Utah Limited Partnership With One Partner

Description

Form popularity

FAQ

The minimum number of partners in a partnership is typically one. This applies to a Utah limited partnership with one partner, allowing you to establish your business without recruiting additional individuals. While one partner can handle the overall operations, it's wise to think about future growth and potential expansions. For legal assistance with forming your partnership, uslegalforms can streamline the process for you.

The number of partners in a partnership can vary based on your business goals. In a Utah limited partnership with one partner, having a single individual simplifies decision-making. On the other hand, a larger partnership can distribute responsibilities and provide diverse expertise. Consider what fits your vision best when deciding on the number of partners.

One person can run a partnership, particularly in a Utah limited partnership with one partner. This setup allows you to be the primary decision-maker while still enjoying some liability protection. However, it's crucial to review the specific regulations that apply to this type of partnership. You might consider using uslegalforms to guide you through the necessary paperwork and requirements for your partnership.

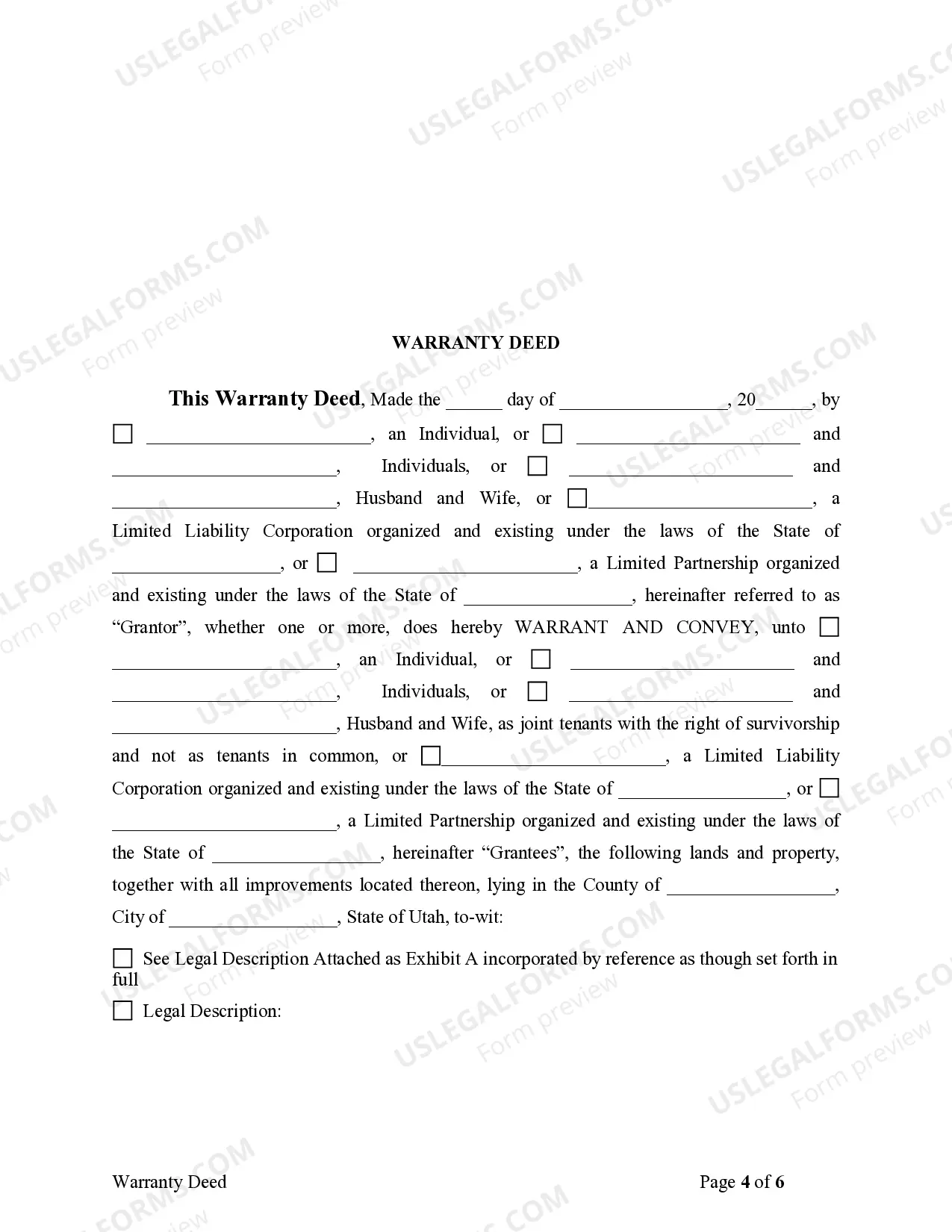

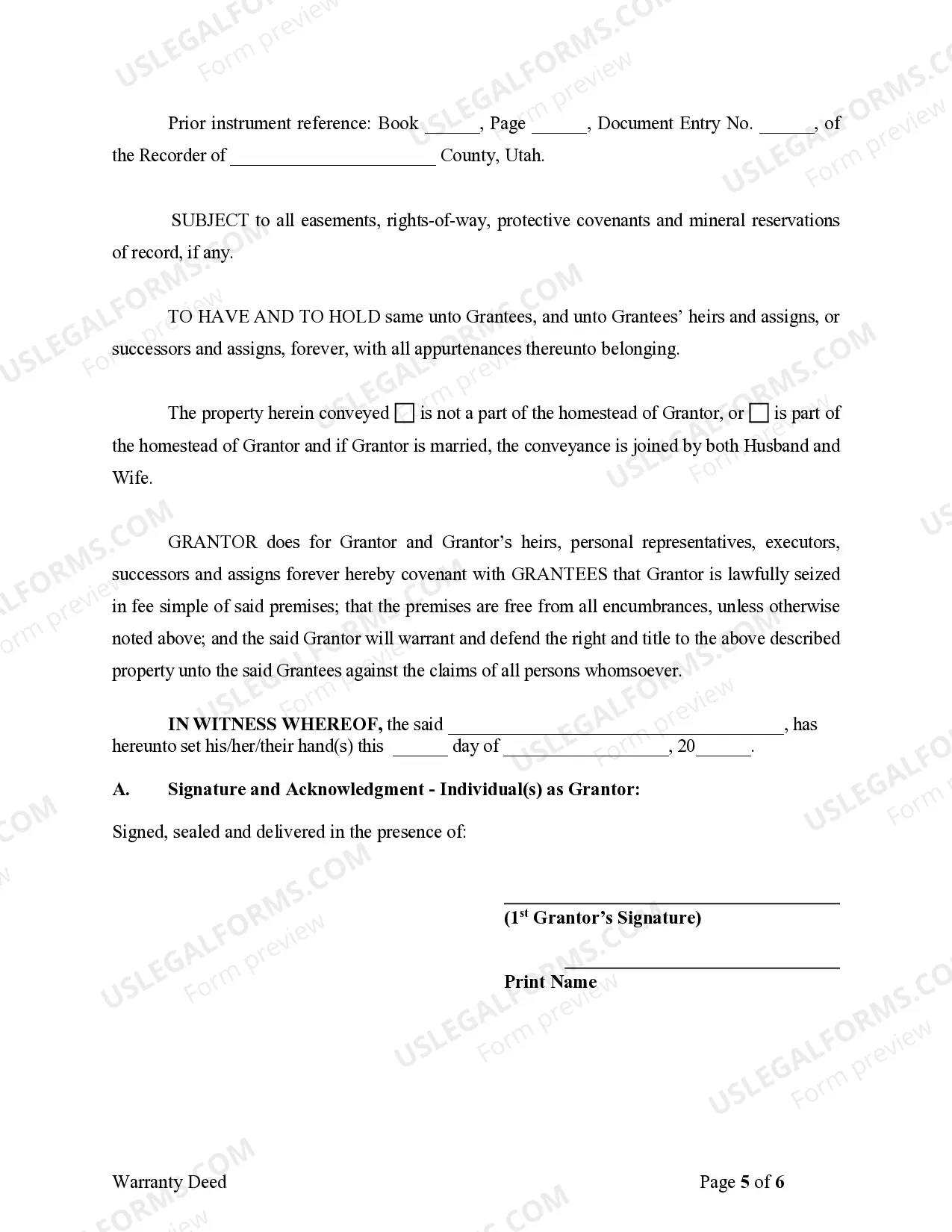

Yes, you can have one partner in a partnership. In a Utah limited partnership with one partner, that individual can take on both general and limited partner roles. This structure allows for greater flexibility in management and liability. It's important to understand the legal implications and responsibilities that come with forming such a partnership.

To form a partnership in Utah, you should start by choosing a business name and drafting a partnership agreement that outlines each partner's rights and responsibilities. This is particularly important if you are considering a Utah limited partnership with one partner, as clarity can help avoid future disputes. Online platforms like uslegalforms can provide templates and legal resources to facilitate the partnership formation process.

