Bonded Indebtedness Formula

Description

How to fill out Bonded Indebtedness Formula?

Whether you handle paperwork frequently or occasionally need to submit a legal document, it is essential to obtain a resource where all the samples are applicable and current.

The first action you should take with a Bonded Indebtedness Formula is to ensure that it is the latest version, as this determines whether it can be submitted.

If you prefer to streamline your search for the most recent document samples, seek them on US Legal Forms.

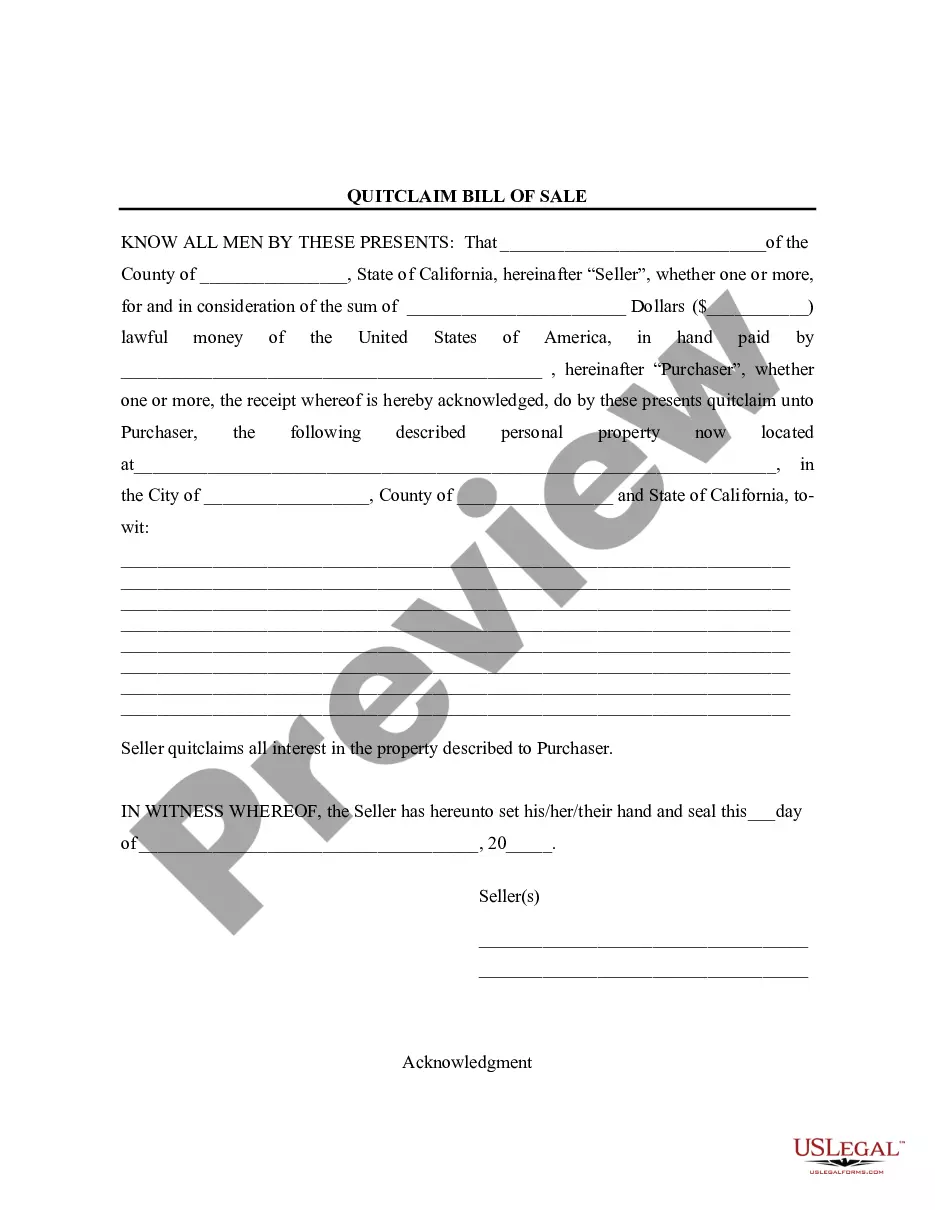

To obtain a form without an account, follow these instructions: Use the search bar to find the desired form. Review the Bonded Indebtedness Formula preview and description to confirm it is precisely what you seek. After double-checking the form, simply click Buy Now. Select a subscription plan that suits your needs. Create an account or sign in to your current one. Use your credit card details or PayPal account to complete the purchase. Choose the document format for download and confirm your selection. Eliminate any confusion associated with handling legal documents. All your templates will be organized and validated with a US Legal Forms account.

- US Legal Forms is a repository of legal documents that includes almost every sample you may be in search of.

- Look for the templates you require, verify their applicability immediately, and understand more about their functionality.

- With US Legal Forms, you gain access to approximately 85,000 form templates across various fields.

- Locate the Bonded Indebtedness Formula examples in just a few clicks and save them anytime in your account.

- A US Legal Forms account will enable you to access all the samples you need with ease and minimal hassle.

- You only need to click Log In in the site header and navigate to the My documents section where all the necessary forms are at your disposal, eliminating the time spent searching for the appropriate template or verifying its authenticity.

Form popularity

FAQ

Net indebtedness is a measure of an entity's total liabilities after accounting for its liquid assets. This value reflects the true financial obligation facing the organization, offering a clearer picture of its fiscal responsibility. Understanding net indebtedness can help organizations make informed financial decisions. Explore the bonded indebtedness formula for a deeper understanding of how to calculate this important metric.

Bonded indebtedness refers to a specific type of long-term debt that is represented by bonds issued by an organization, typically in the public sector. These bonds are secured by the organization's revenue or assets, making them a reliable funding option. Knowing about bonded indebtedness is essential for investors and organizations alike. The bonded indebtedness formula helps clarify how these bonds impact overall financial health.

