Distribution Agreement Trust With Losses

Description

How to fill out Distribution Agreement Trust With Losses?

Whether you handle documents regularly or you need to present a legal report from time to time, it is crucial to have a resource of information where all the samples are connected and current.

The initial step you should take with a Distribution Agreement Trust With Losses is to confirm that it is the most recent version, as it determines if it can be submitted.

If you want to make your quest for the latest document samples easier, look for them on US Legal Forms.

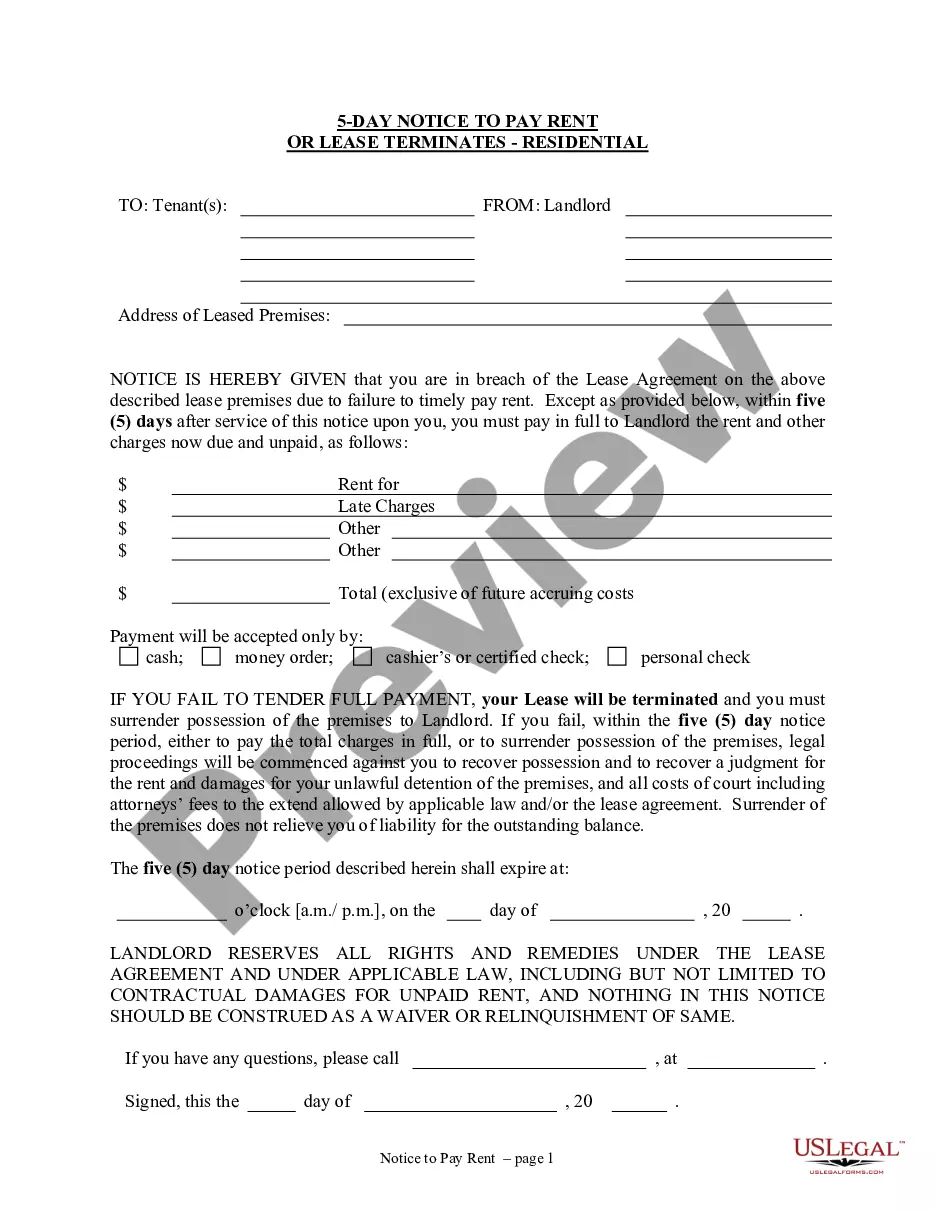

You will not need to spend time searching for the suitable template or verifying its authenticity. To obtain a form without an account, follow these steps: Use the search menu to locate the form you need. Review the Distribution Agreement Trust With Losses preview and description to confirm that it is precisely what you are interested in. After thoroughly checking the form, simply click Buy Now. Choose a subscription plan that suits your needs. Create an account or sign in to your existing one. Use your credit card details or PayPal account to complete the purchase. Choose the file format for download and confirm it. Eliminate the confusion involved with legal documents. All your templates will be organized and verified with a US Legal Forms account.

- US Legal Forms is a directory of legal documents that includes almost any document template you might need.

- Look for the templates you need, evaluate their relevance immediately, and learn more about their application.

- With US Legal Forms, you have access to approximately 85,000 form templates across various fields.

- Acquire the Distribution Agreement Trust With Losses samples in just a few clicks and save them at any time in your account.

- A US Legal Forms account lets you access all necessary samples with greater ease and less hassle.

- Simply click Log In in the site header and navigate to the My documents section where all the forms you need are readily available.

Form popularity

FAQ

Upon termination of a trust or decedent's estate, a beneficiary succeeding to its property is allowed to deduct any unused net operating loss (NOL) if the carryover would be allowable to the trust or estate in a later tax year but for the termination.

IRS Form 1041 is like a Form 1040. This is used to show that the trust is deducting any interest it distributes to beneficiaries from its own taxable income. The trust will also issue a K-1. This IRS form details the distribution, or how much of the distributed money came from principal and how much is interest.

A net capital loss of an estate or trust will reduce the taxable income of the estate or trust, but no part of the loss is deductible by the beneficiaries. If the estate or trust distributes all of its income, the capital loss will not result in a tax benefit for the year of the loss.

Generally, the losses incurred by a trust remain trapped in the trust and cannot be distributed to beneficiaries. However, the losses that are incurred by a trust may be carried forward and offset against assessable income of the trust in calculating the trust's taxable income in future years.

How Losses Can Pass to Beneficiaries. Your trust can offset capital gains and up to $3,000 of standard income with capital losses. Any losses in excess may be pushed forward and used in future tax years. However, they may not pass through to the beneficiaries prior to the year that the trust concludes.