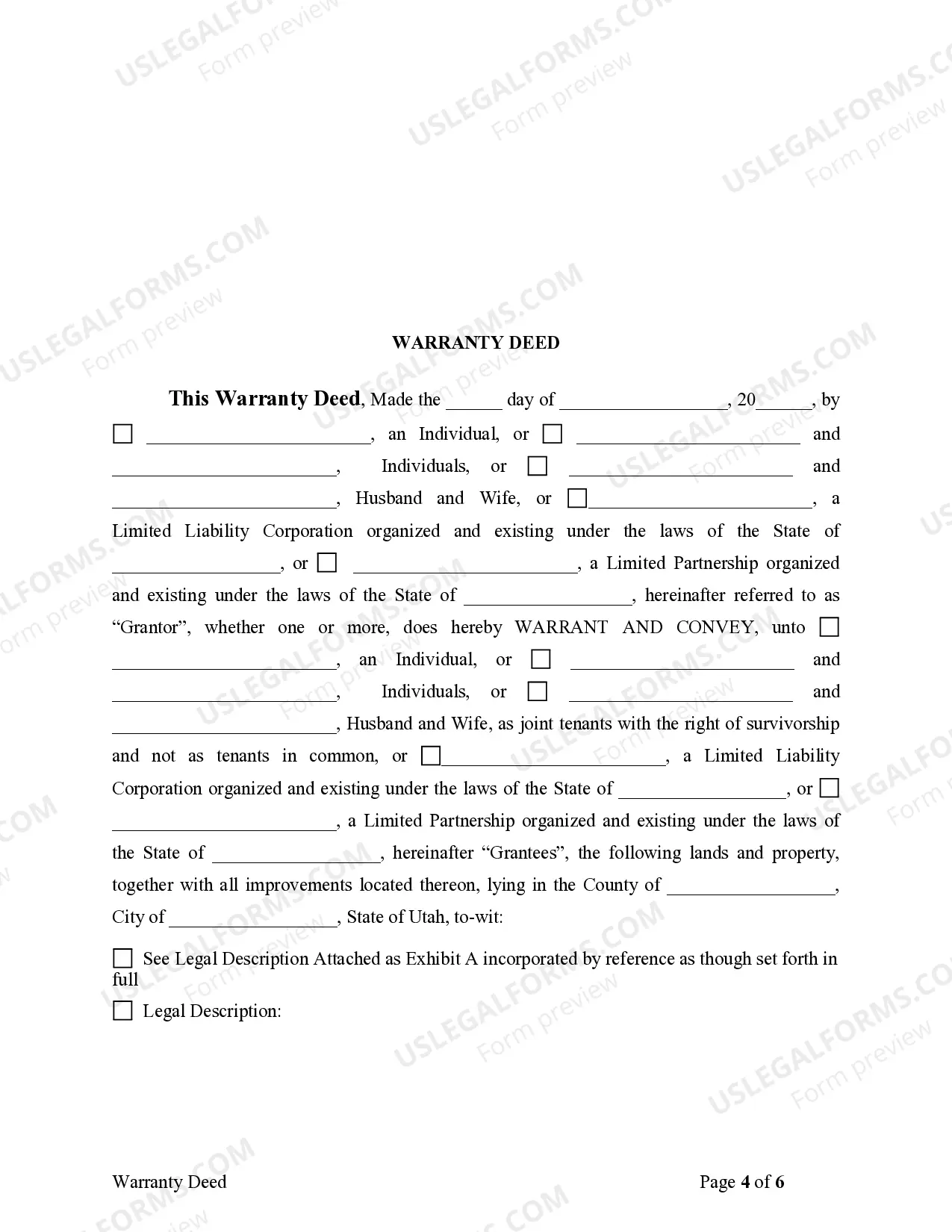

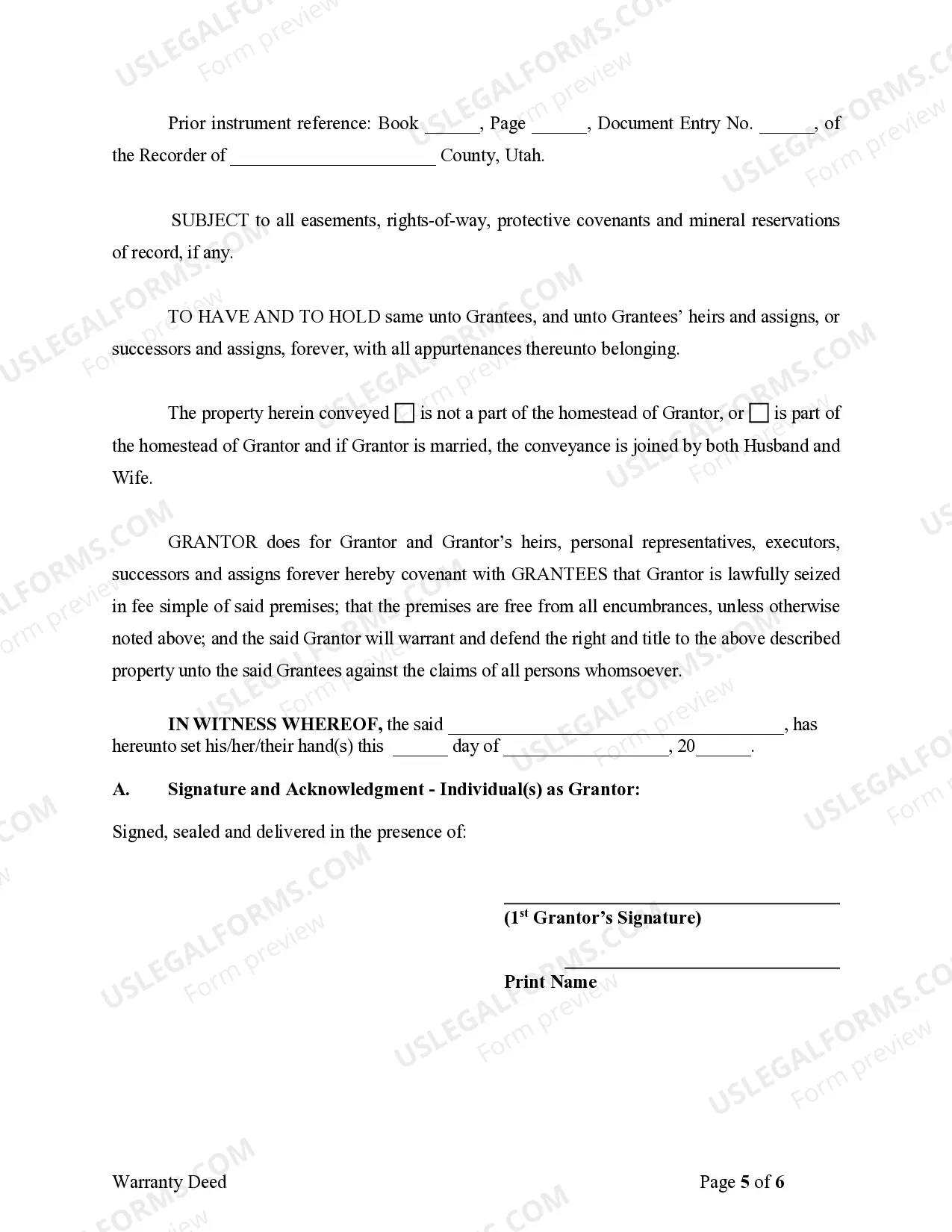

This form is a Warranty Deed where the grantor and/or grantee could be a limited partnership or LLC.

Utah Limited Partnership For Investment

Category:

State:

Utah

Control #:

UT-SDEED-7

Format:

Word;

Rich Text

Instant download

Description

Free preview