Accounting for tenant improvement allowance 842 refers to the accounting treatment and reporting requirements prescribed by the Financial Accounting Standards Board (FAST) under the new lease accounting standard, ASC 842. This standard addresses how lessees (tenants) should account for the tenant improvement allowance received from lessors (landlords) during lease agreements. Under ASC 842, tenant improvement allowances are funds provided by the lessor to the lessee for making improvements or alterations to leased properties. These allowances are often granted to enhance the functionality, aesthetics, or meet specific requirements of tenants within leased spaces. Proper accounting and reporting of these allowances are crucial for lessees to comply with the new lease accounting guidelines. The accounting treatment for tenant improvement allowances under ASC 842 depends on whether the allowance is classified as a lease incentive or a reimbursable leasehold improvement. Let's explore these types in more detail: 1. Lease incentive tenant improvement allowance: — In this case, the tenant improvement allowance is considered a lease incentive provided by the lessor to induce the lessee to enter into a lease agreement. These allowances are typically provided upfront and reduce the lessee's total lease payments. — To account for lease incentive tenant improvement allowances, lessees should recognize them as reduced lease payments, resulting in lower lease liabilities. — Lessees will need to allocate the lease incentive amount over the lease term systematically and consistently, either as a reduction of lease payments on a straight-line basis or by using another systematic method that reflects the pattern of lessee's benefit. 2. Reimbursable leasehold improvement tenant improvement allowance: — Here, the tenant improvement allowance represents the landlord's reimbursement to the tenant for qualifying costs incurred by the lessee in making leasehold improvements. — Lessees should initially record these allowances as deferred inflow of resources or as a deferred credit, recognizing them as a separate liability from the lease liability. — As the lessee incurs qualified leasehold improvement costs, they can recognize the reimbursement in their income statement and credit the allowance account. In both cases, lessees are required to disclose relevant information regarding the tenant improvement allowances in their financial statements. This includes the nature and amount of the allowances, the periods in which they are expected to be utilized, and the accounting policies for recognizing and measuring these allowances. In conclusion, Accounting for tenant improvement allowance 842 involves accurately recording and reporting lease incentive and reimbursable leasehold improvement allowances as prescribed by the ASC 842 guidelines. By adhering to these standards, lessees can ensure compliance and transparent presentation of their financial statements.

Accounting For Tenant Improvement Allowance 842

Description tenant improvement allowance accounting asc 842

How to fill out Tenant Improvement Allowance Accounting Treatment?

Handling legal papers and procedures might be a time-consuming addition to your entire day. Accounting For Tenant Improvement Allowance 842 and forms like it often need you to search for them and understand how you can complete them properly. Therefore, whether you are taking care of economic, legal, or individual matters, having a comprehensive and hassle-free web catalogue of forms when you need it will significantly help.

