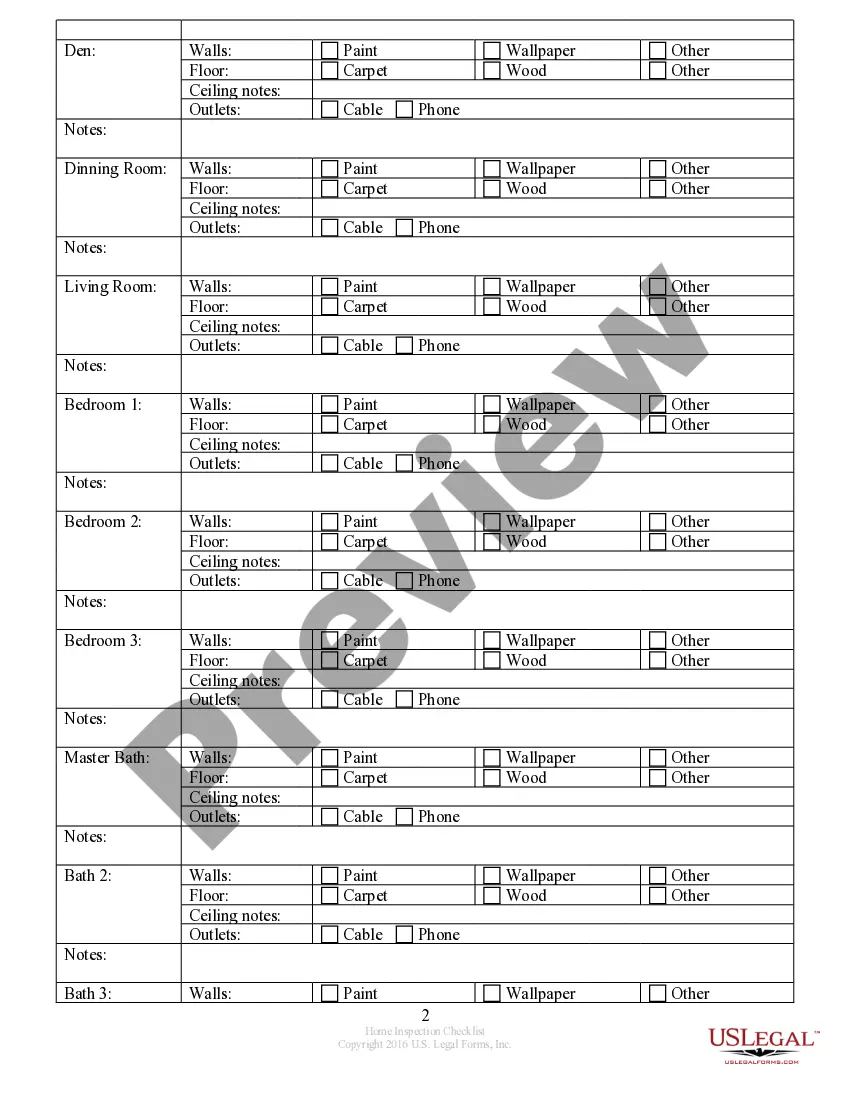

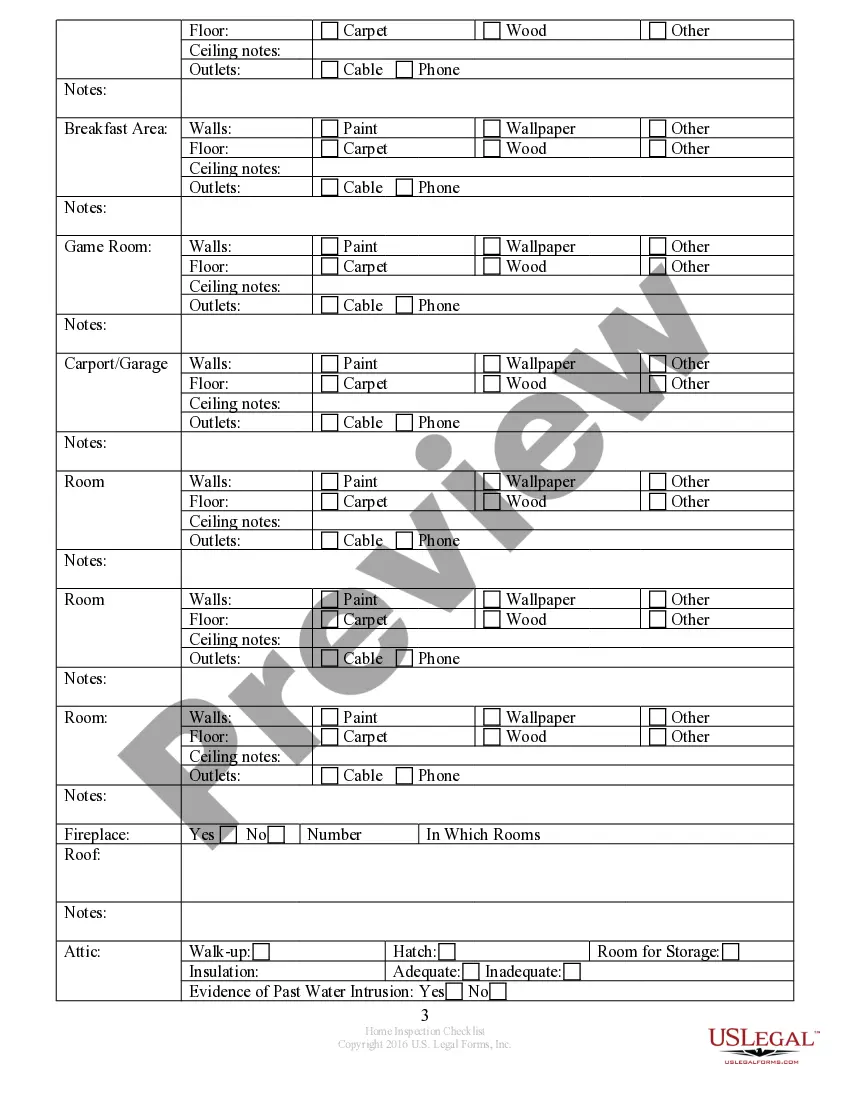

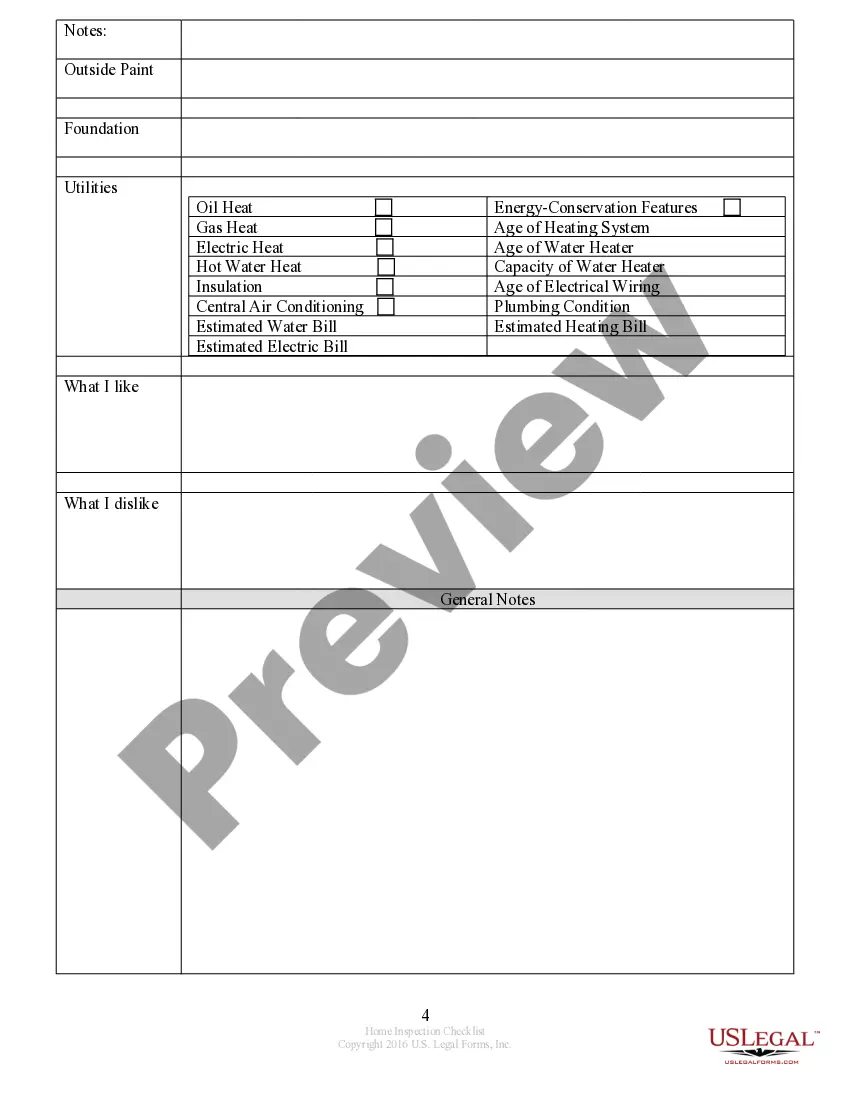

This Buyer's Home Inspection Checklist form is used by the Buyer when initially viewing a home to purchase in Virginia. It provides a comprehensive list of items to check or to ask the Seller prior to making an offer on a home. This is an all-inclusive form and not all items may be applicable to the property being viewed.

A VA loan inspection checklist with appraisal is an essential document used in the mortgage process for individuals applying for a VA loan. This checklist ensures that the property being purchased meets the Department of Veterans Affairs' (VA) standards and is deemed safe and suitable for financing. The VA loan inspection checklist plays a crucial role in protecting the interests of both the lender and the borrower by providing a comprehensive evaluation of the property's condition. The VA loan inspection checklist covers various aspects of the property, ensuring that it meets the minimum property requirements (Mrs) set by the VA. These requirements include a thorough examination of the property's