Distribution Agreement Trust Withholding

Description

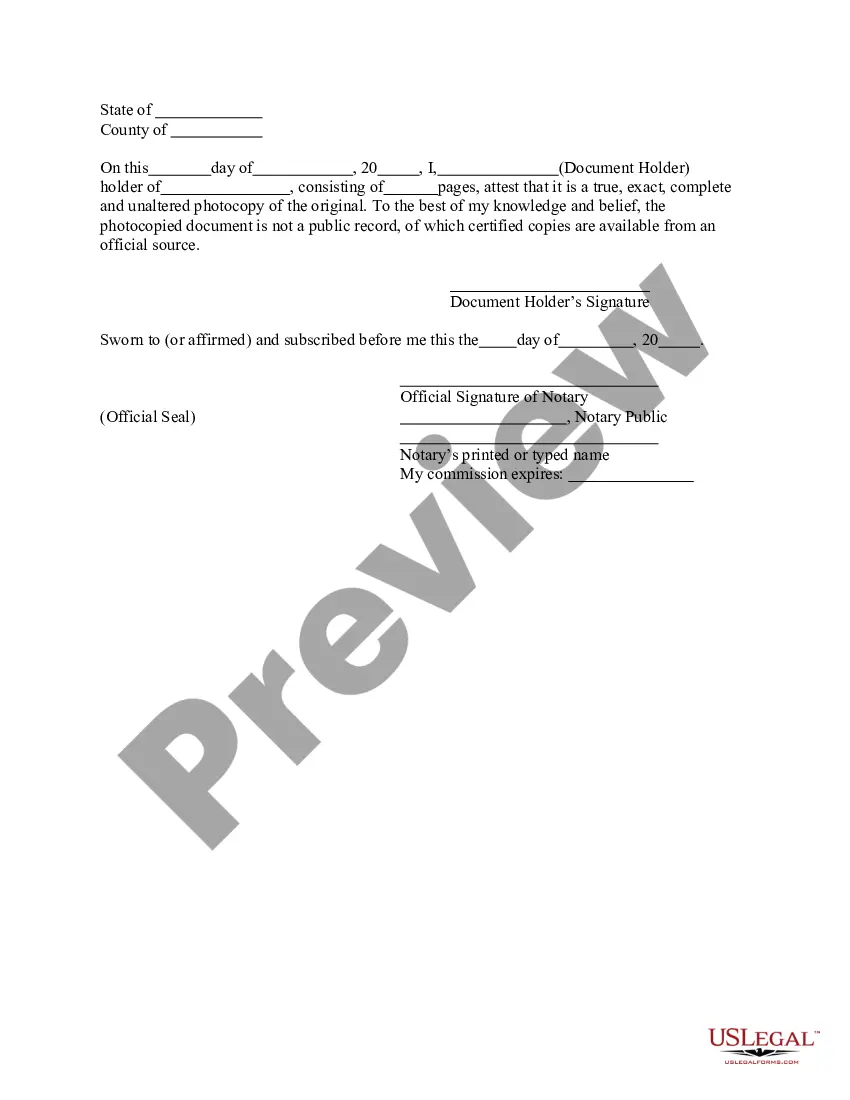

How to fill out Distribution Agreement Trust Withholding?

