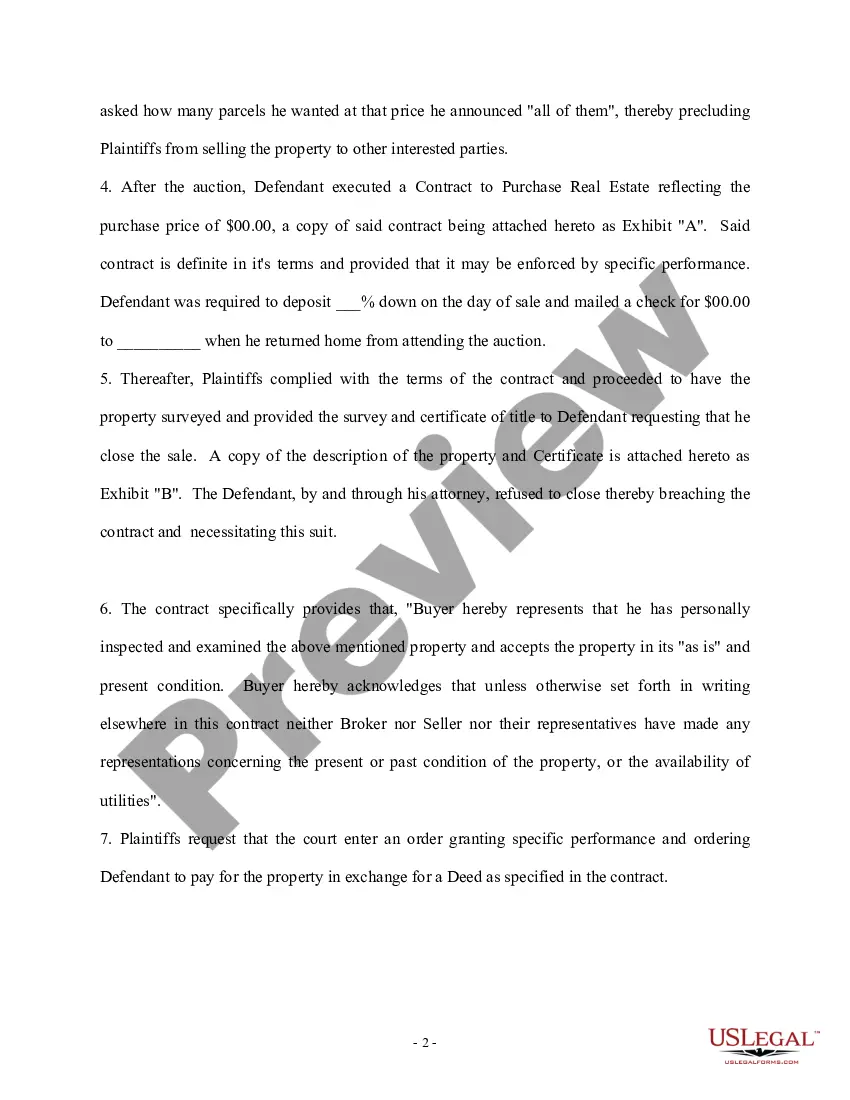

Real estate contract flipping for dummies is a beginner's guide to understanding the process of flipping real estate contracts. Flipping contracts can be a lucrative investment strategy in the real estate industry. It involves finding distressed properties or motivated sellers and then assigning the contract to another investor for a profit. This strategy doesn't require the actual purchase or ownership of the property, making it a low-risk option for beginners. To successfully engage in real estate contract flipping, there are certain steps and key concepts you need to grasp. Here are some essential elements for dummies interested in this field: 1. Understanding Real Estate Contracts: Familiarize yourself with the basics of real estate contracts, including terms, conditions, and legal requirements. This knowledge will provide a solid foundation for successfully flipping contracts. 2. Identifying Motivated Sellers: Learn how to pinpoint motivated sellers who are eager to sell their properties quickly. Motivated sellers are often facing financial issues, divorce, or relocating, making them more willing to negotiate favorable terms. 3. Finding Distressed Properties: Explore avenues for finding distressed properties, such as foreclosure auctions, real estate agents specializing in distressed sales, or online platforms that list distressed properties for sale. 4. Negotiating Contracts: Develop negotiation skills to secure the best possible terms when entering into a contract with motivated sellers. This includes understanding the property's value, conducting market research, and negotiating a favorable purchase price. 5. Assigning the Contract: Learn the process of assigning the contract to another investor or buyer for a fee. This allows you to profit from the contract without actually purchasing the property. Different Types of Real Estate Contract Flipping for Dummies: 1. Wholesaling Contracts: This type of contract flipping involves finding distressed properties, negotiating a purchase agreement, and assigning the contract to a buyer. As a wholesaler, you act as the middleman between the seller and the buyer, earning a fee for facilitating the transaction. 2. Virtual Wholesaling: Virtual wholesaling refers to flipping contracts remotely without physically visiting the property or having a local presence. This method relies on technology, online marketing, and networking to find buyers and sellers in different locations. 3. Co-Wholesaling: Co-wholesaling involves teaming up with other wholesalers to find and flip contracts. By combining resources, networks, and expertise, co-wholesalers can increase their chances of finding profitable deals and maximize profits. 4. Assigning Lease Options: Another form of contract flipping is assigning lease options, where you secure the right to lease a property for a specific period and then assign that right to another investor or tenant-buyer for a fee. Remember, real estate contract flipping requires research, due diligence, and attention to detail. By diligently learning and understanding the process, beginners can successfully engage in this profitable real estate investment strategy.

