A letter agreement template with vesting serves as a legal document detailing the terms and conditions of a vesting plan between two parties. Vesting refers to the process of earning ownership or rights over a particular asset or benefit over time. This type of agreement is commonly used in business partnerships, startup companies, and employee stock option plans. It ensures that both parties are clear on the vesting schedule, conditions, and consequences related to the transfer of ownership or benefits. The main purpose of a letter agreement template with vesting is to establish a fair and structured arrangement wherein one party, typically an employee or founder, earns ownership or rights gradually over a specific period of time. The letter agreement provides clarity on the conditions under which the vesting will occur, such as the length of the vesting period, the percentage of ownership or benefits earned at various intervals, and any additional requirements or performance milestones. Different types of letter agreement templates with vesting may include: 1. Employee Stock Option Agreement: This type of letter agreement is commonly used in companies to grant employees the right to purchase company shares at a predetermined price within a specific timeframe. The agreement typically outlines the vesting schedule, exercise price, and any performance requirements. 2. Founders' Agreement with Vesting: Startups often implement this type of agreement among co-founders to ensure a fair distribution of ownership over time. The letter agreement may lay out the vesting schedule for each founder, as well as any provisions for acceleration or forfeiture of shares in the event of particular circumstances. 3. Partnership Agreement with Vesting: In business partnerships, this letter agreement template may be utilized to establish vesting terms for partners' ownership interests. It outlines the agreed-upon vesting schedule and any provisions for transferring shares or modifying ownership percentages in the event of partner departures or changes in business circumstances. 4. Restricted Stock Unit Agreement: This letter agreement is commonly used by companies to grant employees a specific number of stock units that will vest over time. It details the vesting schedule and any conditions (such as continued employment) that must be met for the employee to receive full ownership rights over the units. In conclusion, a letter agreement template with vesting is a comprehensive legal document that outlines the terms and conditions of a vesting arrangement between parties. It provides clarity on the vesting schedule, conditions, and consequences related to the gradual transfer of ownership or benefits. Different types of such agreements include employee stock option agreements, founders' agreements with vesting, partnership agreements with vesting, and restricted stock unit agreements.

Letter Agreement Template With Vesting

Description

How to fill out Letter Agreement Template With Vesting?

Whether for business purposes or for individual matters, everybody has to manage legal situations at some point in their life. Completing legal papers needs careful attention, beginning from choosing the appropriate form sample. For instance, when you choose a wrong version of a Letter Agreement Template With Vesting, it will be rejected when you submit it. It is therefore important to have a reliable source of legal documents like US Legal Forms.

If you need to get a Letter Agreement Template With Vesting sample, stick to these simple steps:

- Get the template you need by using the search field or catalog navigation.

- Examine the form’s description to make sure it suits your case, state, and county.

- Click on the form’s preview to view it.

- If it is the incorrect form, get back to the search function to find the Letter Agreement Template With Vesting sample you require.

- Get the file if it meets your needs.

- If you have a US Legal Forms profile, just click Log in to access previously saved documents in My Forms.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Pick the correct pricing option.

- Complete the profile registration form.

- Select your transaction method: you can use a bank card or PayPal account.

- Pick the file format you want and download the Letter Agreement Template With Vesting.

- Once it is saved, you can complete the form with the help of editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you never have to spend time seeking for the right template across the internet. Take advantage of the library’s simple navigation to get the right form for any situation.

Form popularity

FAQ

Under a standard four-year time-based vesting schedule with a one-year cliff, 1/4 of your shares vest after one year. After the cliff, 1/36 of the remaining granted shares (or 1/48 of the original grant) vest each month until the four-year vesting period is over. After four years, you are fully vested.

An example: on 01/01/2023 an employee receives 4,000 shares with a 4-year vesting and 1 cliff. It will not be until 01/01/2024 that he will unlock 25% (1,000) of the shares. From that date on, he will vest periodically for 4 years until vesting all 4,000.

