A Certificate of Designation is a legal document that outlines specific rights, privileges, preferences, and restrictions associated with a particular class or series of securities, usually preferred stock. This certificate is filed by a corporation or business entity with the appropriate state authority, such as the Secretary of State's office, to designate the unique characteristics and features of a particular class or series of securities it issues. The Certificate of Designation plays a crucial role in defining the specific rights and obligations of the shareholders who hold these designated securities. It provides clarity to both the company and the shareholders on various important aspects related to their shares. Some key details covered in the certificate typically include dividend rights, liquidation preferences, conversion rights, voting rights, redemption rights, and any other relevant provisions or limitations. The importance of a Certificate of Designation lies in its ability to distinguish between different classes or series of securities that a company may offer, thus allowing flexibility in meeting varying investor preferences. It ensures that the rights and privileges attached to each class or series of securities are well-defined, avoiding any confusion or conflict among shareholders. While the specifics of a Certificate of Designation may vary from company to company, there are two common types worth mentioning: 1. Certificate of Designation for Preferred Stock: Companies often issue different series of preferred stock with varying divided participation, conversion, or voting rights. The Certificate of Designation for Preferred Stock clearly outlines the specific rights and preferences associated with each series issued. 2. Certificate of Designation for Series LLC: In some jurisdictions, a Series Limited Liability Company (LLC) allows the creation of individual series with distinct assets, liabilities, and members. Each series within an LLC may require a Certificate of Designation to articulate the unique rights and obligations of the individual series. Overall, a Certificate of Designation serves as a critical legal document that defines the terms and conditions attached to a particular class or series of securities, offering clear guidelines for both the corporation and its shareholders. It ensures transparency, clarity, and consistency in the management of different securities classes, enabling investors to make informed decisions based on their preferences and risk appetite.

Certificate Of Designation Meaning

Description corporate designation meaning

How to fill out Certificate Of Designation Meaning?

Legal document management might be overpowering, even for the most skilled specialists. When you are looking for a Certificate Of Designation Meaning and do not get the time to spend looking for the correct and up-to-date version, the procedures can be stress filled. A robust online form catalogue might be a gamechanger for anyone who wants to take care of these situations effectively. US Legal Forms is a industry leader in online legal forms, with over 85,000 state-specific legal forms accessible to you at any moment.

With US Legal Forms, you are able to:

- Gain access to state- or county-specific legal and business forms. US Legal Forms handles any demands you might have, from personal to business papers, in one spot.

- Employ innovative tools to accomplish and handle your Certificate Of Designation Meaning

- Gain access to a useful resource base of articles, instructions and handbooks and materials relevant to your situation and requirements

