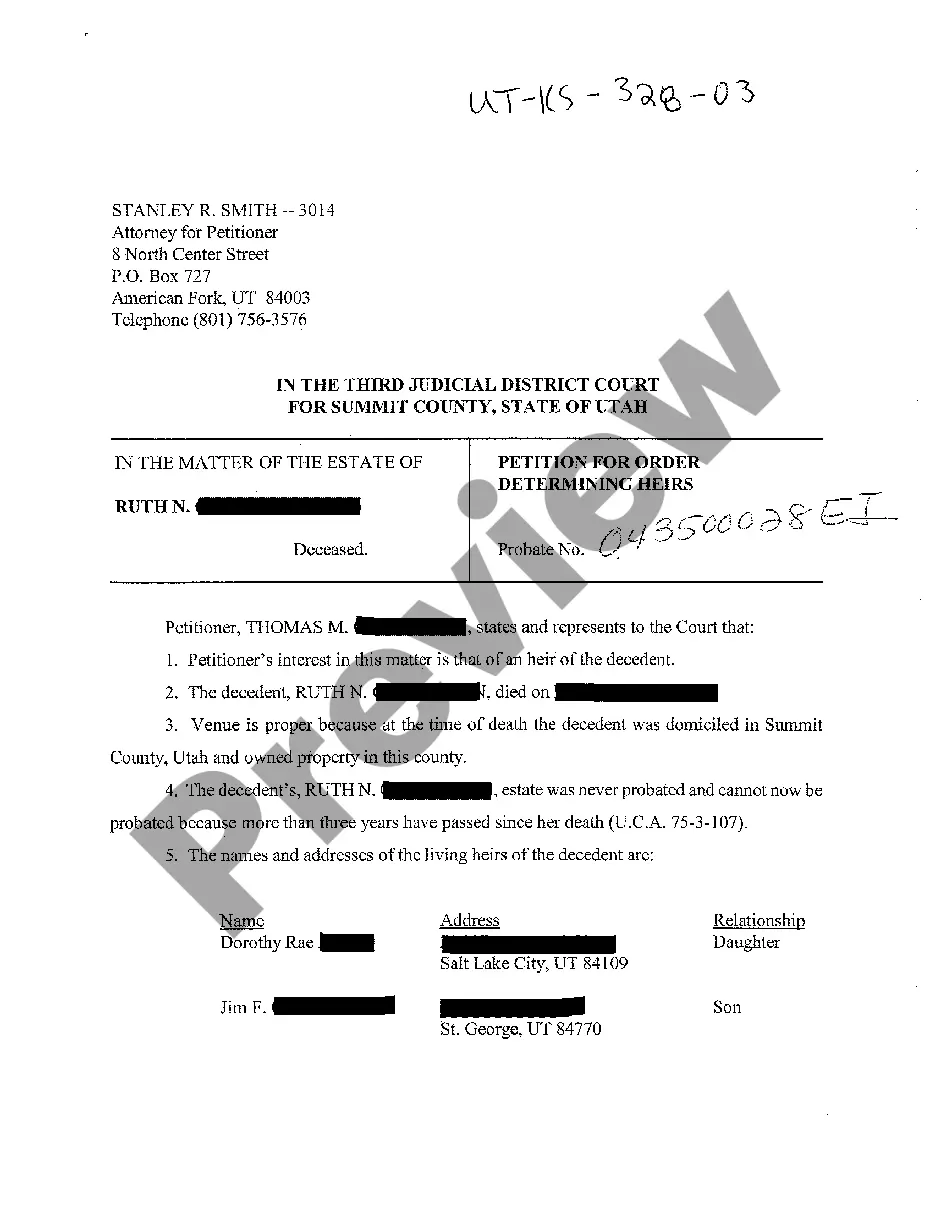

Petition For Determination Of Heirs Utah Withholding

Description

How to fill out Utah Petition For Order Determining Heirs?

Navigating through the red tape of official documents and formats can be challenging, particularly when one does not engage in that professionally.

Even selecting the appropriate format to acquire a Petition For Determination Of Heirs Utah Withholding will be labor-intensive, as it must be accurate and correct to the last numeral.

However, you will need to invest significantly less time selecting a fitting template if it originates from a source you trust.

