A profit and loss statement, also known as an income statement, is a financial report that summarizes the revenues, expenses, and overall profitability of a small business over a specific period. It provides a comprehensive picture of a company's financial performance, which is crucial for making informed business decisions. This article will highlight the significance of a profit and loss statement for small businesses and provide examples of different types. One common type of profit and loss statement example for small businesses is the single-step income statement. This straightforward statement categorizes income and expenses into two main sections: revenues and expenses. Revenues include sales, service fees, interest income, and any other income sources, while expenses include costs of goods sold, operating expenses, interest expenses, and taxes. The net income or net loss is then calculated by subtracting total expenses from total revenues. Another type of profit and loss statement example is the multi-step income statement. This statement is more detailed and provides additional insights into a company's financial performance. It includes multiple steps to calculate the net income or net loss, such as gross profit, operating income, and income before taxes. The gross profit is determined by subtracting the cost of goods sold from net sales, while operating income is derived by deducting operating expenses from gross profit. Finally, income before taxes is obtained by subtracting other non-operating expenses or adding non-operating revenues. Additionally, small businesses often use a comparative profit and loss statement. This type of statement allows the business owner to compare the financial performance of their business over different periods, typically months or years. By analyzing these comparative statements, businesses can identify trends, changes in income or expenses, and assess their overall financial growth or decline. This information enables business owners to make appropriate adjustments, identify areas of improvement, and plan for the future. Keywords: profit and loss statement, income statement, small business, financial report, revenues, expenses, profitability, business decisions, single-step income statement, multi-step income statement, gross profit, operating income, income before taxes, comparative profit and loss statement, financial performance, net income, net loss, costs of goods sold, operating expenses, interest income, interest expenses, taxes.

Profit And Loss Statement Example For Small Business

Description small business profit and loss statement

How to fill out Profit And Loss Account For Small Business?

Legal papers management can be overpowering, even for the most knowledgeable experts. When you are interested in a Profit And Loss Statement Example For Small Business and do not have the time to devote searching for the correct and up-to-date version, the procedures could be demanding. A strong web form catalogue could be a gamechanger for anybody who wants to take care of these situations efficiently. US Legal Forms is a market leader in online legal forms, with over 85,000 state-specific legal forms available whenever you want.

With US Legal Forms, it is possible to:

- Access state- or county-specific legal and business forms. US Legal Forms handles any demands you may have, from personal to enterprise papers, in one spot.

- Employ advanced resources to accomplish and deal with your Profit And Loss Statement Example For Small Business

- Access a resource base of articles, tutorials and handbooks and resources related to your situation and needs

Save effort and time searching for the papers you need, and make use of US Legal Forms’ advanced search and Preview tool to discover Profit And Loss Statement Example For Small Business and download it. In case you have a membership, log in to the US Legal Forms profile, look for the form, and download it. Take a look at My Forms tab to see the papers you previously saved and to deal with your folders as you see fit.

If it is your first time with US Legal Forms, register a free account and get unlimited use of all benefits of the platform. Listed below are the steps to consider after downloading the form you want:

