Title: Wage Form Statements for Cracker Barrel: Understanding Your Earnings Introduction: In this article, we will delve into the comprehensive details of wage form statements provided by Cracker Barrel, an esteemed restaurant and retail company. Understanding these statements is crucial for employees to comprehend their earnings accurately. We will also explore any possible variations in types of wage form statements that Cracker Barrel may offer. 1. Cracker Barrel Wage Form Statement Overview: Cracker Barrel's Wage Form Statement is a document that provides a detailed summary of an employee's compensation and deductions during a specific pay period. It helps individuals monitor their earnings, taxes, and other relevant information. These forms are distributed on a regular basis, usually weekly or bi-weekly. 2. Key Components of Cracker Barrel Wage Form Statement: a) Personal Information: The wage statement typically includes the employee's full name, employee identification number, department, and date of issuance. b) Earnings Summary: This section breaks down the employee's gross earnings for the pay period, including regular hours worked, overtime hours (if applicable), and any shift differentials. Gross earnings encompass the base pay, tips, commissions, bonuses, or any additional compensation. c) Deductions: This part outlines the deductions made from the employee's gross earnings. Common deductions may include federal, state, and local taxes, Social Security contributions, healthcare premiums, retirement contributions, and any other authorized adjustments. d) Net Pay Calculation: The net pay calculation displays the amount an employee receives after all deductions have been subtracted from their gross earnings. This value reflects the actual monetary compensation that an employee takes home. e) Year-to-Date (YTD) Summary: Cracker Barrel's salary statements often include a Year-to-Date summary. This section shows the cumulative earnings, taxes, and deductions from the beginning of the calendar year to the current pay period. 3. Types of Cracker Barrel Wage Form Statements (if applicable): a) Regular Employees: Regular employees who work fixed hours and receive a consistent salary usually receive a standard wage form statement, encompassing the aforementioned components. b) Hourly Employees: Hourly workers who earn wages based on the number of hours worked may receive a slightly different wage form statement. It includes details regarding the specific hours worked (regular and overtime), the hourly wage, and the corresponding amount for each. c) Salaried Employees: Salaried employees, who receive a fixed salary regardless of hours worked, may have a simplified version of the wage form statement. It primarily emphasizes the fixed salary, deductions, and net pay. Conclusion: Understanding the various components of Cracker Barrel's Wage Form Statements is crucial for employees to keep track of their earnings, deductions, and year-to-date details accurately. Regardless of the specific job type within Cracker Barrel, monitoring these statements ensures transparency and allows individuals to manage their finances effectively.

Wage Form Statements For Cracker Barrel

Description onlinewagestatements hca

How to fill out Wage Form Statements For Cracker Barrel?

Whether for business purposes or for personal matters, everyone has to manage legal situations at some point in their life. Filling out legal papers requires careful attention, beginning from choosing the right form template. For example, if you select a wrong edition of a Wage Form Statements For Cracker Barrel, it will be turned down when you send it. It is therefore crucial to get a dependable source of legal documents like US Legal Forms.