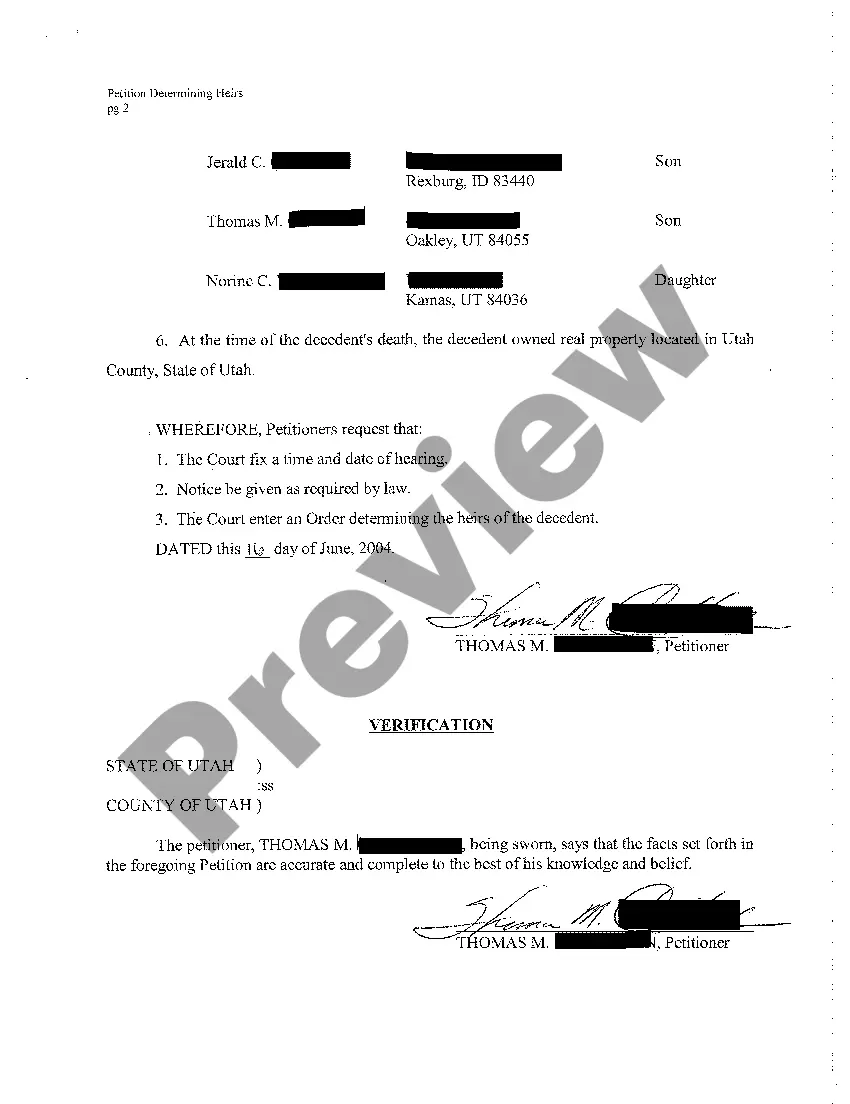

Acquire the correct document in a few straightforward steps: Enter the document's title in the search field. Locate the appropriate Petition For Determination Of Heirs Utah Withholding within the results. Review the description of the template or view its preview. If the format meets your requirements, click Buy Now. Continue to select your subscription plan. Utilize your email and create a security password to establish an account at US Legal Forms. Choose a credit card or PayPal payment method. Download the template document to your device in the format of your choice. US Legal Forms will save you time and effort in verifying if the form you discovered online is suitable for your needs. Create an account and gain unrestricted access to all the templates necessary.

- US Legal Forms is a platform that streamlines the process of finding the correct documents online.

- US Legal Forms is a centralized place where you can access the most current samples of documents, confirm their applicability, and download these samples for completion.

- This is a repository containing over 85K documents that pertain to various professional fields.

- When searching for a Petition For Determination Of Heirs Utah Withholding, you will not have to question its authenticity, as all forms are validated.

- Having an account at US Legal Forms will ensure you have all the essential samples at your disposal.

- Store them in your account history or add them to the My documents catalog.

- You can retrieve your saved forms from any device by simply clicking Log In at the library website.

- If you don't yet possess an account, you can always search for the template you require.

Form popularity

FAQ

In Utah, heirs are typically the closest relatives of the deceased, including children, spouses, and sometimes siblings or parents, based on the state’s intestacy laws. Identifying heirs can become complex, especially with blended families or unclear wills. A Petition for determination of heirs Utah withholding is useful for establishing rightful heirs, thereby aiding in asset distribution.

To avoid probate in Utah, individuals often consider creating a living trust, designating beneficiaries for accounts, or holding property jointly with rights of survivorship. These methods can help bypass the formal probate process, saving time and reducing costs. Additionally, understanding the role of a Petition for determination of heirs Utah withholding can further aid in protecting your assets from probate.

