Accounting for Tenant Improvement Allowance: ASC 842 Under the new lease accounting standard ASC 842, which became effective for public companies on January 1, 2019, and will be effective for private companies on January 1, 2022, tenant improvement allowance (TIA) accounting has undergone changes. Tenant improvement allowance refers to the financial assistance provided by landlords to tenants for making alterations or improvements to leased premises. ASC 842 ascertains that tenant improvement allowances should be recognized as lease incentives and accounted for on the lessee's balance sheet. Prior to this update, TIA was recorded as deferred rent and expensed over the lease term. The following are two types of accounting methods for tenant improvement allowance under ASC 842: 1. Gross Method: Under the gross method, tenant improvement allowance is treated as a lease incentive and must be recorded as a reduction of the right-of-use (YOU) asset on the lessee's balance sheet. This means that the TIA offsets the lease liability recorded at the commencement of the lease. The lessee recognizes the TIA as a reduction of lease payments over the lease term, thereby reducing the expense associated with occupying the leased premises. 2. Net Method: The net method for tenant improvement allowance accounting allows lessees to record the full TIA amount as a lease incentive on the balance sheet. Instead of offsetting the lease liability, the lessee records the TIA as a separate asset and amortizes it over the shortest of the lease term or the useful life of the leasehold improvements. This approach results in a higher YOU asset value compared to the gross method. Both methods require lessees to disclose information related to the tenant improvement allowance, such as the nature, timing, and cash flow of the allowance and any related obligations. It is important for companies to carefully consider and determine the appropriate accounting method for tenant improvement allowance based on their lease agreements and financial reporting requirements. The choice of method impacts the lessee's balance sheet presentation, financial ratios, and disclosure obligations. Implementing ASC 842 brings significant changes to the accounting treatment of tenant improvement allowances. Companies must thoroughly understand and comply with the new standard to ensure their financial statements accurately reflect these lease incentives.

Accounting For Tenant Improvement Allowance Asc 842

Description tenant improvement allowance accounting asc 842

How to fill out Accounting For Tenant Improvements?

Whether for business purposes or for personal matters, everyone has to manage legal situations sooner or later in their life. Completing legal paperwork requires careful attention, starting with choosing the correct form sample. For example, when you select a wrong edition of the Accounting For Tenant Improvement Allowance Asc 842, it will be rejected once you submit it. It is therefore crucial to have a dependable source of legal papers like US Legal Forms.

If you have to get a Accounting For Tenant Improvement Allowance Asc 842 sample, follow these easy steps:

- Find the template you need using the search field or catalog navigation.

- Check out the form’s description to ensure it fits your case, state, and county.

- Click on the form’s preview to see it.

- If it is the wrong form, go back to the search function to locate the Accounting For Tenant Improvement Allowance Asc 842 sample you need.

- Download the file when it matches your requirements.

- If you have a US Legal Forms profile, click Log in to access previously saved documents in My Forms.

- If you do not have an account yet, you may download the form by clicking Buy now.

- Select the appropriate pricing option.

- Finish the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you want and download the Accounting For Tenant Improvement Allowance Asc 842.

- After it is downloaded, you are able to fill out the form with the help of editing applications or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you never have to spend time seeking for the right template across the internet. Use the library’s easy navigation to find the correct template for any situation.

