Agreement Mortgage Loan For Renovation

Description

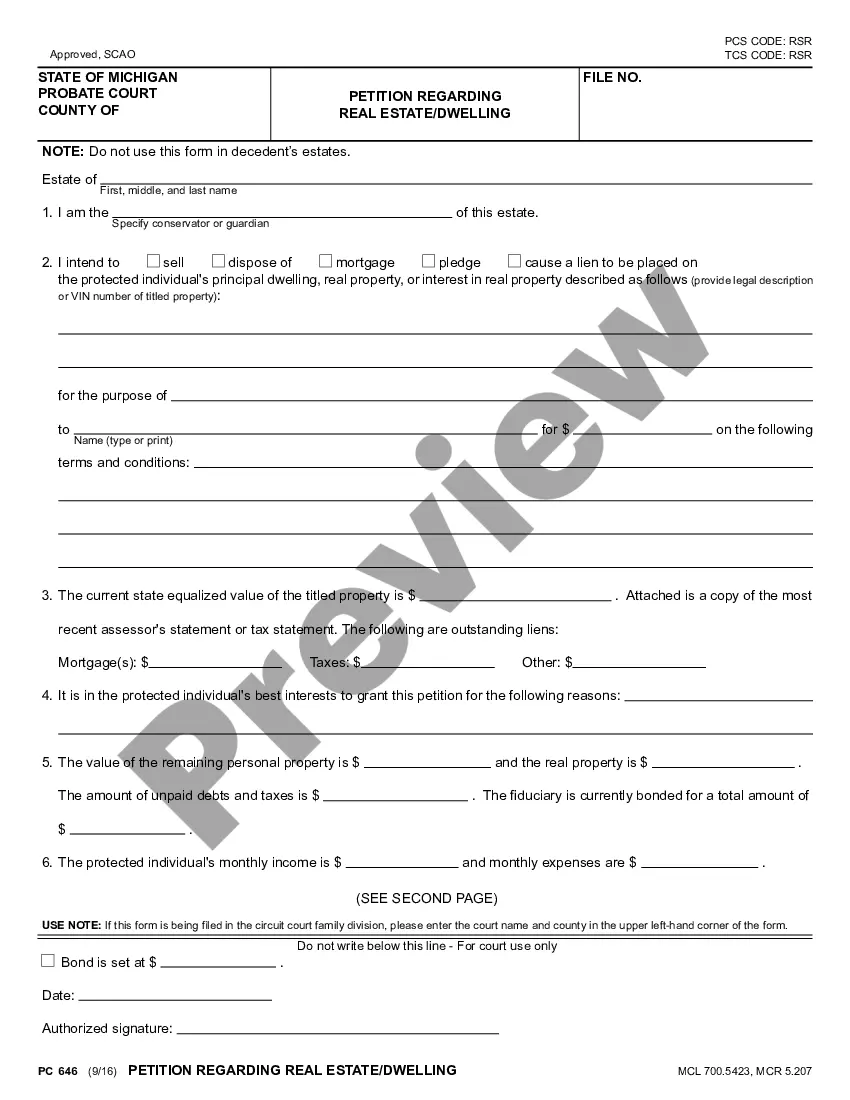

How to fill out Agreement Mortgage Loan For Renovation?

How to obtain professional legal documents that adhere to your state's regulations and draft the Mortgage Loan Agreement for Renovation without seeking an attorney's assistance.

Numerous online services offer templates to address various legal scenarios and requirements. Nonetheless, it might take a while to ascertain which of the existing samples fulfill both your use case and legal standards.

US Legal Forms is a trustworthy platform that aids you in locating official documents crafted in accordance with the latest updates in state law, allowing you to save on legal expenses.

If you do not have an account with US Legal Forms, follow the guide below: Review the webpage you've opened and confirm that the form meets your requirements.

