Contract For Assistant

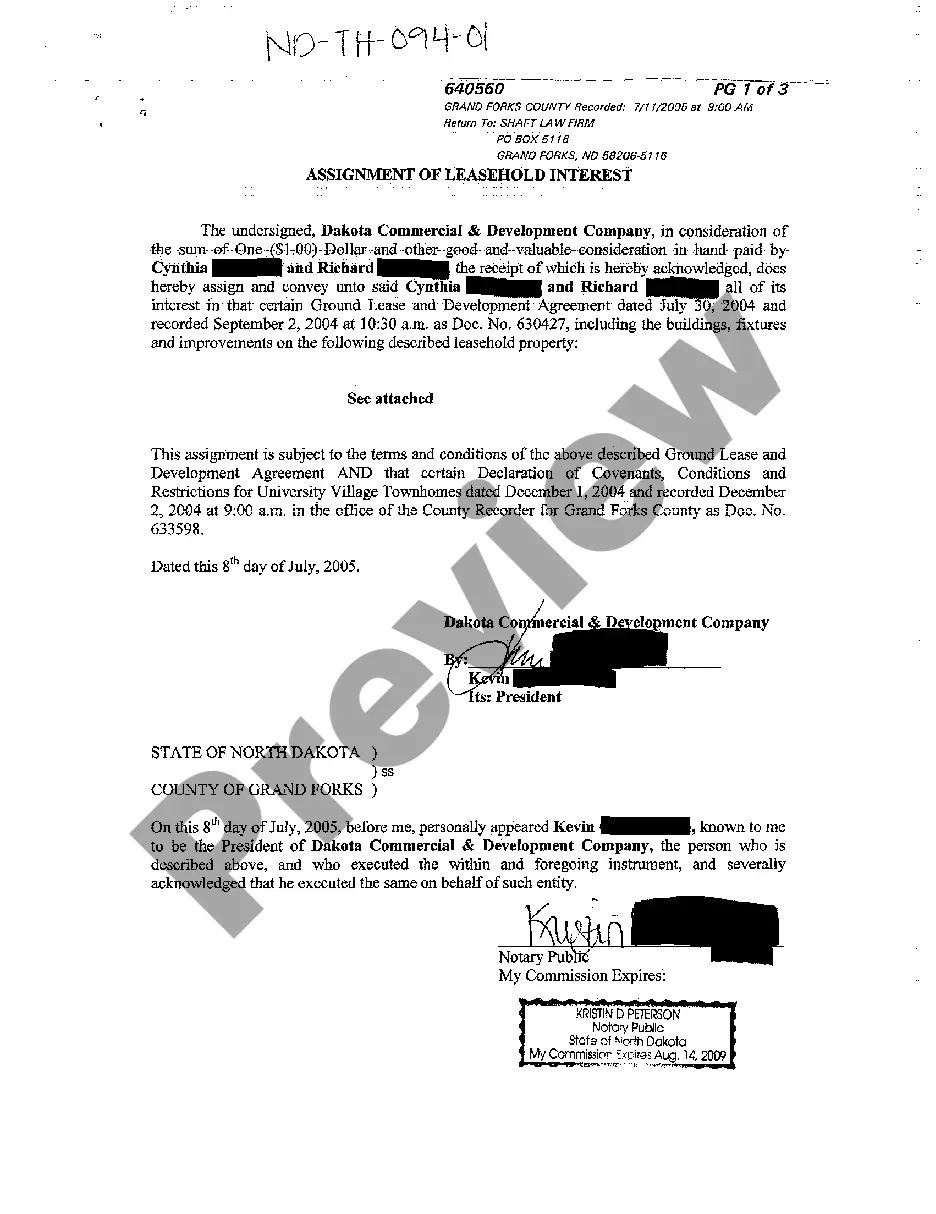

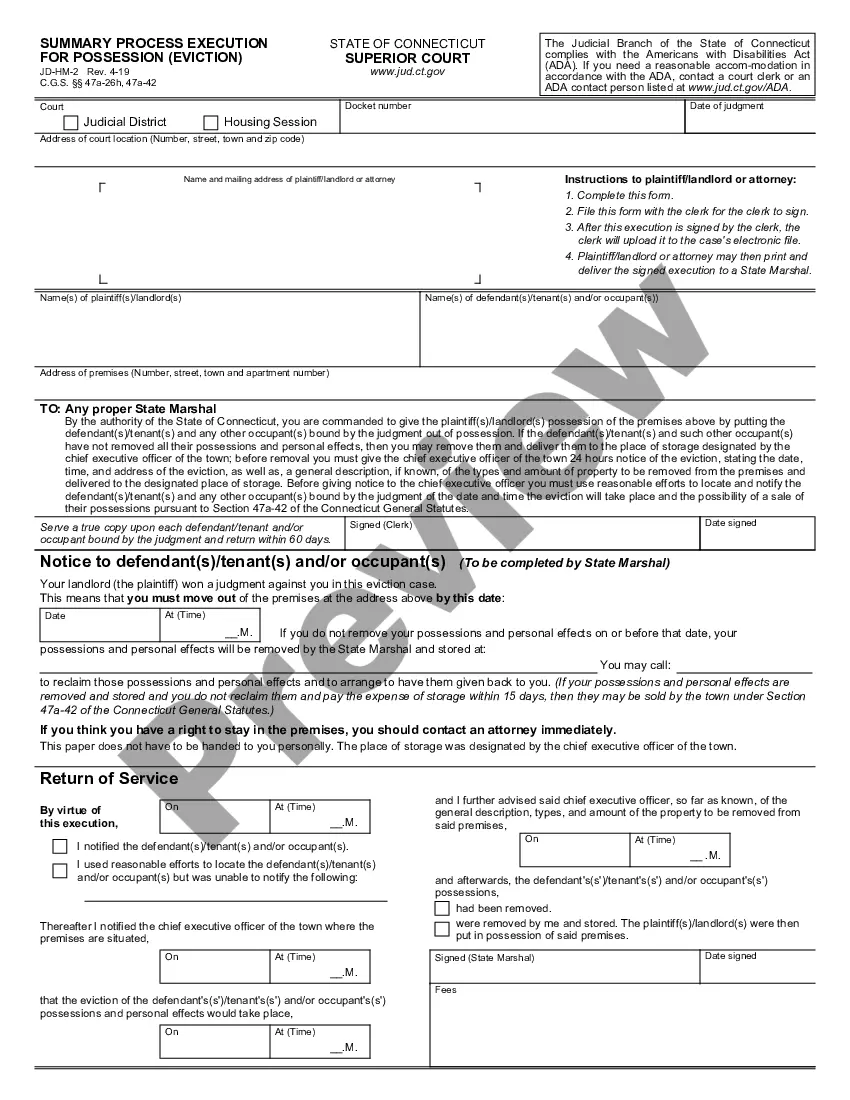

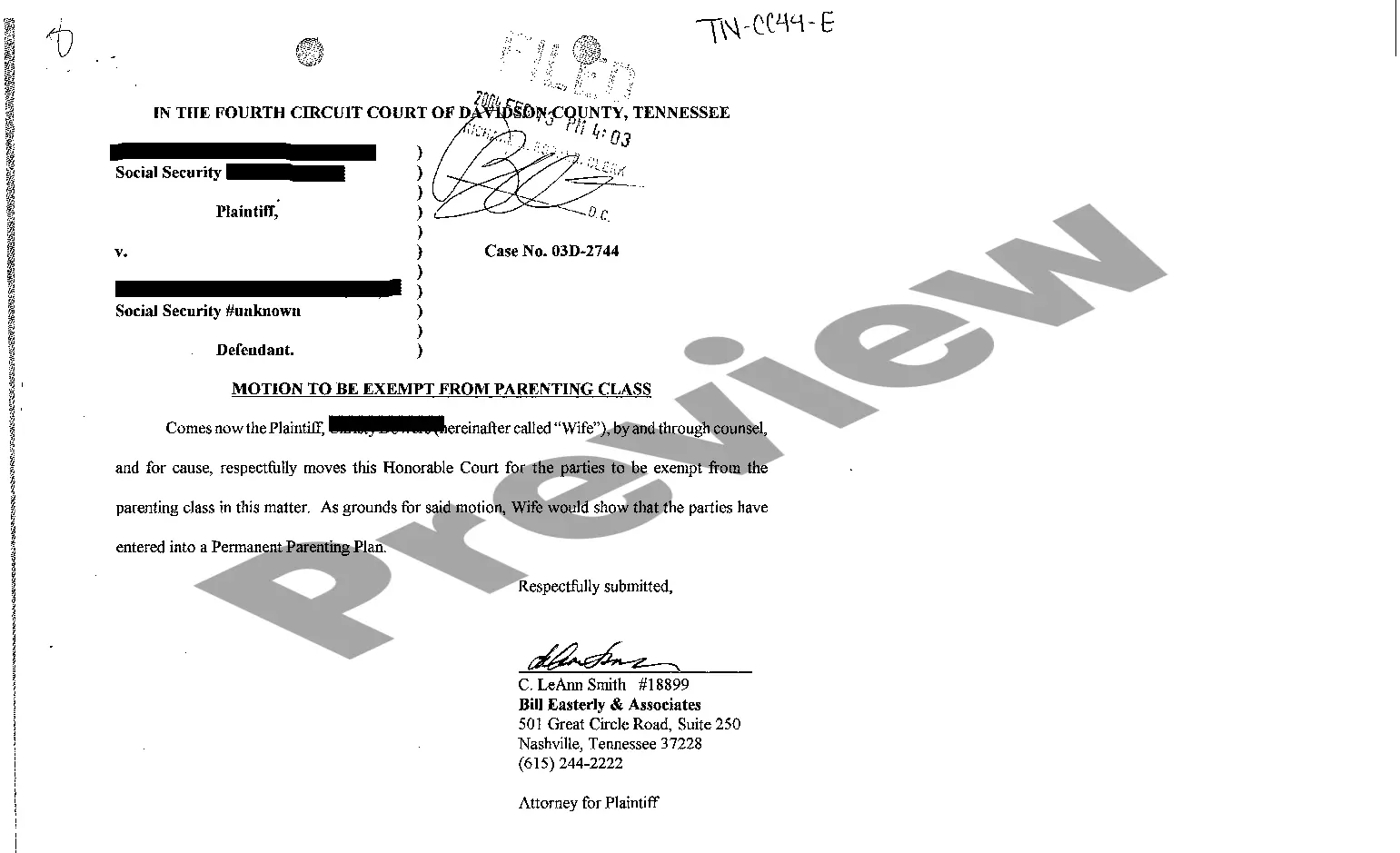

Description

How to fill out Contract For Assistant?

Properly written official documentation is one of the crucial assurances for preventing problems and legal disputes, but obtaining it without an attorney's assistance might require time.

Whether you're looking to swiftly locate a current Contract For Assistant or any other templates for employment, family, or business events, US Legal Forms is always available to assist.

The procedure is even more straightforward for current subscribers of the US Legal Forms library. If your subscription is active, you simply need to Log In/">Log In to your account and hit the Download button next to the selected file. Furthermore, you can access the Contract For Assistant anytime later, as all documents ever obtained on the platform remain accessible within the My documents section of your profile. Save time and money on preparing official documentation. Explore US Legal Forms today!

