1099 Sales Rep Agreement Template With Tax

Description

How to fill out Independent Sales Representative Agreement?

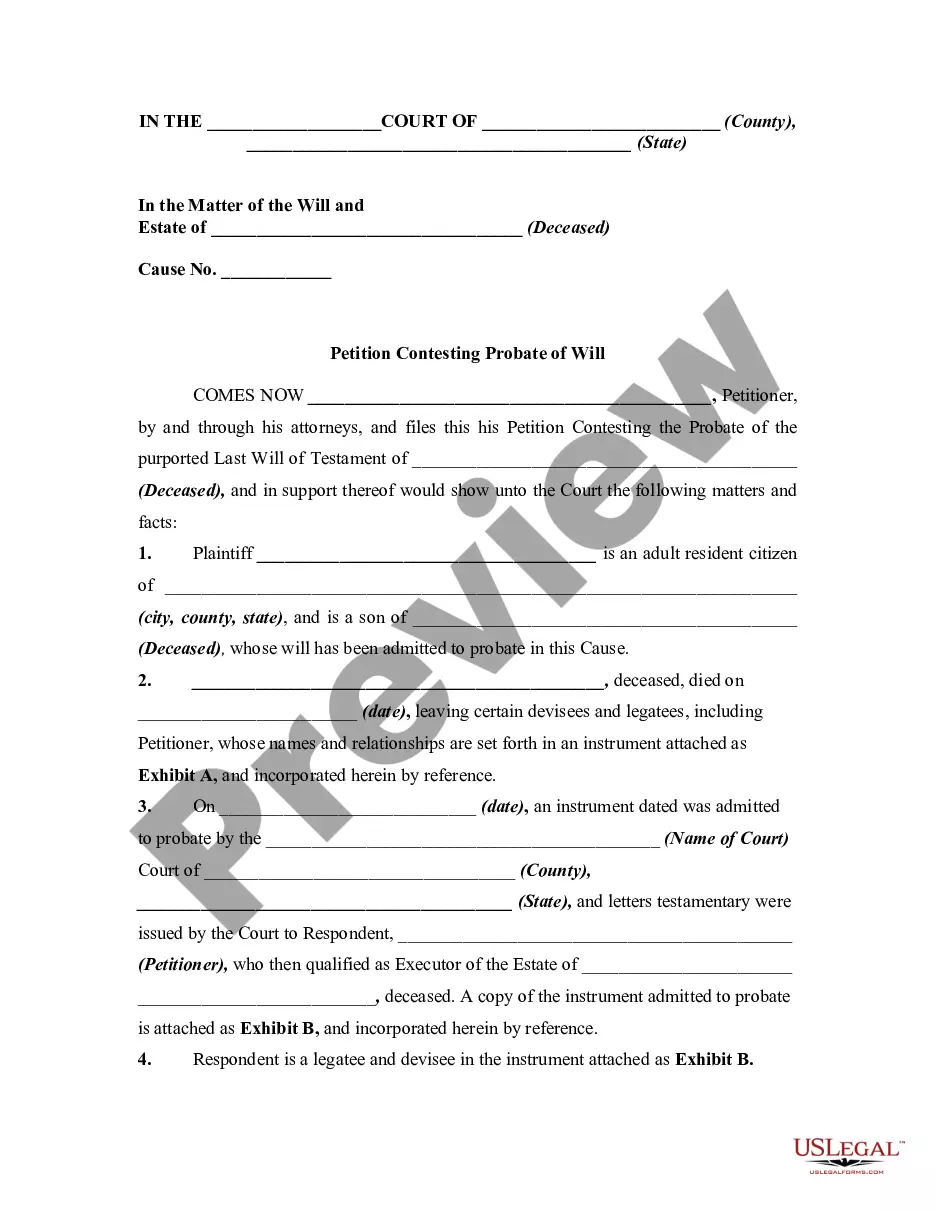

The 1099 Sales Representative Agreement Template With Tax displayed on this page is a versatile formal document crafted by expert attorneys in compliance with federal and local regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with more than 85,000 authenticated, state-specific forms for any commercial and personal situation. It’s the fastest, most straightforward, and most dependable method to acquire the documents you require, as the service ensures the utmost level of data security and anti-malware safeguards.

Use the template to fill out and sign the documents. Print the template for manual completion. Alternatively, use an online multifunctional PDF editor to swiftly and accurately fill out and sign your form with an eSignature. Utilize the same document again whenever necessary. Access the My documents tab in your profile to redownload any previously downloaded documents. Register for US Legal Forms to have verified legal templates for all of life’s situations readily available.

- Explore the document you require and examine it.

- Browse through the template you searched for and view it or check the form description to ensure it meets your requirements. If it doesn’t, utilize the search feature to find the appropriate one.

- Click Buy Now once you have found the template you need.

- Choose a pricing plan that suits you and create an account. Use PayPal or a credit card for a quick payment. If you already possess an account, Log In and verify your subscription to proceed.

- Select the format you prefer for your 1099 Sales Representative Agreement Template With Tax (PDF, DOCX, RTF) and save the document on your device.

Form popularity

FAQ

1099 Explained: Step by step, line by line Payer information box. Located in the top left corner of the form, this is where you enter your company information. ... Payer TIN. ... Recipient's TIN. ... Recipient's name and address. ... FATCA filing requirement. ... Account number. ... Box 1: Non-Employee Compensation. ... Box 2: (Blank)

Ing to the Internal Revenue Service, you must have considered the sales rep to be an independent contractor for the entire tax year, not have a W-2 employee performing the same tasks as the contractor, treat the sales rep as a contractor on all of your tax filings and have a sound reason for considering him a ...

A 1099 commission sales representative is a professional who works as a freelancer, independent contractor or as a self-employed professional. They're often hired by employers to complete a specific, temporary task. Employers typically don't pay these representatives a salary since they're hired as a contractor.

The document should state that the sales rep is a contractor and spell out what he or she does, how often and how much he or she is paid, and provide a definition of how commission is paid out, such as getting 15 percent of each sale.