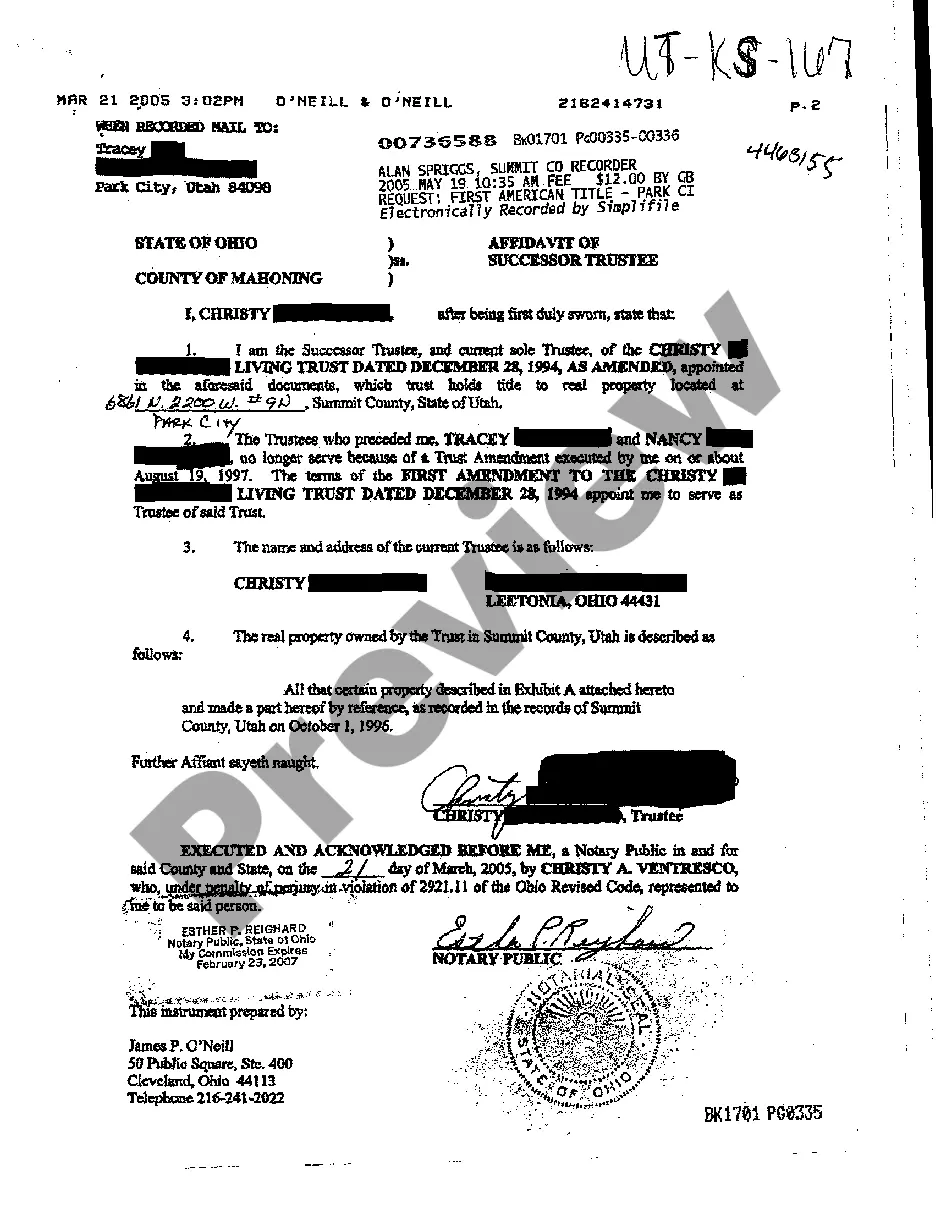

Affidavit Of Successor Trustee Form Utah

Description

How to fill out Affidavit Of Successor Trustee Form Utah?

How to locate professional legal documents that adhere to your state's regulations and complete the Affidavit Of Successor Trustee Form Utah without consulting a lawyer.

Numerous online services offer templates to address various legal circumstances and requirements. Nevertheless, it might take time to determine which of the available samples meet both the use case and legal standards for you.

US Legal Forms serves as a dependable platform that assists you in finding official documents drafted in compliance with the latest state law revisions while saving you money on legal support.

In case you don’t have a US Legal Forms account, please follow the instructions below: Review the webpage you have accessed and confirm that the form meets your requirements. To verify, utilize the form description and preview options if available. Search for another sample in the header relevant to your state if necessary. Once you locate the correct document, click on the Buy Now button. Select the most appropriate pricing plan, then Log In/">Log In or create an account. Choose the payment option (by credit card or via PayPal). Pick the file format for your Affidavit Of Successor Trustee Form Utah and click Download. The acquired documents will remain your property: you can always revisit them in the My documents section of your profile. Join our library and prepare legal documentation independently, much like a seasoned legal professional!