structure, mechanical systems, safety features, and overall habitability. The appraisal component of the inspection determines the value of the property, which ultimately plays a role in determining the loan amount that can be approved. Key components of a VA loan inspection checklist typically include: 1. Structural Integrity: The inspector will assess the foundation, roof, walls, and overall structural stability of the property to ensure it is sound and able to withstand normal wear and tear. 2. Safety Features: The checklist examines the property for the presence of adequate safety features such as handrails, smoke detectors, and proper ventilation systems. 3. Mechanical Systems: The inspection evaluates the functioning of important mechanical systems like heating, cooling, electrical, and plumbing. Any issues or deficiencies in these systems should be addressed before approval. 4. Property Accessibility: The checklist will verify that the property meets accessibility standards, especially for disabled veterans, ensuring that there are no hindrances preventing easy access inside and outside the dwelling. 5. Pest Infestation: An inspection for any signs of pest infestation, including termites, rodents, or insects, is conducted to safeguard against potential damage and hazards. 6. Overall Cleanliness: Although not a significant factor for appraisal, the checklist may include a general assessment of the property's cleanliness and tidiness. Additionally, while the general VA loan inspection checklist remains consistent, there might be variations based on the type of property being inspected. For instance, a condominium checklist may focus on evaluating the condition of common areas, shared amenities, and the financial stability of the condo association. On the other hand, a checklist for a manufactured or mobile home may emphasize compliance with HUD codes, safety standards, and the presence of permanent attachments. In conclusion, a VA loan inspection checklist with appraisal is a vital tool used during the VA loan process to verify that the property meets the necessary criteria for VA financing. It safeguards the interests of both parties involved and ensures that the veteran borrower obtains a safe and habitable home that meets the VA's minimum property requirements.