Loan Agreement Form With Collateral

Description loan agreement sample with collateral

How to fill out Loan Agreement Form With Collateral?

Legal managing can be overwhelming, even for skilled specialists. When you are looking for a Loan Agreement Form With Collateral and don’t get the time to spend looking for the appropriate and up-to-date version, the operations might be demanding. A robust online form catalogue could be a gamechanger for anybody who wants to take care of these situations effectively. US Legal Forms is a market leader in online legal forms, with more than 85,000 state-specific legal forms available whenever you want.

With US Legal Forms, you are able to:

- Access state- or county-specific legal and business forms. US Legal Forms covers any requirements you might have, from individual to enterprise documents, all-in-one location.

- Make use of innovative resources to complete and deal with your Loan Agreement Form With Collateral

- Access a resource base of articles, tutorials and handbooks and materials related to your situation and requirements

Help save effort and time looking for the documents you need, and employ US Legal Forms’ advanced search and Review tool to discover Loan Agreement Form With Collateral and get it. If you have a membership, log in to your US Legal Forms account, look for the form, and get it. Review your My Forms tab to find out the documents you previously saved and also to deal with your folders as you can see fit.

Should it be your first time with US Legal Forms, create an account and acquire unrestricted usage of all benefits of the platform. Listed below are the steps for taking after getting the form you want:

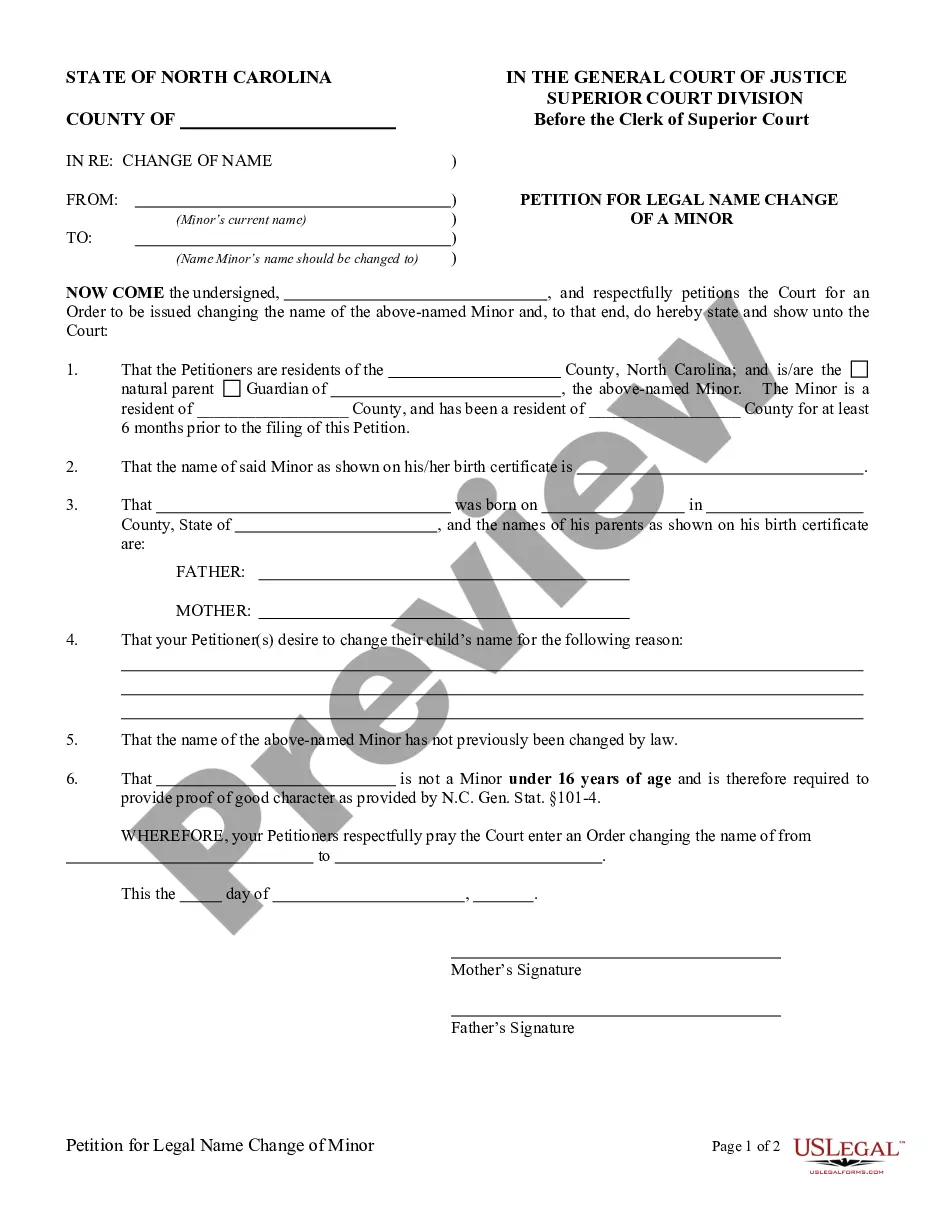

- Verify this is the right form by previewing it and looking at its information.

