Distribution Agreement Trust Withholding Tax

Description

How to fill out Distribution Agreement Trust Withholding Tax?

There is no longer a necessity to spend extensive time searching for legal documents to fulfill your local state obligations.

US Legal Forms has amassed all of them in a single location and improved their accessibility.

Our platform offers over 85,000 templates for various business and personal legal situations sorted by state and area of usage.

Choose Buy Now next to the template name when you identify the correct one. Pick the most appropriate pricing plan and register for an account or Log In. Complete the payment for your subscription using a credit card or PayPal to proceed. Choose the file format for your Distribution Agreement Trust Withholding Tax and download it to your device. Print out your form to complete it manually or upload the sample if you wish to utilize an online editor. Drafting legal documents under federal and state laws and regulations is swift and straightforward with our platform. Try US Legal Forms today to organize your paperwork!

- All forms are expertly drafted and confirmed for authenticity, allowing you to feel confident in obtaining an up-to-date Distribution Agreement Trust Withholding Tax.

- If you are acquainted with our service and already possess an account, you must verify that your subscription is current before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documentation anytime by navigating to the My documents tab in your profile.

- If you have not used our service before, the procedure will require a few additional steps to finalize.

- Here’s how new users can acquire the Distribution Agreement Trust Withholding Tax from our catalog.

