Notice of assignment factoring refers to a financial transaction in which a business sells its accounts receivables to a third party, known as a factor, in exchange for immediate cash flow. This practice helps businesses improve their liquidity by converting their unpaid invoices into cash without having to wait for their customers to make the payments. In this process, the business notifies its customers that the unpaid invoices have been assigned to a factor, indicating that the customers should make the payments directly to the factor instead of the original business. This notification is known as a Notice of assignment. There are different types of Notice of assignment factoring that businesses can choose from based on their specific needs and requirements. These include: 1. Recourse Factoring: In this type of factoring, the business remains responsible for any unpaid invoices if the customer fails to make the payment. The factor provides the business with the agreed-upon cash advance, but if the customer does not pay, the business must reimburse the factor. 2. Non-Recourse Factoring: With non-recourse factoring, the factor assumes the credit risk for unpaid invoices. If a customer fails to make a payment, the factor absorbs the loss instead of the business. However, non-recourse factoring usually comes with higher fees and stricter credit evaluations. 3. Spot Factoring: Spot factoring allows businesses to selectively choose which invoices to factor, providing flexibility when it comes to managing cash flow. This option enables businesses to factor specific invoices as needed, without any obligation to factor all their invoices. 4. Invoice Discounting: Invoice discounting is a type of Notice of assignment factoring in which a business retains control over the collection process. Instead of notifying customers, the business privately assigns the invoices to the factor. The factor provides an advance payment, and the business remains responsible for collecting the payment from the customers. Overall, Notice of assignment factoring offers businesses a way to access immediate working capital by leveraging their accounts receivables. By choosing the appropriate type of factoring, businesses can effectively manage their cash flow, reduce financial stress, and focus on growth opportunities.