tenant incentives accounting Form popularity

tenant allowance asc 842 Other Form Names

leasehold improvement allowance accounting FAQ

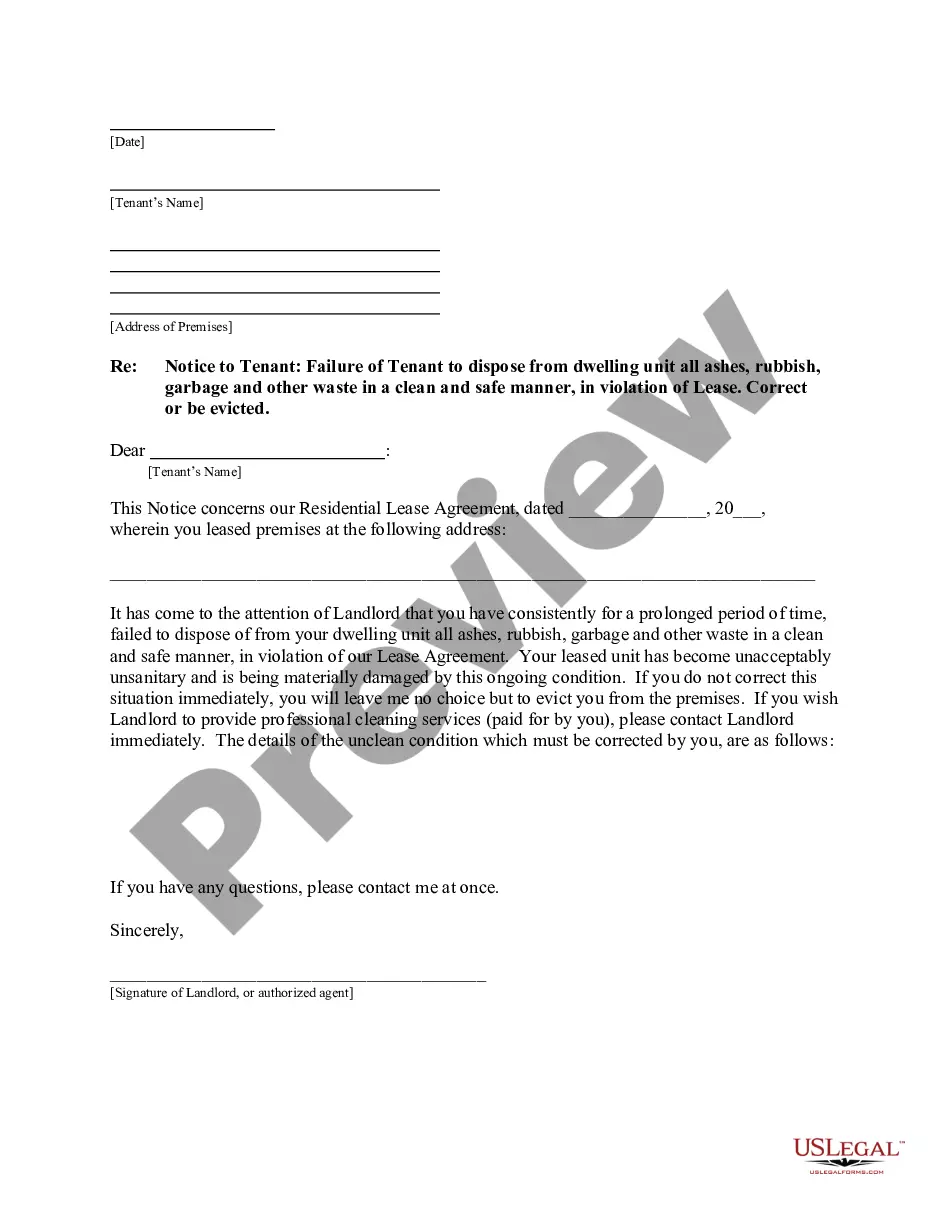

A forced eviction date will be scheduled 10 days after the Order for Possession is posted on your door by a constable. Up to and including that date, you can still pay the judgment in full to avoid the eviction.

No. Many Pennsylvania courts have said your landlord cannot evict you by self-help, meaning such things as padlocking your door, shutting off your utilities, using force to evict you, or using any eviction method other than going to court.

There is no specific law regarding when a landlord has to change carpet, but the general rule of thumb that judges use is a 5 year straight line depreciation... So the carpet depreciates 20% a year down to zero after 5 years.

Under the right to a safe and habitable home, a landlord cannot force a tenant to move into a home or unit ?as-is? and cannot demand that the tenant be responsible for repairs. To be safe, and habitable, a unit or home should have: Working smoke alarms. Working hot water.

Before a landlord can start filing an eviction, the landlord must give the tenant a 10-Day Notice to Quit. This eviction notice allows the tenant 10 days to settle any unpaid rent. The tenant must resolve their nonpayment of rent after the 10 days' notice or leave the rental premises.

Eviction is a legal process a landlord uses to make you move out. To evict you, your landlord must give you a 3, 30, 60 or 90-day notice. If you get one of these, it's important that you take action, like pay the rent you owe, move out, or get legal help.

How much notice does a landlord have to give a tenant to move out in Pennsylvania? In the state of Pennsylvania, for a lease that is one year or less in length, a landlord can give a tenant 15-day notice to leave. For leases over one year, landlords can give a 30-day notice to leave from the date the lease ends.

Entry. Advanced Notice: No state law in Pennsylvania requires landlords to give advance notice before entering a property. Generally, 24 hours' notice is recommended. Permitted Times: Pennsylvania state law does not designate any time-of-day restrictions for entering.