A profit and loss statement for self-employed individuals is a financial document that provides a comprehensive overview of a person's income, expenses, and net profit or loss over a specific period, typically on a monthly, quarterly, or annual basis. It is an essential tool for self-employed professionals, freelancers, and small business owners to analyze their financial performance, track business profitability, and make informed decisions. The profit and loss statement, also known as an income statement or statement of earnings, consists of various key components that play a crucial role in assessing financial health. Let's explore these elements and understand their significance: 1. Revenue: Also referred to as sales or income, revenue represents the total amount of money earned from the provision of goods, services, or other business activities. It includes all sources of income generated by the self-employed individual. 2. Cost of Goods Sold (COGS): COGS refers to the direct expenses incurred in producing goods or services that have been sold. This may include production materials, labor costs, or any other costs directly associated with the production process. 3. Gross Profit: Calculated by subtracting the COGS from the revenue, the gross profit reflects the profitability of a self-employed individual's core business operations. It showcases how efficiently the business is utilizing its resources to generate profits. 4. Operating Expenses: These are the regular and ongoing expenditures required to run a self-employed individual's business. They include rent, utilities, insurance, salaries and wages, marketing expenses, professional fees, and other administrative costs. Tracking these expenses is crucial to determine the overall profitability of the business. 5. Operating Income: The operating income is derived by subtracting operating expenses from the gross profit. It indicates the profitability of the business before considering interest, taxes, and other non-operating expenses. 6. Non-operating Income and Expenses: These include income and expenses that are not directly related to the core business operations. Non-operating income might consist of interest earned, dividends received, or profit from the sale of assets. Non-operating expenses could include interest paid, bank fees, or any other expenses not directly linked to the core business. 7. Net Profit or Loss: The net profit (or loss) is obtained by deducting non-operating expenses and taxes from the operating income. It represents the final financial result of a self-employed individual's business activities during a specified period. A positive net profit indicates a profitable venture, while a negative net profit implies a loss. Different types of profit and loss statements might be required depending on the specific needs and circumstances of the self-employed individual. For example: 1. Monthly Profit and Loss Statement: useful for monitoring short-term financial performance, detecting trends, and making timely adjustments to improve profitability. 2. Quarterly Profit and Loss Statement: provides a more comprehensive overview of business performance over a longer period, aiding in strategic decision-making and identifying seasonal patterns. 3. Annual Profit and Loss Statement: showcases the overall financial health of the business and is typically required for tax purposes, loan applications, and assessing long-term profitability. In conclusion, a profit and loss statement is a fundamental financial tool for self-employed individuals to evaluate their business's performance, identify areas of strength or weakness, and plan for future growth. By analyzing the revenue, expenses, and net profit (or loss), business owners can make informed financial decisions to improve profitability and achieve their goals.