To calculate net borrowings, take the total amount borrowed and subtract any repayments made during the period. This gives you the outstanding balance of loans or credit still owed. A clear understanding of net borrowings is vital for managing debt efficiently. For further insight, the bonded indebtedness formula provides a structured approach to understanding these figures.

Indebtedness is calculated by summing all outstanding debts an entity owes. This includes loans, credit lines, and any other financial obligations. It's important to consider both short-term and long-term liabilities. Utilizing a bonded indebtedness formula can aid in maintaining clarity in your financial assessments.

The formula for net indebtedness calculates the total debt of an entity after considering liquid assets. Specifically, you subtract liquid assets from total liabilities to arrive at the net figure. Understanding this formula is crucial for evaluating financial stability and obligations. You can find resources on the bonded indebtedness formula to help you grasp these calculations clearly.

To calculate the bond formula, focus on the key components: the bond's face value, interest rate, and time to maturity. The bonded indebtedness formula incorporates these elements to yield accurate results. It simplifies the understanding of what determines a bond's value and its potential returns.

The settlement amount of a bond refers to the total value that will be exchanged when the bond matures. This amount includes the principal repayment and any accrued interest. Utilizing the bonded indebtedness formula assists in calculating this, helping you avoid any confusion regarding the bond's final value.

Calculating bond payout involves not only the interest payments but also the return of the principal at maturity. Use the bonded indebtedness formula to discount future interest payments back to their present value. This approach gives you a clear picture of total payouts an investor can expect over the life of the bond.

For a 7% coupon rate bond with a $1,000 face value, you would receive $70 in interest annually, calculated using the formula Interest = Face Value x Coupon Rate. This demonstrates the effectiveness of the bonded indebtedness formula for assessing annual yields. Knowing this can greatly enhance your investment decision-making. If you want to streamline this process, consider checking out US Legal Forms for helpful templates and resources.

The formula for calculating interest on a bond is simple: Interest = Face Value x Coupon Rate. This straightforward calculation reveals how much an investor will earn from their bond. When applying the bonded indebtedness formula, this also allows you to evaluate the overall performance of your investments. If you need assistance, US Legal Forms can provide valuable resources and templates.