Agreement To Provide Insurance Form

Description

How to fill out Agreement To Provide Insurance Form?

There is no longer a necessity to invest time searching for legal documents to adhere to your local state rules.

US Legal Forms has gathered all of them in a single location and made their availability easier.

Our site provides more than 85,000 templates for any business and personal legal matters categorized by state and usage area. All forms are correctly drafted and confirmed for authenticity, so you can be assured of obtaining an updated Agreement To Provide Insurance Form.

Click Buy Now beside the template name once you identify the suitable one. Choose the most appropriate subscription plan and register for an account or Log In. Make payment for your subscription with a card or through PayPal to proceed. Select the file format for your Agreement To Provide Insurance Form and download it to your device. Print your form to complete it manually or upload the template if you prefer to fill it out in an online editor. Organizing official paperwork under federal and state laws is swift and simple with our library. Try US Legal Forms now to maintain your documentation in order!

- If you are acquainted with our platform and already possess an account, ensure your subscription is current before accessing any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all obtained documents whenever necessary by navigating to the My documents section in your profile.

- If you've never interacted with our platform before, the procedure will require a few additional steps to finish.

- Here’s how new users can acquire the Agreement To Provide Insurance Form from our library.

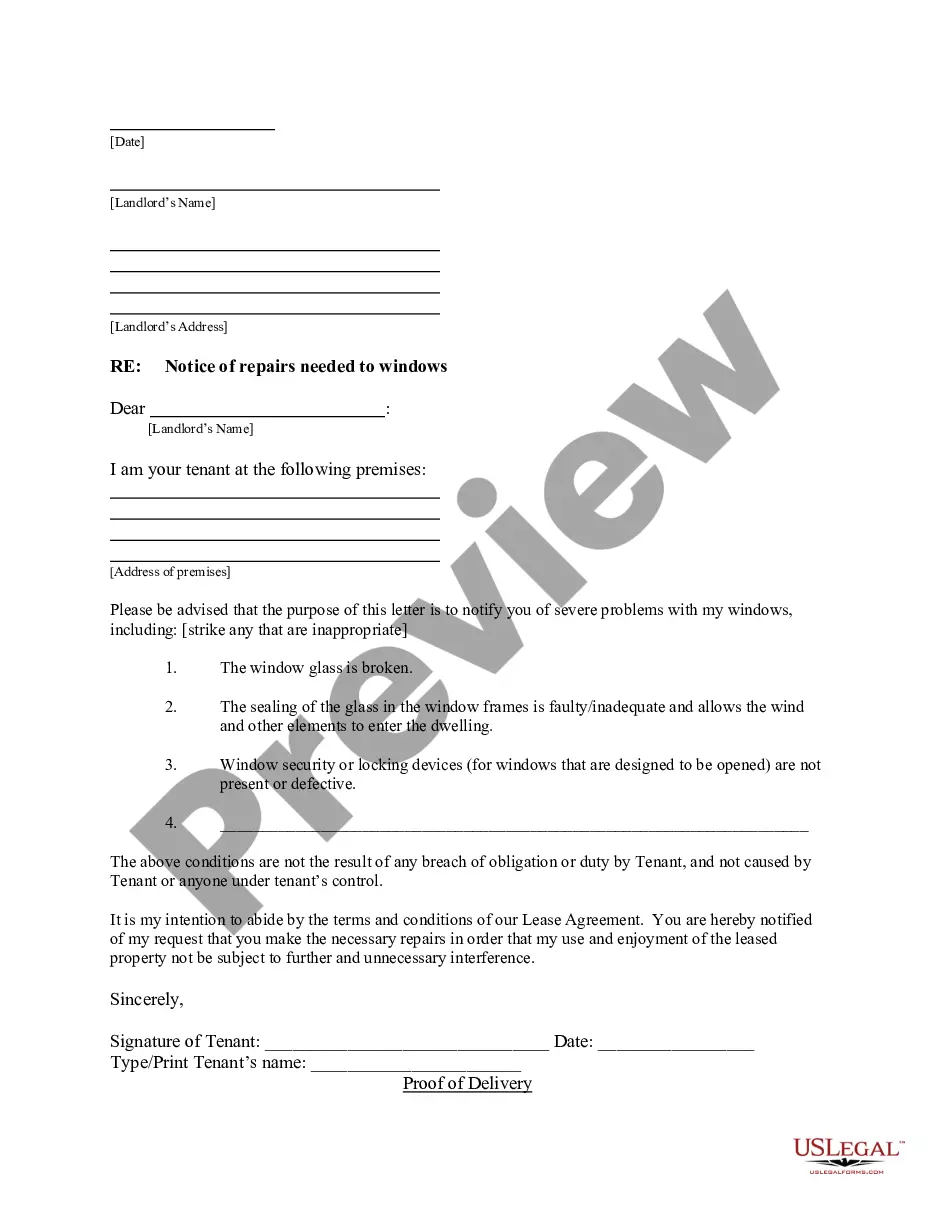

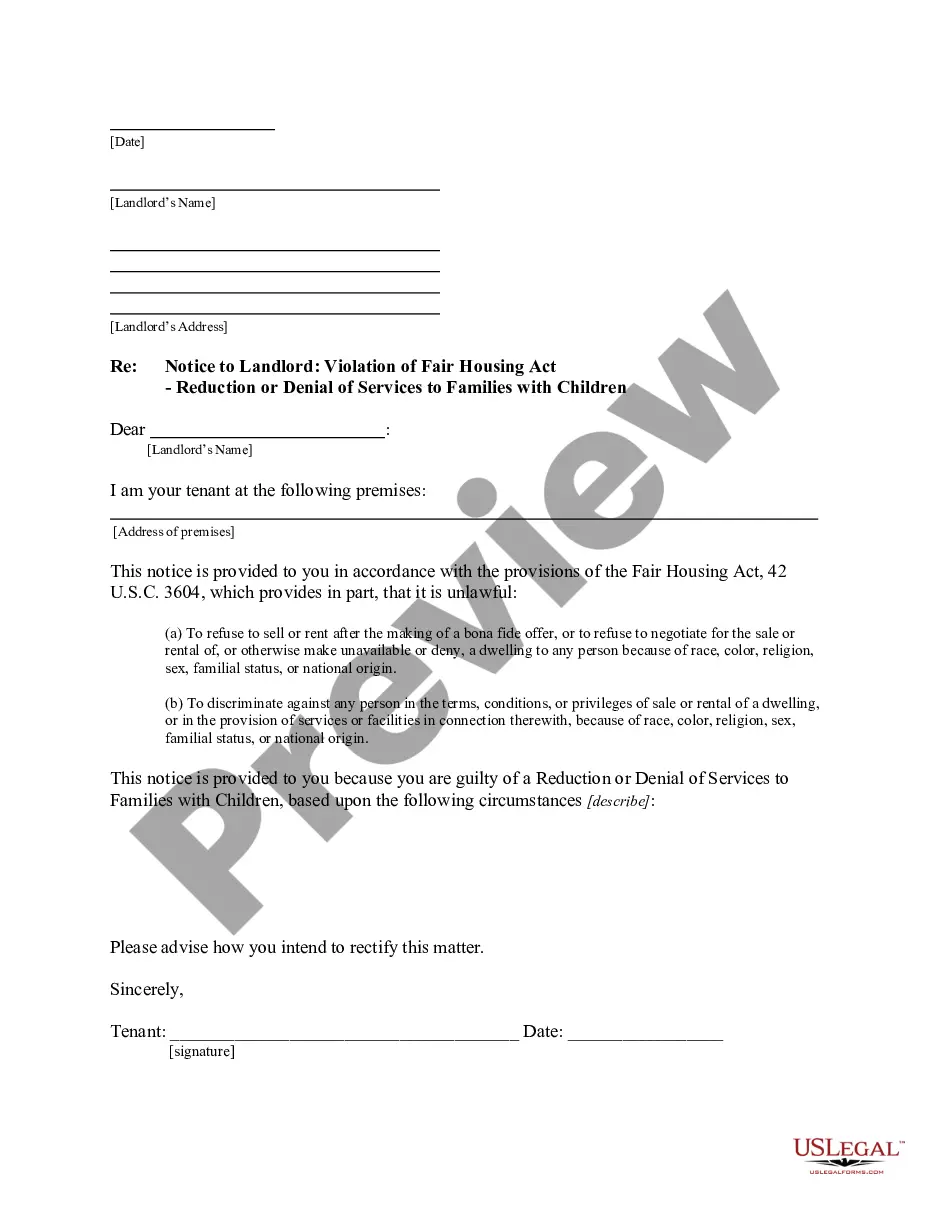

- Examine the page content thoroughly to confirm it features the sample you need.

- To do this, utilize the form description and preview options if available.

- Make use of the Search bar above to find another sample if the last one did not meet your needs.

Form popularity

FAQ

In general, an insurance contract must meet four conditions in order to be legally valid: it must be for a legal purpose; the parties must have a legal capacity to contract; there must be evidence of a meeting of minds between the insurer and the insured; and there must be a payment or consideration.

An insurance agreement is a legal contract between an insurance company and an insured party. This contract allows the risk of a significant financial loss or burden to be transferred from the insured to the insurer. In exchange, the insured promises to pay a small, guaranteed payment called a premium.

There are four necessary elements to comprise a legally binding contract: (1) Offer and acceptance, (2) consideration, (3) legal purpose, and (4) competent parties. The effective date of a policy is the date the insurer accepts an offer by the applicant "as written."

Every insurance policy has five parts: declarations, insuring agreements, definitions, exclusions and conditions. Many policies contain a sixth part: endorsements. Use these sections as guideposts in reviewing the policies. Examine each part to identify its key provisions and requirements.

There are 4 requirements for any valid contract, including insurance contracts:offer and acceptance,consideration,competent parties, and.legal purpose.