Yes, you can act as your own registered agent in Utah, provided you have a physical address in the state. Being your own registered agent can simplify certain administrative tasks, especially for a Utah limited partnership with one partner. However, consider whether this is the best choice for your business, as registered agents are responsible for receiving important legal documents.

Yes, Utah allows for the formation of single member LLCs, which denotes that one individual can own and operate the business. This is a distinct structure from a Utah limited partnership with one partner, offering liability protection to the single member. It is essential to choose the structure that best fits your business needs, and uslegalforms can assist you in making the right choice.

To add a partner to your existing business, you should first review your current business structure and operating agreement. If you have a Utah limited partnership with one partner, you may need to draft an amendment to include the new partner's rights and responsibilities. Utilizing platforms like uslegalforms can simplify this process by providing necessary templates and guidance to ensure compliance with Utah laws.

No, there are no general partners in a Limited Liability Partnership (LLP). All partners have limited liability protection, which differentiates LLPs from limited partnerships. This structure allows for shared management without the risks associated with general partners. Understanding the distinctions is important when considering business structures in Utah.

Yes, an individual can definitely be a partner in a limited partnership. Individuals often opt to become limited partners due to the reduced liability and investment opportunities. In creating a Utah limited partnership with one partner, that individual can reap the benefits of partnership while controlling financial risks. This setup is attractive for those looking to invest while protecting personal assets.