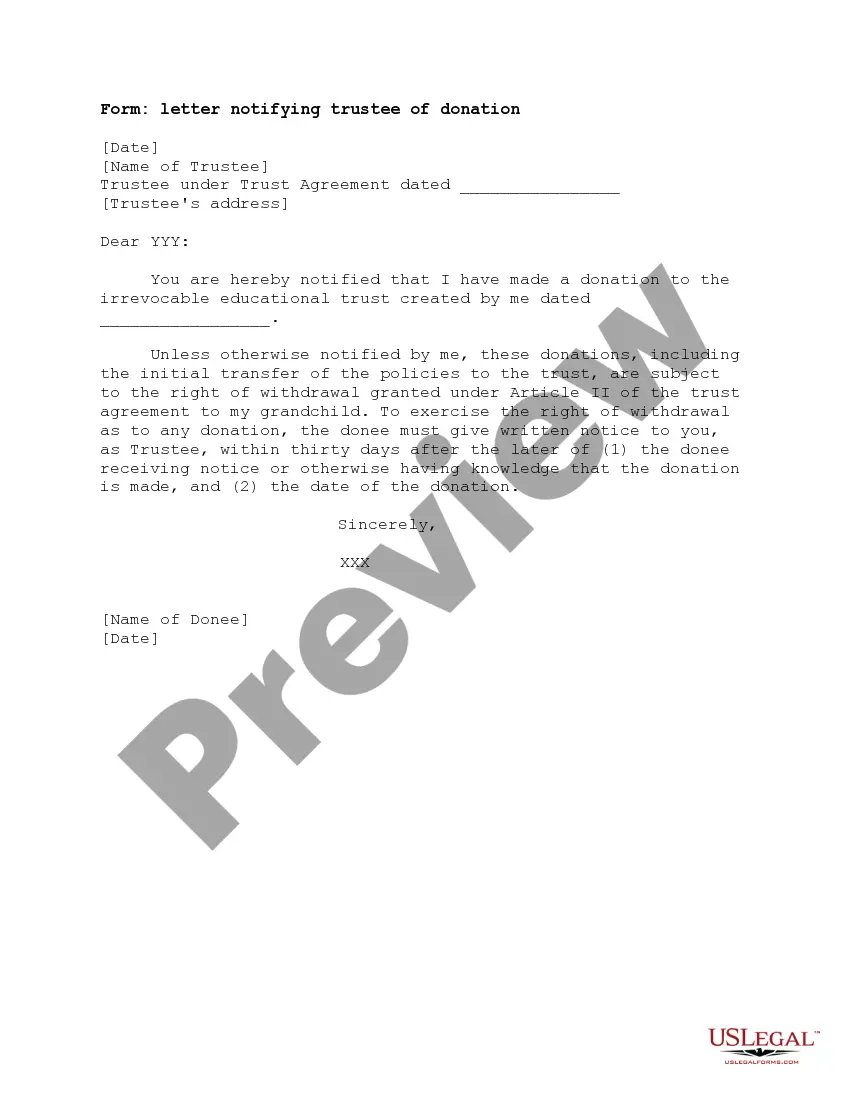

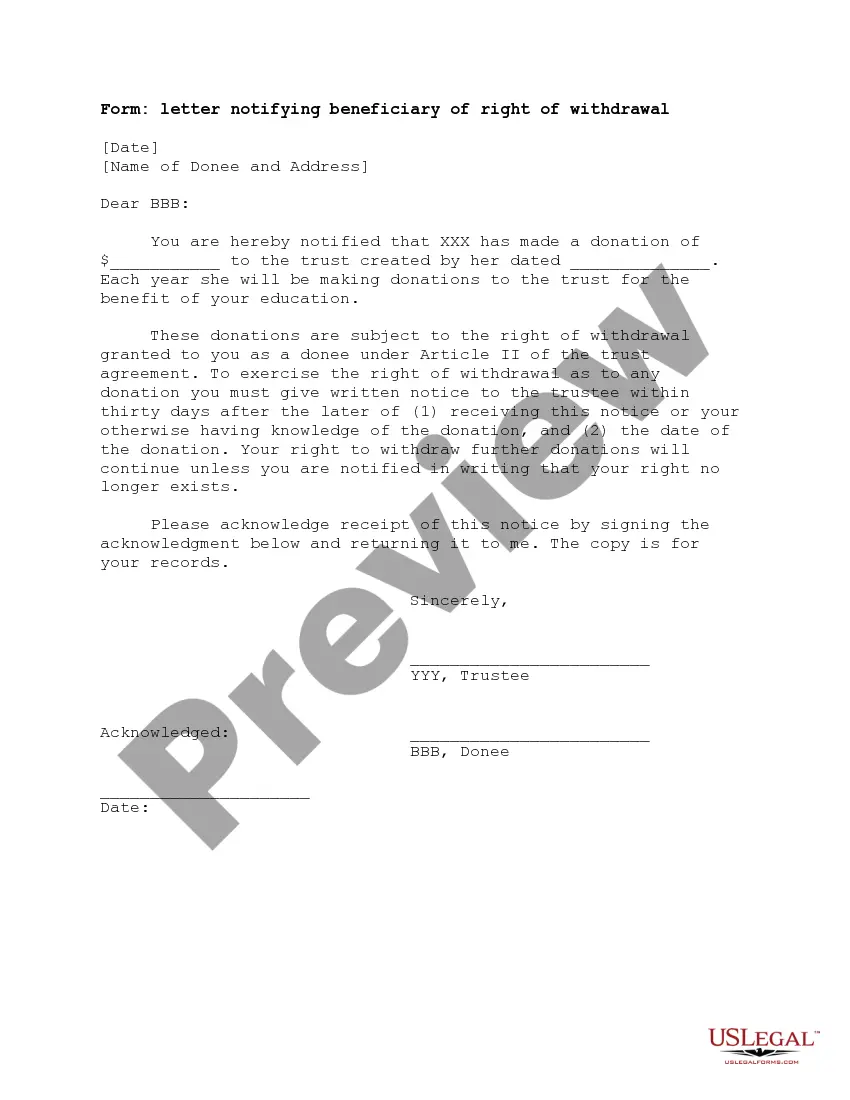

This packet includes three documents. First is a letter from attorney to client explaining the purpose and conditions of an irrevocable education trust. Second is a sample letter from Trustor to Trustee advising of the donation to the trust. Third is a sample letter from Trustee to Beneficiary notifying trustee of the donation and right to withdraw with certain conditions.

Educational Trust In Tamilnadu

Description

Form popularity

FAQ

Yes, educational trusts in Tamil Nadu are subject to taxation, though they may qualify for certain exemptions depending on their structure and purpose. Trusts that engage in educational activities often receive favorable tax treatment, but it's important to understand the specific tax obligations. Consulting a tax professional or legal advisor can provide clarity on how taxes will apply to your educational trust.

Starting an educational trust in Tamil Nadu requires you to first identify the educational goals you wish to achieve. Then, gather a group of trustees who will manage the trust and begin drafting the trust deed. Finally, you will need to complete the registration process to legally establish the trust. Utilizing tools from UsLegalForms can help you manage this process efficiently.

To set up an educational trust in Tamil Nadu, begin by defining the trust's objectives and goals. Next, draft a trust deed that outlines the rules and regulations governing the trust. Ensure you include details about the beneficiaries and the purpose of the trust. You may consider using platforms like UsLegalForms to simplify the documentation process and ensure compliance with legal requirements.