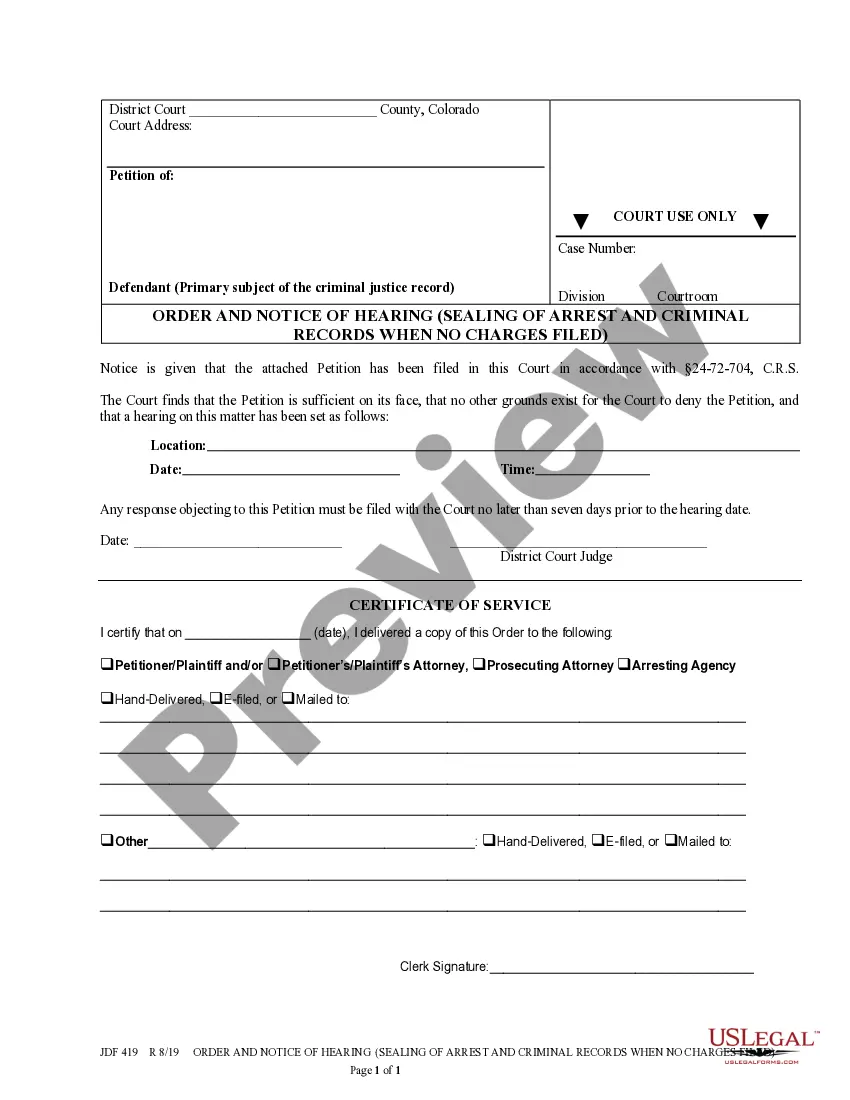

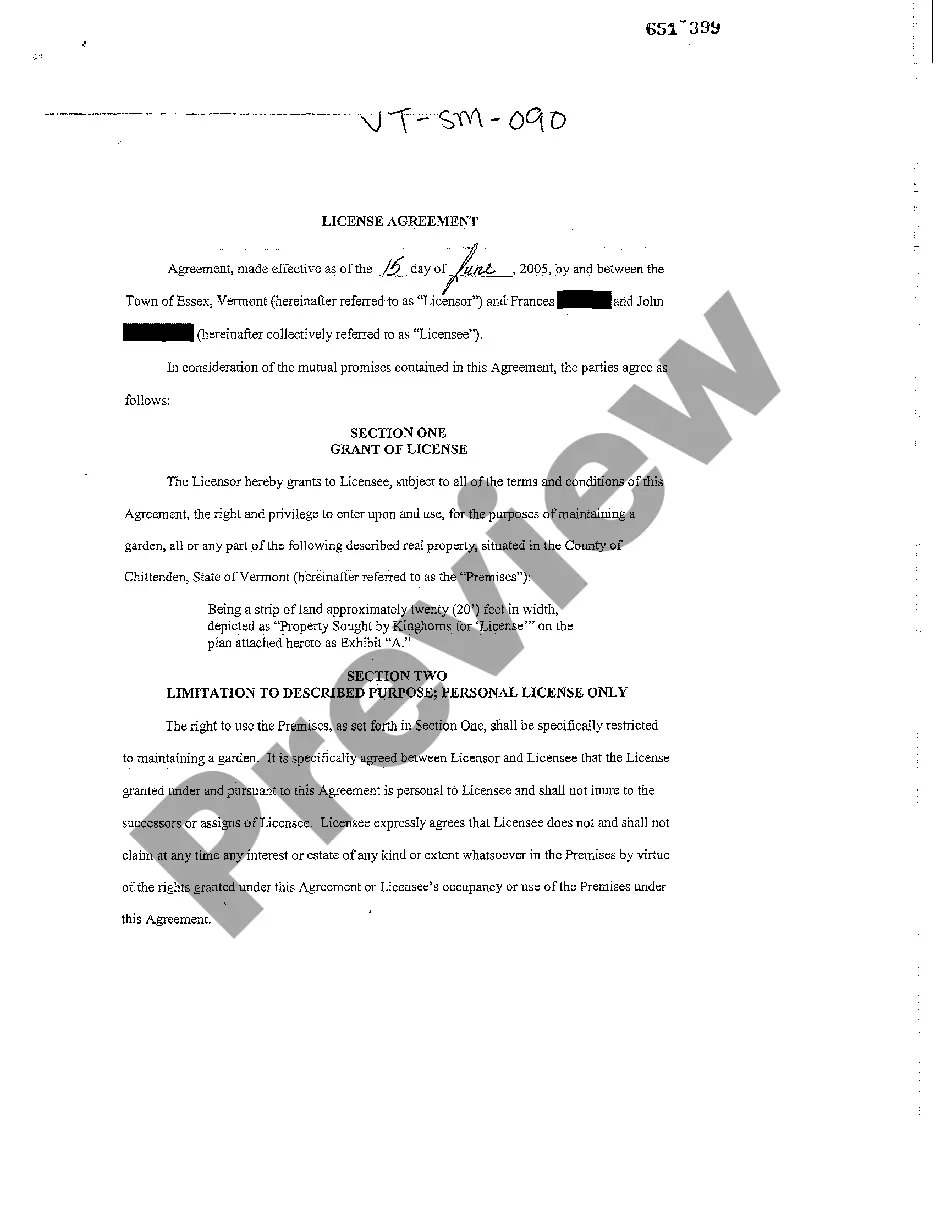

US Legal Forms is the top web platform of legal templates, offering more than 85,000 state-specific forms and a number of tools to help you complete your papers effortlessly. Discover the catalogue of relevant papers available to you with just one click.

US Legal Forms offers you state- and county-specific forms offered at any moment for downloading. Shield your document administration operations using a top-notch services that lets you prepare any form in minutes without any extra or hidden charges. Simply log in in your profile, identify Accounting For Tenant Improvement Allowance 842 and acquire it right away within the My Forms tab. You can also gain access to formerly downloaded forms.

Is it the first time using US Legal Forms? Register and set up your account in a few minutes and you’ll get access to the form catalogue and Accounting For Tenant Improvement Allowance 842. Then, adhere to the steps listed below to complete your form:

- Ensure you have the proper form by using the Review option and reading the form information.

- Choose Buy Now when all set, and choose the monthly subscription plan that is right for you.

- Choose Download then complete, eSign, and print the form.

US Legal Forms has twenty five years of expertise supporting users manage their legal papers. Find the form you require today and enhance any operation without having to break a sweat.

lease incentives asc 842 Form popularity

tenant allowance asc 842 Other Form Names

accounting for tenant improvement allowance under asc 842 FAQ

Only the first report of a defect or condition must be reported within the first 12 months or 12,000 miles. The subsequent repair attempts or days out of service may occur after the first year.

