Hardship Letter For Rental Assistance

Description

How to fill out Hardship Letter For Rental Assistance?

Steering through the red tape of official paperwork and formats can be difficult, particularly if one does not engage in such activities professionally.

Even locating the appropriate format for a Hardship Letter For Rental Assistance can be labor-intensive, as it must be authentic and accurate to the last digit.

However, you will need to invest significantly less time locating a suitable template from a reliable source.

Accomplish obtaining the appropriate form in a few straightforward steps.

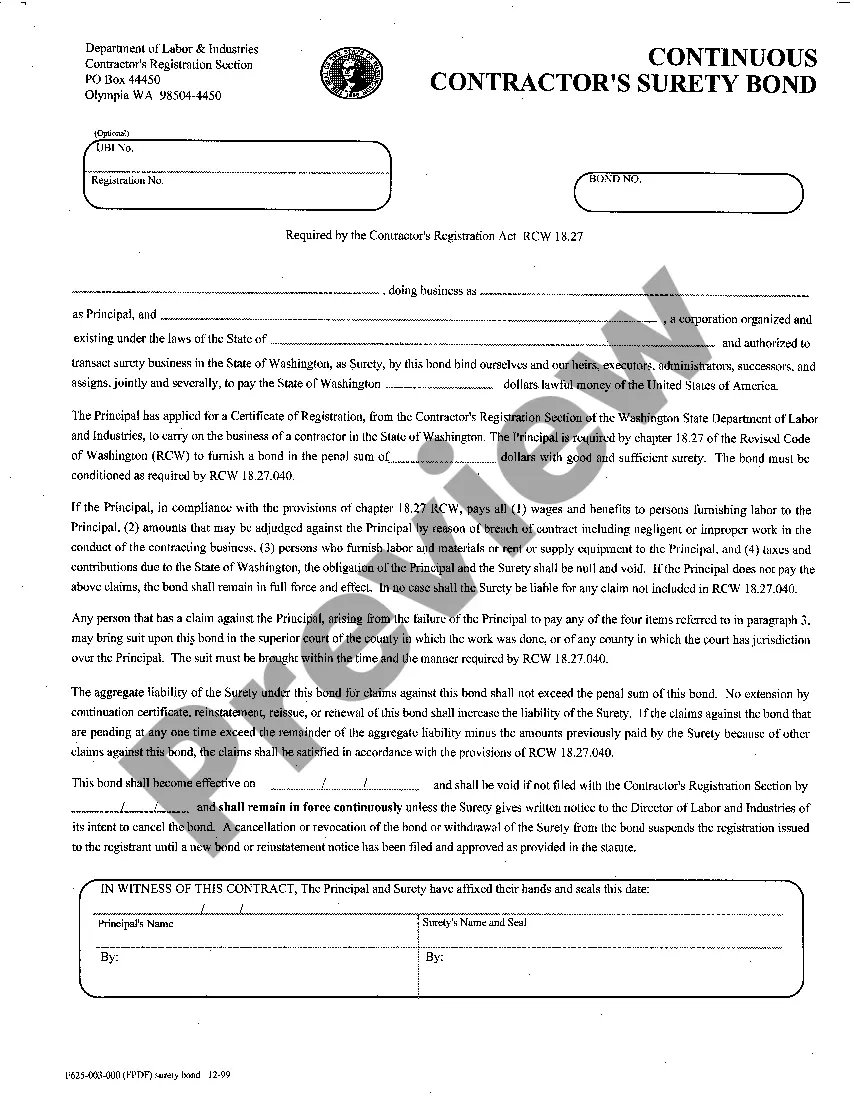

- US Legal Forms is a platform that streamlines the process of finding the correct forms online.

- US Legal Forms is the sole destination you require to obtain the latest templates of documents, verify their usage, and download these templates for completion.

- This is a compilation of over 85,000 forms applicable in various sectors.

- When searching for a Hardship Letter For Rental Assistance, you will not have to doubt its validity as all the forms are validated.

- Having an account at US Legal Forms ensures that you have all the essential templates at your fingertips.

- You can save them in your history or add them to the My documents section.

- You can access your saved forms from any device by clicking Log In at the library site.

- If you do not already have an account, you can always conduct a new search for the template you need.

Form popularity

FAQ

Filling out a financial hardship form involves gathering all pertinent financial information to accurately represent your situation. Start by detailing your income sources, monthly expenses, and any significant financial challenges you face. When submitting a hardship letter for rental assistance along with this form, ensure that both documents align and clearly illustrate your need. If you need assistance, platforms like US Legal Forms can provide templates and guidance for this process.

Hardship letters can be effective in securing rental assistance, provided they are written clearly and truthfully. Many organizations and landlords understand that unexpected circumstances can disrupt finances. A well-crafted hardship letter for rental assistance that provides clear evidence of your situation can persuade decision-makers to consider your request favorably. Each case is unique, but a well-articulated letter can significantly improve your chances.

When writing a hardship letter for rental assistance, avoid using negative language or personal attacks. Do not embellish your situation or exaggerate details, as honesty is vital. It’s also best not to include irrelevant information that doesn’t directly relate to your financial hardships, as this can dilute the effectiveness of your letter. Stick to the facts and keep your tone respectful to maintain credibility.

A hardship letter for rental assistance clearly outlines your current financial difficulties and requests support. For instance, you might explain job loss, medical expenses, or unexpected bills that have made rent payments challenging. It is crucial to provide details about your situation yet keep the letter concise. Using a platform like US Legal Forms can help you create a professional hardship letter tailored to your needs.

A hardship letter to a landlord typically starts with a respectful greeting, followed by a clear explanation of your financial struggles. You should detail specific instances that have led to your current situation, such as loss of income or increased expenses. Ending with a request for understanding or a proposed solution can foster a positive dialogue.

An example of a hardship letter for rent includes a detailed account of your financial troubles, such as job loss, medical expenses, or unexpected bills. In the letter, affirm your commitment to resolving the situation while also requesting assistance. This structured approach conveys your urgency and sincerity.

When explaining your financial hardship, be direct and provide relevant details. Focus on your income sources, expenses, and any unexpected circumstances that have impacted your finances. This transparency allows your landlord or aid organizations to understand your situation better and respond appropriately.

A convincing hardship letter should clearly outline your financial difficulties and provide supporting information. Start with a respectful greeting to your landlord, then state your situation succinctly. Remember, presenting your case honestly and requesting rental assistance will strengthen your appeal.

To inform your landlord about your inability to afford rent, write a clear and honest message. Begin by explaining your current financial situation and the reasons contributing to it. It may be helpful to mention that you are preparing a hardship letter for rental assistance, which outlines your circumstances in detail.

When writing a hardship letter for rental assistance, start with a formal greeting and state the purpose of your letter. Detail the factors contributing to your hardship, such as job loss or medical bills, and specify the assistance you seek. Be concise, respectful, and clear, ensuring you articulate why you need the support to maintain stability during this challenging period.