To set up an educational trust, begin by defining your objectives, such as providing scholarships or funding educational programs. Assemble a dedicated team to help manage the trust’s functions and responsibilities. Once you have a draft of the trust deed, register it with the appropriate government authority to ensure that your trust operates legally. If you wish to streamline this process and access ready-made documents, consider the services offered by USLegalForms for forming an educational trust in Tamilnadu.

Creating an education trust involves drafting a trust deed that specifies the purpose and governance of the trust. You will need to appoint trustees who will manage the trust's assets and oversee the educational initiatives. Additionally, register the trust to make it a legal entity capable of receiving grants and donations. For anyone looking to establish an educational trust in Tamilnadu, it is beneficial to use resources such as USLegalForms to access the required documents and understand the legal process.

A school trust in India operates by managing the assets and finances of an educational institution to ensure its smooth functioning. Trust members oversee the school's operations and make decisions about funds allocated for infrastructure, faculty, and student services. This structure helps maintain transparency and efficiency within the school. If you are considering forming an educational trust in Tamilnadu, understand the scope and regulations to ensure compliance with Indian educational laws.

To form a temple trust in Tamilnadu, start by gathering a group of dedicated individuals who share the same vision. You will need to draft a trust deed outlining the objectives, management structure, and operation methods. After finalizing the deed, register the trust with the local authorities to ensure legal recognition. The process may seem intricate, but utilizing resources like USLegalForms can provide you with templates and guidance specific to establishing an educational trust in Tamilnadu.