The Lemon Law is also triggered if the vehicle is out of service for thirty days or more for any number of defects or conditions. Only the first report of a defect or condition must be reported within the first 12 months or 12,000 miles.

The Pennsylvania Lemon Law does not cover Used Cars. However, there are other laws, such as the Magnuson Moss Warranty Act that provide protection for the purchase of a used defective car. If your used car is defective, our firm can help you get money back using the The Magnuson Moss Warranty Act .

Consumers who believe they may have purchased a car that isn't roadworthy should file a complaint with the Pennsylvania Office of Attorney General's Bureau of Consumer Protection by visiting OAG's website, emailing scams@attorneygeneral.gov, or calling 1-800-441-2555.

Pennsylvania law states that every vehicle offered for sale must be roadworthy. It is also illegal for a dealer to sell you a car without informing you of the following problems if the seller knows or should know that they exist: a cracked or twisted frame. a cracked engine block or head.

Under the terms of this law, buyers have 72 hours to return a vehicle if they determine that a car requires repairs to make it roadworthy. Once returned, the used car dealer will have ten days to either repair the defect or refund the consumer's purchase.

Pennsylvania's Automobile Lemon Law is designed to protect Pennsylvania consumers from unsafe and defective new cars. The Automobile Lemon Law applies to the PURCHASE or LEASE of new vehicles that are registered in Pennsylvania. The vehicle must be used for personal, family or household purposes.