Independent Contractor Form Document For Administrative Services

Description

How to fill out Independent Contractor Form Document For Administrative Services?

What is the most dependable service to obtain the Independent Contractor Form Document For Administrative Services along with other recent versions of legal documents? US Legal Forms is the solution!

It's the largest collection of legal templates for any purpose. Each sample is meticulously crafted and confirmed for adherence to federal and local laws. They are categorized by industry and state of application, making it easy to find the one you require.

US Legal Forms is a fantastic resource for anyone who needs to manage legal documents. Premium users can also take advantage of the ability to fill out and sign previously saved files electronically at any time using the built-in PDF editing feature. Give it a try today!

- Skilled users of the site simply need to Log In to the platform, verify their subscription status, and click the Download button beside the Independent Contractor Form Document For Administrative Services to acquire it.

- Once saved, the template is accessible for future use within the My documents section of your account.

- If you do not possess an account with our library yet, here are the steps you must follow to create one.

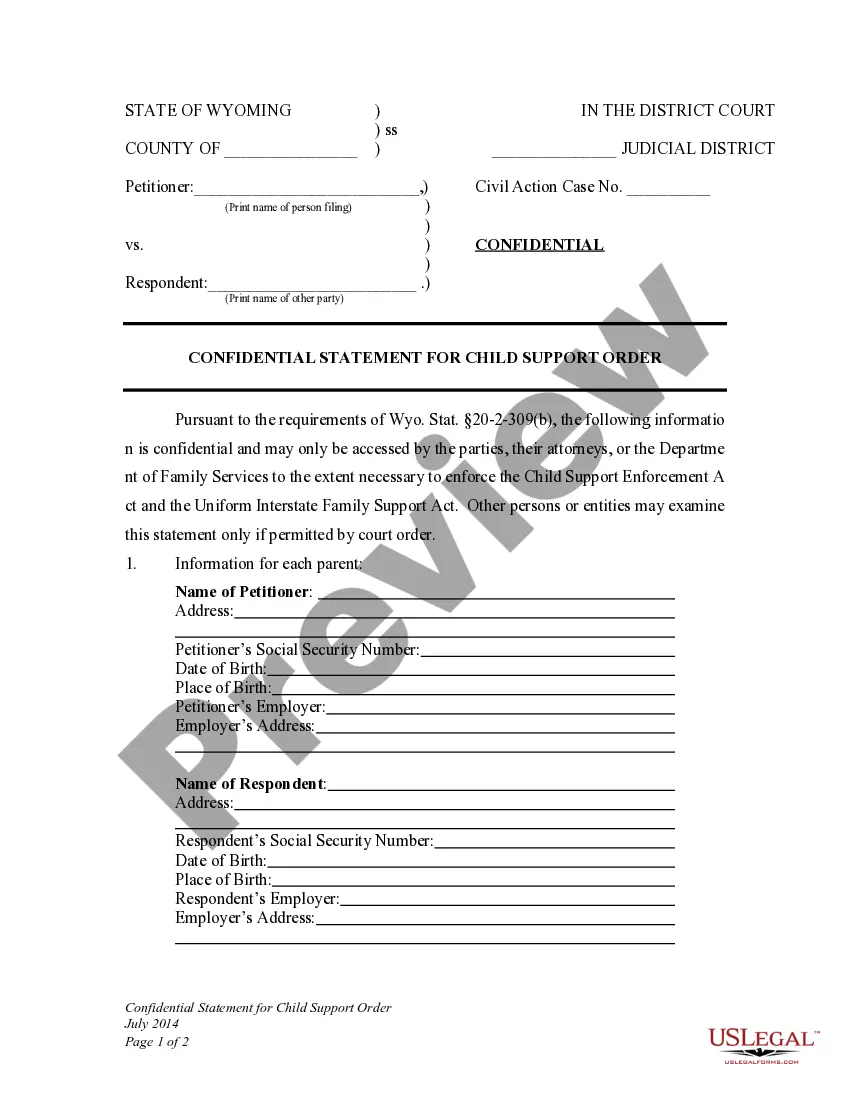

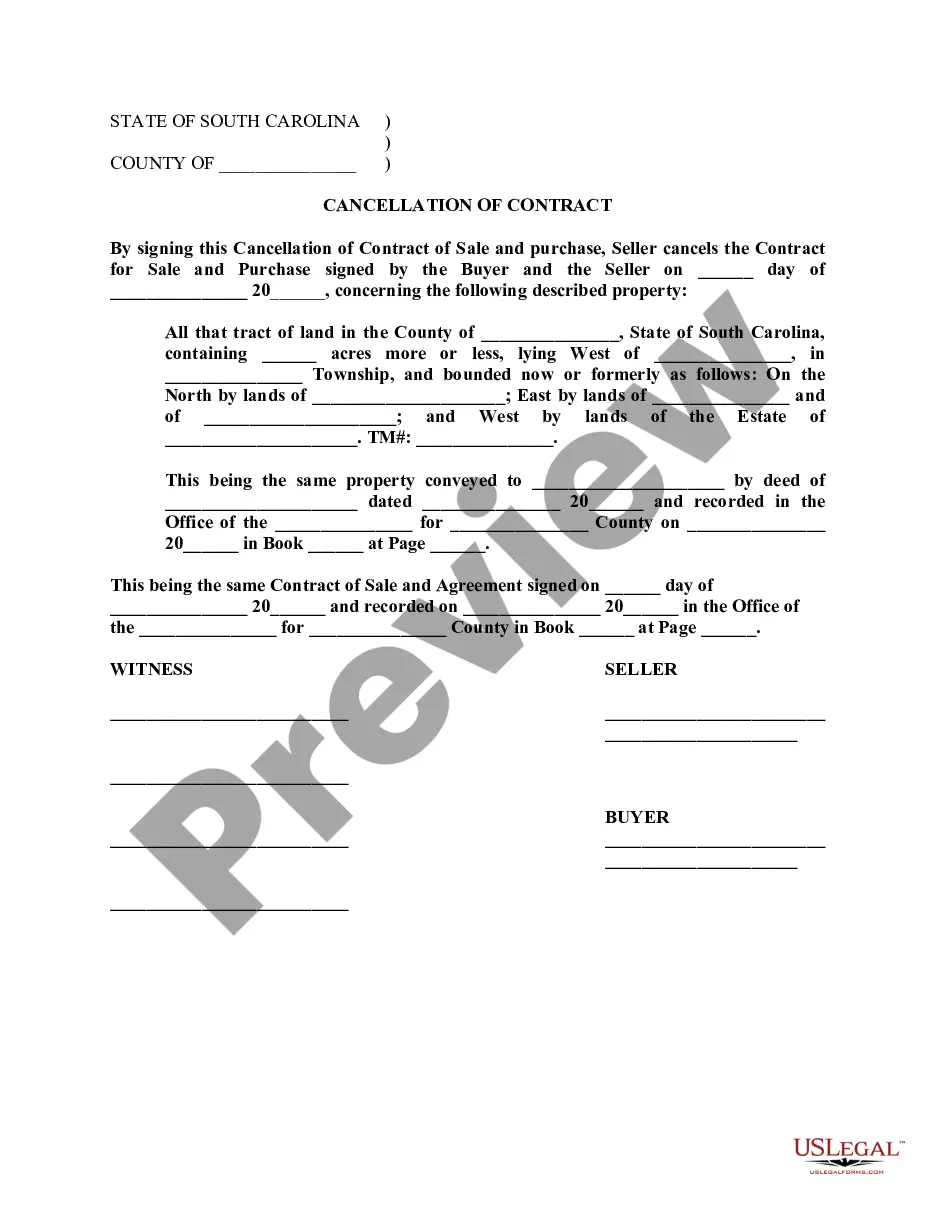

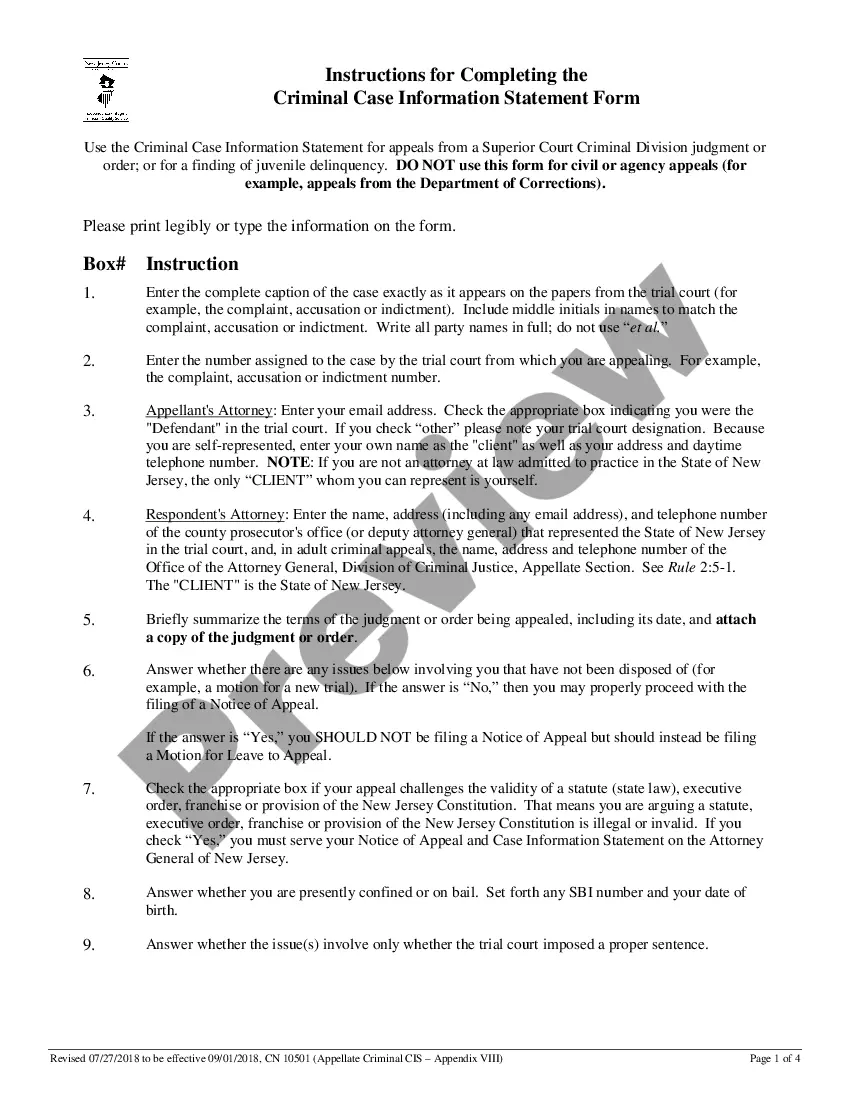

- Template compliance verification. Before obtaining any template, ensure it meets your usage criteria and complies with your state or locality's requirements. Review the template description and utilize the Preview if provided.

Form popularity

FAQ

NEC is the version of Form you use to tell the Internal Revenue Service whenever you've paid an independent contractor (or other selfemployed person) $600 or more in compensation. (That's $600 or more over the course of the entire year.)

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Generally, if you're an independent contractor you're considered self-employed and should report your income (nonemployee compensation) on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship).

How to Fill Out a 1099-MISC FormEnter your information in the 'payer' section.Fill in your tax ID number.As a business owner, enter the contractor's tax ID number which is found on their form W-9.Fill out the account number you have assigned to the independent contractor.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.