Transfer On Death Deed Form Virginia With Florida

Description

How to fill out Virginia Revocable Transfer On Death Deed From Individual To Individual?

Managing legal documents and processes can be a lengthy addition to your schedule.

Transfer On Death Deed Form Virginia With Florida and similar forms typically necessitate that you search for them and navigate the steps to fill them out properly.

Consequently, if you are managing financial, legal, or personal issues, utilizing a comprehensive and seamless online repository of forms when required will be beneficial.

US Legal Forms is the leading online resource for legal templates, providing over 85,000 state-specific forms and a range of tools that will assist you in completing your documents with ease.

Simply Log In to your account, find Transfer On Death Deed Form Virginia With Florida, and download it immediately from the My documents section. You can also retrieve previously stored forms.

- Explore the collection of relevant documents available to you with just a single click.

- US Legal Forms provides you with state- and county-specific forms that can be accessed anytime for download.

- Safeguard your document management processes with high-quality services that enable you to prepare any form in just minutes without extra or concealed fees.

Form popularity

FAQ

In particular, Florida law does not provide for transfer on death deeds. Florida has not adopted the Uniform Real Property Transfer on Death Act, which would otherwise allow people to use a transfer on death deed for their property. However, a lady bird deed accomplishes the same thing as a TOD deed.

