Distribution Agreement Form Withholding

Description

How to fill out Distribution Agreement Form Withholding?

Navigating the maze of official documents and templates can be challenging, particularly if one does not engage in such tasks professionally.

Finding the correct template for the Distribution Agreement Form Withholding will also be labor-intensive, as it must be accurate and precise to the last detail.

Nevertheless, you will need to invest significantly less time locating a suitable template from a reliable source.

Obtain the correct form in a few straightforward steps: Enter the document name in the search box. Locate the relevant Distribution Agreement Form Withholding in the results list. Review the sample's description or view its preview. If the template meets your requirements, click Buy Now. Then select your subscription plan. Use your email to create a secure password for your US Legal Forms account. Choose either credit card or PayPal as your payment method. Save the template file on your device in your preferred format. US Legal Forms will save you time and energy in assessing whether the found form online is right for you. Establish an account and enjoy unlimited access to all the templates you require.

- US Legal Forms is a platform that streamlines the process of finding the right forms online.

- US Legal Forms is the only destination you require to obtain the latest versions of documents, verify their usage, and download them for completion.

- It features a collection of over 85,000 forms applicable in different areas.

- When searching for a Distribution Agreement Form Withholding, you will not need to question its authenticity since all forms have been verified.

- Creating an account at US Legal Forms ensures that you have all the essential samples at your fingertips.

- You can keep them in your history or add them to the My documents section.

- Access your saved forms from any device by clicking Log In on the library's website.

- If you do not have an account yet, you can always search for the template you need.

Form popularity

FAQ

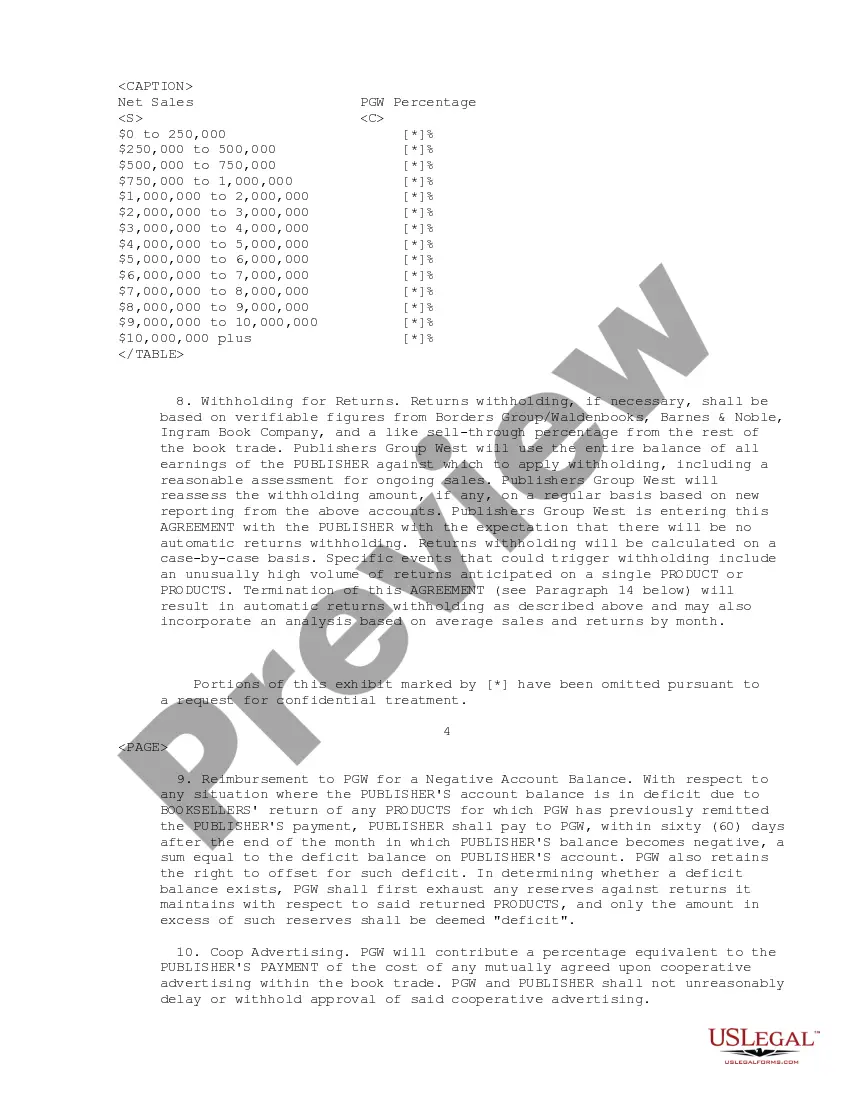

If a distribution is eligible to be rolled over to a qualified retirement plan, IRA, 403(b), or governmental 457(b) plan, there is a mandatory 20% withholding requirement unless the participant requests a direct rollover to one of these plans.

Determining the tax-free portion of a pension The dollar amount is determined by dividing the total amount of your previously taxed contributions (you can find this amount on your IMRF Certificate of Benefits) by the number of pension payments you can expect to receive.

When you take 401(k) distributions and have the money sent directly to you, the service provider is required to withhold 20% for federal income tax. 1 If this is too muchif you effectively only owe, say, 15% at tax timethis means you'll have to wait until you file your taxes to get that 5% back.

How Distribution Agreements WorkSet an appointment with the manufacturer.Negotiate the distribution terms.Review specifics, such as promotional literature.Hire a business lawyer to help you draft the terms.Sign or renegotiate the contract.Begin executing the agreement as contained within provisions.

Any taxable distribution paid to you is subject to mandatory withholding of 20%, even if you intend to roll the distribution over later. If the distribution is rolled over, and you want to defer tax on the entire taxable portion, you will have to add funds from other sources equal to the amount withheld.