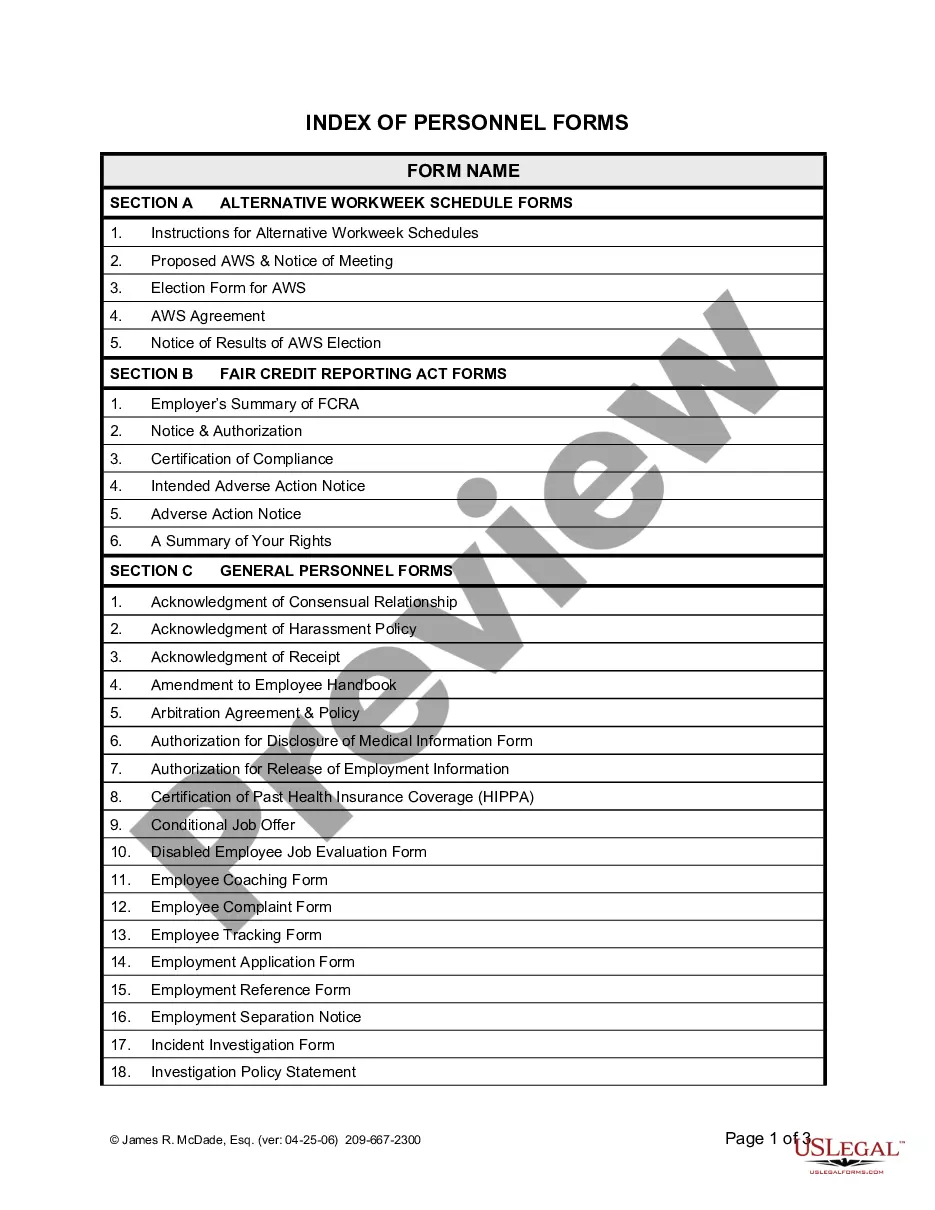

- US Legal Forms is not a typical online directory.

- It is a repository of over 85,000 authenticated templates for diverse business and personal situations.

- All documents are categorized by field and state to streamline your search process.

- Additionally, it integrates with robust solutions for PDF editing and eSignature, allowing users with a Premium subscription to swiftly complete their paperwork online.

- It requires minimal effort and time to acquire the necessary documents.

- If you already possess an account, Log In and verify your subscription's validity.

- Download the Mortgage Loan Agreement for Renovation using the corresponding button adjacent to the file name.