Real Estate Contract Flipping For Dummies

Description real estate contract flipping

How to fill out Real Estate Contract Flipping For Dummies?

The Real Estate Contract Flipping For Dummies you see on this page is a multi-usable formal template drafted by professional lawyers in line with federal and state laws. For more than 25 years, US Legal Forms has provided people, companies, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, most straightforward and most trustworthy way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Acquiring this Real Estate Contract Flipping For Dummies will take you just a few simple steps:

- Browse for the document you need and check it. Look through the sample you searched and preview it or check the form description to confirm it suits your requirements. If it does not, use the search option to get the right one. Click Buy Now when you have found the template you need.

- Sign up and log in. Opt for the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Acquire the fillable template. Choose the format you want for your Real Estate Contract Flipping For Dummies (PDF, Word, RTF) and save the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a valid.

- Download your paperwork one more time. Make use of the same document again anytime needed. Open the My Forms tab in your profile to redownload any earlier downloaded forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

selling house contracts Form popularity

how to sell house contracts Other Form Names

FAQ

Put simply, the 70 percent rule states that you shouldn't buy a distressed property for more than 70 percent of the home's after-repair value (ARV) ? in other words, how much the house will likely sell for once fixed ? minus the cost of repairs.

Although there is a potential to make money flipping real estate contracts, there are also some drawbacks. One drawback is that creating a large amount of income from flipping real estate contracts will require many deals. This will require investors to spend more time and effort evaluating potential deals.

It is without a doubt the easiest way to start out with no money and no experience. However, there are also some distinct disadvantages to flipping contracts. The main disadvantages to flipping contracts are: You are dependent on your buyers to close. You make no money if you cant flip the contract.

How to get started with house flipping Set a budget. A big financial drain is not having enough money to finance your project. ... Find the right property. If you don't have a massive budget, look for properties that best fit your current finances. ... Make an offer. ... Set a timeline. ... Hire trusted contractors. ... Sell your property.

Basically, the rule says real estate investors should pay no more than 70% of a property's after-repair value (ARV) minus the cost of the repairs necessary to renovate the home. The ARV of a property is the amount a home could sell for after flippers renovate it.