Sale Stock Corporation Form 2021

Category:

State:

Multi-State

Control #:

US-EG-9221

Format:

Word;

Rich Text

Instant download

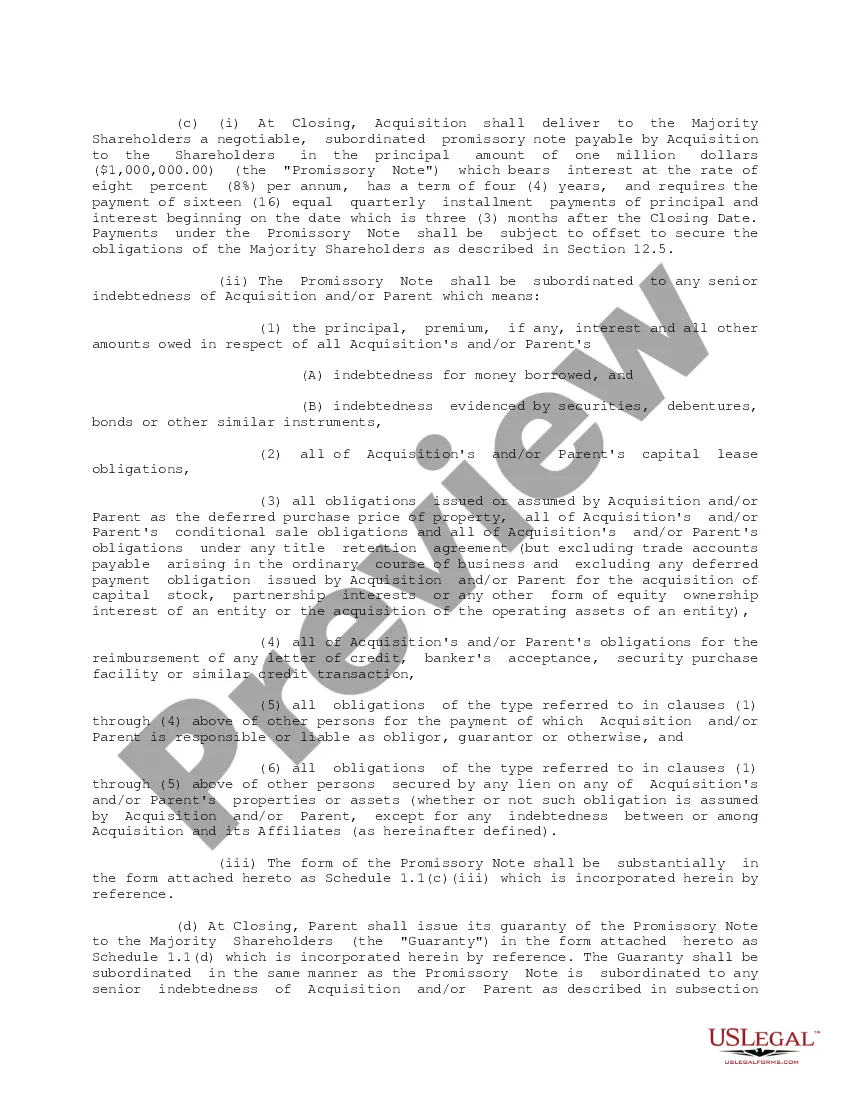

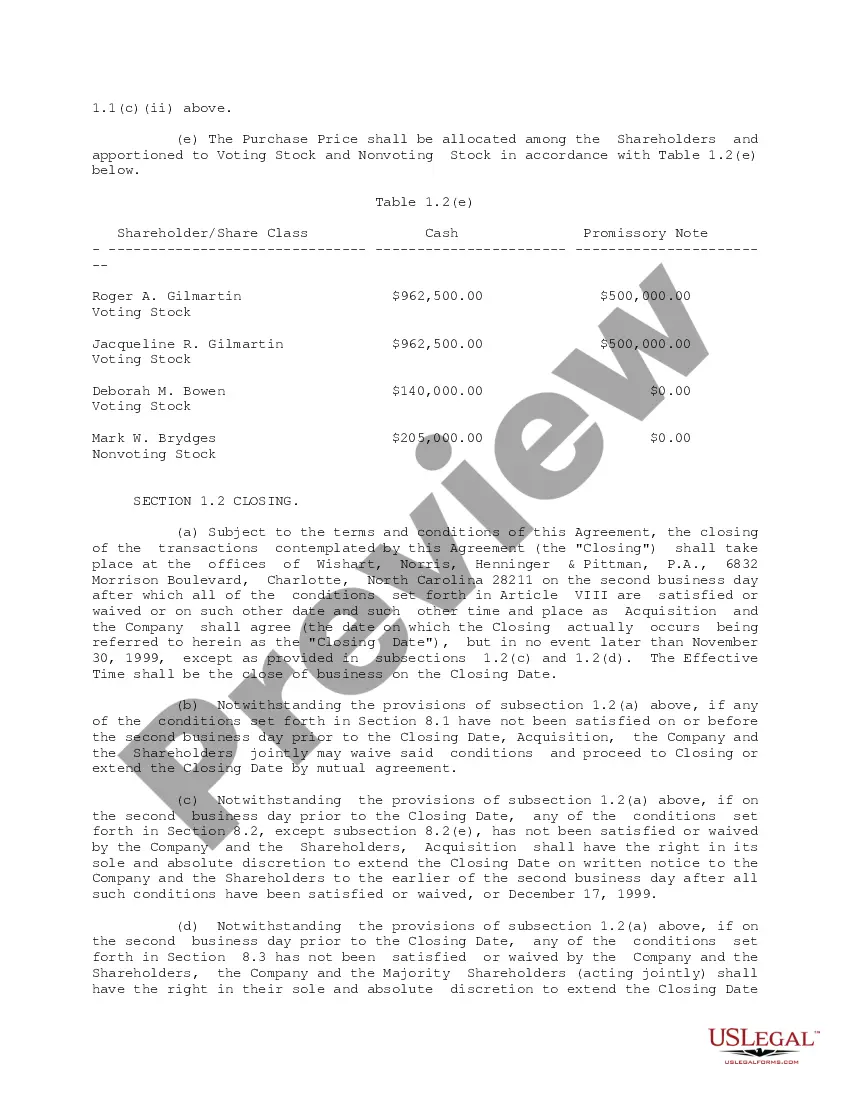