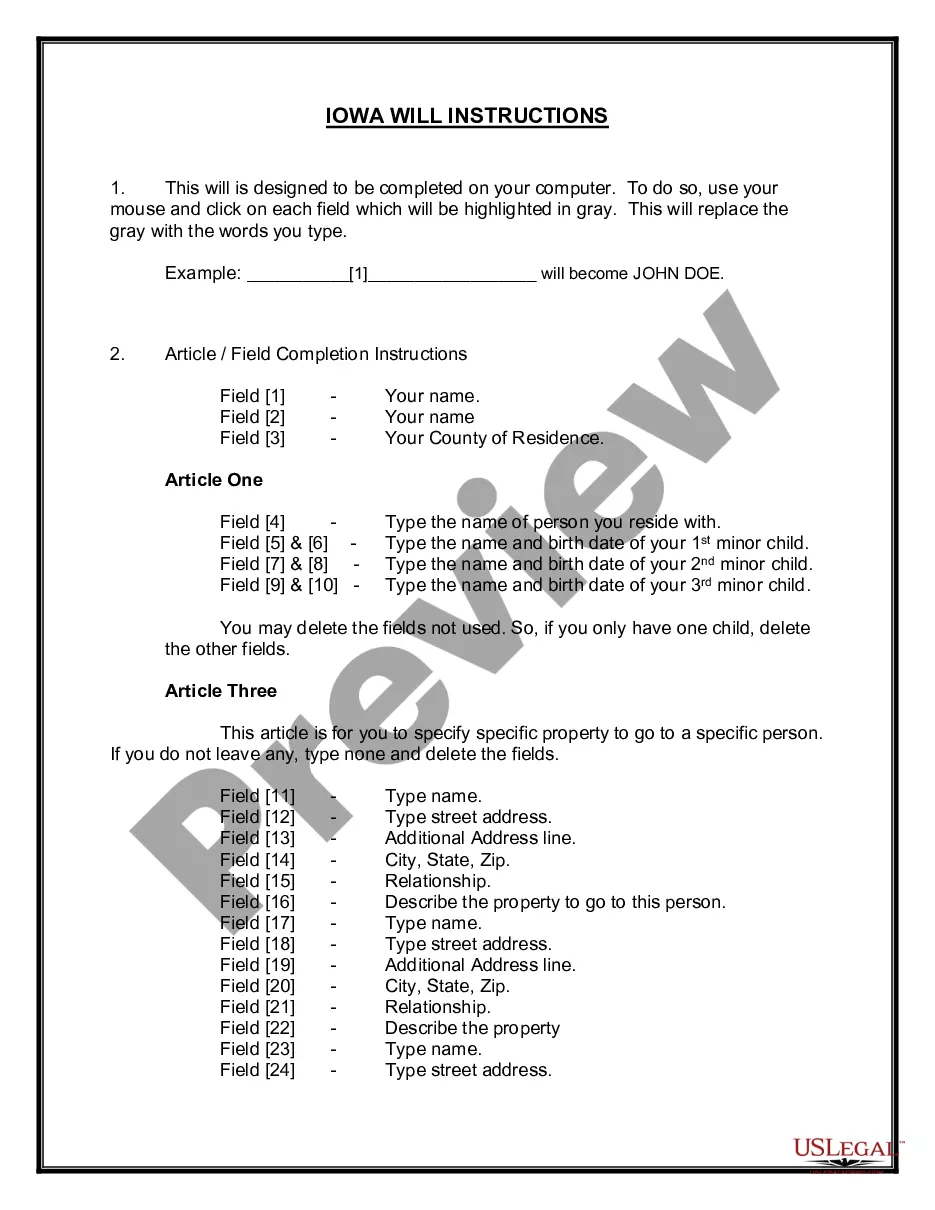

If you need to obtain a Wage Form Statements For Cracker Barrel template, stick to these simple steps:

- Find the sample you need by using the search field or catalog navigation.

- Check out the form’s description to ensure it fits your situation, state, and county.

- Click on the form’s preview to view it.

- If it is the incorrect form, go back to the search function to find the Wage Form Statements For Cracker Barrel sample you require.

- Get the template when it matches your requirements.

- If you already have a US Legal Forms account, simply click Log in to gain access to previously saved templates in My Forms.

- In the event you don’t have an account yet, you may download the form by clicking Buy now.

- Select the correct pricing option.

- Finish the account registration form.

- Select your transaction method: you can use a bank card or PayPal account.

- Select the document format you want and download the Wage Form Statements For Cracker Barrel.

- After it is saved, you are able to complete the form by using editing applications or print it and complete it manually.

With a large US Legal Forms catalog at hand, you do not have to spend time searching for the appropriate sample across the internet. Utilize the library’s easy navigation to get the proper template for any situation.

Form popularity

FAQ

There are three requirements for a valid will in South Carolina: It is signed by the will-maker. It must have two witness signatures. It must be notarized by a notary public.

How do you prove separation in SC? You can prove separation for a no-fault divorce in South Carolina by living in separate residences for at least one year. It is not considered ?separation? if you live in different rooms in the same house.

First permanent English settlement in South Carolina established at Albemarle Point in Charleston in 1670.

Spouses in South Carolina have a right to all marital property. Marital property is all the real and personal property acquired by the parties during the marriage and owned at the date of filing for divorce.

If the retirement account started during the marriage, then it's almost certainly a marital asset, and the spouse could be entitled to some of it, possibly even more than 50% depending on the circumstances. If the retirement account started before the marriage, then it may be non-marital.

It really depends on the size of the marital estate. If the marital estate is large enough, then the court can award the house and its equity to one spouse while the other makes up for it by receiving other assets. Family court judges have a ton of discretion in making their decisions.

In South Carolina, when a spouse requests alimony, the court has the discretion to make an appropriate alimony order, considering the couple's circumstances. South Carolina law provides for the following types of alimony: Alimony pendente lite.

As family law attorneys in Charleston, SC, we've been asked whether South Carolina is a community property state. The short answer is ?no.? However, South Carolina is called an ?equitable division,? sometimes referred to as a ?separate property,? state. In most long marriages, the split will not be far from 50/50.