- US Legal Forms is not merely a conventional web directory.

- It comprises over 85,000 validated templates for diverse business and personal scenarios.

- All documents are organized by area and state to streamline your search experience.

- Furthermore, it connects with robust solutions for PDF editing and eSignature, allowing users with a Premium subscription to swiftly fill out their documents online.

- It requires minimal effort and time to acquire the necessary documents.

- If you already possess an account, Log In/">Log In and verify that your subscription remains active.

- Download the Affidavit Of Successor Trustee Form Utah by clicking the relevant button adjacent to the file name.

Form popularity

FAQ

Trustees can be easily changed on a revocable trust since the trust instrument's grantor is still alive and in charge, and changing the trustee is as simple as adding an amendment to an existing trust. You can write a new Trust and nullify the old Trust.

Both the settlor and/or beneficiary can be a trustee, however if a beneficiary is a trustee it could lead to a conflict of interest especially when trustees have the power to decide by how much each beneficiary can benefit.

It's perfectly legal to name a beneficiary of the trust (someone who will receive trust property after your death) as successor trustee. In fact, it's common. EXAMPLE: Mildred names her only child, Allison, as both sole beneficiary of her living trust and successor trustee of the living trust.

Additionally, the trust must be managed and administered by a person who is a resident of the United States. It does not matter if the successor trustee is an American citizen or not. As long as the trustee is a resident of this country and administers the trust here, it should not be classified as a foreign trust.

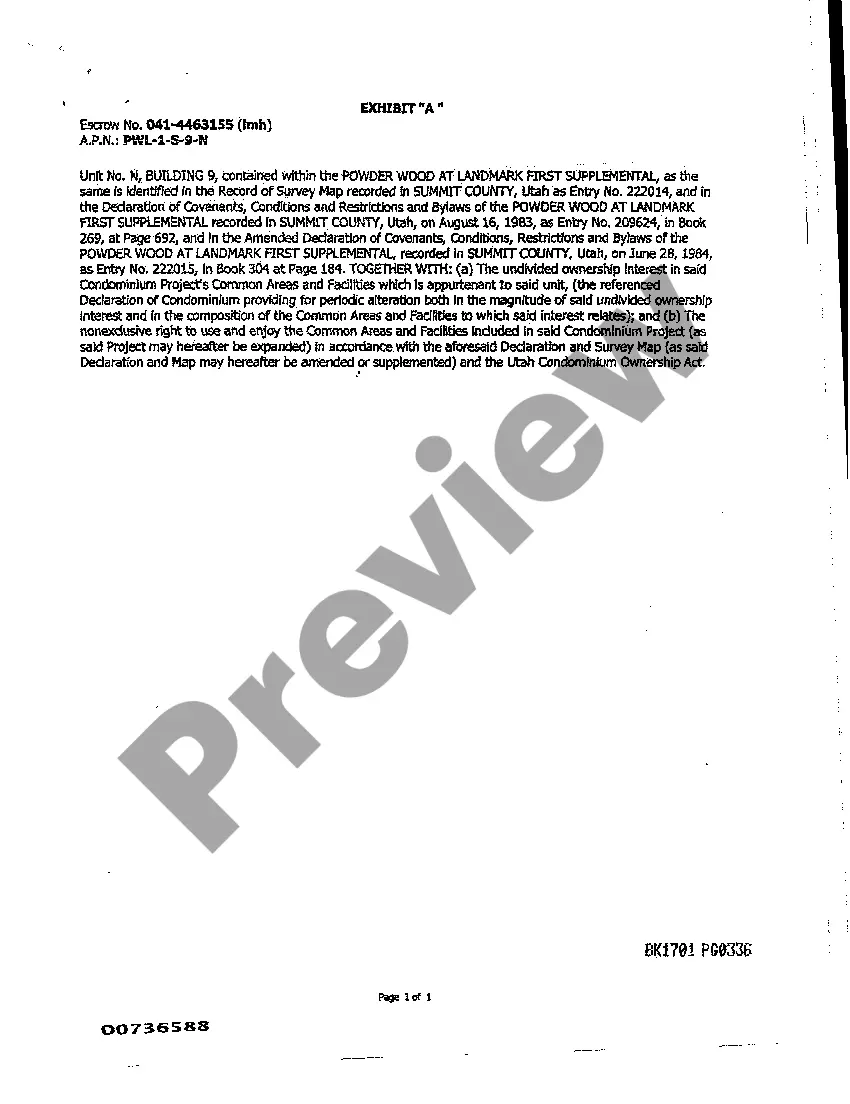

Identification of the PartiesCounty. The county where the affidavit is being recorded and real property is located.Affiant name.Decedent name.Vesting deed execution date.Settlor.Trust name, date, and original trustee.