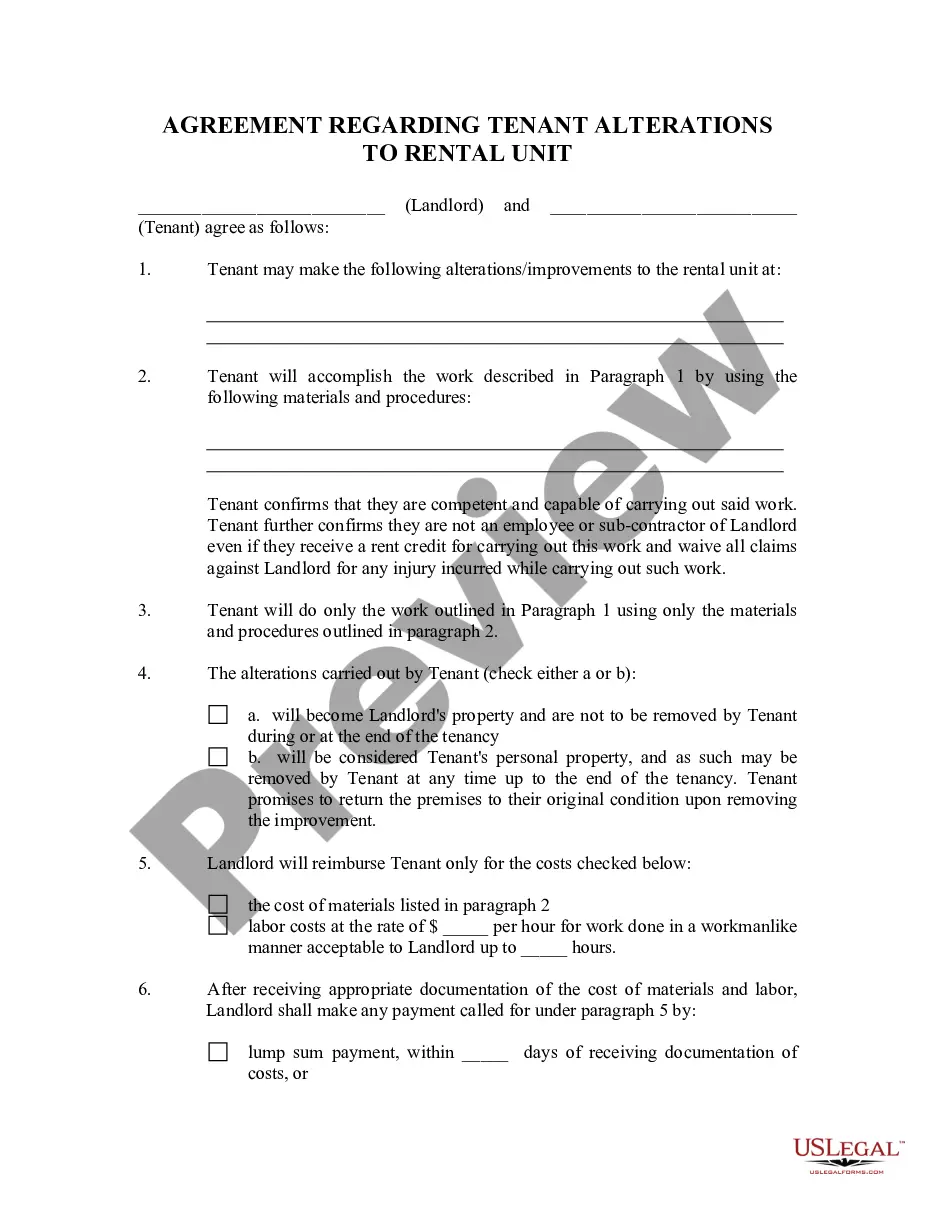

Some basic terms that must be included in the vesting agreement are: Details of the shareholder. Number of shares. Type of shares. Vesting criteria. Vesting schedule. Company buy-back options. Terms of confidentiality. Definitions and interpretations.

A vesting agreement is an agreement entered into between a corporation and a shareholder (usually an employee) that restricts the vesting of securities with the shareholder over a period of time or subject to other conditions.

Vesting Provisions refer to the terms and conditions that govern how the equity ownership (shares) of founders, key employees, or other stakeholders will be distributed or 'earned back' over time.