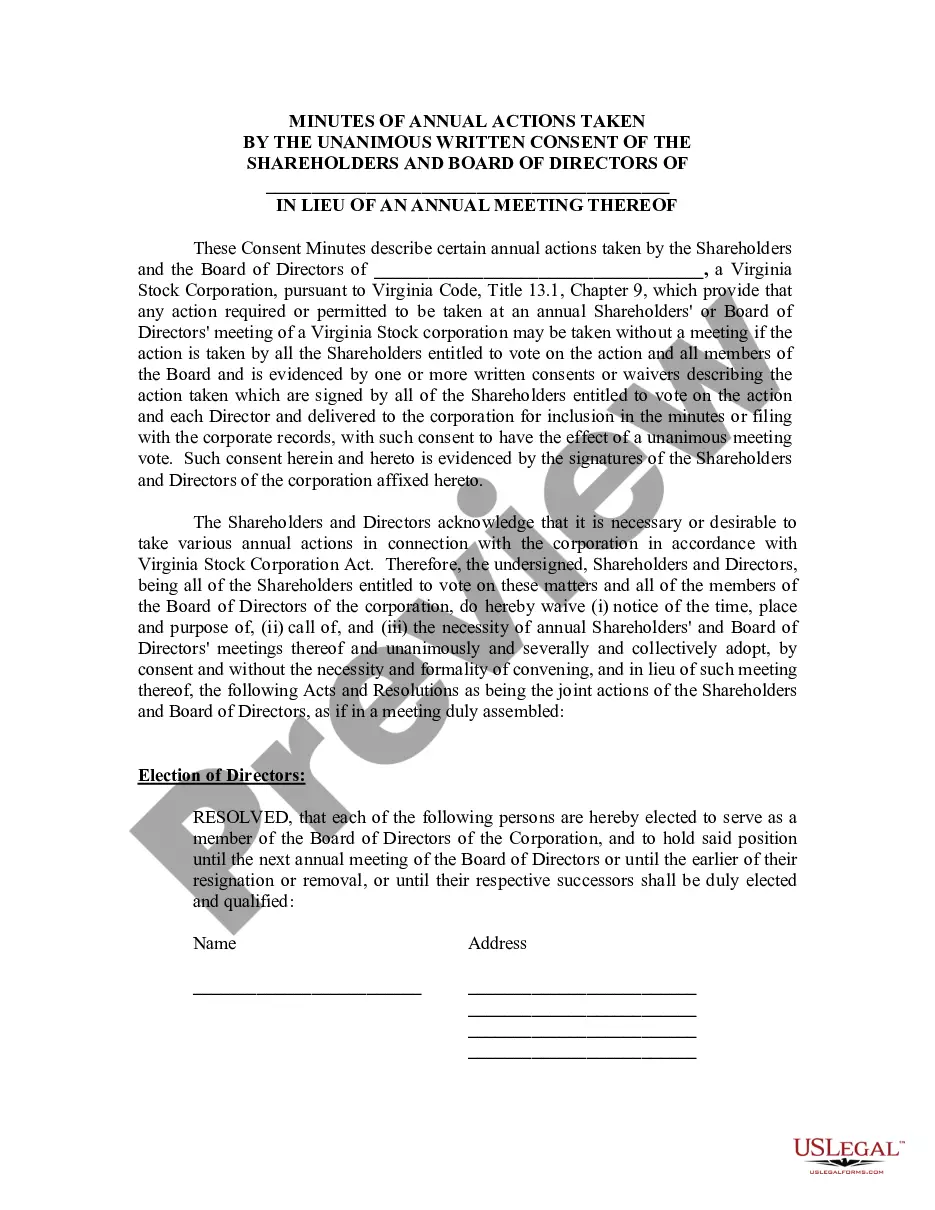

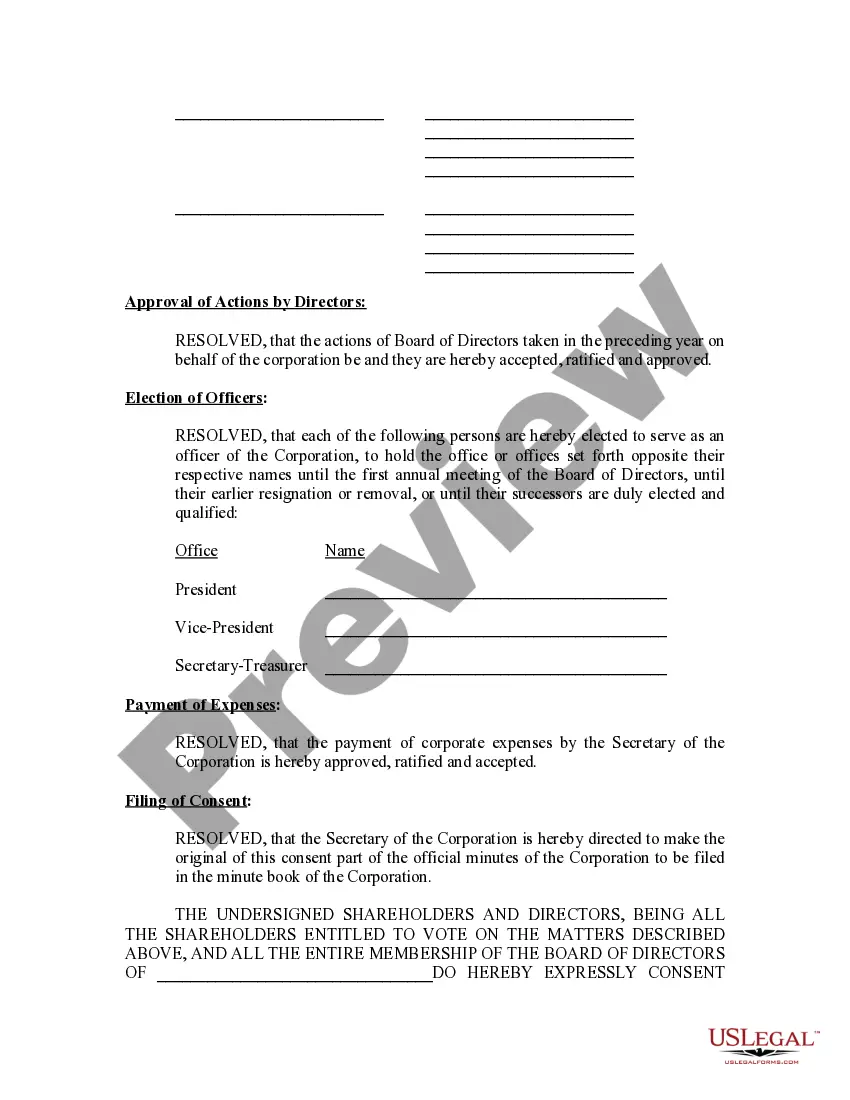

Virginia Annual With Specifications

Description

How to fill out Virginia Annual Minutes?

Whether for business purposes or for personal affairs, everyone has to handle legal situations at some point in their life. Completing legal papers demands careful attention, starting with choosing the appropriate form template. For instance, if you choose a wrong edition of a Virginia Annual With Specifications, it will be rejected once you send it. It is therefore essential to have a reliable source of legal files like US Legal Forms.

If you have to get a Virginia Annual With Specifications template, follow these easy steps:

- Get the sample you need by using the search field or catalog navigation.

- Examine the form’s information to ensure it fits your case, state, and region.

- Click on the form’s preview to examine it.

- If it is the wrong document, return to the search function to find the Virginia Annual With Specifications sample you need.

- Get the file when it matches your needs.

- If you already have a US Legal Forms account, just click Log in to gain access to previously saved templates in My Forms.

- In the event you do not have an account yet, you can download the form by clicking Buy now.

- Choose the proper pricing option.

- Complete the account registration form.

- Select your payment method: use a bank card or PayPal account.

- Choose the document format you want and download the Virginia Annual With Specifications.

- When it is saved, you are able to fill out the form with the help of editing applications or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you don’t need to spend time searching for the appropriate sample across the internet. Take advantage of the library’s simple navigation to get the proper template for any situation.

Form popularity

FAQ

Prior to your first day: Form I-9, Employment Eligibility Verification (PDF) Form W-4, Employee's Withholding Allowance Certificate (PDF). Form VA-4, Employee's Virginia Income Tax Withholding Exemption Certificate. Employee Direct Deposit Authorization (PDF) or the EPPI Card Application (PDF)

Yourself (and Spouse): Each filer is allowed one personal exemption. For married couples, each spouse is entitled to an exemption. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

Claiming 1 on your tax return reduces withholdings with each paycheck, which means you make more money on a week-to-week basis. When you claim 0 allowances, the IRS withholds more money each paycheck but you get a larger tax return.

If you are eligible for an out-of-state tax credit on your Virginia individual income tax return under the provisions of Section 58.1-332, Code of Virginia, complete this form to authorize your employer to allow a portion of the credit each pay period to reduce the Virginia income taxes withheld from your wages.