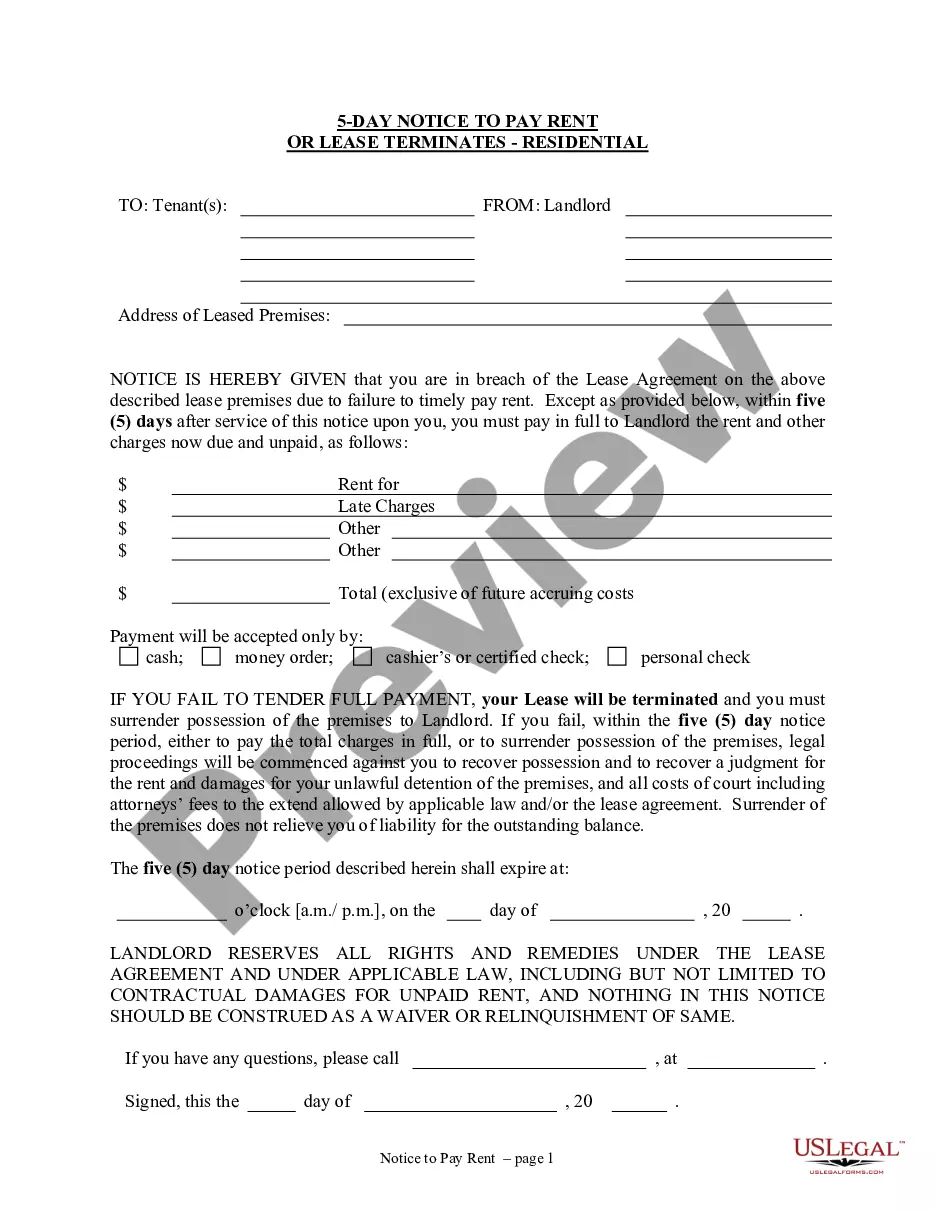

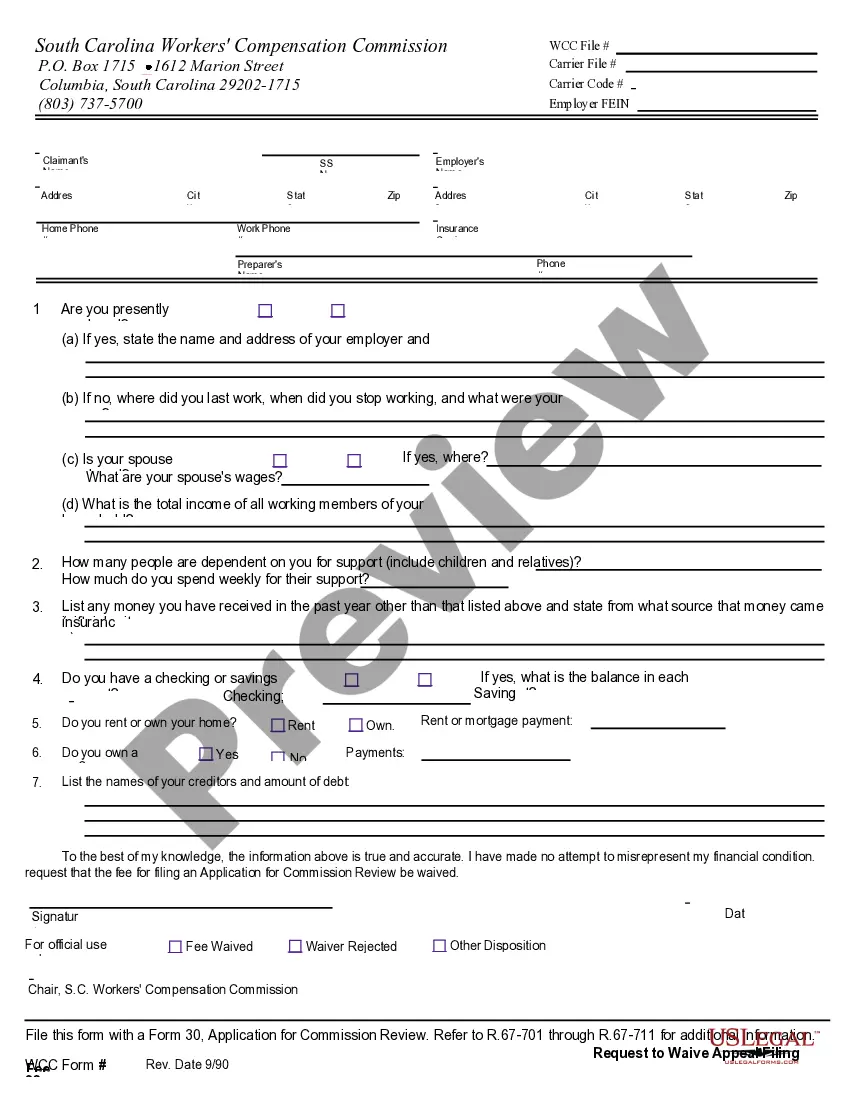

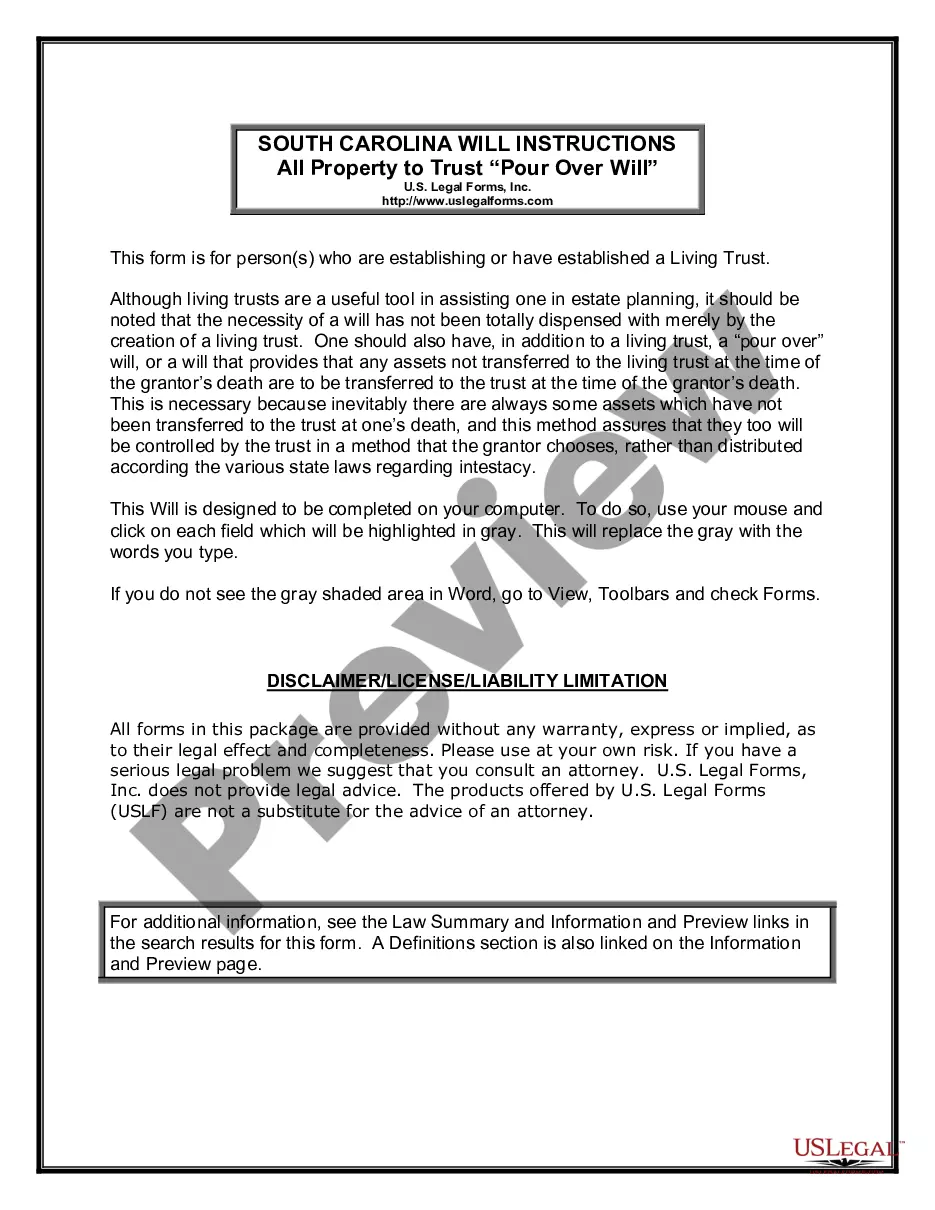

When it's necessary to present Distribution Agreement Trust Withholding that adheres to your local jurisdiction's laws and regulations, there can be many alternatives to choose from.

There's no need to scrutinize every document to ensure it satisfies all the legal requirements if you are a US Legal Forms member.

It is a reliable service that can assist you in acquiring a reusable and current template on any topic.