- Verify that the form fits your circumstances and locality by reviewing the description and preview.

- Search for an additional example (if necessary) using the Search bar in the page header.

- Click on Buy Now when you find the relevant template.

- Select the pricing plan, Log In/">Log Into your account, or create a new one.

- Choose your preferred payment option to purchase the subscription plan (via credit card or PayPal).

- Pick PDF or DOCX file format for your Contract For Assistant.

- Click Download, then print the template to complete it or incorporate it into an online editor.

Form popularity

FAQ

A virtual assistant is an independent contractor who provides administrative services to clients while operating outside of the client's office. A virtual assistant typically operates from a home office but can access the necessary planning documents, such as shared calendars, remotely.

What should be included in a virtual assistant contractDetailed descriptions of the work.Deliverables.Expected working hours/days.Payment details.Non-disclosure agreement (NDA) & non-solicitation clause.Cancellation clause.Termination of contract.Restrictive covenants.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

How to Create and Send Contracts to Your Virtual Assistant...Step 1: Write your contract. Create your contract in Pages, Word, or a Google Doc.Step 2: Upload your contract to HelloSign. Log into or sign up for HelloSign.Step 3: Prepare the contract for signing.Step 4: Send the contract to your client.

YES. You don't have to file a 1099 form if you don't have one from your client, but you have to report ALL income. It's your responsibility to track your expenses, track your income, and claim it all on your taxes. 1099 forms aside, that's your job.