Independent Contractor Agreement Engineer With 1099 Form

Description

How to fill out Engineering Agreement - Self-Employed Independent Contractor?

Individuals often link legal documentation with something complex that only an expert can manage.

In a certain sense, this is accurate, as creating an Independent Contractor Agreement Engineer With 1099 Form demands comprehensive understanding of topic criteria, covering state and local statutes.

However, with US Legal Forms, the process has become more user-friendly: ready-to-use legal documents for any personal and business scenario tailored to state regulations are compiled in one online library and are now accessible to all.

Follow the guidelines to create an account or Log In to proceed to the payment page. Complete your subscription payment utilizing PayPal or a credit card. Select your file format and click Download. Print your document or upload it to an online editor for quicker completion. All templates in our library are reusable: once acquired, they are stored in your profile, allowing access whenever needed via the My documents tab. Experience all the advantages of using the US Legal Forms platform. Subscribe now!

- US Legal Forms provides over 85k current documents categorized by state and area of use, allowing a search for the Independent Contractor Agreement Engineer With 1099 Form or any specific template to take only a few minutes.

- Previously registered users with an active subscription must Log In to their account and click Download to obtain the form.

- New users will need to create an account and subscribe before they can save any documents.

- The following is a step-by-step instruction on how to acquire the Independent Contractor Agreement Engineer With 1099 Form.

- Thoroughly examine the page content to ensure it meets your requirements.

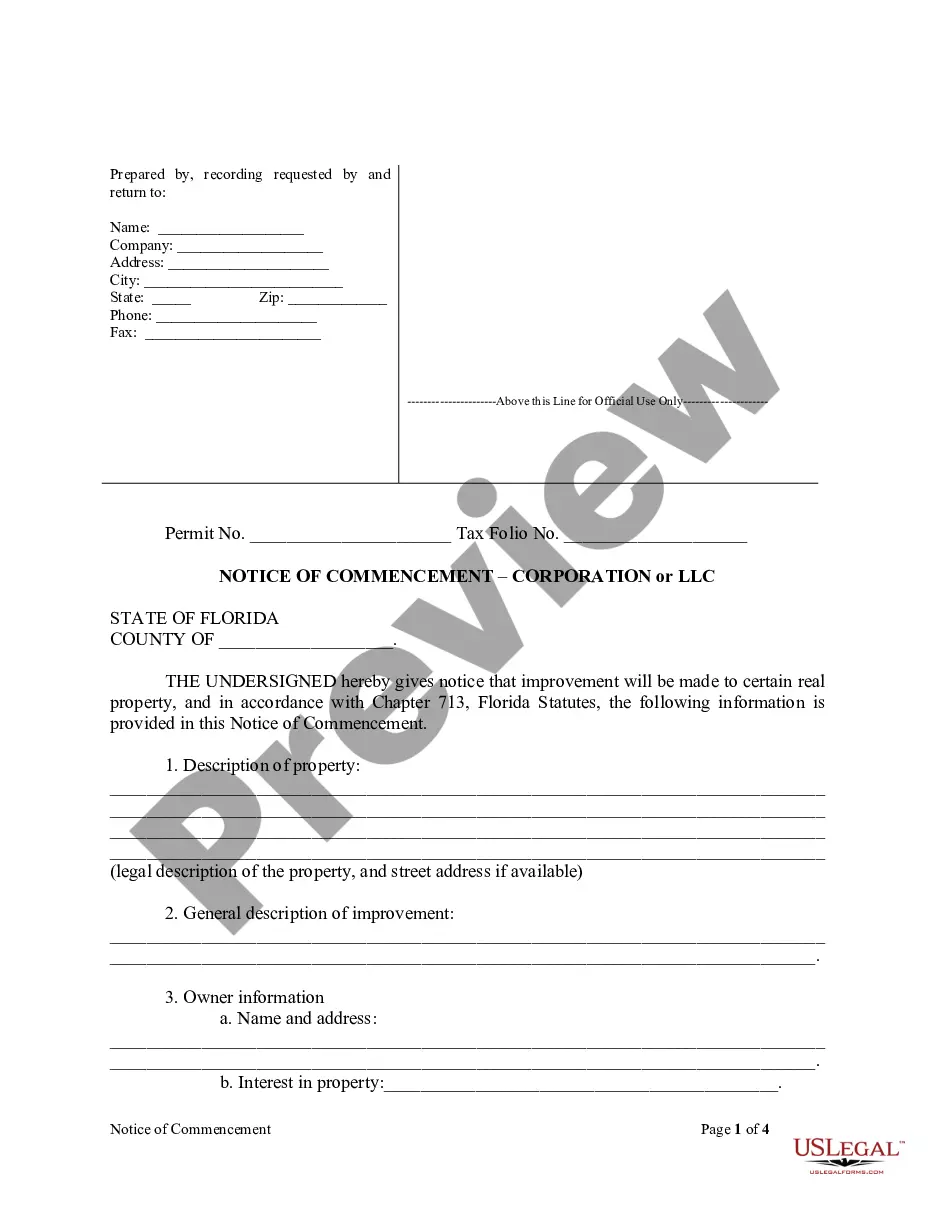

- Review the form description or confirm it through the Preview option.

- If the previous option does not fit your needs, search for another example using the Search field in the header.

- Once you identify the appropriate Independent Contractor Agreement Engineer With 1099 Form, click Buy Now.

- Choose the subscription plan that aligns with your needs and financial plan.

Form popularity

FAQ

How to Fill Out a 1099-MISC FormEnter your information in the 'payer' section.Fill in your tax ID number.As a business owner, enter the contractor's tax ID number which is found on their form W-9.Fill out the account number you have assigned to the independent contractor.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Payers use Form 1099-MISC, Miscellaneous Information or Form 1099-NEC, Nonemployee Compensation to: Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099-NEC).

How is Form 1099-NEC completed?Obtain a copy of Form 1099-NEC from the IRS or a payroll service provider.Provide the name and address of both the payer and the recipient.Calculate the total compensation paid.Note the amount of taxes withheld if backup withholding applied.More items...