Agreement With Manufacturer Withholding Tax

Description

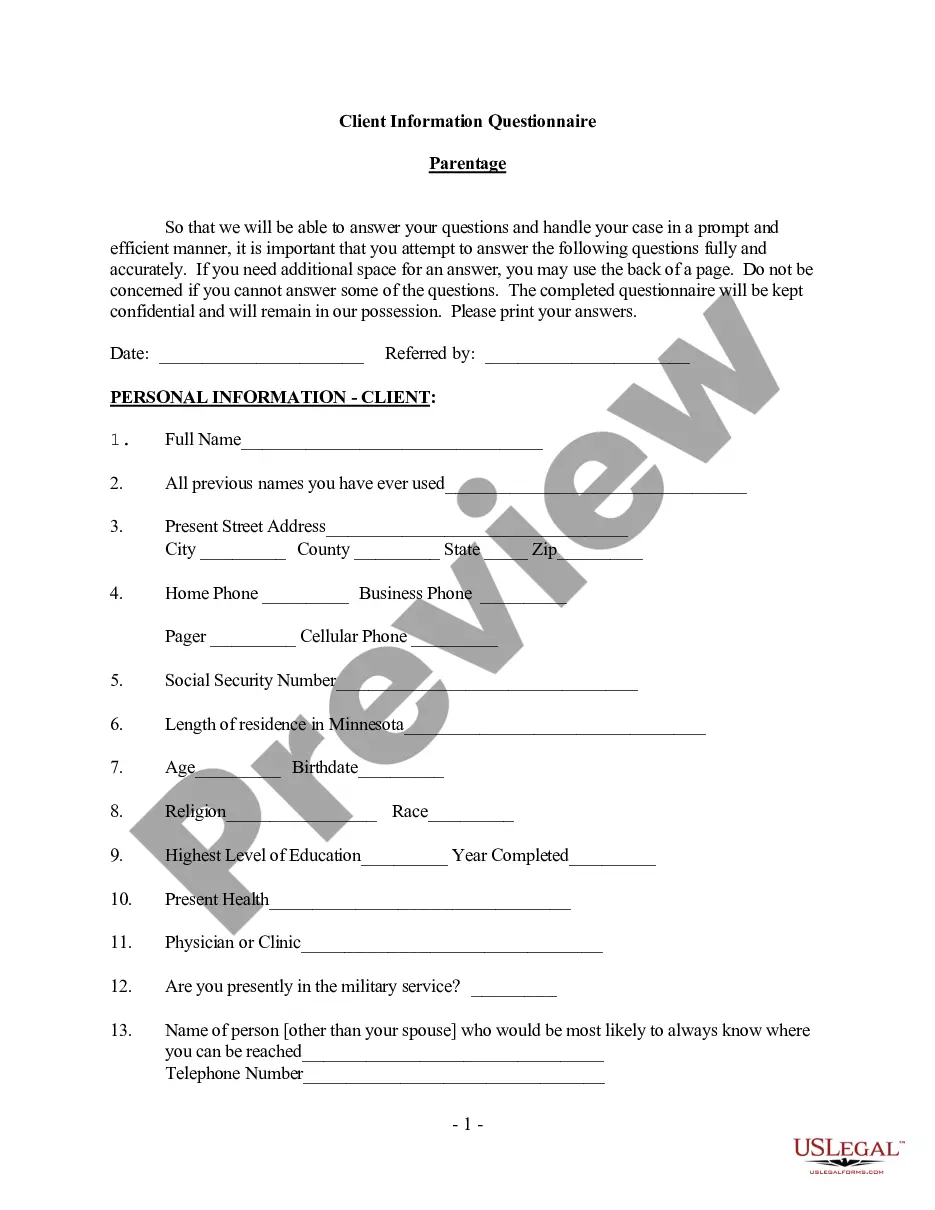

How to fill out Agreement With Manufacturer Withholding Tax?

Steering through the red tape of official documents and formats can be challenging, particularly if one does not engage in that professionally.

Even selecting the appropriate format for the Agreement With Manufacturer Withholding Tax will be time-intensive, as it needs to be accurate and precise to the last digit.

However, you will need to invest considerably less time picking a suitable template from a source you can depend on.

Obtain the correct form in a few simple steps: Enter the name of the document in the search box. Locate the proper Agreement With Manufacturer Withholding Tax on the result list. Review the description of the sample or open its preview. If the template meets your requirements, click Buy Now. Proceed to select your subscription plan. Use your email and create a secure password to register an account at US Legal Forms. Choose a credit card or PayPal payment method. Save the template file on your device in the format of your preference. US Legal Forms will save you time and effort verifying whether the form you discovered online is appropriate for your needs. Create an account and gain unlimited access to all the templates you require.

- US Legal Forms is a platform that streamlines the process of locating the correct forms online.

- US Legal Forms is a single spot one needs to locate the most recent document samples, verify their usage, and download these samples for completion.

- It is a repository with over 85K forms that are applicable in various sectors.

- When searching for an Agreement With Manufacturer Withholding Tax, you will not have to question its authenticity as all the forms are validated.

- An account at US Legal Forms will guarantee you have all the necessary samples at your disposal.

- Store them in your history or add those to the My documents collection.

- You can access your saved forms from any device by simply clicking Log In at the library website.

- If you still don’t possess an account, you can always search again for the template you require.

Form popularity

FAQ

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

How to fileStep 1: Authorise users for WHT filing.Step 2: File your WHT on mytax.iras.gov.sg.Step 3: View the acknowledgement page and make payment.Step 4: View and download S45 Notices and Letters.Other WHT digital services.FAQs.Related Content.09-Dec-2021

How to pay withholding tax Malaysia online?Click Perkhidmatan ezHasil and click on the submenu e-TT.Fill in the form to generate the VA number.The VA number must be used as an account number when performing payment via online banking or over the counter bank payment.

How to pay withholding tax Malaysia online?Click Perkhidmatan ezHasil and click on the submenu e-TT.Fill in the form to generate the VA number.The VA number must be used as an account number when performing payment via online banking or over the counter bank payment.

Withholding tax rates in ThailandInterest paid to a non-resident company or individual is subject to withholding tax at 15% unless it can be reduced under a tax treaty. Royalties paid to a non-resident company or individual is subject to a 15% final withholding tax and can be reduced under a tax treaty.