Form popularity

FAQ

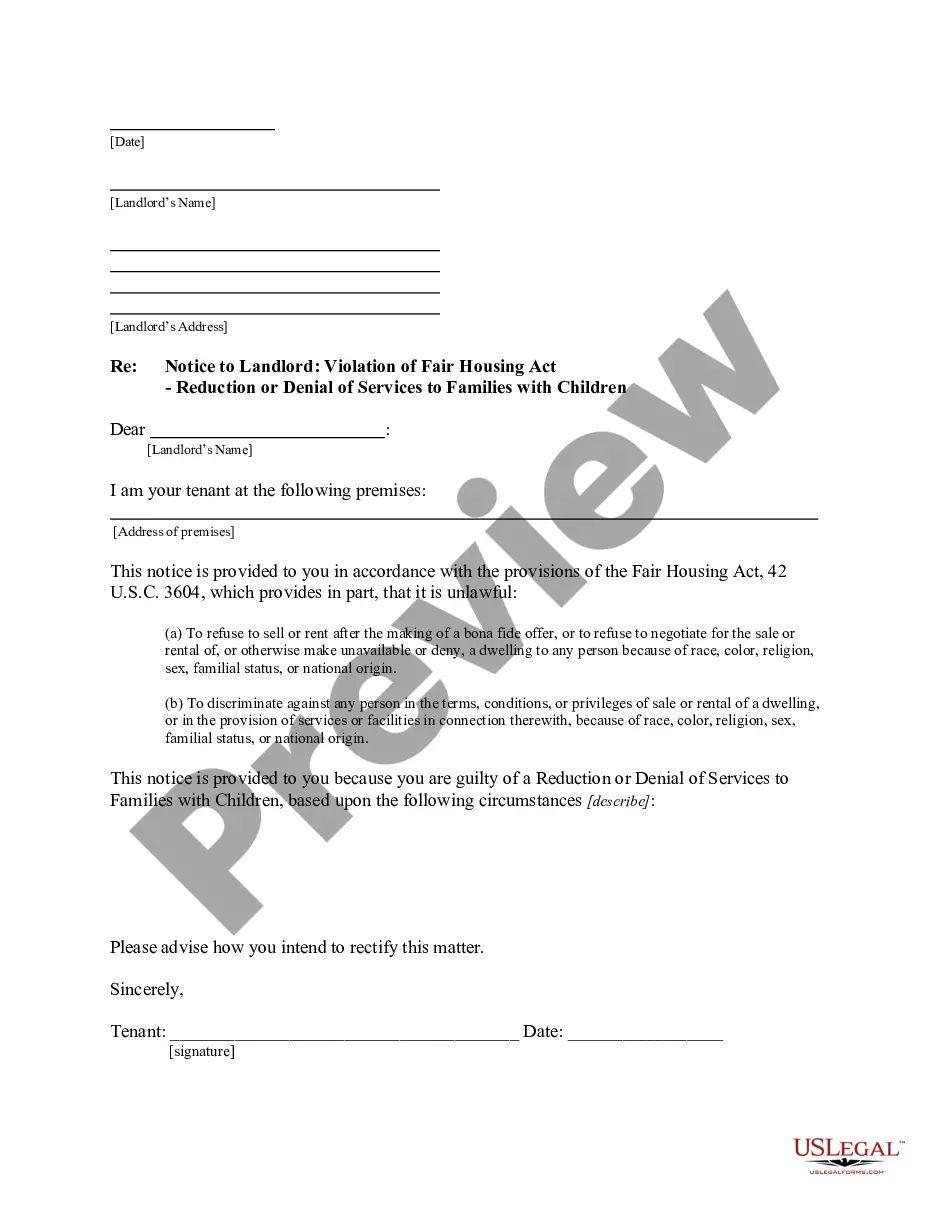

A Loan Agreement is a legal contract between a borrower and a lender regulating the mutual promises made by each party.

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to store their own copy, ideally in a safe place.