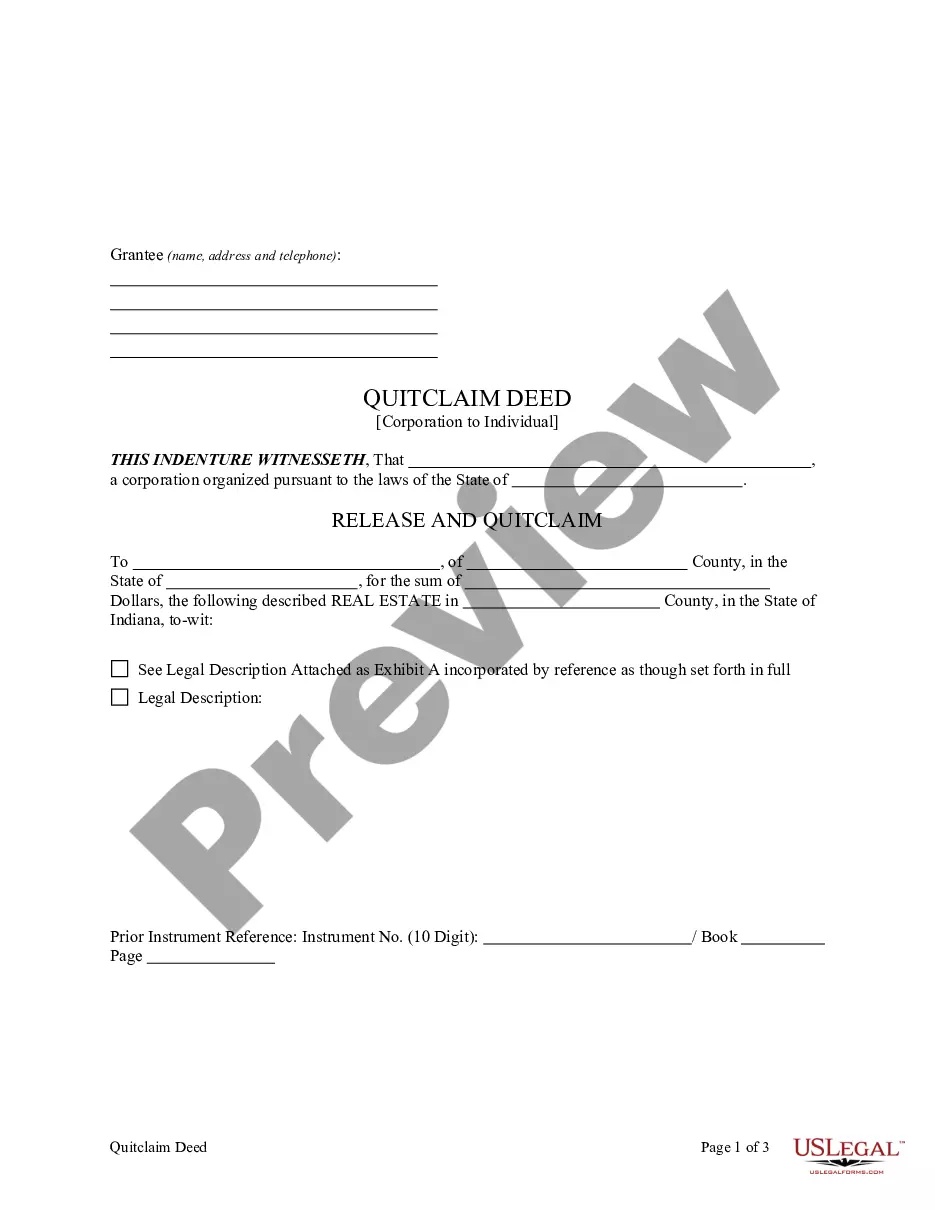

Help save time and effort looking for the papers you will need, and use US Legal Forms’ advanced search and Preview tool to get Certificate Of Designation Meaning and download it. For those who have a subscription, log in for your US Legal Forms profile, look for the form, and download it. Take a look at My Forms tab to see the papers you previously saved as well as to handle your folders as you can see fit.

If it is your first time with US Legal Forms, create a free account and obtain unlimited use of all advantages of the platform. Here are the steps for taking after downloading the form you want:

- Validate this is the right form by previewing it and looking at its information.

- Ensure that the sample is accepted in your state or county.

- Select Buy Now once you are ready.

- Select a monthly subscription plan.

- Find the formatting you want, and Download, complete, sign, print and deliver your papers.

Enjoy the US Legal Forms online catalogue, supported with 25 years of experience and reliability. Enhance your daily papers management in to a easy and user-friendly process right now.

designation meaning in application form Form popularity

legal corporation meaning Other Form Names

FAQ

Online payments are available 24/7 at onlineservices.NCcourts.org for supervised and unsupervised probationers with their case file number, the county that issued the charge, and a major credit card, including American Express®, Discover®, MasterCard®, and Visa® cards.

Whether you are paying monetary obligations previously imposed in a court's judgment or pleading guilty by ?waiver? (as discussed in the previous two questions), your payment options are the same: online, by mail, or in person at the courthouse (or at a magistrate's office, for in-person waivers).

The file for a court case can be viewed by visiting the clerk of court's office in the county where the case is located. Staff can provide copies of documents in court files for a fee. Also, see the Remote Public Access Program to learn more about licensing for data access and extracts.

Online probation payments can be made using the OCAP system at http:// onlineservices.nccourts.org/OCAP . Please have the county where you were convicted and your case number available when paying online.

Filing the Documents Take the original and two (2) copies of the Motion to the Civil Division of the Clerk of Superior Court's office in the county where your case is filed. The Clerk will stamp each Motion ?filed,? place the original in the Court file and return two (2) copies of the ?filed? document to you.

For eCourts counties: You may search Portal online for case information and court records by name, case number, attorney, and more. Individuals performing background checks should use the county clerk's office for doing so, not Portal. For media inquiries, view more information for members of the media.

OnlinePayments online can be made by credit card or debit card at the courts' Online Services portal. If you were placed on supervised probation, you can make a partial payment of the total due.

Elisa Chinn-Gary - Mecklenburg County Clerk of Superior Court - Clerk of Superior Court & Judge of Probate | LinkedIn.