Investment Management Agreement Template Foreign

Description

How to fill out Investment Management Agreement Template Foreign?

There’s no longer a need to squander hours searching for legal documents to fulfill your local state obligations.

US Legal Forms has gathered all of them in a single location and made them easier to access.

Our website provides over 85k templates for any business and personal legal situations categorized by state and usage area.

Utilize the search bar above to find another sample if the one currently displayed does not suit you.

- All forms are properly prepared and verified for accuracy, so you can trust in acquiring an updated Investment Management Agreement Template Foreign.

- If you are acquainted with our platform and have an account, ensure your subscription is active prior to acquiring any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents at any time by accessing the My documents tab in your profile.

- If you are new to our platform, the procedure will require some additional steps to finish.

- Here’s how new users can find the Investment Management Agreement Template Foreign in our collection.

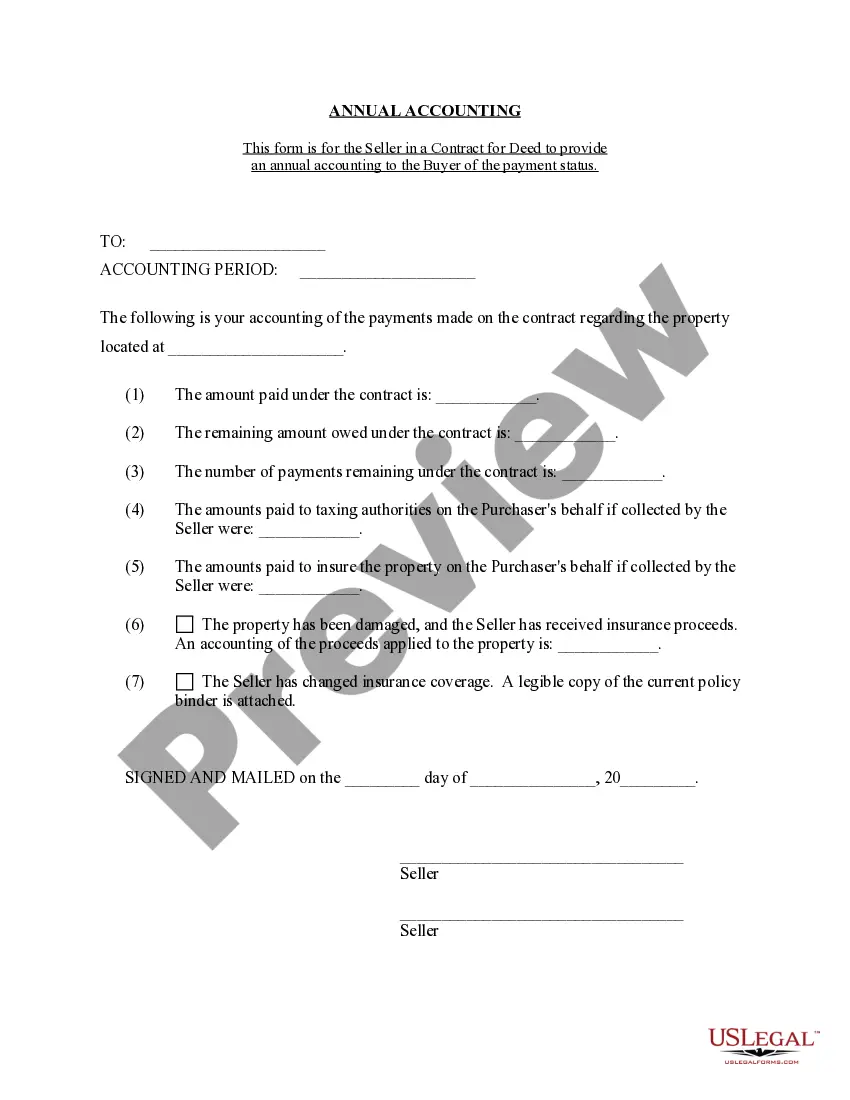

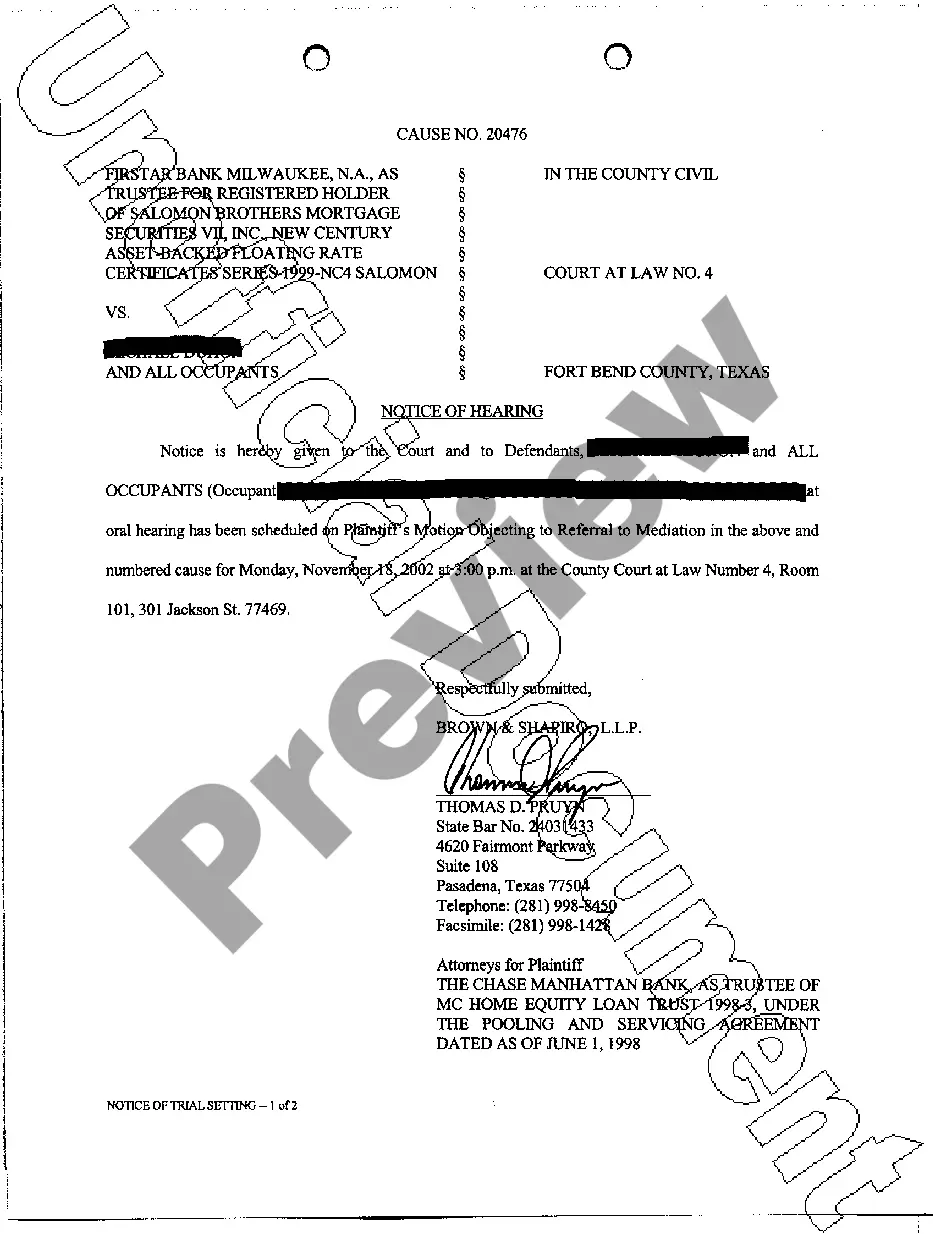

- Examine the page content closely to verify that it contains the sample you need.

- To do this, use the form description and preview options if available.

Form popularity

FAQ

If you are the client, some of the basic terms you will want to bear in mind are: Authority. The agreement will grant the adviser discretionary or non-discretionary authority.Investment Guidelines.Fees and Expenses.Use of Pooled Vehicles and Other Managers.Custody.Reporting.Brokerage.Voting/Class Actions.

An Individually Managed Account or IMA is a discretionary management agreement whereby clients delegate the day to day investment decisions and implementation of their chosen investment strategy to PPM while retaining the full beneficial ownership of their investments.

Investment management agreements (IMAs) are legal documents that give investment managers the authority to manage capital on behalf of investors. They detail the terms and conditions under which a client will invest in a shared vehicle while agreeing to pay investment management service fees and direct expenses.

When you invest in an MDAs (or SMA) portfolio on the other hand, all assets are bought at once. The investment program in an IMA may have growth, income, or other goals. For example, your funds can be directed to specific sectors, such as environmentally conscious investments.

Investment Management Agreement (IMA means a formal arrangement between a financial adviser and an investor stipulating the terms under which the adviser is authorized to act on behalf of the investor to manage the assets listed in the agreement. Sample 1Sample 2.