysA 401(k) distribution occurs when you take money out of the retirement account and use it for retirement income. If you have taken money from your account before 59 1/2 years of age, you have made a withdrawal.

Key Takeaways A qualified distribution is a tax- and penalty-free withdrawal from a qualified retirement plan such as a 401(k) or 403(b) plan. Qualified distributions come with conditions set by the IRS, so investors don't avoid paying taxes.

Delay IRA withdrawals until age 59 1/2. You can avoid the early withdrawal penalty by waiting until at least age 59 1/2 to start taking distributions from your IRA. Once you turn age 59 1/2, you can withdraw any amount from your IRA without having to pay the 10% penalty.