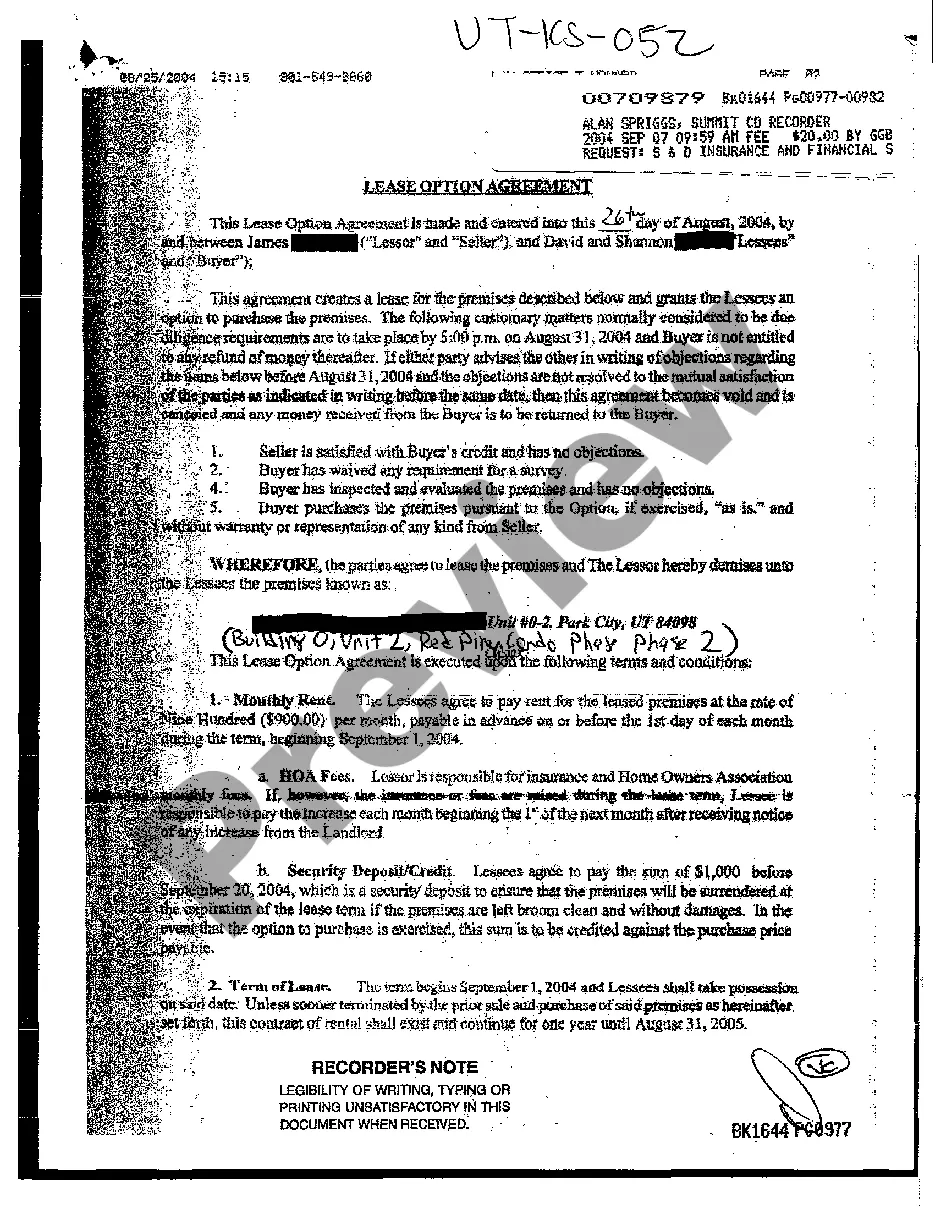

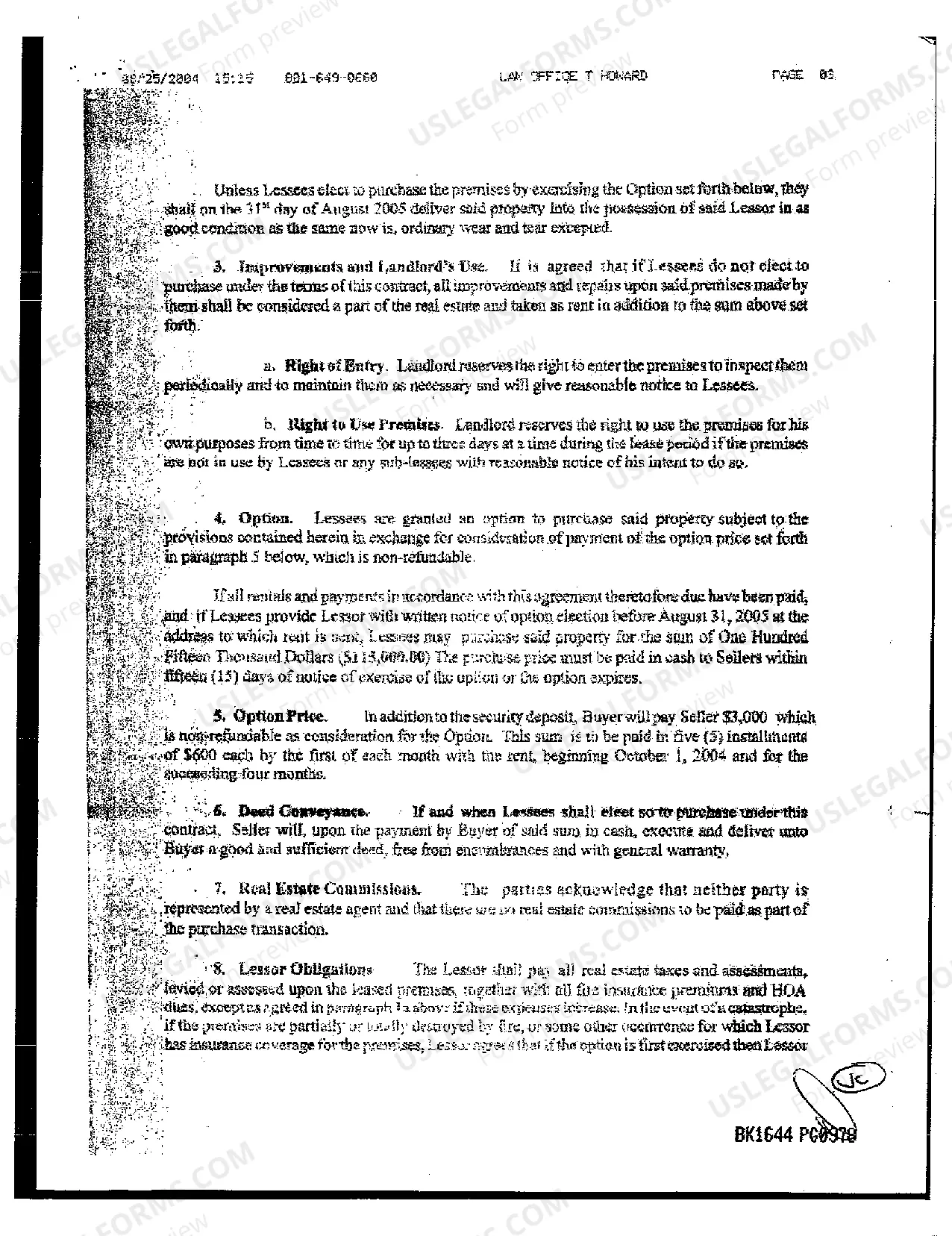

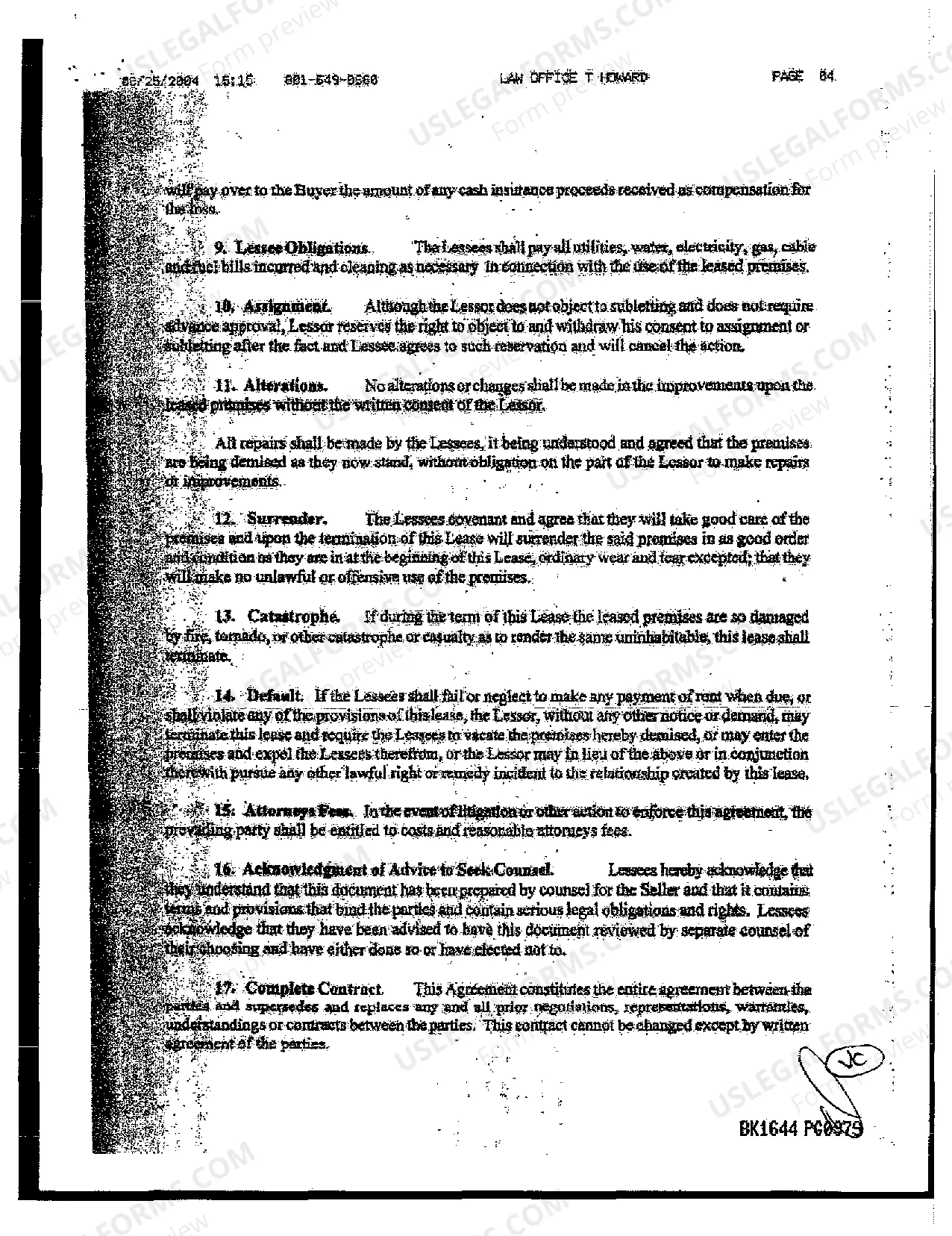

Lease Option Utah Withholding Form

Description

How to fill out Lease Option Utah Withholding Form?

There's no longer a requirement to waste time searching for legal documents to fulfill your local state obligations.

US Legal Forms has compiled all of them in a single location and enhanced their availability.

Our website provides more than 85,000 templates for any business and individual legal matters categorized by state and usage area.

Utilize the search field above to find another sample if the prior one didn't match your needs.

- All forms are properly drafted and validated for authenticity, so you can trust in obtaining the current Lease Option Utah Withholding Form.

- If you are acquainted with our service and already possess an account, ensure your subscription is active before retrieving any templates.

- Log In/">Log In to your account, select the document, and click Download.

- You can also revisit all saved documents whenever necessary by accessing the My documents tab in your profile.

- If you have never utilized our service before, the procedure will require a few extra steps to finish.

- Here's how new users can find the Lease Option Utah Withholding Form in our directory.

