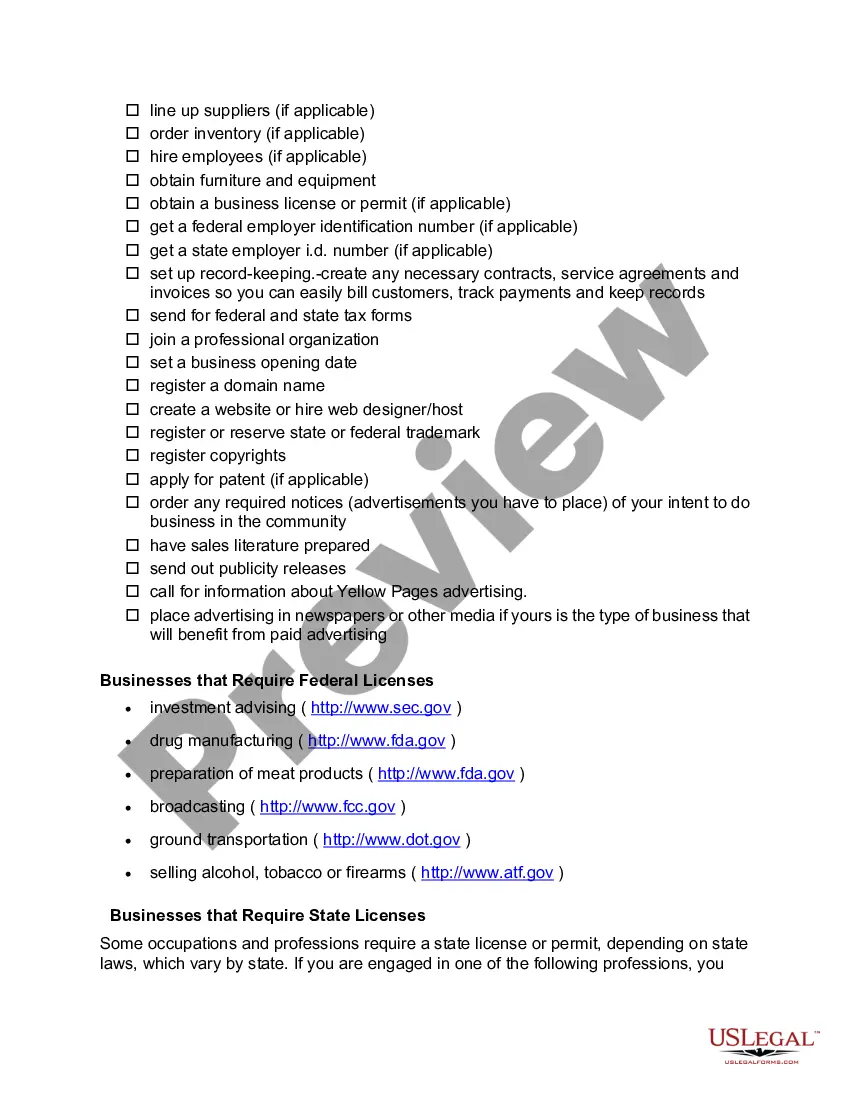

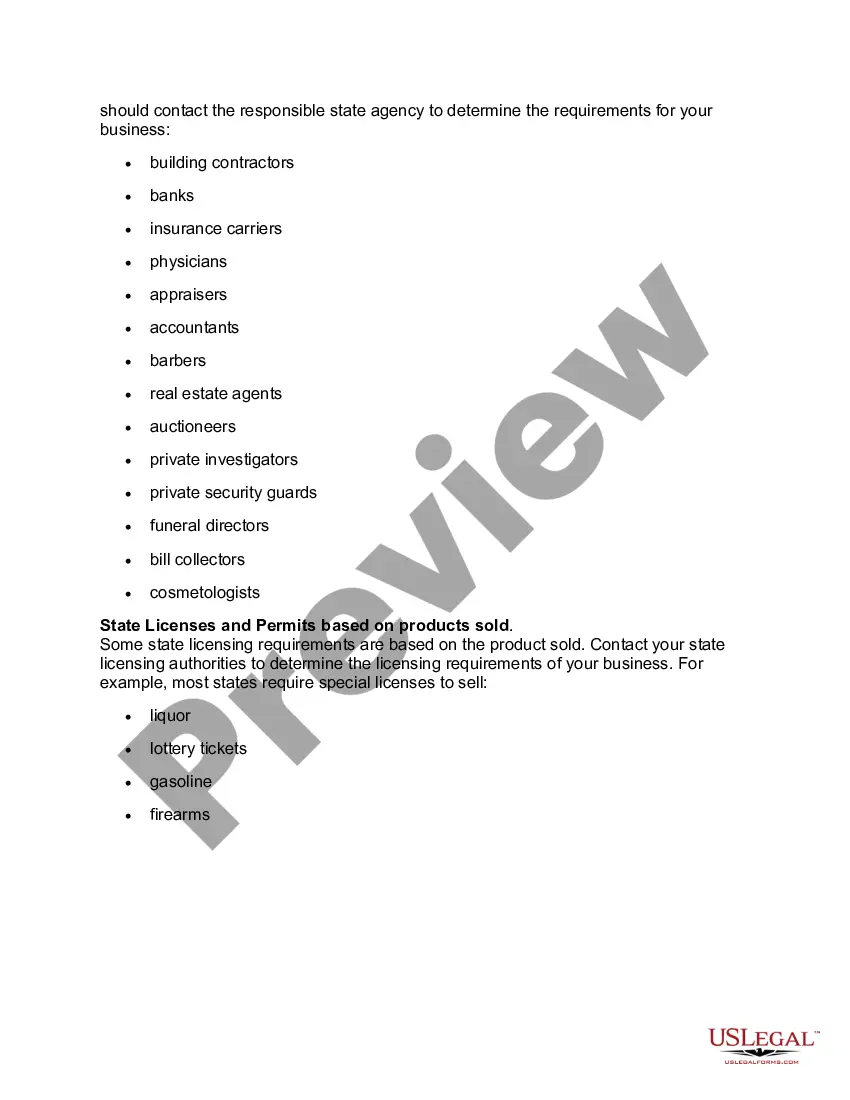

This form is a handy checklist for the owner of a new business to use as a helpful tool in forming a new business. The form covers the stages of background planning, initial business transactions, and initial tasks that need to be accomplished to get the business up and running smoothly.

Title: Essential Checklist for Starting a Business in Florida: Everything You Need to Know Introduction: Starting a business in Florida can be an exciting venture, but it also requires careful planning and adherence to the state's regulations. This detailed checklist will guide you through the essential steps and considerations necessary to launch a successful business in Florida. We will explore various types of checklists based on the specific legal structure of your business. 1. Determine Your Business Structure: — Sole Proprietorship, Partnership, Limited Liability Company (LLC), Corporation, or Nonprofit Organization: Each structure has different legal and tax implications. — Conduct thorough research to choose the suitable legal structure for your business. 2. Register Your Business Name: — Perform a name search in Florida's Division of Corporations' records to ensure your desired name is available. — Register your business name and obtain any required permits or licenses. 3. Obtain Necessary Licenses and Permits: — Identify the specific licenses, permits, and certifications required for your business type. — Examples may include Professional Licenses, Sales Tax Permit, Employer Identification Number (EIN), Health Department Permits, and more. 4. Create a Business Plan: — Write a comprehensive business plan outlining your objectives, target market analysis, marketing strategies, financial projections, and operational structure. — Include an executive summary, company description, product/service description, marketing plan, funding requirements, and timelines. 