Notice Of Assignment Factoring

Description factoring release letter sample

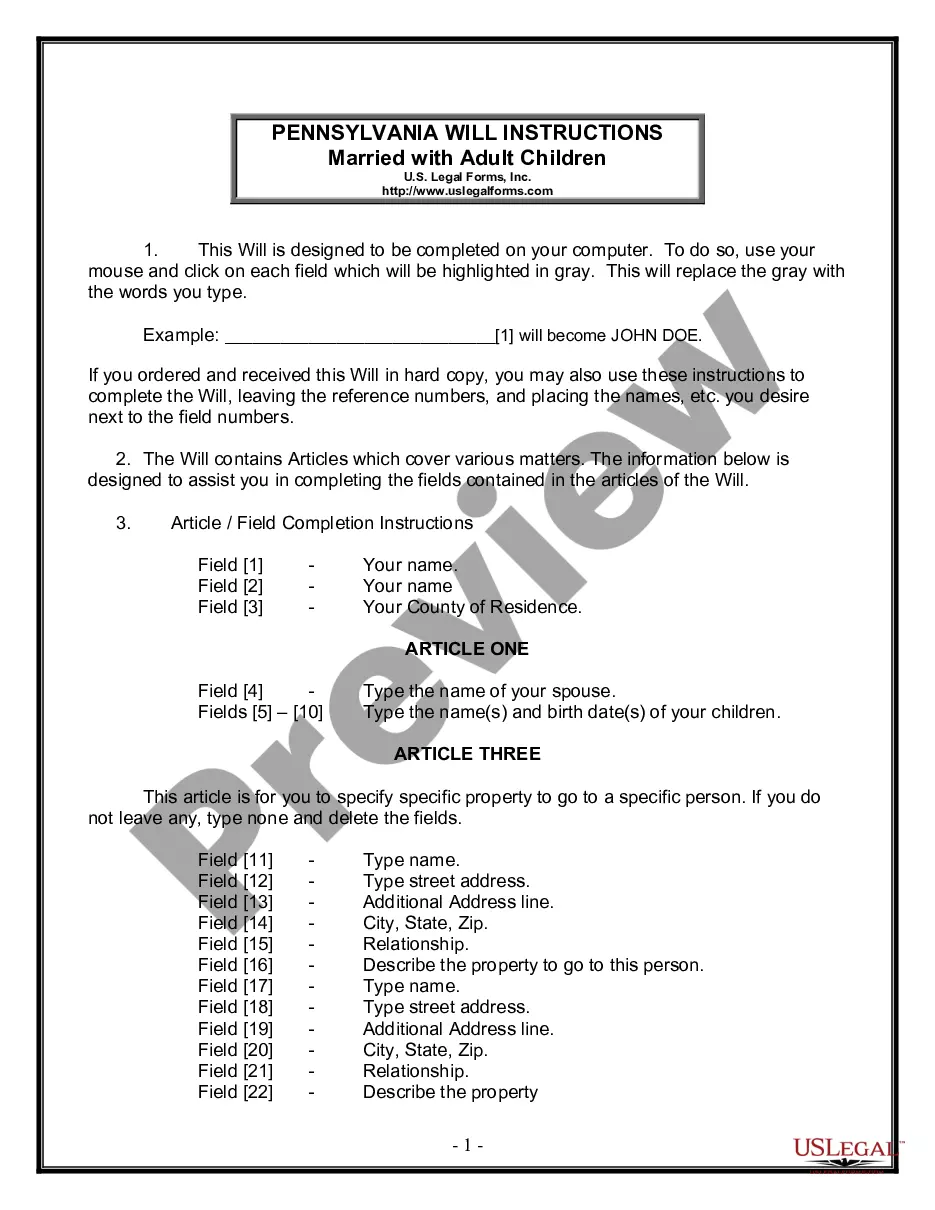

How to fill out Notice Of Assignment Factoring?

Obtaining legal templates that comply with federal and local regulations is essential, and the internet offers numerous options to pick from. But what’s the point in wasting time looking for the correctly drafted Notice Of Assignment Factoring sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the biggest online legal catalog with over 85,000 fillable templates drafted by attorneys for any business and life scenario. They are easy to browse with all files organized by state and purpose of use. Our experts keep up with legislative updates, so you can always be confident your paperwork is up to date and compliant when acquiring a Notice Of Assignment Factoring from our website.

Obtaining a Notice Of Assignment Factoring is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the right format. If you are new to our website, adhere to the instructions below:

- Take a look at the template utilizing the Preview feature or through the text description to ensure it fits your needs.

- Browse for a different sample utilizing the search tool at the top of the page if necessary.

- Click Buy Now when you’ve found the suitable form and select a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Notice Of Assignment Factoring and download it.

All documents you find through US Legal Forms are multi-usable. To re-download and fill out earlier obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Creating a living trust in Iowa occurs when you create a trust document and sign it in front of a notary public.

How much does a Trust cost in Iowa? In Iowa, the cost of setting up a basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts may cost even more.

A trust is private while a will is not. Alternatively, a trust is not filed with the court and in Iowa, we have a Certification of Trust, which we can provide to financial institutions or anyone else who may need to know about the existence of the trust.

Family trusts can be used to pass on wealth within the family. They allow you to specify who should receive the money and what it should be used for, whether during the settlor's lifetime or after their death. One advantage of using a trust is that it can prevent children from frittering away their inheritances.

When assets are passed in a will, they are distributed as soon as probate concludes. Trusts are more complex to challenge than wills are, making them more secure.

Typically, you'll name yourself as the "trustee" of your trust. This means that while you are alive, you retain control of the trust and its property. In your trust document, you will also name a "successor trustee" to take over and manage the trust (distribute your property) after you die.

How Do I Set Up A Living Trust In Iowa? Take inventory of the property that will be included in the trust. Name a successor trustee. Decide who will be the beneficiaries of the trust (those that will get the property after you die) Seek an attorney to help prepare the trust documents.

While wills are commonly used, living trusts offer advantages such as avoiding probate, providing for minor children, and efficient asset management. However, living trusts can be more complex and involve higher upfront costs.