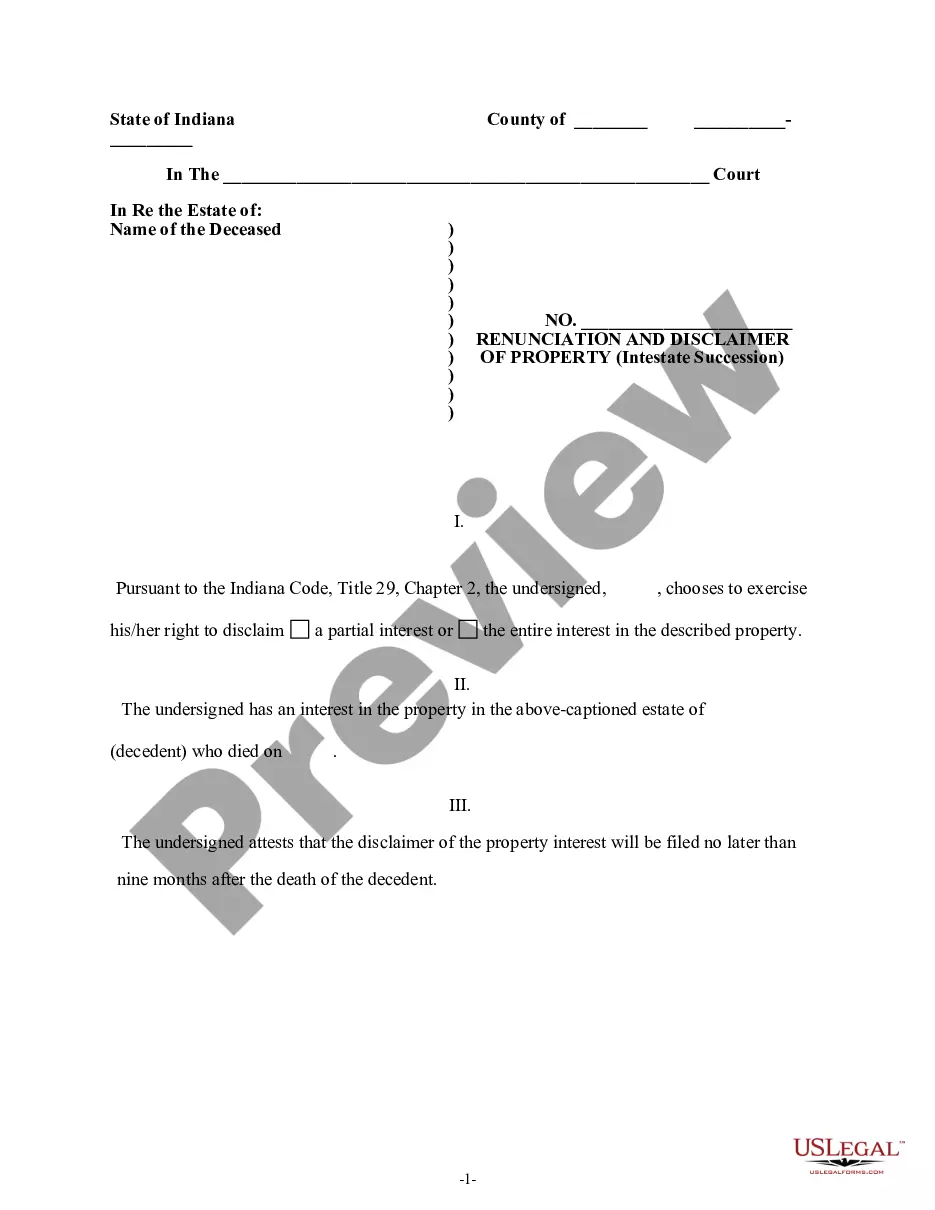

Give the age, father's name and residential address of the Lender and Borrower. Mention the relationship between the Lender and Borrower. Write the amount of loan that has been lent to the Borrower. Mention the purpose of the loan like conducting wedding, hospital charges, investing in a business or any other purposes.