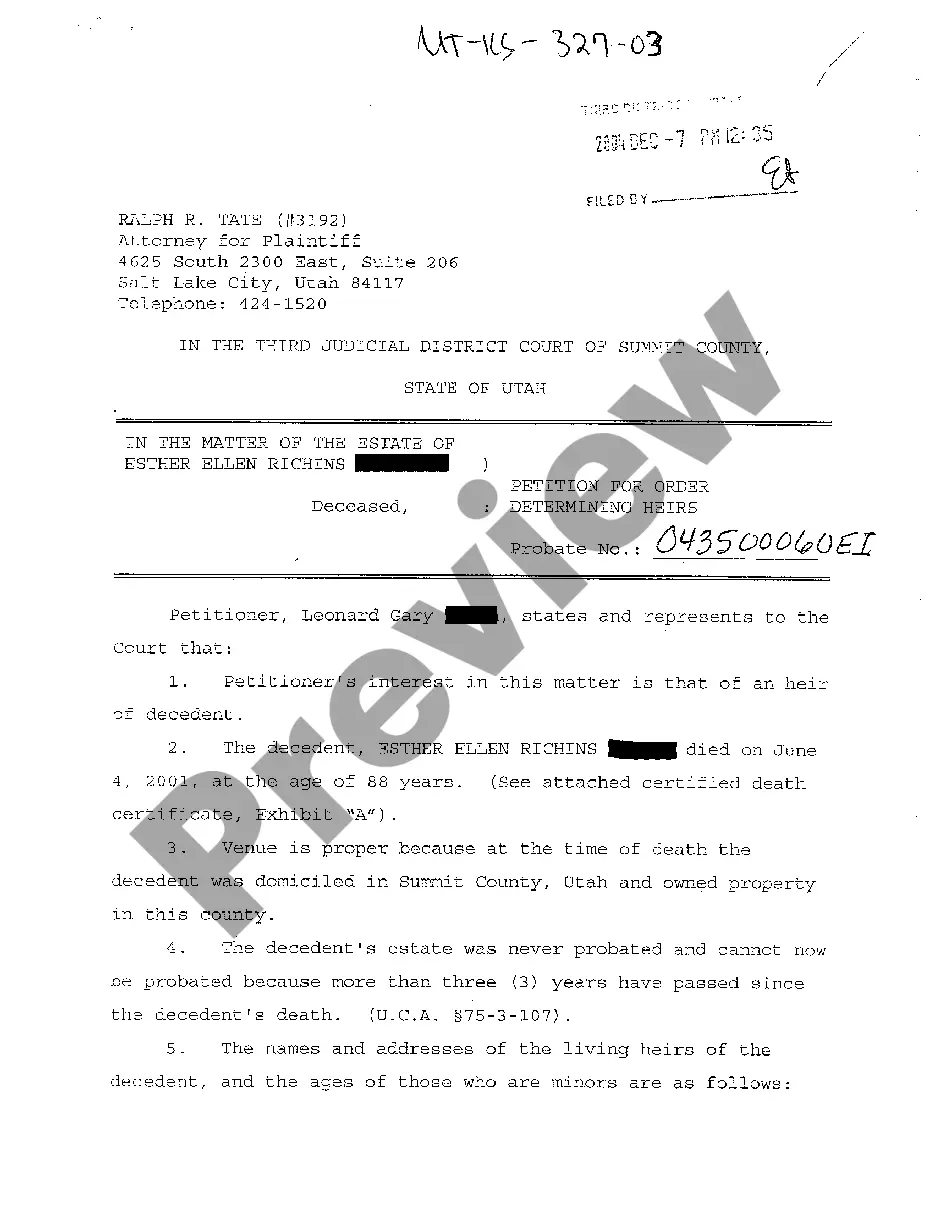

Probate is usually triggered when a person passes away and leaves behind assets that need to be managed legally. This can include real estate, bank accounts, and other valuable property. If you encounter a situation where a decedent's estate qualifies for a Petition for determination of heirs Utah withholding, it helps streamline the resolution process, ensuring rightful heirs receive their share.

In Utah, a will generally must go through probate to distribute the deceased's assets as specified. However, there are certain exceptions, such as when all assets are held in a trust or when they fall below a certain value. By utilizing a Petition for determination of heirs Utah withholding, you can clarify asset distribution and simplify the process if probate is necessary.

In Utah, when someone dies without a will, the law dictates who inherits their assets. The distribution typically follows a hierarchy. First, the spouse and children inherit, and if there are no direct descendants, the estate may pass to parents or siblings. To clarify these legal matters, you may consider a Petition for determination of heirs in Utah withholding, which can streamline the process and ensure rightful heirs are recognized.

Determination of heirs refers to the legal process of identifying individuals entitled to inherit from a deceased person's estate. This process is vital for ensuring that the deceased's wishes are respected, especially if no will exists. Engaging in a Petition for determination of heirs Utah withholding is often necessary to formally recognize the rightful heirs and facilitate the distribution of the estate.

There are several ways to avoid probate in Utah, including setting up a living trust, designating beneficiaries on accounts, or holding property as joint tenants. Proper planning is essential to ensure your assets pass directly to heirs without the probate process. For guidance, using tools like a Petition for determination of heirs Utah withholding can help navigate this complexity.

In Utah, estates valued at over $100,000 typically require probate. However, certain assets may bypass probate regardless of the estate's total value. Filing a Petition for determination of heirs Utah withholding can clarify the need for probate and help manage the estate efficiently, preserving the estate's value.

Heirs are determined based on statutory guidelines and the legal documents available. In Utah, this usually involves examining the decedent's will, if one exists, and adhering to state laws for intestate succession. To effectively assess heirship, a Petition for determination of heirs Utah withholding may be necessary, ensuring that all potential heirs are identified and recognized.

The duration for determining heirship in Utah can vary, typically taking several months. Factors influencing time include the complexity of the estate, court schedules, and any disputes over heirship. Utilizing a Petition for determination of heirs Utah withholding can help streamline the process and clarify the rightful heirs more efficiently.