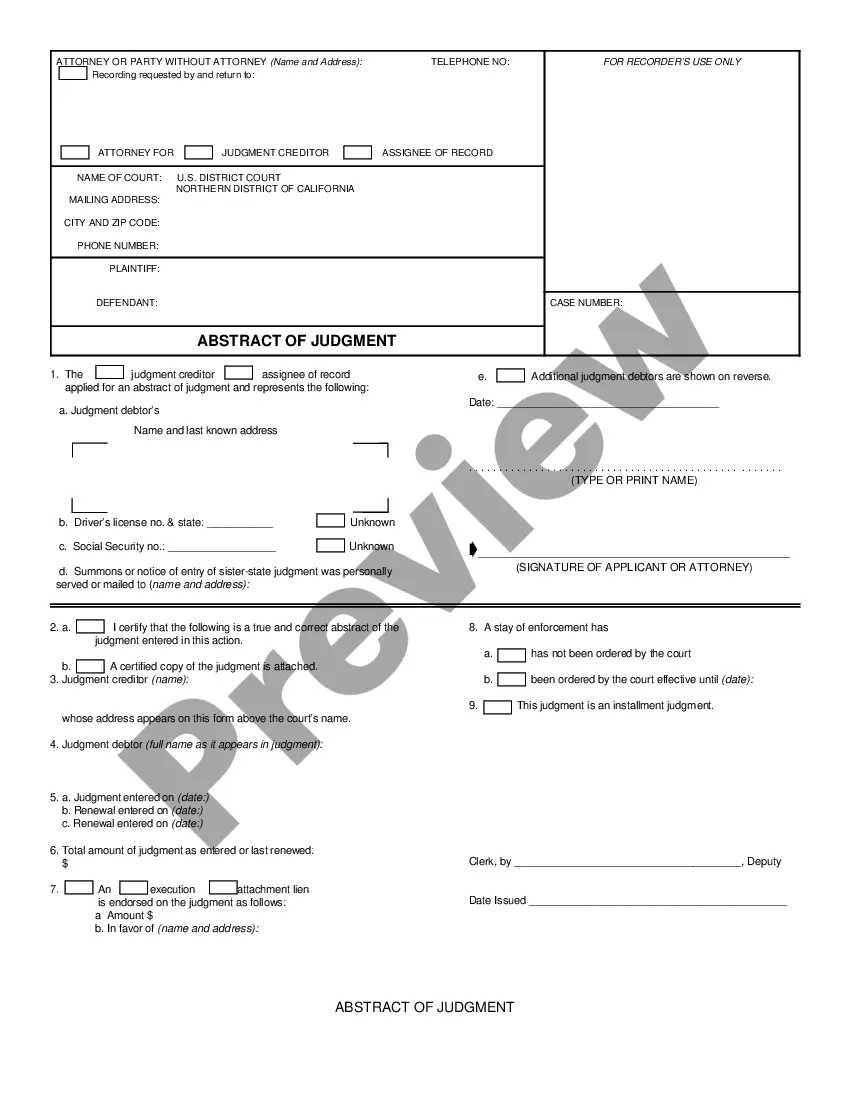

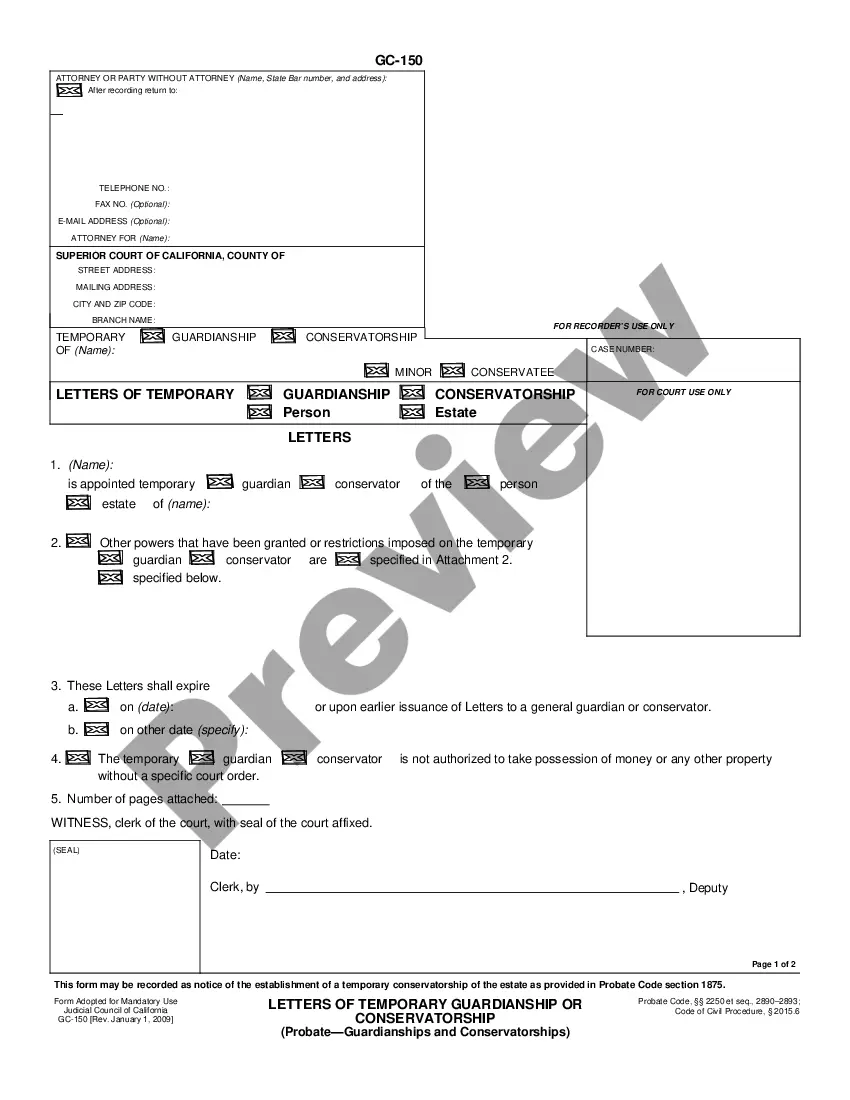

- Verify this is the proper form by previewing it and reading through its information.

- Ensure that the sample is acknowledged in your state or county.

- Pick Buy Now once you are all set.

- Choose a subscription plan.

- Find the format you want, and Download, complete, eSign, print out and send out your papers.

Enjoy the US Legal Forms web catalogue, backed with 25 years of experience and trustworthiness. Change your everyday papers administration in a easy and user-friendly process right now.

profit and loss for business Form popularity

profit and loss statement for a small business Other Form Names

example of a profit and loss statement for a small business FAQ

Here are the steps to take in order to create a profit and loss statement for your business. Step 1: Calculate revenue. ... Step 2: Calculate cost of goods sold. ... Step 3: Subtract cost of goods sold from revenue to determine gross profit. ... Step 4: Calculate operating expenses.

The following are easy steps in creating a comprehensive Profit and Loss Statement for your business: Track Operating Revenue. ... Record Cost of Sales. ... Calculate Gross Profit. ... Determine Overhead. ... Add Up Operating Income. ... Consider Other Income and Expenses. ... Finally Arrive at Your Net Profit.

You can send your scores for free to one recipient every year that you take AP Exams. To use your free score send, sign in to My AP, go to My AP Profile, select the Score Send tab and choose the college, university, or scholarship organization that you want to receive your score report.

For example, for a shopkeeper, if the value of the selling price is more than the cost price of a commodity, then it is a profit and if the cost price is more than the selling price, it becomes a loss.

The P&L contains details about a company's revenue, or the total amount of income from the sale of goods or services associated with the company's primary operations. It also shows the company's business expenses, such as rent, cost of goods sold (COGS), freight, and payroll.