LLC Member Buyout Agreement — A Comprehensive Guide to Understanding the Process In the realm of business, changes and transitions are inevitable. As an LLC (Limited Liability Company) member, there may come a time when you need to separate from your current agreement or buy out a fellow member. This is where an LLC Member Buyout Agreement becomes crucial. In this detailed description, we will explore what an LLC Member Buyout Agreement entails, its significance, and highlight different types of buyout agreements available. An LLC Member Buyout Agreement is a legally binding document that outlines the terms and conditions involved in the buyout of a member's interest in an LLC. This agreement serves as a roadmap to smoothly handle member transitions, such as retirement, resignation, dissolution, death, or any other event that warrants a disengagement. It outlines the rights, responsibilities, and processes that both parties must adhere to during the buyout process. The significance of creating and signing an LLC Member Buyout Agreement cannot be overstated. This agreement provides clarity and protects the interests of all parties involved, minimizing potential conflicts and disputes. It guarantees a fair and equitable distribution of assets and liabilities, and ensures the LLC's continuity or dissolution in a streamlined manner. Different types of LLC Member Buyout Agreements exist to cater to various scenarios and preferences. Some prominent types include: 1. Cross-Purchase Buyout Agreement: Also known as a "Buy-Sell Agreement," this type of agreement allows the remaining LLC members to buy the departing member's interest proportionally. Each member agrees to purchase the departing member's interest at a predetermined price or formula. 2. Entity-Purchase Buyout Agreement: Also referred to as a "Redemption Agreement," this agreement focuses on the LLC itself buying out the departing member's interest. The LLC entity purchases the member's interest using its own funds or by securing a loan. This type is helpful when having many members who may not individually afford to buy out the departing member. 3. Wait-and-See Buyout Agreement: This type of agreement combines elements from both the cross-purchase and entity-purchase agreements. Initially, the remaining members have an option to buy the departing member's interest. If they decline, the LLC has the right to fulfill the buyout. 4. Put-Call Buyout Agreement: In this agreement, the departing member has the option to "put" their interest to the remaining members, who can then decide whether to "call" and purchase the interest or decline. This type provides flexibility to both parties and allows for negotiation based on market conditions or predetermined formulas. It's important to consult legal and financial professionals experienced in LLC agreements to determine the most suitable type of buyout agreement for your specific needs and circumstances. They will ensure that the agreement adheres to applicable state laws and meets the desired objectives. In conclusion, an LLC Member Buyout Agreement is a crucial aspect of managing transitions within an LLC effectively. Whether it's through a cross-purchase, entity-purchase, wait-and-see, or put-call agreement, having a clearly defined and legally binding agreement in place safeguards the interests of all involved parties during the buyout process. By understanding the significance of this agreement and seeking professional guidance, LLC members can navigate member buyouts with confidence and strive for a seamless transition.