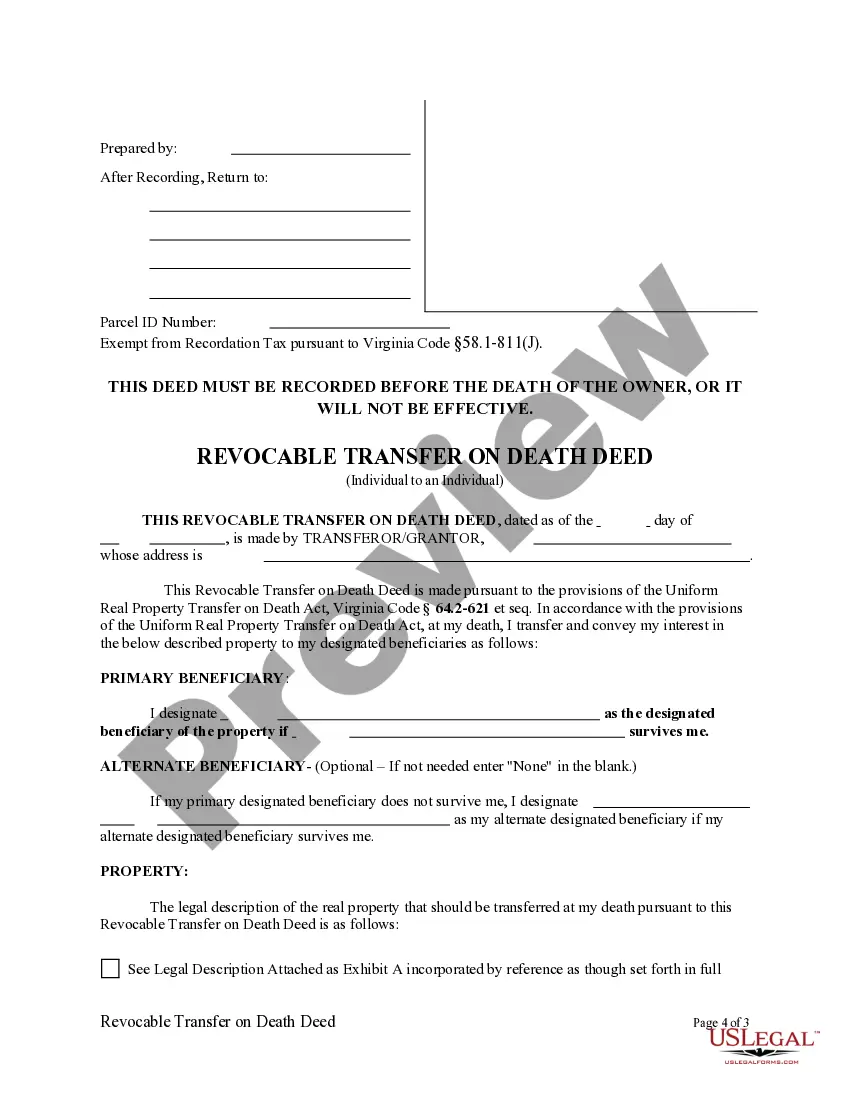

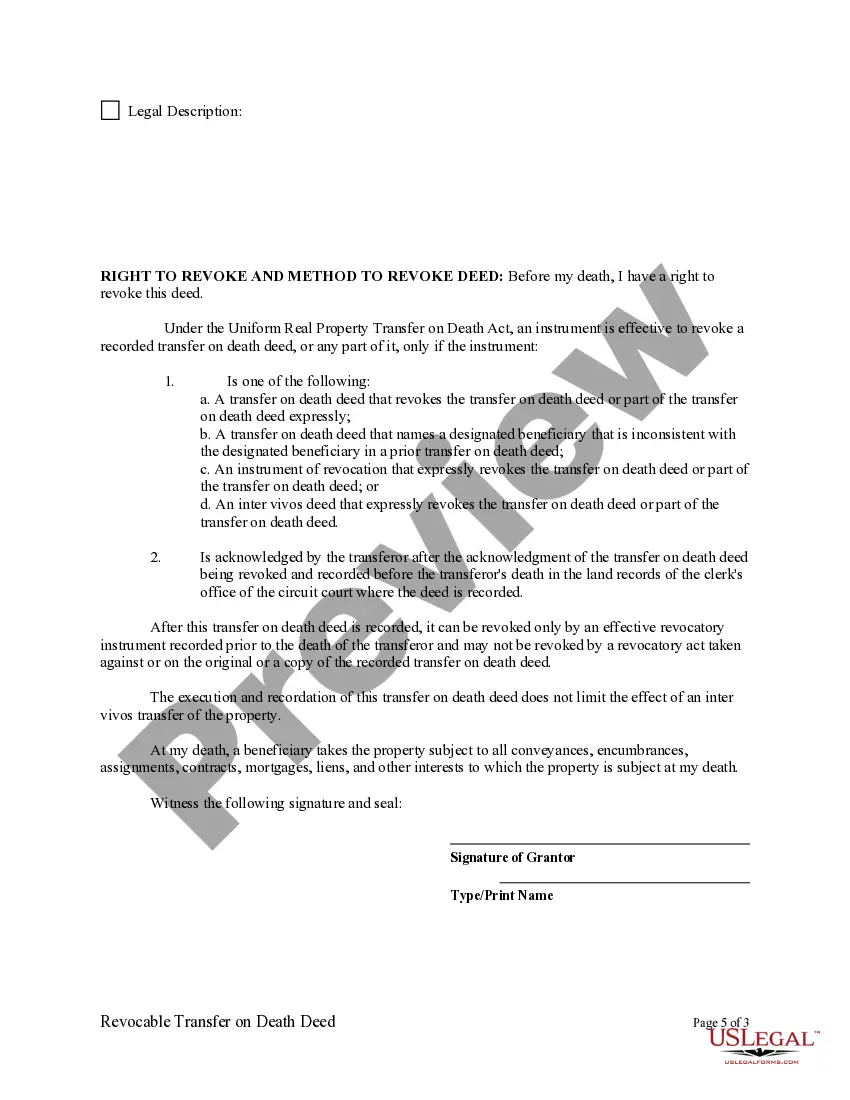

In Virginia, an owner of real property can transfer their ownership interest to one or more beneficiaries, effective upon their death, through a Transfer on Death Deed (?TOD Deed?). TOD Deeds automatically transfer ownership of the subject property directly to the designated beneficiaries upon the owner's death.

How can I transfer a property deed from a deceased relative in Florida? If the controlling deed does not contain life estate language, then the only way to transfer property without a will is by either a summary administration or by a formal probate administration based on Florida's intestacy law.

You must sign the deed and get your signature notarized, and then record (file) the deed with the circuit court clerk's office before your death. Otherwise, it won't be valid.

Florida does not allow real estate to be transferred with transfer-on-death deeds. There is a type of deed available in Florida known as an enhanced life estate deed, or "Lady Bird" deed, that functions like a transfer-on-death deed.