Keywords: Inheritance tax waiver form, Pennsylvania, types Detailed Description: An Inheritance tax waiver form for Pennsylvania, also known as an Inheritance Tax Waiver Application, is a crucial document used in the process of transferring property or assets to inheritors upon the death of the deceased person. This form allows beneficiaries to request an exemption or reduction in the inheritance tax imposed by the state. The purpose of an Inheritance tax waiver form for pa is to provide the necessary details about the assets being transferred, their value, and the relationship of the beneficiary to the deceased individual. This information helps the Pennsylvania Department of Revenue determine the applicable inheritance tax rates, if any, that the inheritors must pay. There are two main types of Inheritance tax waiver forms in Pennsylvania: 1. Form REV-1500: This form is used when the decedent's estate consists of real estate properties. It requires details about the property, such as its location, assessed value, and any liens or mortgages associated with it. The form must be completed and submitted to the Department of Revenue along with supporting documents, such as a certified death certificate and a copy of the will. 2. Form REV-1501: This form is utilized for all other types of assets, including personal property, money, investments, and financial accounts. It requires information about the decedent's holdings, their estimated value, and their location. Similar to Form REV-1500, this form must be completed accurately and accompanied by relevant supporting documents. It's important to note that an Inheritance tax waiver form for pa needs to be filed within nine months from the date of the decedent's death. Failure to meet this deadline may result in penalties and delays in the inheritance distribution process. In summary, an Inheritance tax waiver form for Pennsylvania is an essential document for inheritors seeking an exemption or reduction in the inheritance tax. The two primary types of forms, REV-1500 and REV-1501, cater to different types of assets being transferred. It is crucial to understand the specific requirements for each form and ensure that all necessary information and supporting documents are provided accurately and on time.

