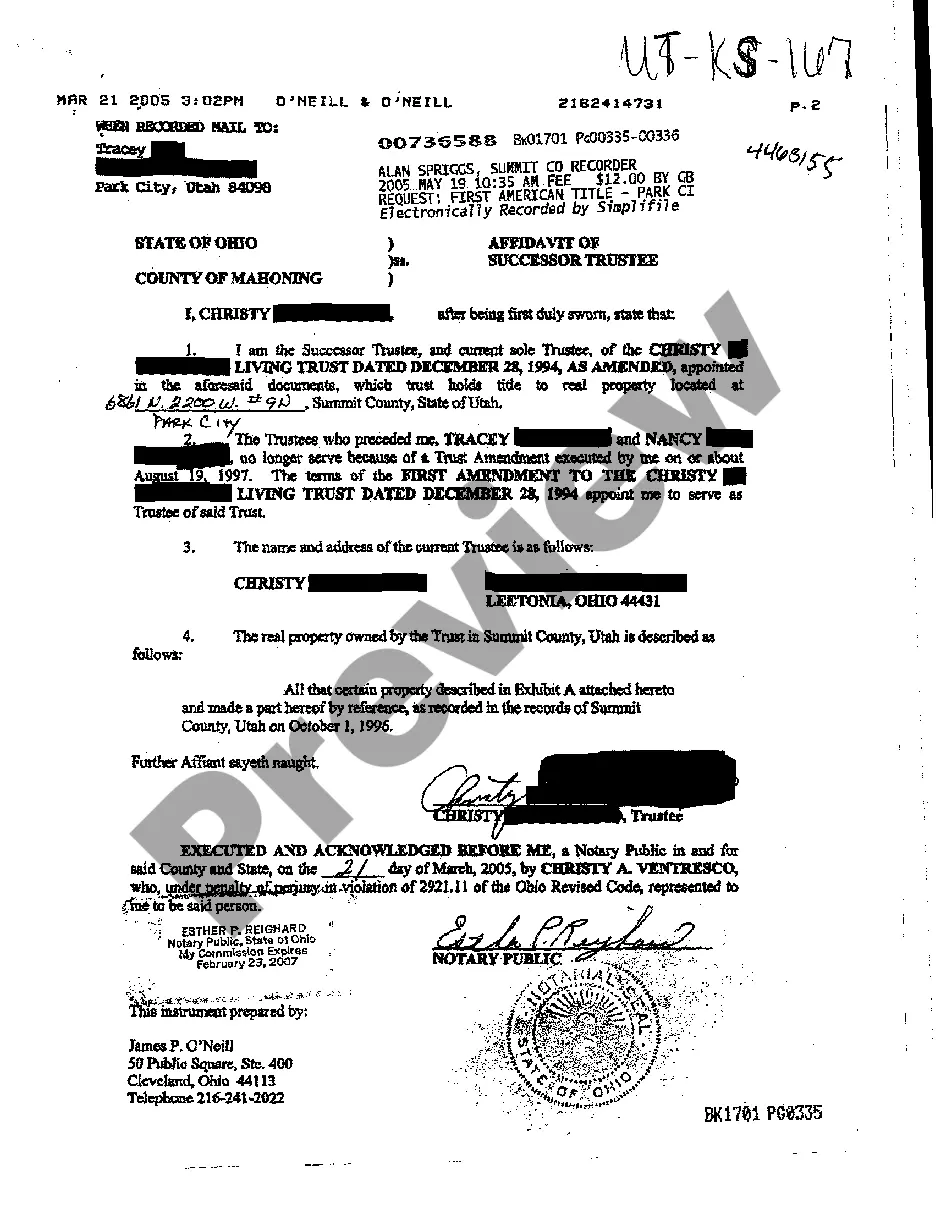

Affidavit Of Successor Trustee Utah Withholding

Description

How to fill out Affidavit Of Successor Trustee Utah Withholding?

Whether you frequently handle paperwork or occasionally need to submit a legal document, it is essential to have a reliable source of information where all related and current samples are available.

One important step to take with an Affidavit Of Successor Trustee Utah Withholding is to verify that you have the most updated version, as this determines its eligibility for submission.

If you aim to streamline your search for the latest document samples, consider looking for them on US Legal Forms.

To acquire a form without an account, follow these instructions: Utilize the search menu to find the form you need, review the preview and details of the Affidavit Of Successor Trustee Utah Withholding to ensure it aligns with your requirements, once you confirm the form, simply click Buy Now, select a suitable subscription plan, create a new account or Log In/">Log In to your existing account, provide your credit card details or PayPal account to finalize the purchase, choose the download format and validate it. Erase any uncertainty associated with dealing with legal documents; all your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is an extensive repository of legal documents that provides almost every document type you might search for.

- Search for the templates you need, assess their relevance immediately, and learn more about their application.

- With US Legal Forms, you gain access to approximately 85,000 document templates across various fields.

- Locate examples of the Affidavit Of Successor Trustee Utah Withholding in just a few clicks and save them in your profile for future use.

- A profile on US Legal Forms equips you with the ability to obtain all the samples you require more comfortably and conveniently.

- All you need to do is click Log In/">Log In in the website header and navigate to the My documents section for immediate access to all necessary forms.

- You won’t need to spend time searching for the right template or verifying its authenticity.

Form popularity

FAQ

Probate is required if: the estate includes real property (land, house, condominium, mineral rights) of any value, and/or. the estate has assets (other than land, and not including cars) whose net worth is more than $100,000.

Visit the Title Office As the beneficiary of the vehicle or the administrator of the deceased person's estate, you can visit your local UT title office with the above-stated documents to initiate the vehicle title transfer.

Is there a time limit on applying for probate? Though there is no time limit on the probate application itself, there are aspects of the process which do have time scales. Inheritance tax for example, is a very important part of attaining probate in the first place and must be done within 6 months of date of death.

The Utah Code allows for probate to be filed up to three years after a person's death. If it has been longer than the allowed time, a special process will need to be followed.

Utah law allows someone handling the estate of a person who died (the decedent) with a "small estate" to use a small estate affidavit to collect personal property (such as money in a bank account, jewelry, clothing, and furniture) instead of going through the probate process. Utah Code 75-3-1201.