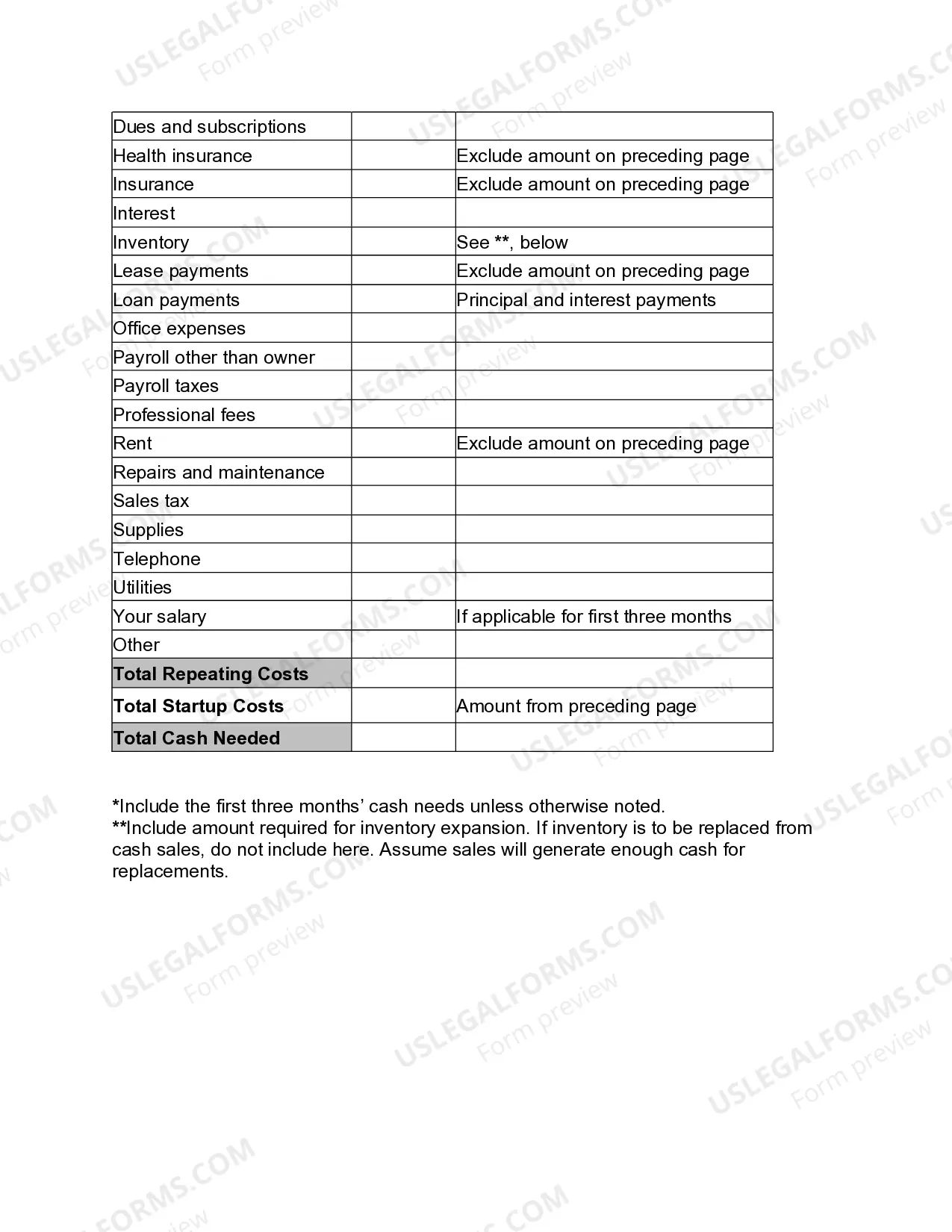

This form is an Excel spreadsheet that can be used to calculate startup costs for a new business. It includes itemized categories for funding and costs, and is a valuable tool to help plan the financial aspects of your new business.

Start Up Cost Template For Small Business

Description business startup costs template

How to fill out Start Up Cost Template For Small Business?

Whether for business purposes or for individual matters, everyone has to manage legal situations sooner or later in their life. Filling out legal papers needs careful attention, starting with choosing the correct form sample. For instance, when you choose a wrong edition of the Start Up Cost Template For Small Business, it will be declined when you submit it. It is therefore essential to have a dependable source of legal files like US Legal Forms.

If you need to get a Start Up Cost Template For Small Business sample, stick to these easy steps:

- Find the template you need by using the search field or catalog navigation.

- Look through the form’s information to ensure it suits your case, state, and region.

- Click on the form’s preview to see it.

- If it is the wrong form, return to the search function to find the Start Up Cost Template For Small Business sample you require.

- Get the template if it meets your requirements.

- If you already have a US Legal Forms profile, click Log in to gain access to previously saved documents in My Forms.

- In the event you don’t have an account yet, you can obtain the form by clicking Buy now.

- Select the correct pricing option.

- Finish the profile registration form.

- Choose your transaction method: you can use a bank card or PayPal account.

- Select the document format you want and download the Start Up Cost Template For Small Business.

- Once it is saved, you are able to complete the form by using editing applications or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you don’t have to spend time seeking for the appropriate template across the internet. Make use of the library’s straightforward navigation to get the appropriate template for any situation.

start up cost template Form popularity

start up expenses template Other Form Names

FAQ

Examples of startup costs Permits and licenses. Incorporation fees. Logo design. Website design. Brochure and business card printing. Signage. Down payment on rental property. Improvements to the chosen location.

It can be a bit subjective in determining what is a start-up cost, but start-up costs should always be expensed as incurred. Typically, start-up costs include any expense that is incurred prior to the business generating revenue.

You must break them down into smaller, specific categories. Each category is treated differently for tax purposes. The categories for your startup costs might include organizational costs, syndication costs, Section 197 intangible costs, tangible depreciation personal property costs, and Section 195 startup costs.

Examples of startup costs include licensing and permits, insurance, office supplies, payroll, marketing costs, research expenses, and utilities.

How Much Money on Average to Start a Business? On average, startup and first-year costs often fall between $30,000 and $40,000. However, it is possible to start a business with an initial investment of $0, $100, $1,000, all the way up to millions of dollars.