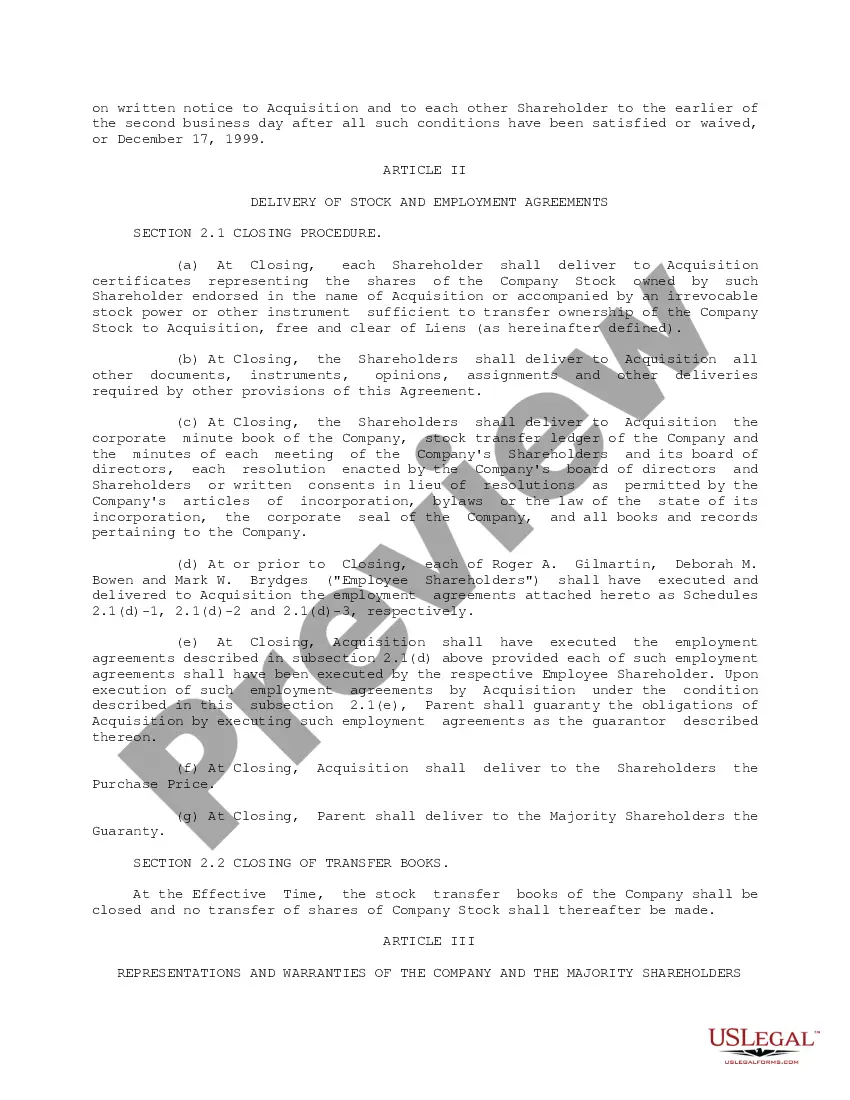

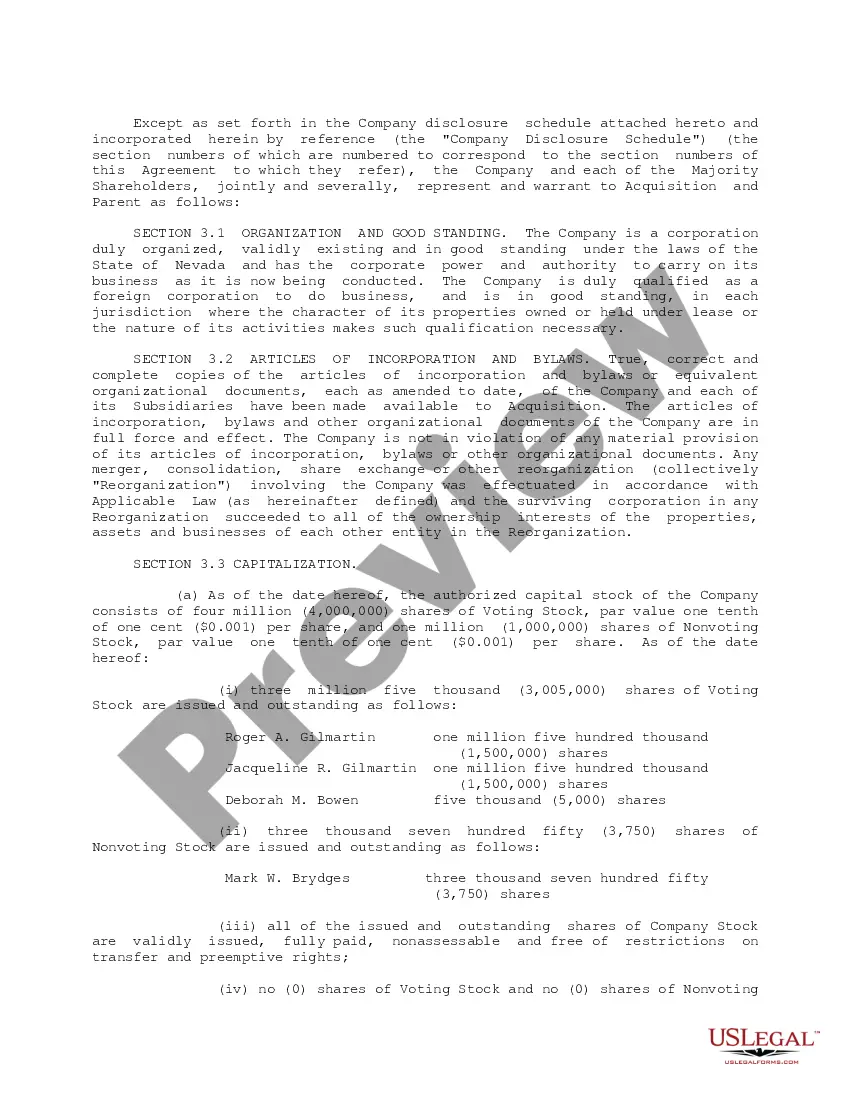

Description Stock Corp Incorporation

Agreement for Purchase and Sale of stock between GEC Acquisition Corporation, Exigent International, Inc., GEC North America Corporation, Roger A. Gilmartin, Jacqueline R. Gilmartin, Deborah M. Bowen and Mark W. Brydges regarding the acquisition

Free preview Sample Purchase Agreement Pdf