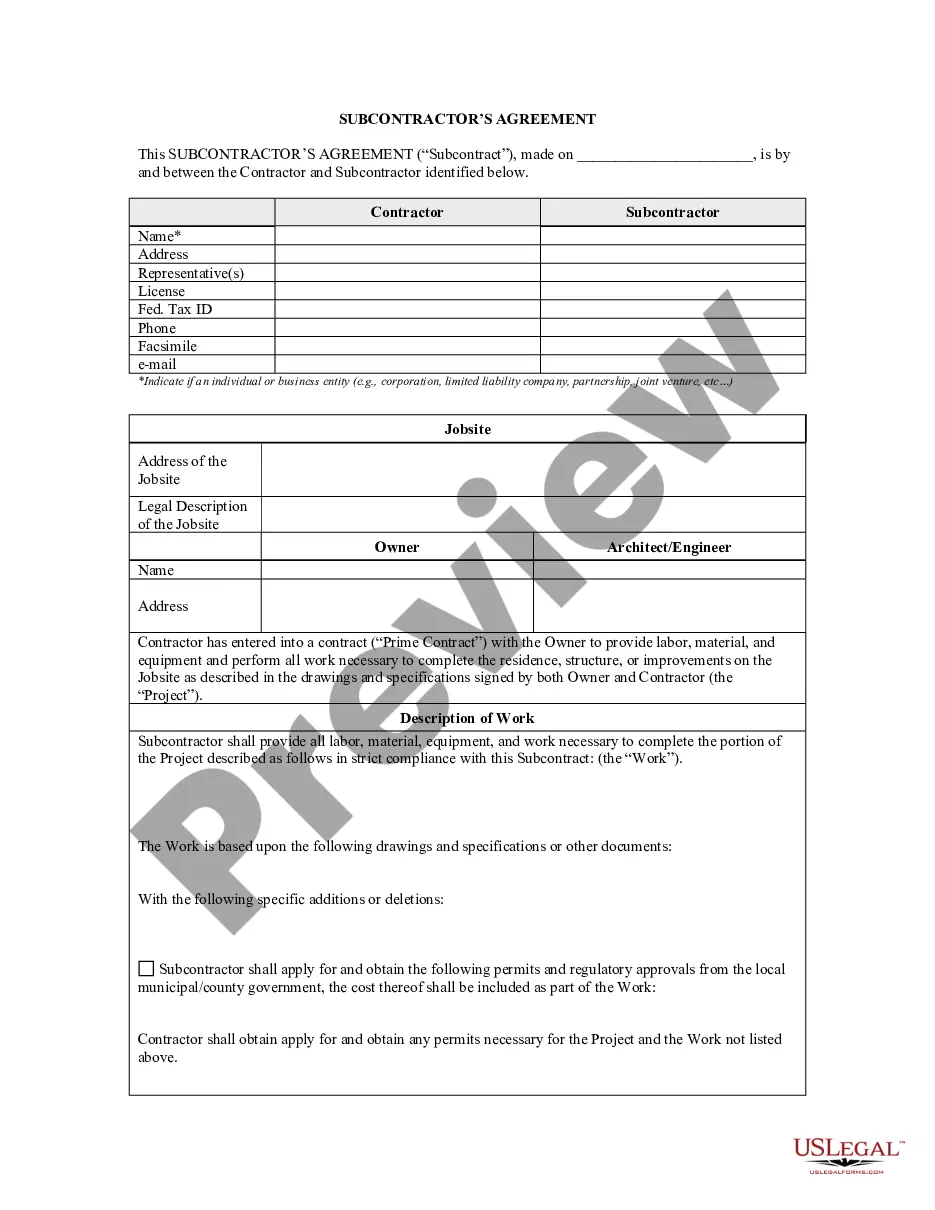

A renovation loan agreement is a written agreement between the borrower and the lender. This agreement must be fully executed by both the lender and the borrower at closing and dated the same date as the note.

Many often wonder: Is there a way to add renovation costs of my new home to a mortgage? The short answer is: Yes. While you'll likely have additional questions, it's best to contact a reputable lender, such as Contour Mortgage for guidance when choosing the right rehab loan for your project.