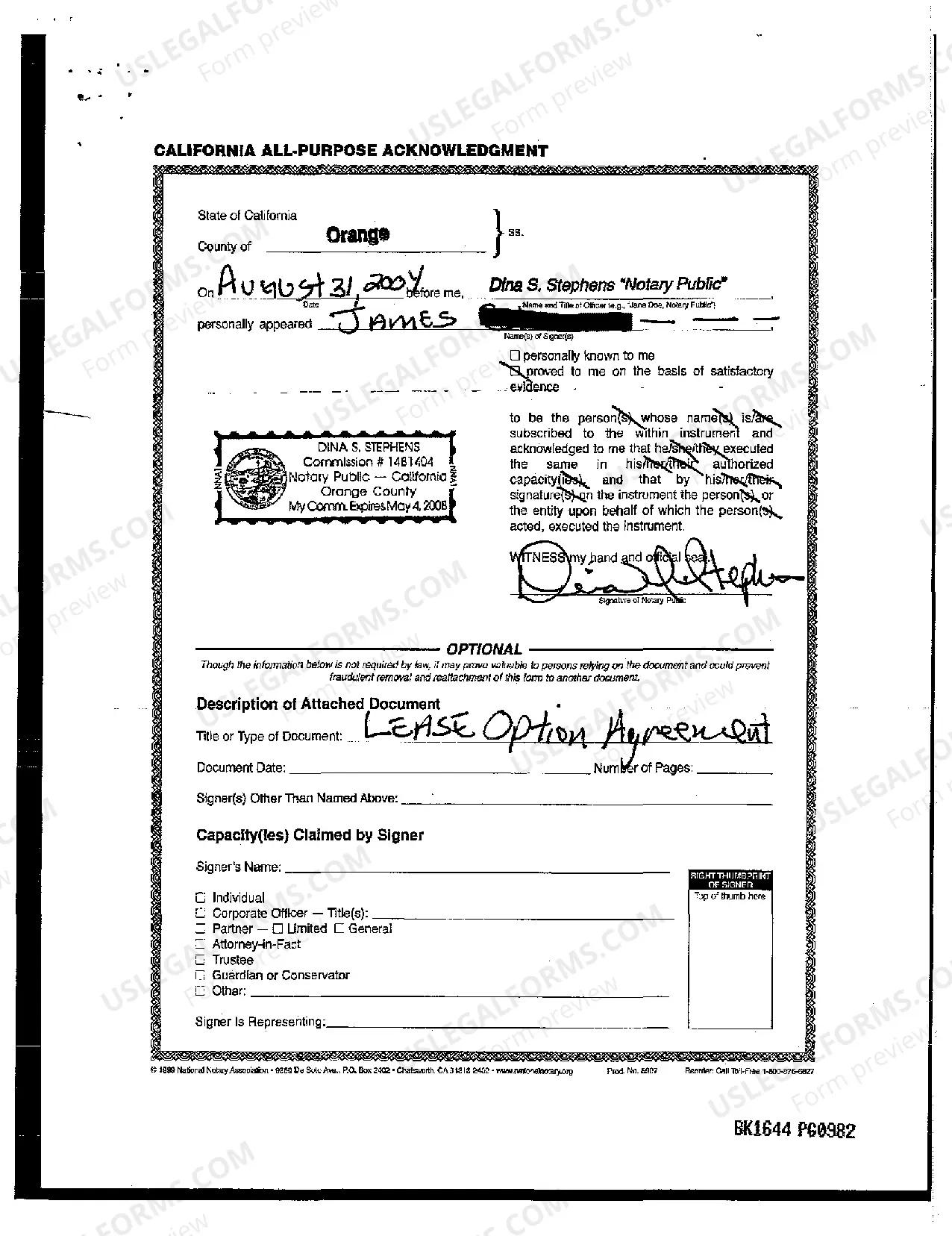

- Examine the page content closely to ensure it includes the sample you need.

- To do so, use the form description and preview options if available.

Form popularity

FAQ

Two allowances at one job and zero at the other. If you are married and have one child, you should claim three allowances.

Unlike many other states, Utah does not have a separate state equivalent to Form W-4, but instead relies on the federal form. You can download blank Forms W-4 from irs.gov. Clearly label W-4s used for state tax withholding as your state withholding form.

Withholding Formula (Effective Pay Period 10, 2018)Multiply the adjusted gross biweekly wages by the number of pay dates in the tax year to obtain the gross annual wages. Multiply the annual taxable wages by 4.95 percent to determine the annual gross tax amount.

The income tax withholding formula for the State of Utah has been updated to eliminate the withholding allowance for employees who have not filed a W-4 form. The tax withheld will be at a flat 4.95 percent for those employees. No action on the part of the employee or the personnel office is necessary.

This is determined by your filing status, how many jobs you have, and whether or not you have dependents. For example, a single person with one job will claim fewer allowances than someone who is married with children.