Broadcast Agreement Form Withholding

Description

How to fill out Broadcast Agreement Form Withholding?

How to obtain expert legal documents adhering to your state's regulations and prepare the Broadcast Agreement Form Withholding without consulting a lawyer.

Numerous online services provide templates to address various legal situations and formal procedures. However, it may require time to determine which of the available examples meet both the practical application and legal standards for you.

US Legal Forms is a credible resource that assists you in locating official documents crafted in accordance with the latest updates in state law, helping you save on legal fees.

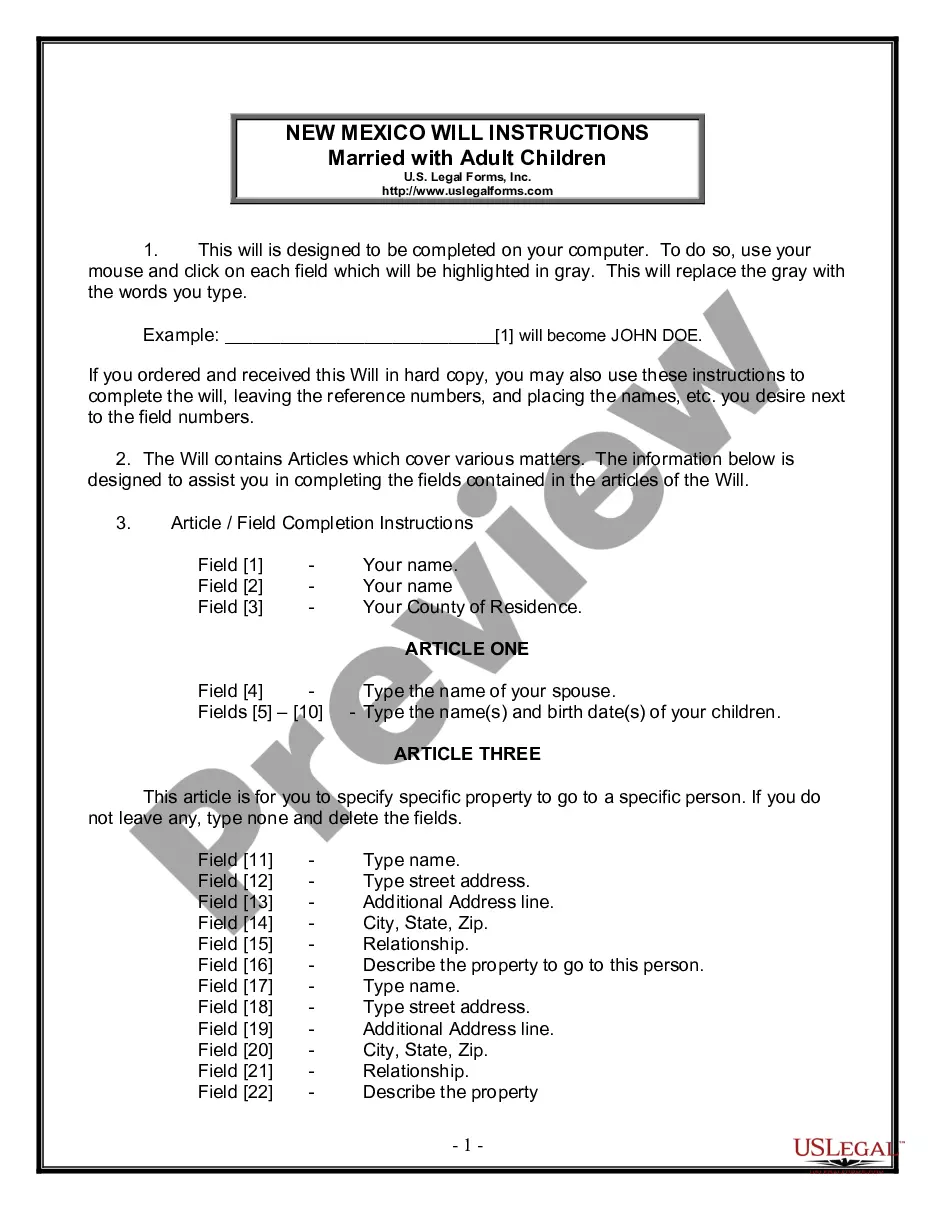

If you do not have an account with US Legal Forms, follow the steps outlined below: Review the webpage you have accessed and confirm if the form meets your requirements. Utilize the form description and preview options, if available. Look for an alternative template in the header by specifying your state if necessary. Click the Buy Now button once you locate the appropriate document. Select the most suitable pricing plan, then sign in or create a new account. Choose your payment method (by credit card or via PayPal). Select the file format for your Broadcast Agreement Form Withholding and click Download. The downloaded templates will remain in your possession; you can always access them in the My documents section of your account. Register for our library and prepare legal documents independently like a seasoned legal professional!

- US Legal Forms is not just a typical web archive.

- It comprises over 85,000 validated templates for a range of business and personal situations.

- All documents are categorized by field and state, simplifying your search experience.

- Moreover, it connects with robust solutions for PDF editing and electronic signatures, enabling users with a Premium subscription to swiftly finalize their documents online.

- It requires minimal effort and time to acquire the necessary paperwork.

- If you already possess an account, Log In and verify that your subscription is active.

- Download the Broadcast Agreement Form Withholding by clicking the corresponding button next to the document title.

Form popularity

FAQ

What to include on a BASGoods and services tax (GST)Pay as you go (PAYG) income tax instalments.Pay as you go (PAYG) tax withheld.Fringe benefits tax (FBT) instalment.Luxury car tax (LCT)Wine equalisation tax (WET)Fuel tax credits.Instalment notices for GST and PAYG instalments.

A Withholding declaration applies to payments made after the declaration is provided to you. The information provided on this form is used to determine the amount of tax to withhold from payments based on the PAYG withholding tax tables we publish.

W1 Total salary, wages and other payments. Include at W1 total gross payments from which you are usually required to withhold amounts. These payments include: salary, wages, allowances and leave loading paid to employees (including those subsidised by JobKeeper payments)

G11 (Non-capital purchases) Non-capital purchases may include trading stock and normal running expenses, such as stationary, brokerage fees and repairs. Report the total amount you paid, or were liable to pay, on all purchases relevant to the reporting period.

If you use this method, the amounts you report at all these labels must include GST: G12 Subtotal (G10+G11) G13 Purchases for making input taxed sales fringe benefits. G14 Purchases without GST in the price.