Clawback Meaning in Insurance: Explained with Different Types Clawback is a term used in the insurance industry that refers to the recovery of funds by an insurer after a claim has been paid out. It is a critical aspect of risk management in insurance and is typically implemented to rectify situations where an overpayment has occurred due to errors, fraud, or other circumstances. There are several types of clawback provisions in insurance, each serving a unique purpose. Here, we'll delve into the meaning of clawback in insurance and discuss its various types: 1. Premium Clawback: Premium clawback occurs when an insurer recoups the excess premium initially paid by an insured. This happens when an insured revises their policy during the coverage period, resulting in a lower premium obligation. The insurer then reimburses the insured for the difference between the original premium paid and the adjusted premium amount. 2. Claims Clawback: In the realm of claims, a clawback may happen when an insurer discovers that they have made an excessive payment to a policyholder. This can occur due to errors made during claims processing, miscalculations, or instances of fraud. The insurer will then "claw back" the overpayment from the policyholder by deducting it from future claim settlements. 3. Clawback of Agent Commissions: Insurance agents typically receive commissions based on the premiums collected from their clients. However, if a policy is canceled or if a premium is returned (e.g., due to early policy termination), the insurer may exercise a clawback provision to recover the commission previously paid to the agent. 4. Loss Experience Clawback: Loss experience clawbacks, also known as experience rating adjustments, are used in loss-sensitive insurance policies. If the actual loss experience of a policyholder exceeds the anticipated or predicted levels, the insurer may enact a clawback to recover funds equivalent to the excess losses incurred. This helps maintain the overall profitability and risk balance of the insurance provider. 5. Risk Corridor Clawback: Risk corridor programs are designed to stabilize insurance marketplaces and limit risks for insurers participating in high-risk markets. Under these programs, if an insurer's actual costs fall significantly below the anticipated levels, the excess profit gained is subject to clawback. Conversely, if the costs exceed expectations, the insurer may be entitled to reimbursement. In summary, clawback in insurance refers to the recovery of funds by an insurer after a claim or premium payment has been made. The various types of clawbacks include premium clawback, claims clawback, clawback of agent commissions, loss experience clawback, and risk corridor clawback. These provisions enable insurers to rectify overpayments, mitigate risks, and maintain a balanced financial position within the industry.