Profit And Loss Statement For Self-employed

Description what is a profit loss statement for self employed

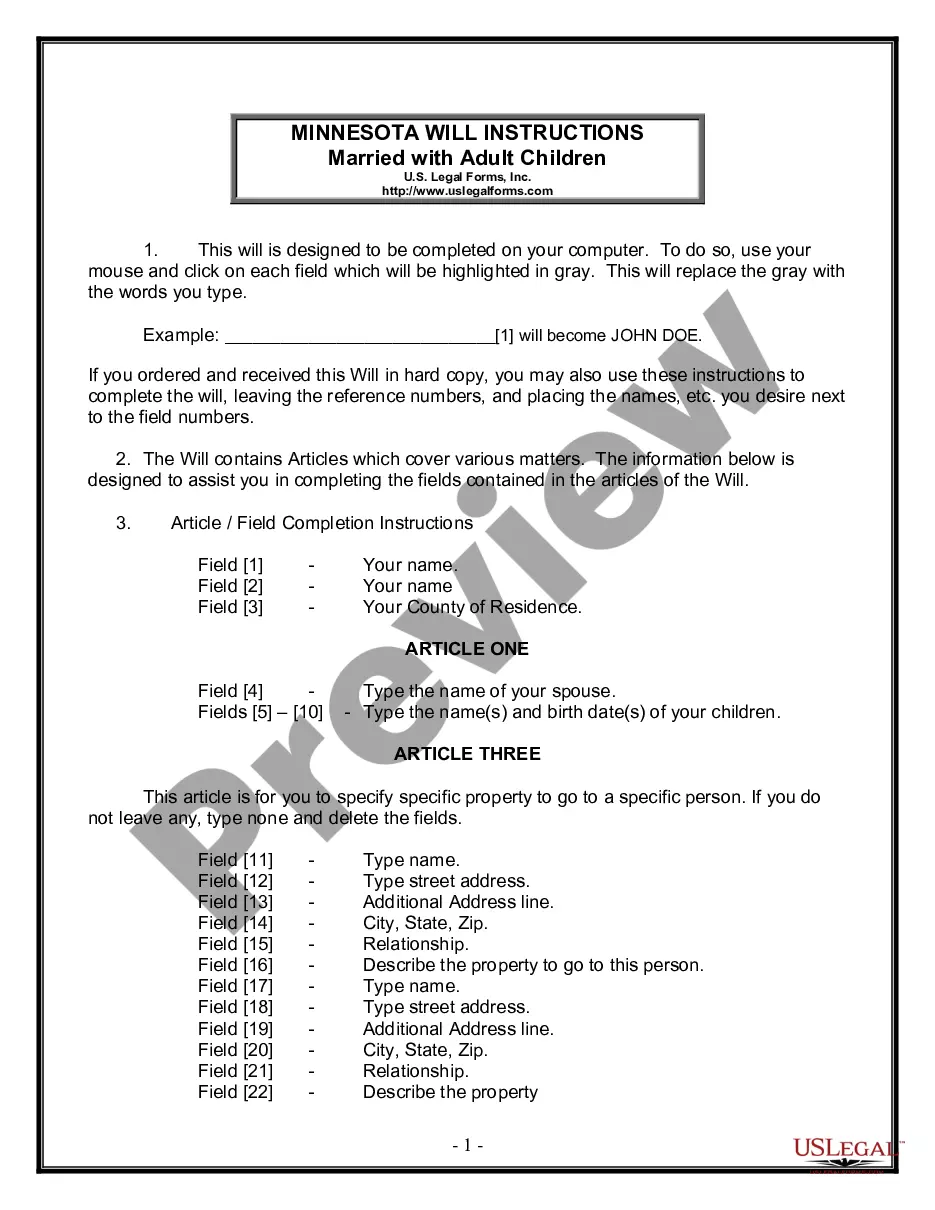

How to fill out Profit And Loss Statement For Self-employed?

Legal managing might be mind-boggling, even for experienced experts. When you are looking for a Profit And Loss Statement For Self-employed and don’t get the a chance to devote searching for the correct and up-to-date version, the processes might be demanding. A strong web form library could be a gamechanger for anyone who wants to manage these situations effectively. US Legal Forms is a industry leader in online legal forms, with over 85,000 state-specific legal forms available at any moment.

With US Legal Forms, it is possible to:

- Access state- or county-specific legal and business forms. US Legal Forms handles any demands you could have, from individual to organization papers, all in one location.

- Make use of innovative tools to finish and manage your Profit And Loss Statement For Self-employed

- Access a resource base of articles, instructions and handbooks and materials related to your situation and requirements

Help save effort and time searching for the papers you need, and utilize US Legal Forms’ advanced search and Review feature to get Profit And Loss Statement For Self-employed and get it. For those who have a membership, log in to your US Legal Forms account, look for the form, and get it. Review your My Forms tab to find out the papers you previously saved as well as manage your folders as you see fit.

If it is the first time with US Legal Forms, make a free account and acquire unlimited use of all advantages of the library. Here are the steps to take after accessing the form you need:

- Confirm this is the right form by previewing it and reading through its information.

- Ensure that the sample is recognized in your state or county.

- Pick Buy Now when you are all set.

- Choose a subscription plan.

- Find the formatting you need, and Download, complete, eSign, print out and deliver your document.

Benefit from the US Legal Forms web library, backed with 25 years of expertise and reliability. Enhance your everyday document administration in to a easy and intuitive process right now.

Form popularity

FAQ

Typically, a profit and loss statement for self-employed is prepared by the business owner, accountants, or bookkeeping professionals. Anyone involved in managing the finances can create a P&L statement, making it vital for understanding your business's financial standing. Various software solutions and templates can aid in making this process straightforward.

You can create your profit and loss statement for self-employed using online accounting tools, spreadsheets, or templates available on various platforms. Websites like US Legal Forms offer customizable templates that help simplify the creation process. Additionally, you could also consult a tax professional if you need personalized assistance.

You can get a profit and loss statement made by accountants, bookkeepers, or through user-friendly accounting software. Alternatively, consider utilizing platforms like US Legal Forms that provide easy-to-follow templates. These options cater to various skill levels, helping you generate an accurate statement effortlessly.

The IRS does not explicitly require a profit and loss statement for self-employed individuals; however, maintaining one can simplify your tax preparation and reporting. A P&L statement helps track income and expenses, which is crucial for tax purposes. It's always wise to keep thorough financial records, as they may be requested in the event of an audit.

Yes, a tax preparer can create a profit and loss statement for self-employed individuals. They can analyze your financial data, ensuring compliance with tax regulations. Working with a tax preparer can streamline the process, providing you with a clear view of your financial status and any potential deductions.

To create a profit and loss statement for self-employed, start by gathering your income records and expenses. Organize your data into two main sections: total revenue and total expenses. Subtract total expenses from total revenue to determine your net profit or loss, ensuring all transactions are accounted for accurately.

You can obtain a profit and loss statement for self-employed by utilizing accounting software, hiring a professional accountant, or using templates available online. These resources can simplify your data entry process and help you visualize your earnings and expenses. Additionally, platforms like US Legal Forms offer templates that guide you in creating an accurate statement tailored to your specific needs.

To lay out a profit and loss statement effectively, start with your revenue at the top, followed by direct costs, and then operating expenses. Subtract the total expenses from the total revenue to determine your net profit or loss. Clarity is key, so ensure each section is well organized. The US Legal Forms platform offers easy-to-use templates to help you create a comprehensive profit and loss statement for self-employed individuals.

The basic formula for a profit and loss statement is: Total Revenue minus Total Expenses equals Net Profit or Loss. This straightforward calculation helps you understand your financial standing as a self-employed individual. By consistently applying this formula, you can make informed decisions for your business. Consider using US Legal Forms to find helpful templates that simplify this process.

The IRS business loss rule allows you to deduct losses from your business against other income, reducing your overall tax liability. When you file your profit and loss statement for self-employed, you can report these losses to potentially benefit your tax situation. Understanding this rule is vital for maintaining financial health. Platforms like US Legal Forms provide valuable resources for understanding and documenting these losses.