Sample Limited Partnership Pdf With Pictures

State:

Multi-State

Control #:

US-EG-9173

Format:

Word;

Rich Text

Instant download

Description

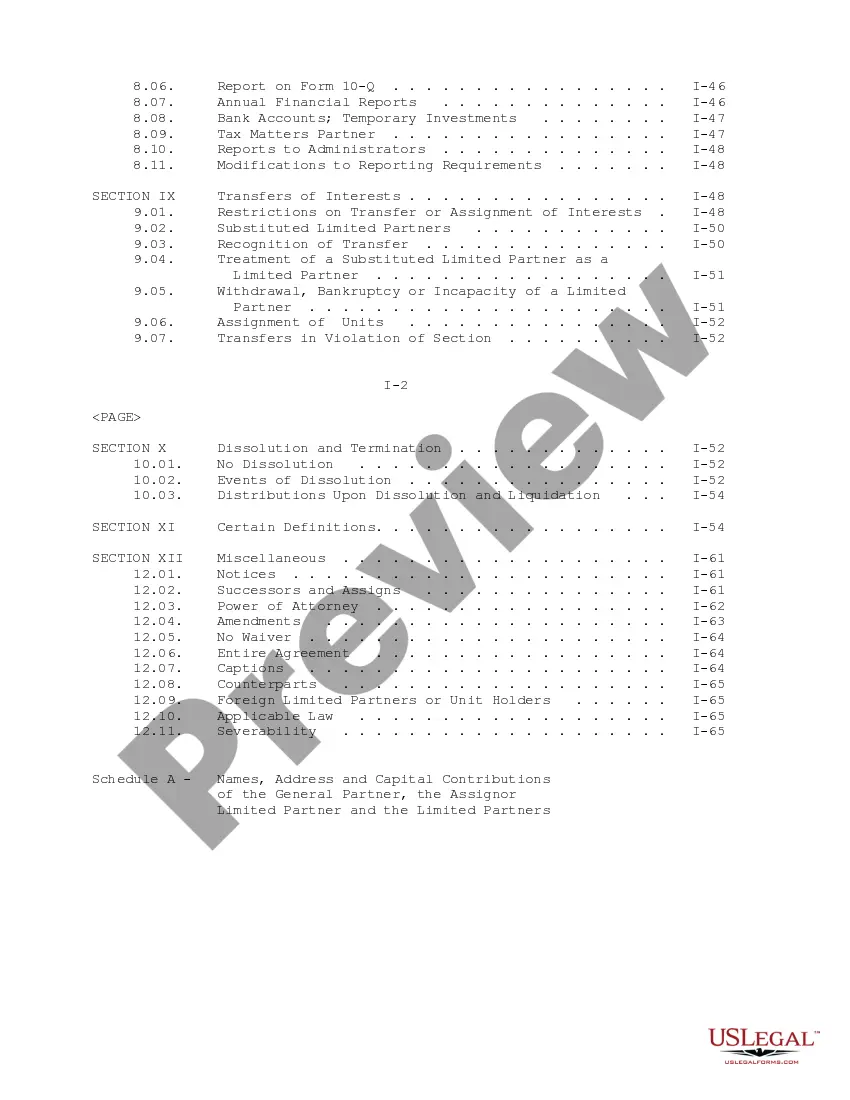

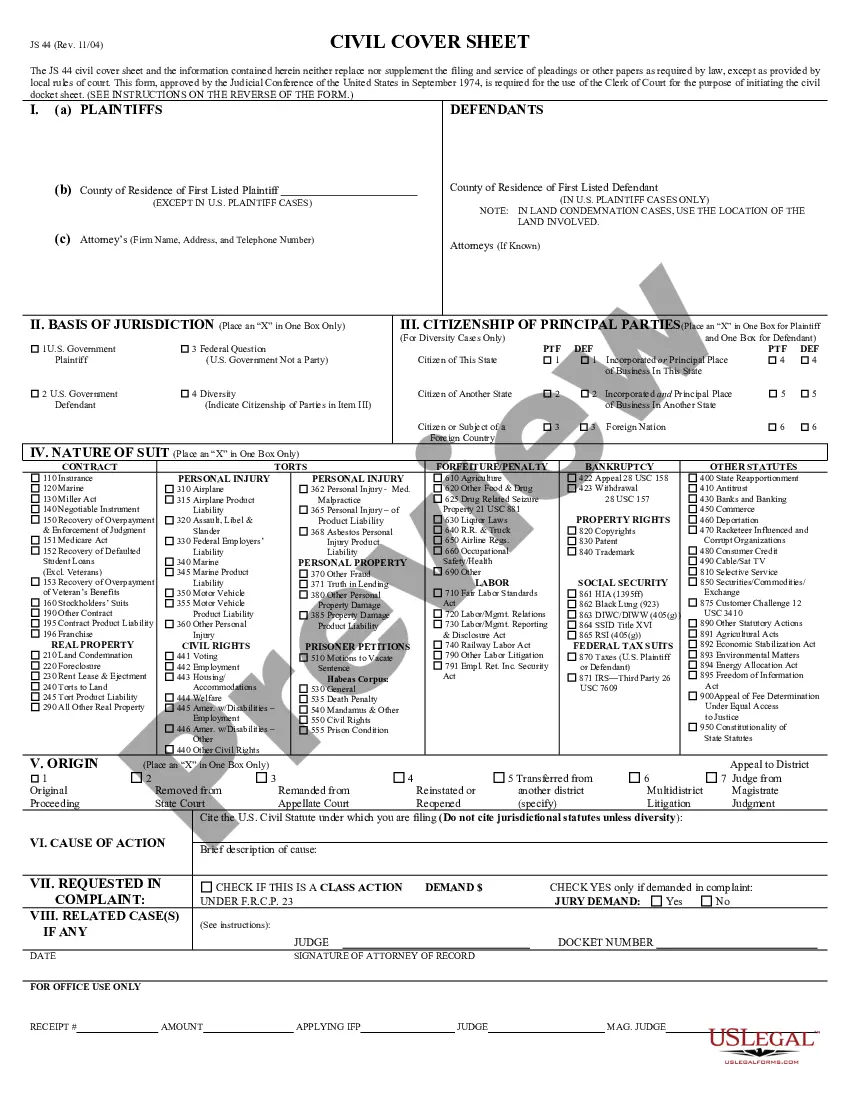

Amended and Restated Agr. of Limited Partnership of Shopco Regional Malls, LP btwn Shearson Regional Malls, Inc. and Shearson Regional Malls Depositary Corp. dated October 6, 1998. 67 pages

Free preview