Llc Member Buyout Agreement With Us

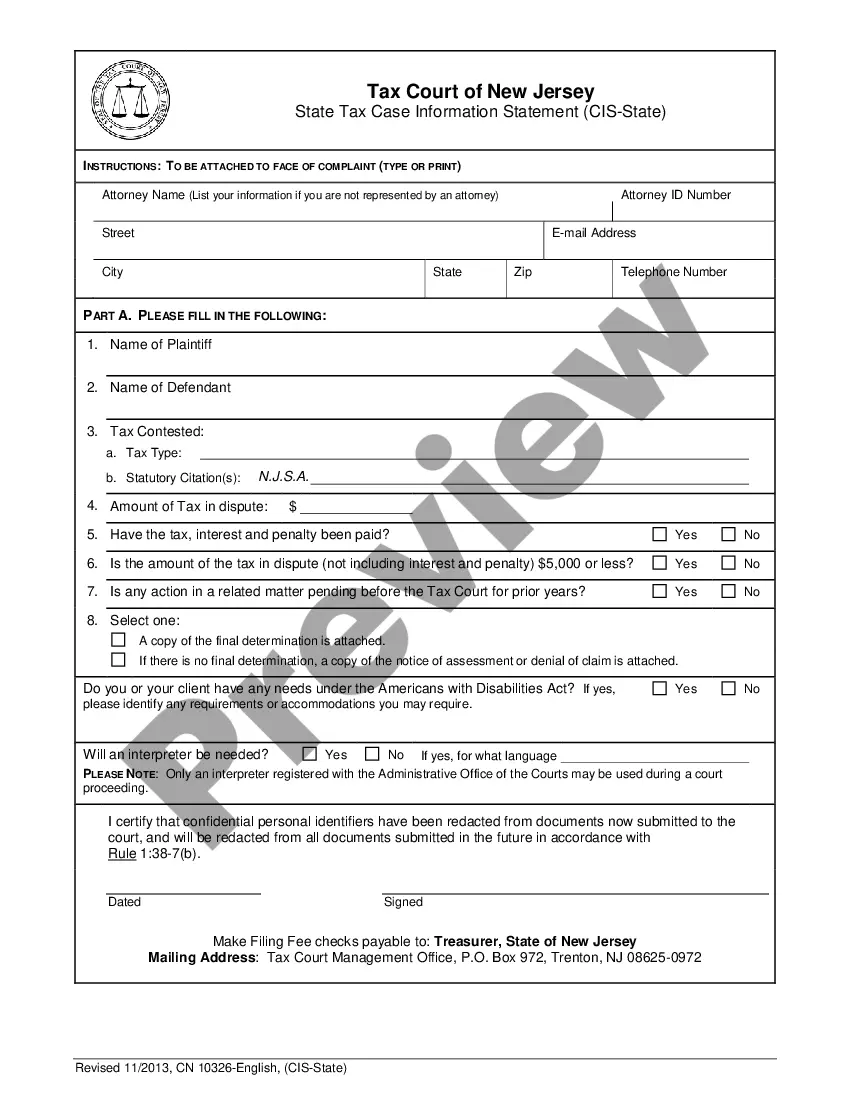

Description llc buyout agreement template

How to fill out Llc Member Buyout Agreement With Us?

Whether for business purposes or for personal matters, everyone has to handle legal situations sooner or later in their life. Completing legal papers requires careful attention, starting with choosing the appropriate form template. For example, if you choose a wrong version of a Llc Member Buyout Agreement With Us, it will be declined when you send it. It is therefore crucial to get a trustworthy source of legal documents like US Legal Forms.

If you have to get a Llc Member Buyout Agreement With Us template, follow these simple steps:

- Get the sample you need using the search field or catalog navigation.

- Look through the form’s description to ensure it suits your case, state, and region.

- Click on the form’s preview to see it.

- If it is the wrong form, get back to the search function to find the Llc Member Buyout Agreement With Us sample you require.

- Download the file when it matches your needs.

- If you already have a US Legal Forms profile, click Log in to gain access to previously saved files in My Forms.

- If you don’t have an account yet, you can download the form by clicking Buy now.

- Pick the correct pricing option.

- Complete the profile registration form.

- Choose your transaction method: you can use a credit card or PayPal account.

- Pick the document format you want and download the Llc Member Buyout Agreement With Us.

- Once it is downloaded, you can complete the form with the help of editing applications or print it and complete it manually.

With a large US Legal Forms catalog at hand, you do not have to spend time looking for the right sample across the web. Take advantage of the library’s simple navigation to get the correct template for any situation.

buyout agreement llc sample Form popularity

FAQ

To buy out partners in an LLC, you need to follow a clear process that includes reviewing your operating agreement. This document often outlines the steps for a member buyout, which may involve obtaining a fair market value for the ownership stake. We can assist you with creating an LLC member buyout agreement with us, ensuring that all legal aspects are covered. By utilizing our services, you can simplify the buyout process and protect the interests of all parties involved.

Filling out an LLC operating agreement requires you to provide the LLC’s name, address, and purpose, along with details about member roles and responsibilities. You'll also outline procedures for buyouts, which can be crucial if members decide to leave. Our platform simplifies this process, offering templates for an LLC member buyout agreement with us that ensure all necessary information is included.

Structuring a buyout agreement involves defining the terms of the buyout, including the valuation and payment schedule. It’s crucial to include responsibilities and timelines, ensuring all parties are on the same page. Using our platform for an LLC member buyout agreement with us allows for a comprehensive approach to these structures.

To structure a buyout deal, start by determining the valuation of the member's interest in the LLC. You should agree on payment methods, which can include lump-sum payments or installments. This clarity helps facilitate a fair transaction, and our tools assist in documenting the entire process within an LLC member buyout agreement with us.

An LLC buyout typically involves one member purchasing the interest of another member. This process allows for a smooth transition of ownership and ensures that the remaining members can maintain control of the LLC. You can streamline this process by using our LLC member buyout agreement with us.

When an LLC buys out a member, the ownership shares are transferred, which can significantly impact the remaining partners. A well-defined LLC member buyout agreement with us can facilitate this transaction smoothly, defining payment terms and share valuations. This process helps maintain business continuity while ensuring the interests of all parties are protected.

Removing a member from an LLC can be a complex process and often hinges on the terms set in the operating agreement. Generally, member removal must follow specified procedures to ensure fairness. An LLC member buyout agreement with us can provide the framework needed to handle such removals professionally, minimizing conflicts.

In partnerships, when one partner wishes to exit, it may disrupt the business dynamics. The partnership agreement should provide guidelines for how to handle such departures. Engaging with us to establish an LLC member buyout agreement can assure that the leaving partner has a fair exit while protecting the interests of remaining partners.

When a partner expresses a desire to leave an LLC, it can lead to financial and operational challenges. A comprehensive operating agreement can help address this situation. By working with us to create an LLC member buyout agreement, all parties can understand their rights and responsibilities, facilitating a more amicable separation.

If a partner decides to leave an LLC, it is essential to review the LLC operating agreement. This document often contains clauses related to member departures and buyouts. Utilizing a well-crafted LLC member buyout agreement with us ensures that the exit process is clear, fair, and maintains the stability of the business.