- Be sure that the sample is accepted in your state or county.

- Pick Buy Now once you are ready.

- Select a subscription plan.

- Find the formatting you want, and Download, complete, sign, print and send your document.

Take advantage of the US Legal Forms online catalogue, backed with 25 years of experience and stability. Enhance your day-to-day document administration in to a smooth and easy-to-use process right now.

short loan agreement sample Form popularity

collateral agreement contract law Other Form Names

collateral agreement FAQ

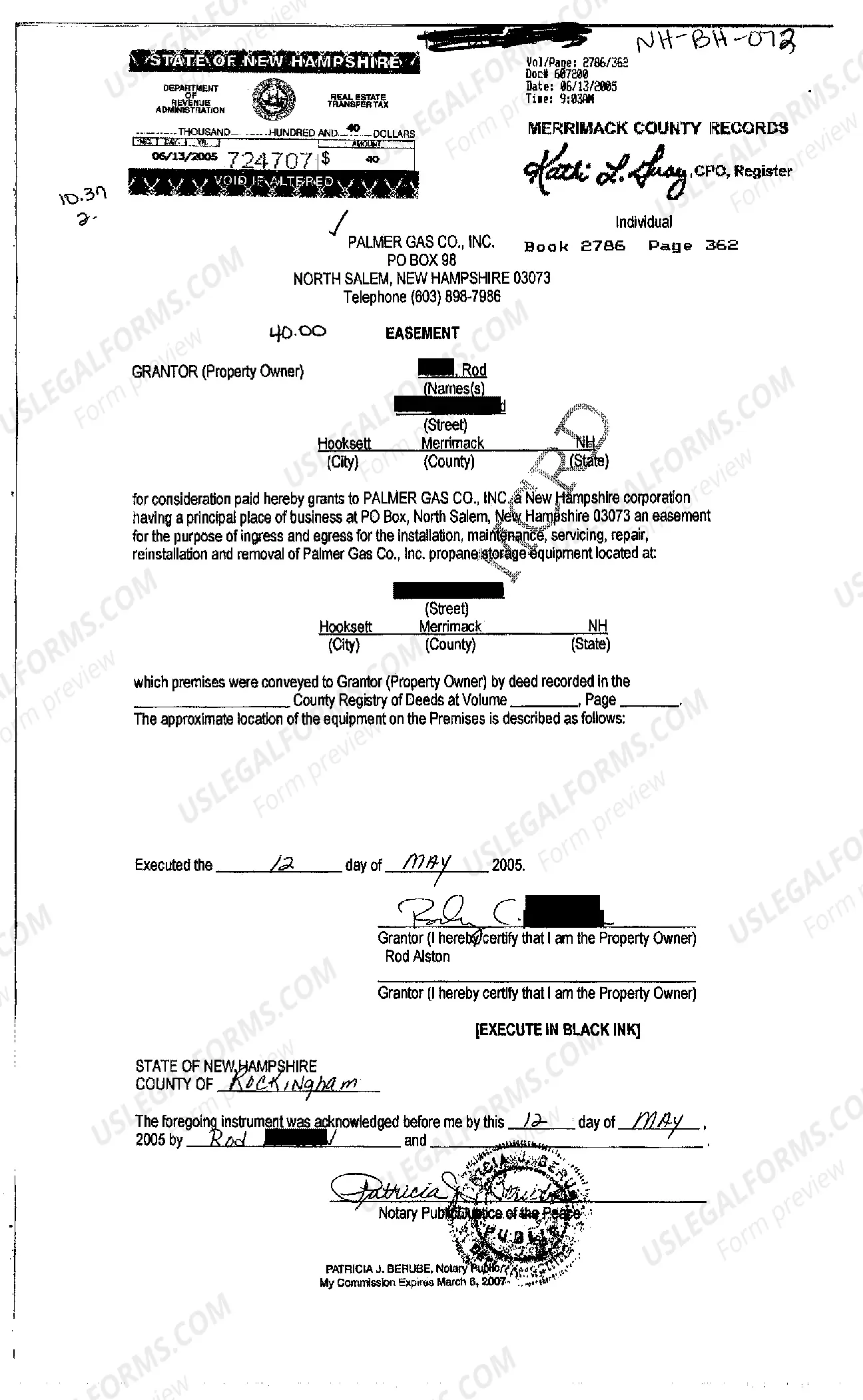

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

A secured promissory note requires the borrower to safeguard the loan by putting up items of hard value, such as the home, condominium or rental property you're purchasing, as collateral to ensure the mortgage is repaid.

For example, if X agrees to buy goods from Y that will, ingly, be manufactured by Z, and does so on the strength of Z's assurance as to the high quality of the goods, X and Z may be held to have made a collateral contract consisting of Z's promise of quality given in consideration of X's promise to enter into the ...

Collateral is an item of value pledged to secure a loan. Collateral reduces the risk for lenders. If a borrower defaults on the loan, the lender can seize the collateral and sell it to recoup its losses.