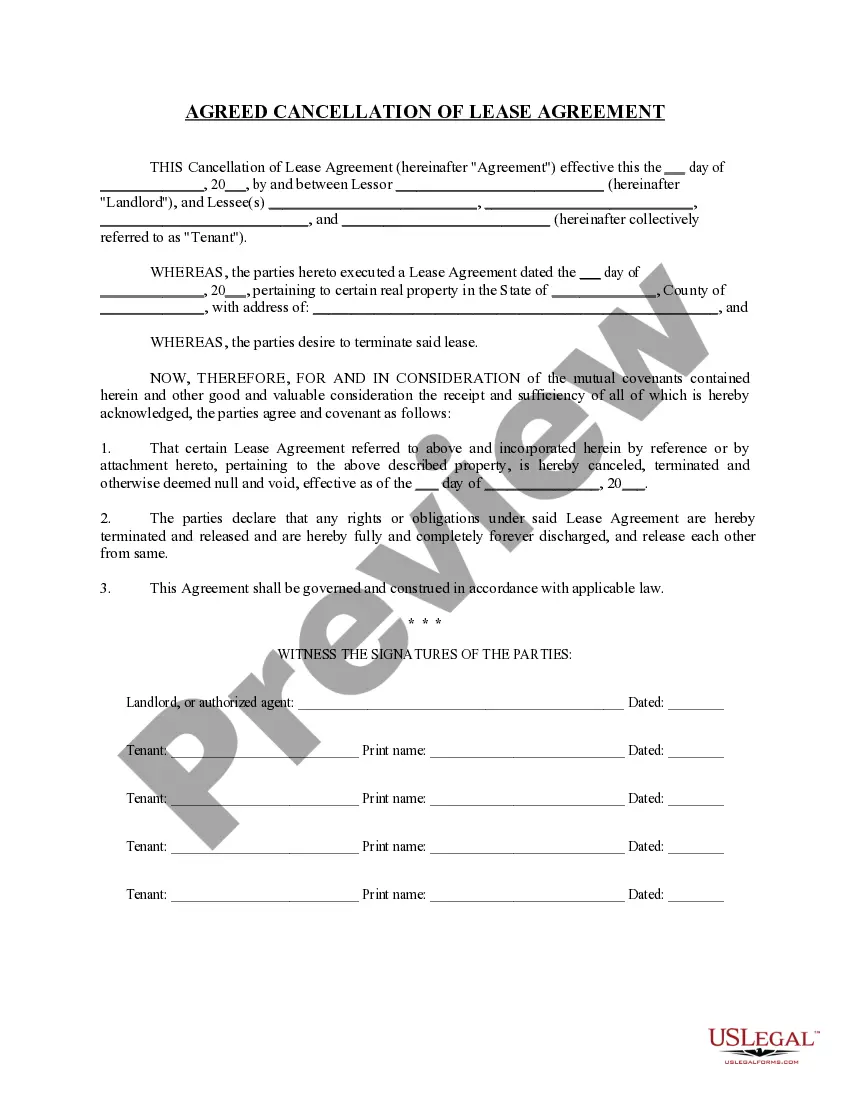

Navigate through the provided page and verify it aligns with your needs. Use the Preview mode and read the form description if available. Look for another example using the Search field if needed. Click Buy Now once you locate the suitable Distribution Agreement Trust Withholding. Select the most appropriate pricing plan, Log In to your account, or create one. Make a payment for a subscription (PayPal and credit card options are available). Download the template in your chosen file format (PDF or DOCX). Print the document or fill it out electronically via an online editor. Acquiring professionally crafted official documents becomes simple with US Legal Forms. Additionally, Premium subscribers can take advantage of comprehensive integrated tools for online document editing and signing. Give it a try today!

- US Legal Forms is the most extensive online directory with a repository of over 85,000 ready-to-use documents for business and personal legal needs.

- All templates are verified to comply with each state's regulations.

- Thus, when downloading Distribution Agreement Trust Withholding from our platform, you can be assured that you have a valid and current document.

- Obtaining the necessary template from our site is remarkably straightforward.

- If you already possess an account, simply Log In to the system, confirm your subscription is active, and save your selected file.

- In the future, you can access the My documents section in your profile to retrieve the Distribution Agreement Trust Withholding at any time.

- If this is your first experience with our site, please follow the instructions below.