Clawback Meaning In Insurance

Description clawback of reimbursement

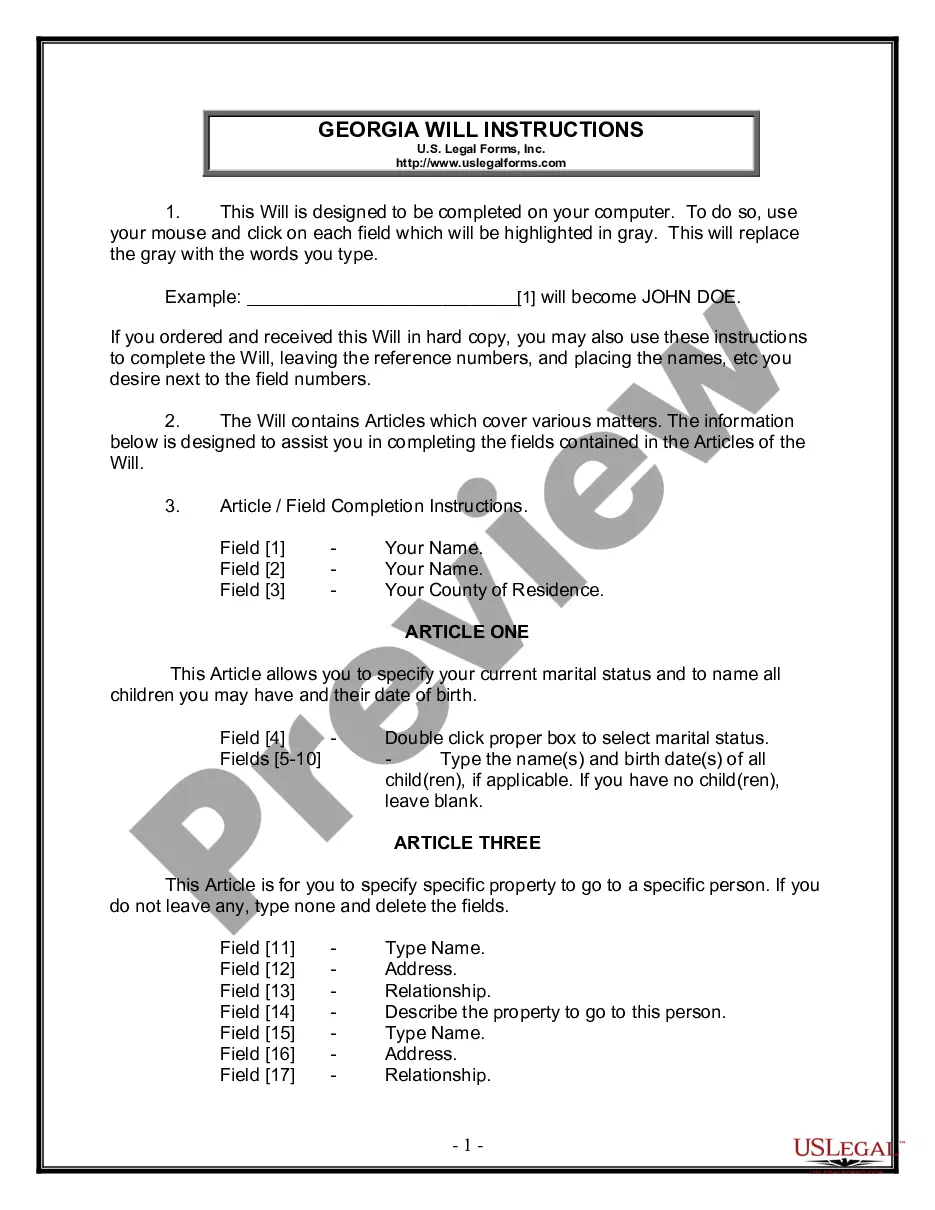

How to fill out Clawback Meaning In Insurance?

Whether for business purposes or for individual matters, everyone has to handle legal situations sooner or later in their life. Filling out legal paperwork requires careful attention, starting with selecting the correct form template. For instance, if you pick a wrong edition of the Clawback Meaning In Insurance, it will be rejected once you submit it. It is therefore important to get a trustworthy source of legal documents like US Legal Forms.

If you need to obtain a Clawback Meaning In Insurance template, follow these simple steps:

- Find the sample you need by using the search field or catalog navigation.

- Check out the form’s information to make sure it fits your case, state, and county.

- Click on the form’s preview to view it.

- If it is the wrong document, get back to the search function to locate the Clawback Meaning In Insurance sample you need.

- Download the file when it matches your requirements.

- If you have a US Legal Forms account, simply click Log in to gain access to previously saved documents in My Forms.

- If you do not have an account yet, you may download the form by clicking Buy now.

- Select the correct pricing option.

- Finish the account registration form.

- Choose your payment method: you can use a bank card or PayPal account.

- Select the file format you want and download the Clawback Meaning In Insurance.

- After it is downloaded, you can fill out the form by using editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you never need to spend time seeking for the right sample across the web. Use the library’s straightforward navigation to get the correct template for any situation.

Form popularity

FAQ

Clawbacks under a clawback policy should recover compensation that is (1) incentive-based, (2) erroneously awarded, and (3) received by an executive officer during the three years preceding the date an accounting restatement was required (discussed below).

What are insurance clawbacks? ?Insurance clawbacks? describe when a third-party payor (usually an insurance plan) requests repayment of funds it initially paid to underwrite a service. Clawbacks occur when the payor later determines that the service was not covered.

Clawback Agreement Example For example, a senior executive may have been awarded $1 million dollars in stock, based on company performance. Then years later, it may be discovered that the company performance calculations were inaccurate or fraudulent.

Employee agrees that the Company shall have the right to require Employee to repay the value of the shares received by Employee pursuant to this Agreement, as may be required by law (including, without limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act and implementing rules and regulations ...

Clawbacks are legal clauses that allow companies to recoup funds that they previously distributed. Clawbacks usually apply in cases of fraud or employee misconduct and companies can use them to recover Medicaid payments, executive-level bonuses, company pensions, life insurance payments or shareholder dividends.