5. Secure Business Financing: — Explore different funding options, such as personal savings, small business loans, venture capital, crowdfunding, or reaching out to private investors. — Prepare financial statements, including profit and loss statements, cash flow projections, and balance sheets to support loan applications. 6. Set Up Business Bank Accounts: — Open a business bank account separate from personal accounts to maintain clear financial records. — Consider choosing a bank that offers features suitable for your business, such as online banking, merchant services, or business credit cards. 7. Determine Tax Obligations: — Register with the Florida Department of Revenue for a Florida Sales and Use Tax Certificate if applicable. — Understand federal, state, and local tax obligations, and seek guidance from a certified accountant or tax professional. 8. Secure Business Insurance: — Assess the insurance needs of your business, including general liability, property insurance, professional liability, workers' compensation, and business interruption insurance. — Obtain insurance coverage from a reputable insurance provider to protect your business from potential risks. 9. Develop a Marketing Strategy: — Conduct market research to identify your target audience, competition, and key marketing channels. — Create a marketing plan encompassing digital marketing, social media strategies, traditional advertising, networking opportunities, and partnerships. 10. Hire Employees, if Necessary: — Understand federal and state employment laws regarding minimum wage, working hours, employee benefits, and taxes. — Set up payroll systems, obtain an Employer Identification Number (EIN), and familiarize yourself with federal employer tax obligations. Conclusion: Starting a business in Florida involves numerous considerations, legalities, and steps. This checklist serves as a comprehensive guide to ensure you cover all necessary aspects, from choosing the right legal structure to understanding tax obligations and marketing strategies. Following this checklist will help you navigate through the process successfully, setting the foundation for a thriving business in the Sunshine State.