Form popularity

FAQ

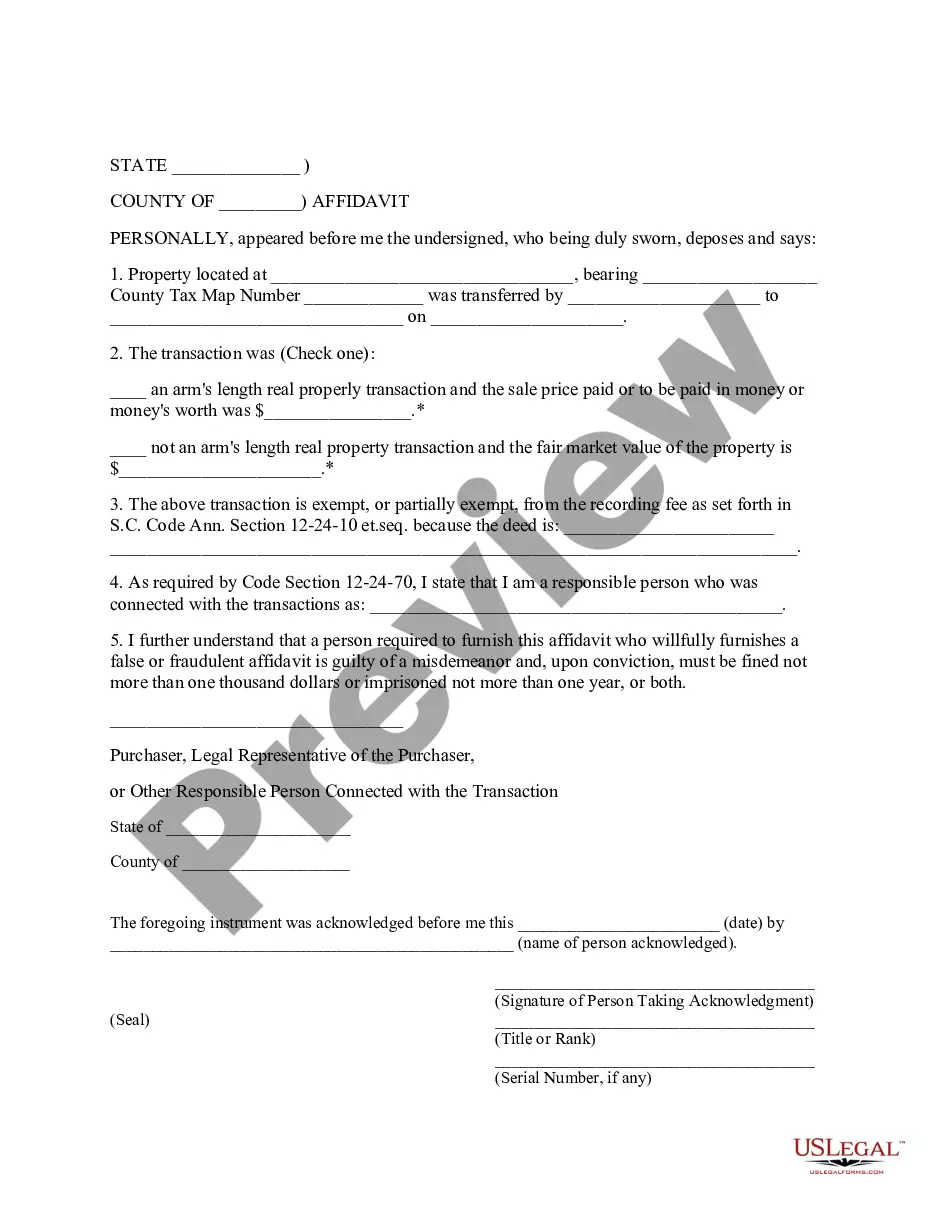

When trust beneficiaries receive distributions from the trust's principal balance, they do not have to pay taxes on the distribution. The Internal Revenue Service (IRS) assumes this money was already taxed before it was placed into the trust.

A grantor trust is subject to tax withholding when a foreign person is treated as its owner and the trust has income subject to withholding. A fiduciary is not required to withhold tax if a foreign person assumes responsibility for withholding as a qualified intermediary or an authorized foreign agent.

Form 3520 for U.S. recipients of foreign gifts You're only required to file this form if you received: A gift of more than $100,000 from a foreign person or estate. A gift of more than $15,601 from a foreign partnership or corporation.

Withholding Withholding cannot be distributed to the beneficiaries. It must be refunded to the trust or estate.

No Tax Return or Taxes Due & Form 3520: A common misconception that many taxpayers (understandably) have, is that if a person is not required to file a tax return, then they are not required to file a form 3520 with the IRS but that is incorrect.