Inheritance Tax Waiver Form For Pa

Description inheritance tax waiver form

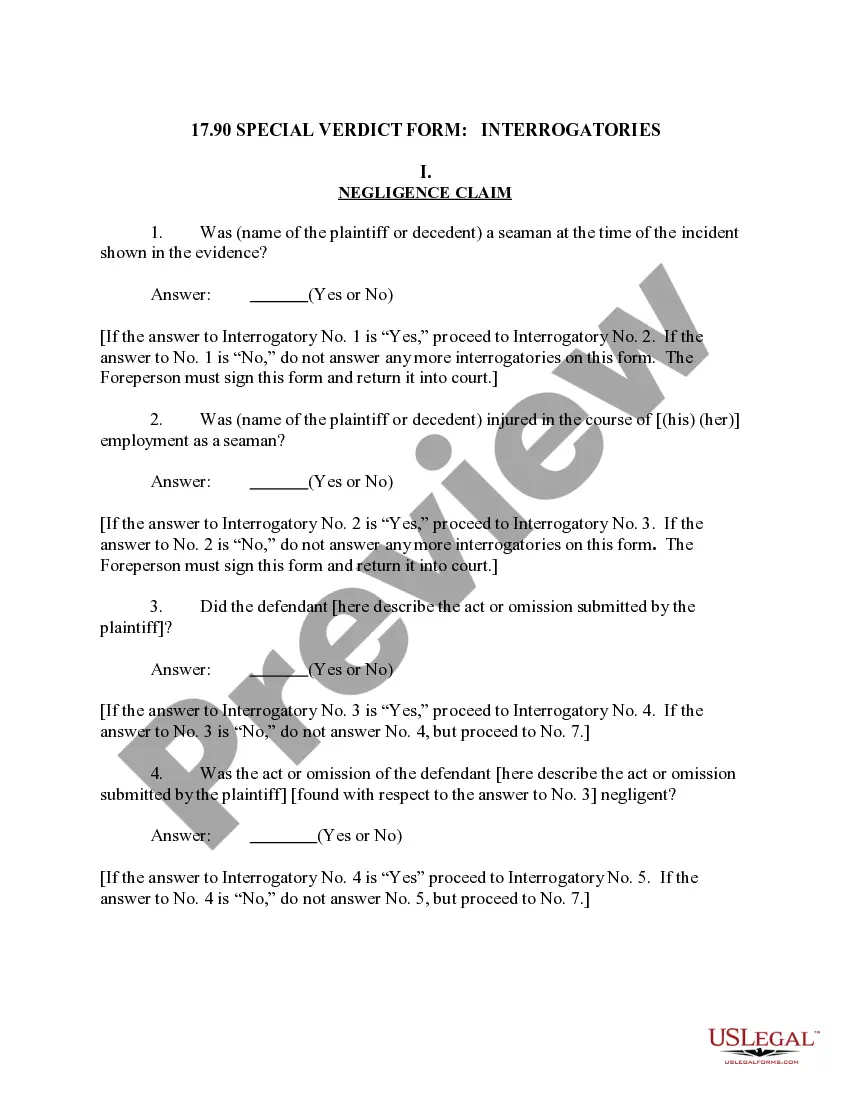

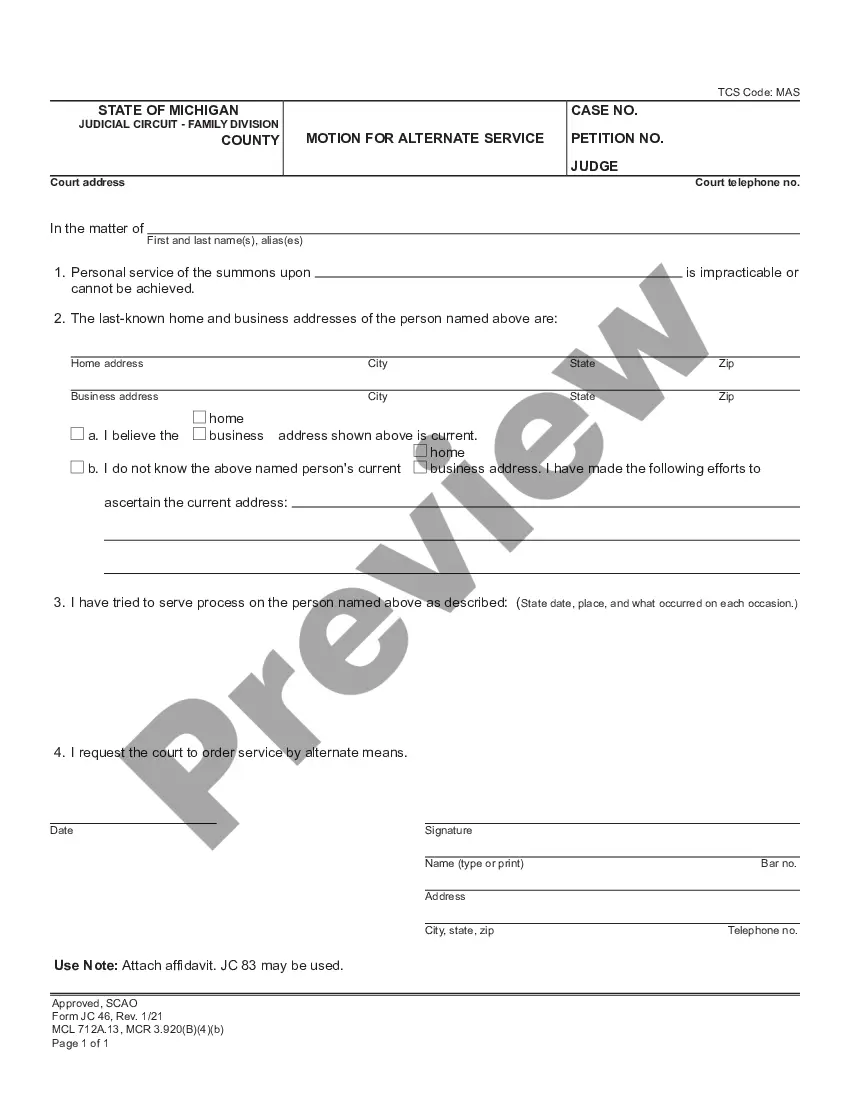

How to fill out Inheritance Tax Waiver Form For Pa?

The Inheritance Tax Waiver Form For Pa you see on this page is a reusable formal template drafted by professional lawyers in line with federal and state regulations. For more than 25 years, US Legal Forms has provided people, companies, and attorneys with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the fastest, simplest and most reliable way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Acquiring this Inheritance Tax Waiver Form For Pa will take you just a few simple steps:

- Look for the document you need and check it. Look through the sample you searched and preview it or review the form description to confirm it satisfies your requirements. If it does not, make use of the search option to find the right one. Click Buy Now when you have located the template you need.

- Subscribe and log in. Select the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Choose the format you want for your Inheritance Tax Waiver Form For Pa (PDF, Word, RTF) and save the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork one more time. Utilize the same document once again anytime needed. Open the My Forms tab in your profile to redownload any previously purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

inheritance tax waiver states Form popularity

inheritance waiver form Other Form Names

FAQ

There are practical ways to minimize or avoid PA inheritance tax without needing to move to a state without estate tax or inheritance tax. #1 - Gifting. Either to individuals, charities, or irrevocable trusts. #2 - Buying real property in a state without estate or inheritance tax.

Preparing the Pennsylvania Inheritance Tax Return The Probate Attorney typically prepares the Inheritance Tax Return. An accountant can prepare the return but many accountants are unfamiliar with the return.

The family exemption is a right given to specific individuals to retain or claim certain types of a decedent's property in ance with Section 3121 of the Probate, Estate and Fiduciaries Code. For decedents dying after January 29, 1995, the family exemption is $3,500.

If inheritance tax is paid within three months of the decedent's death, a 5 percent discount is allowed. For further information and answers to commonly asked questions, please review the brochure, Pennsylvania Inheritance Tax and Safe Deposit Boxes.

Property owned jointly between husband and wife is exempt from inheritance tax, while property inherited from a spouse, or from a child aged 21 or younger by a parent, is taxed a rate of 0%.