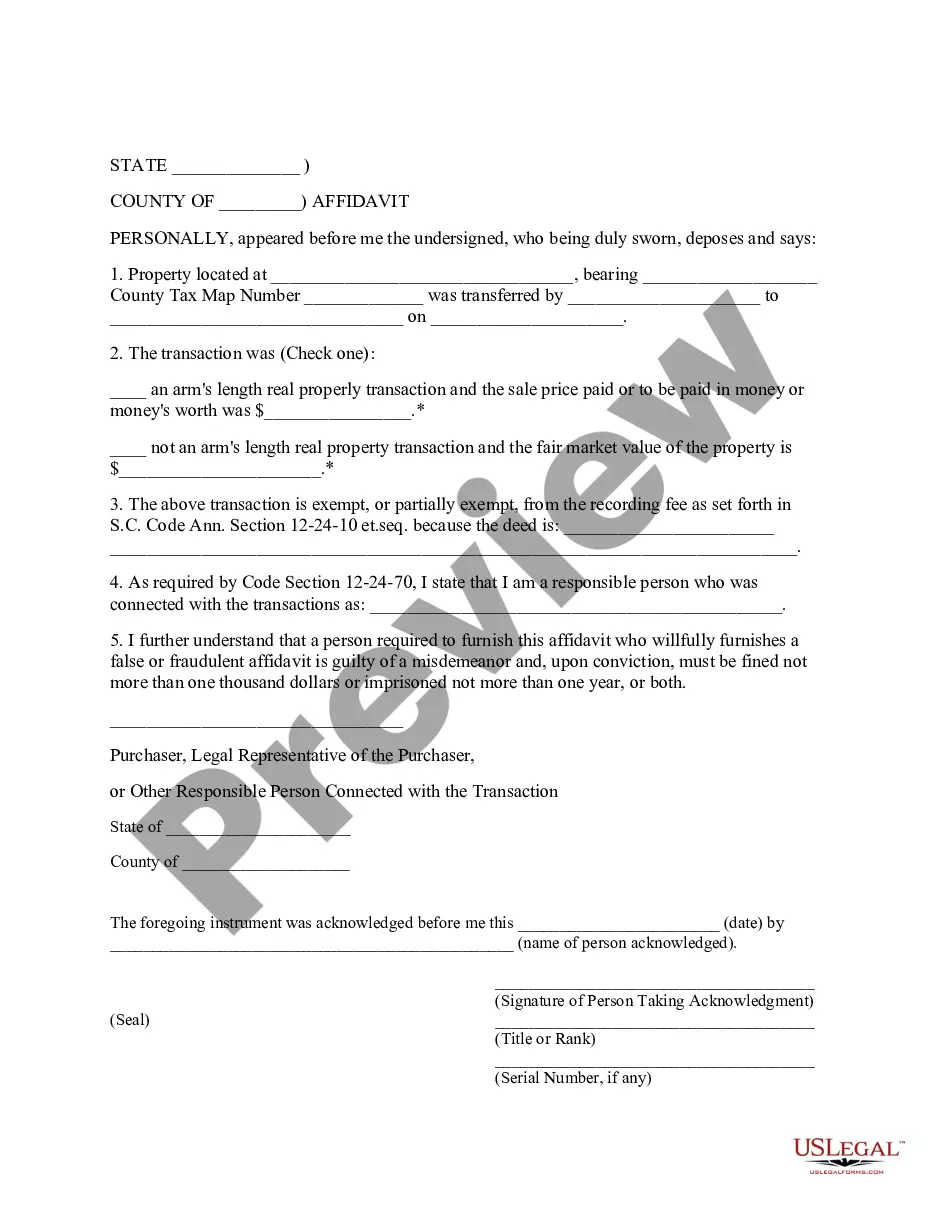

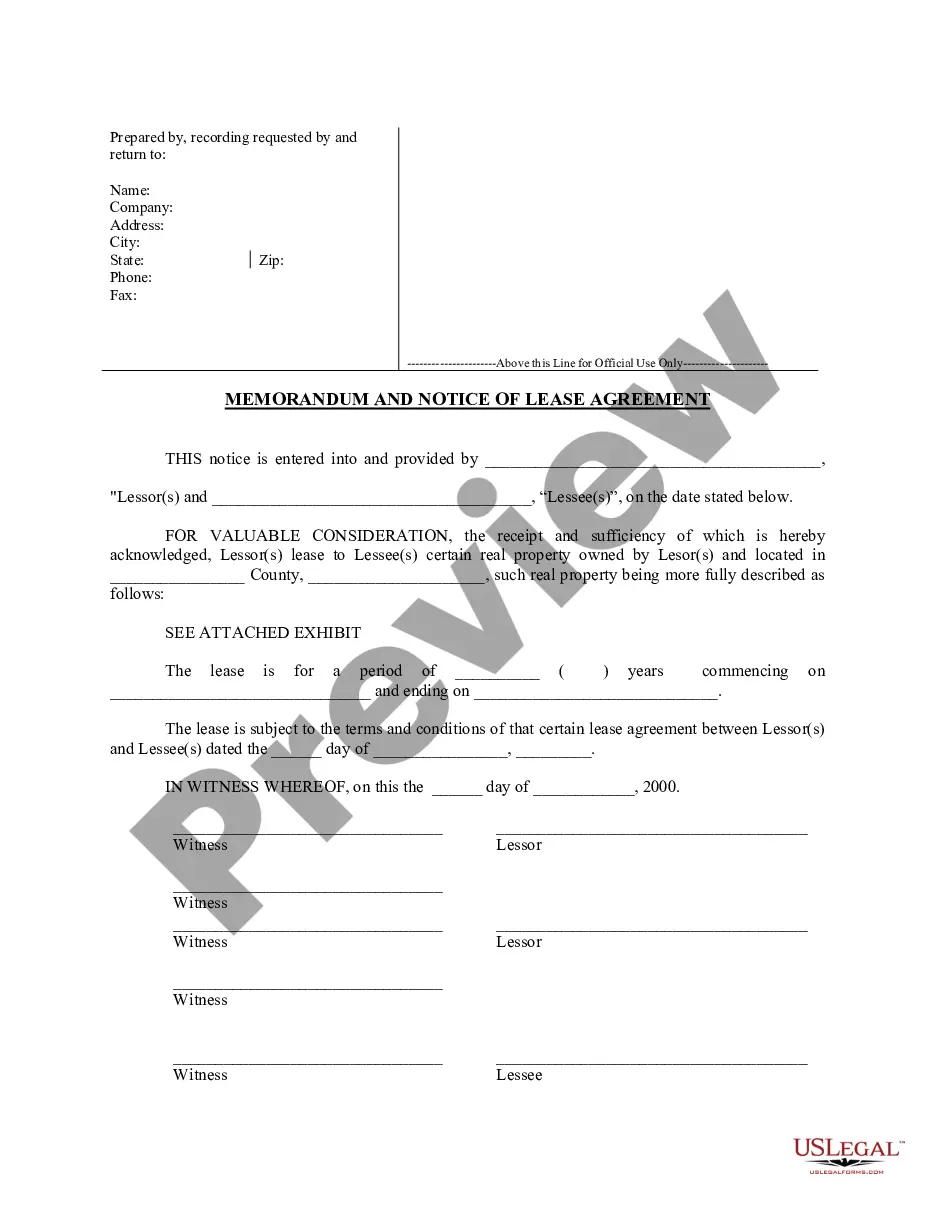

- Carefully read the page content to verify it contains the example you need.

- To achieve this, use the form description and preview options if available.

Form popularity

FAQ

Trust beneficiaries must pay taxes on income and other distributions that they receive from the trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets. IRS forms K-1 and 1041 are required for filing tax returns that receive trust disbursements.

A grantor trust is subject to tax withholding when a foreign person is treated as its owner and the trust has income subject to withholding. A fiduciary is not required to withhold tax if a foreign person assumes responsibility for withholding as a qualified intermediary or an authorized foreign agent.

Key Takeaways. Money taken from a trust is subject to different taxation than funds from ordinary investment accounts. Trust beneficiaries must pay taxes on income and other distributions that they receive from the trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets.

Withholding Withholding cannot be distributed to the beneficiaries. It must be refunded to the trust or estate.

According to U.S. tax code, estates and trusts are allowed to deduct the distributable net income or the sum of the trust income required to be distributedwhichever is lessand other amounts properly paid or credited or required to be distributed to beneficiaries to prevent double taxation on income.